Miners Reduce Holdings Amid Rising Prices

Miners represent the bedrock of the Bitcoin market. Their behavior is one of the best indicators of market health and can be used as a gauge of market sentiment.

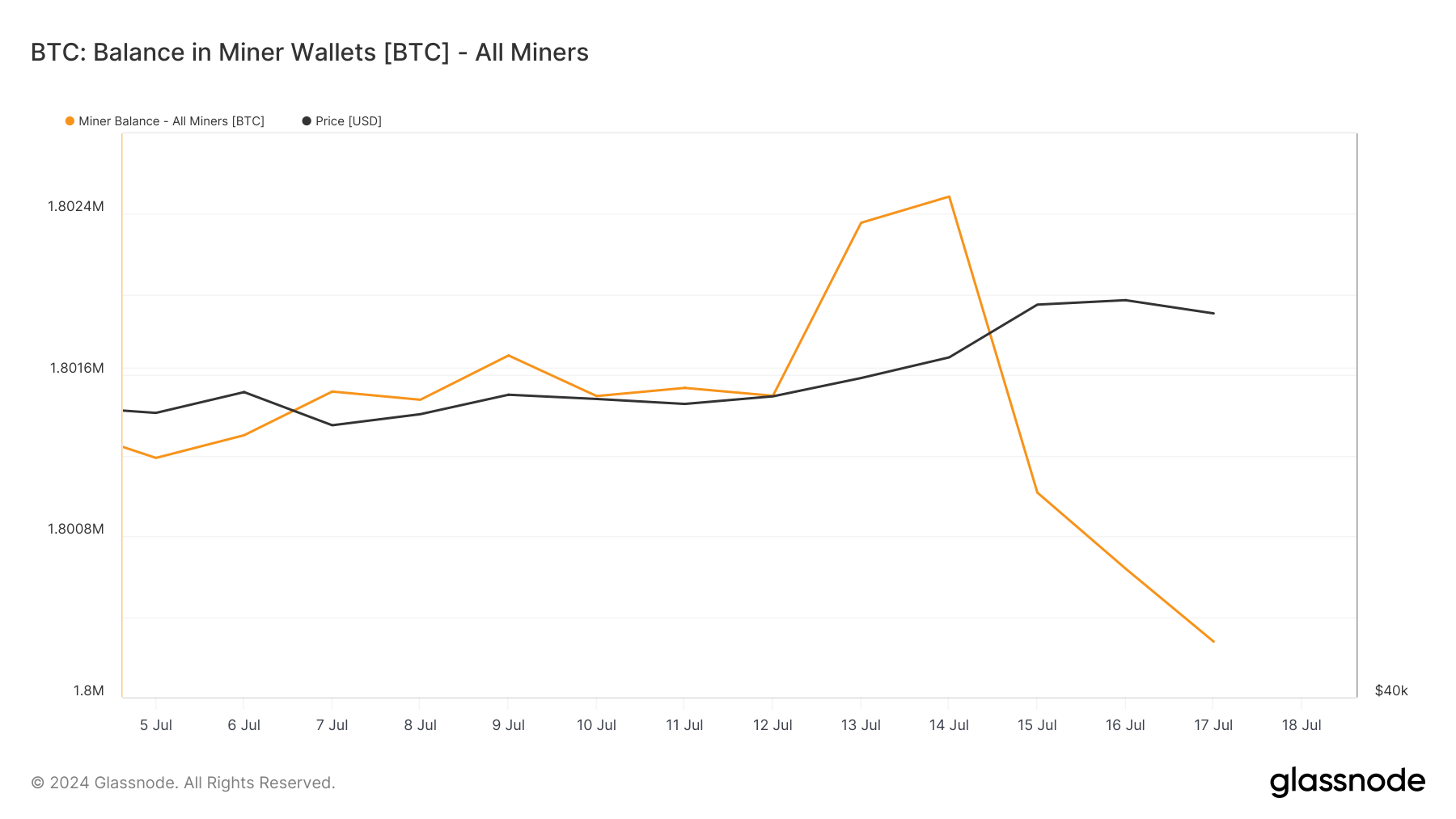

Miner Balance reflects the total amount of BTC held by miners. It is used as one of the main indicators of selling pressure as miners frequently sell to cover operating costs.

However, since miners are competing to remain as profitable as possible, they usually do not sell or distribute their holdings when the Bitcoin price is too low. If miners hold BTC, it can be a sign of confidence in future price increases. Conversely, if miners sell, it can indicate that they are willing to take profits when the price is high enough or that they expect the price to fall.

