Mobile health network solution, US IPO terms confirmed (pending: MNDR)

Erdark/E+ via Getty Images

Mobile health network solution aims for US IPO

Mobile health network solution (MNDR) has filed to raise $10.125 million in an IPO of its Class A common stock, according to its SEC F-1 registration statement.

Mobile health offerings A telehealth platform and related services for participants in Singapore’s healthcare system.

Given the numerous risks involved, the company’s mediocre growth rate from a small revenue base, recent swing to operating losses and cash burn, and very high valuation assumptions, my outlook for the Mobile Health Network Solutions IPO is a sell (avoid).

What does mobile health do?

Singapore-based Mobile-Health Network Solutions was founded in Singapore to develop a mobile and website-based telehealth platform that facilitates patient and healthcare provider interactions through teleconferencing.

The management team is led by Siaw Tung Yeng, MD, co-founder and co-CEO. He has been with the company since its founding in 2016 and was previously its Chief Executive Officer. He is Information Officer and Regional Medical Director at Healthway Medical Group and is also a Clinical Lecturer at Yong Loo Lin School of Medicine, National University of Singapore.

The Company’s primary software and service offerings include:

-

Website

-

mobile app

-

electronic medical certificate

-

drug delivery

-

direct clinic

-

Corporate Medical and Wellness Services

-

Other services.

As of June 30, 2023, Mobile-Health Network Solutions had total fair market value investments from investors of $14.5 million.

The company seeks to integrate its platform into the operations of healthcare providers, doctors and other healthcare professionals in Singapore and ultimately beyond.

MNDR also offers a mobile app to patients. System usage has increased significantly during the COVID-19 pandemic.

As you can see in the figure below, as sales increased slightly, selling, general and administrative expenses as a percentage of total sales increased sharply.

|

Sales, G&A |

costs and profits |

|

period |

percentage |

|

Fiscal Year June 30, 2023 |

24.1% |

|

Fiscal Year June 30, 2022 |

8.8% |

(Source-SEC)

Our Sales, G&A efficiency multiple, defined as how many additional dollars of new revenue are generated for each dollar of Sales, G&A costs, was 0.5x for the most recent reporting period. (Source-SEC)

The most recent calculation of MNDR was negative (29%) as of June 30, 2023, so the company has underperformed in this regard, as per the table below.

|

rule of 40 |

calculate |

|

Recent revenue growth (%) |

13% |

|

operating profit margin |

-42% |

|

gun |

-29% |

(Source-SEC)

What is the mobile health market?

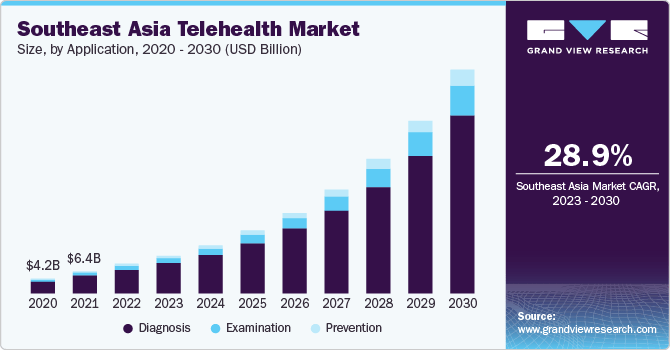

According to Grand View Research’s 2023 market research report, the telehealth services market in Southeast Asia was approximately USD 8.5 billion in 2022 and is expected to reach USD 64.8 billion by 2030.

This represents a very high forecast CAGR (Compound Annual Growth Rate) of 28.9% from 2023 to 2030.

The main expected reasons for this projected growth are the increasing prevalence of smartphone and tablet use and rising consumer awareness of the “importance of health and fitness monitoring to control the development of chronic diseases.”

Additionally, the chart below shows the historical and projected growth trajectory of the Southeast Asia Telemedicine Market by Service Application from 2020 to 2030.

Grand View Research

Key competitors or other industry participants include:

-

hallodog

-

HEYDOC International SDN. BHD.

-

seize

-

MyDoc Pte. Corporation

-

Doctor Anywhere Pte Ltd.

-

Telemy

-

GOOD DOCTOR TECHNOLOGY (Singapore) PTE. LTD.

-

DoctorOnCall

-

Allo Doctor

-

Click&Care.

Mobile Health Network Solutions Recent Financial Performance

The company’s recent financial performance can be summarized as follows:

-

Maximum revenue growth from a small base

-

Decrease in gross profit and decrease in gross margin

-

Operating losses and conversion to cash used in operations.

The following are relevant financial results derived from the Company’s registration statement.

|

total revenue |

||

|

period |

total revenue |

% difference vs. previous |

|

Fiscal Year June