Last week, miner balances decreased by approximately 1,260 BTC. This decrease continues a long-term trend of decreasing miner balances that has been going on since October 2023. Miner balances are now at levels not seen since April 2019. The decrease we saw last week is not surprising, but it reflects a broader pattern of miners gradually reducing their holdings.

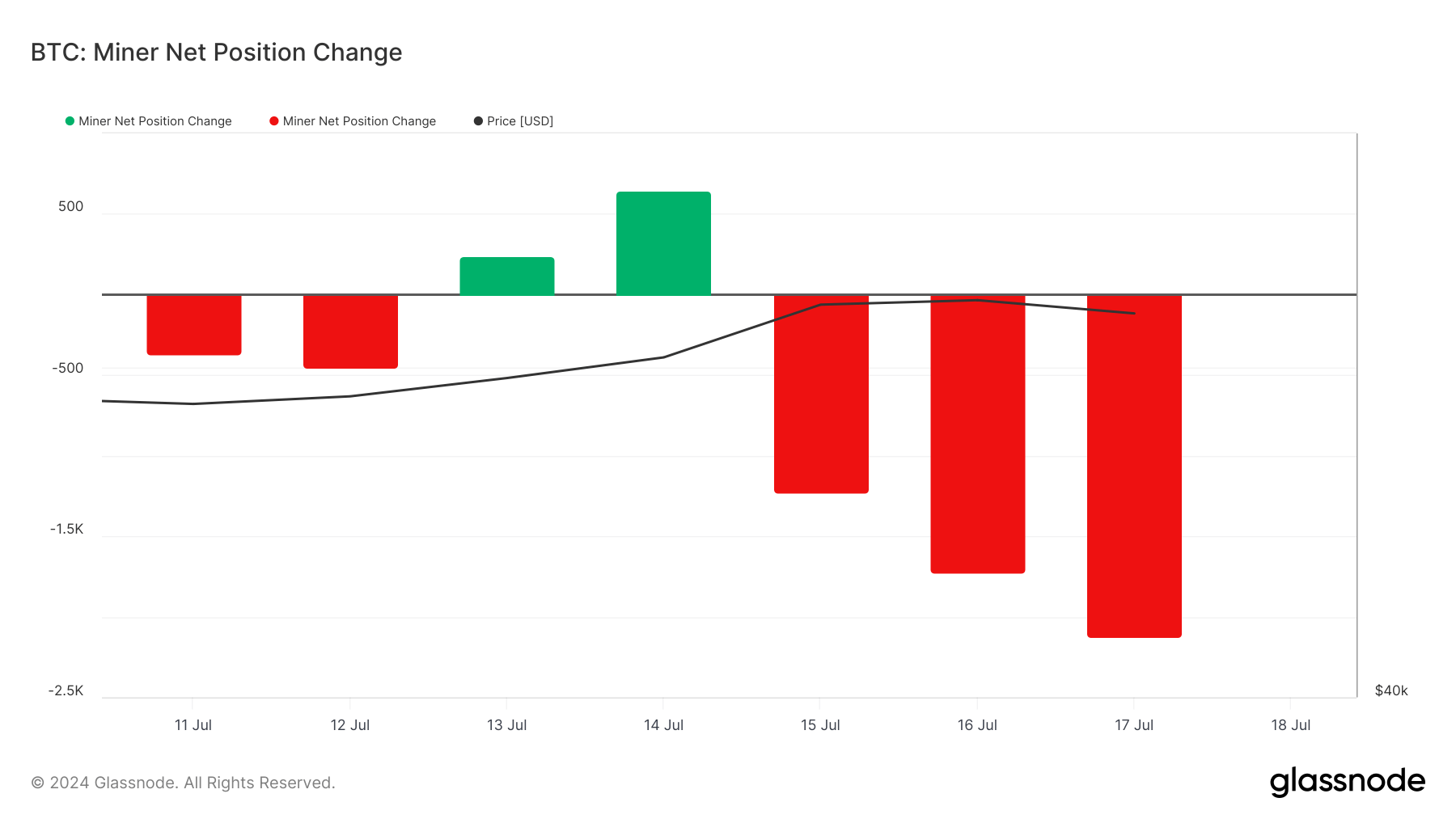

Looking at the changes in miner net positions, there was a change last week. Breaking the three-month trend of net outflows, there was a temporary accumulation on July 13th and July 14th with net inflows of 241 BTC and 645 BTC respectively.

This was followed by a significant net outflow that lasted until July 17, when miners sold 2,126 BTC. The recent surge in selling has been correlated with a notable rise in the Bitcoin price, which peaked at $65,172 on July 16 before declining slightly to $64,120 the following day.

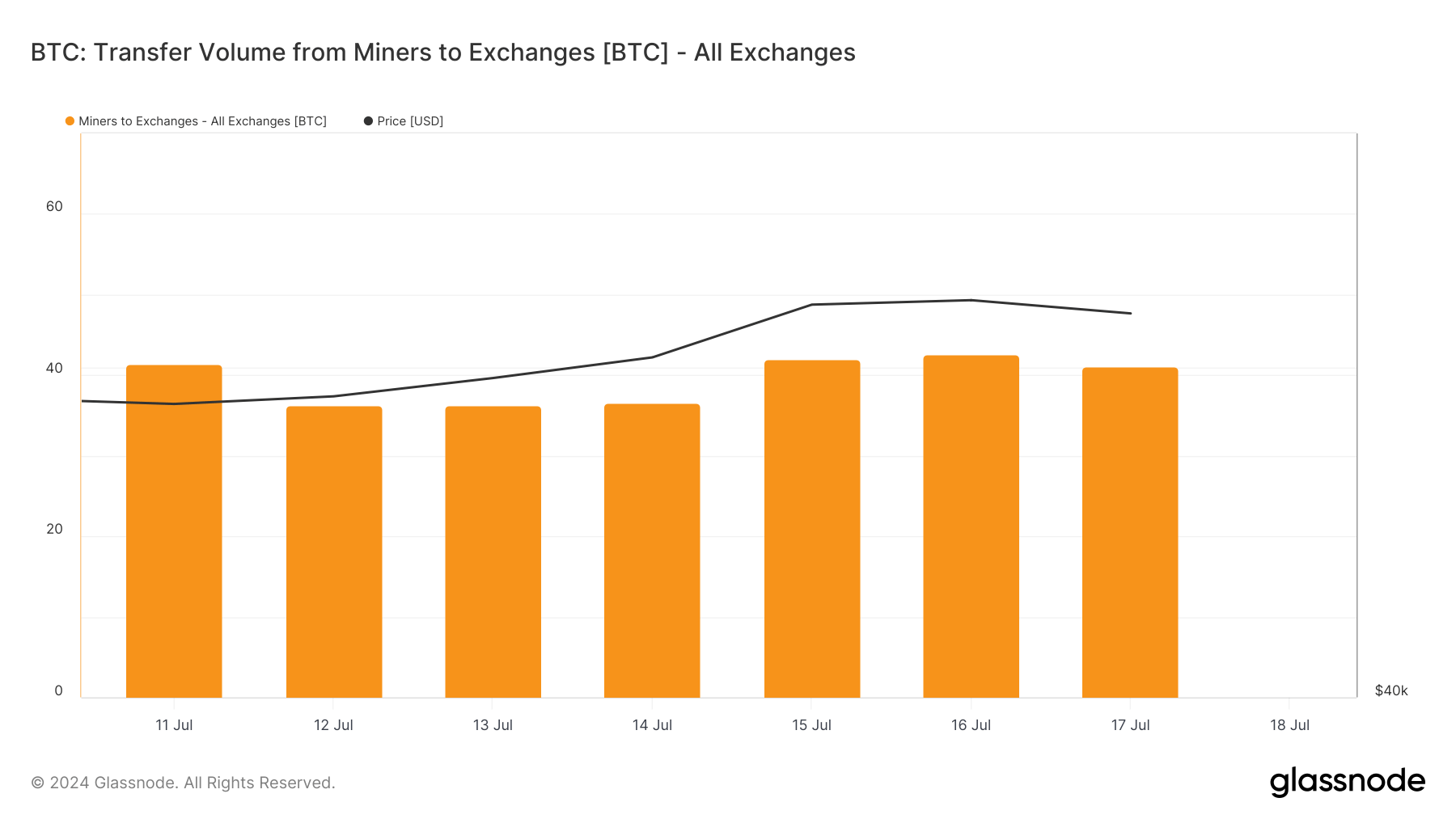

The volume of transfers from miners to exchanges has remained relatively stable, ranging between 36 and 42 BTC per day. This stability suggests that miners are not significantly increasing their direct selling to exchanges, even as overall outflows increase.

The highest transfer volume to exchanges in the past three months was 262 BTC on June 13, indicating that recent volumes are within normal range. The decreasing miner balances and relatively low transfer volumes to exchanges suggest that miners may be selling their bitcoins through over-the-counter (OTC) transactions rather than on public exchanges.

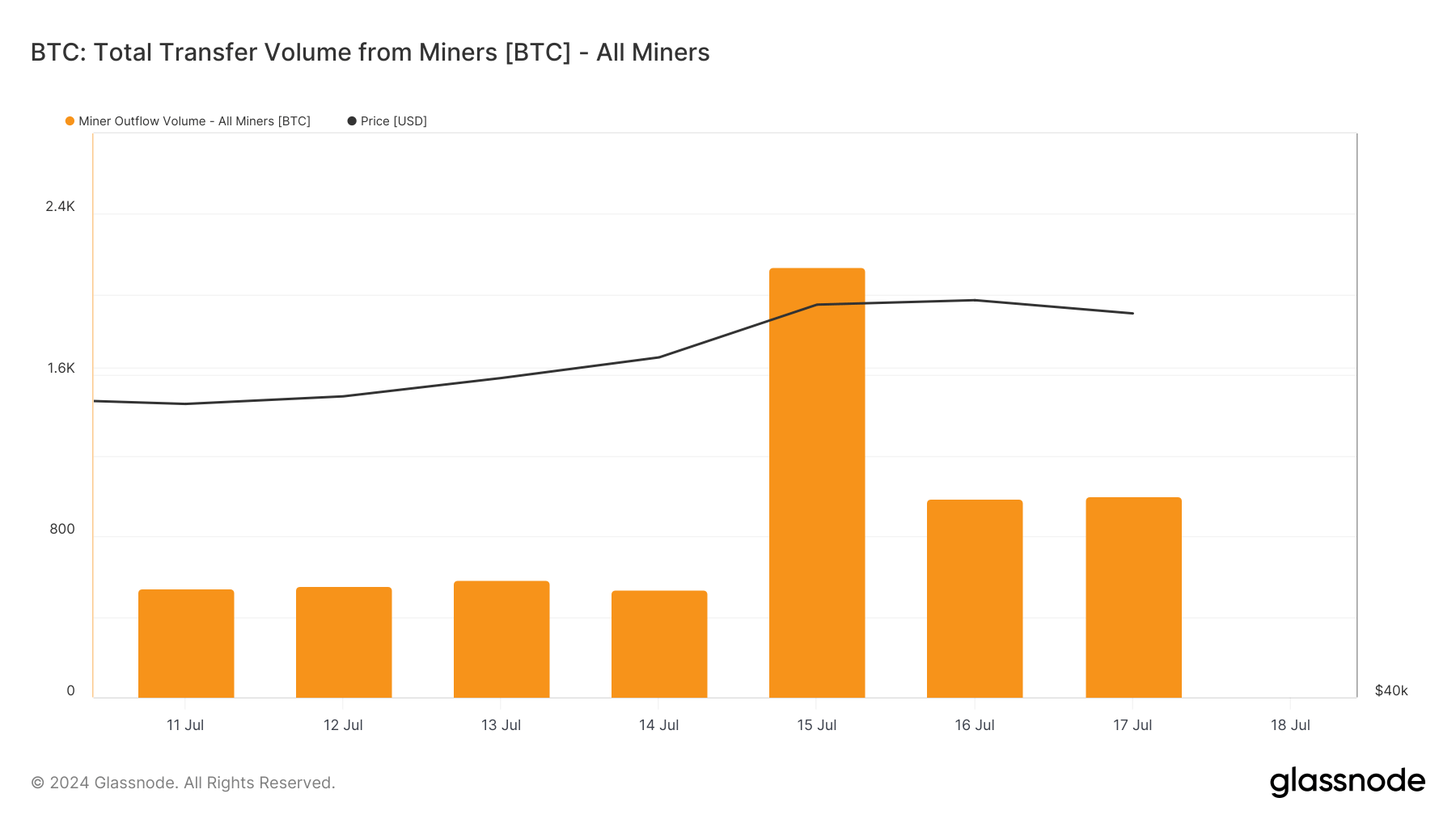

Miner transfers are more volatile, with a significant spike of 2,136.10 BTC on July 15, the second highest in the past 30 days. This spike coincides with a sharp price increase, showing that miners have taken advantage of the higher prices to move significant amounts of BTC. This trend is further confirmed by the outflow of 985.60 BTC on July 16 and 1,001.63 BTC on July 17.

According to the data, miners are reducing their overall holdings to maximize their profits when prices rise. This strategic selling contributes to market liquidity and can affect short-term price movements.

The article Miners Reduce Holdings as Prices Rise was first published on CryptoSlate.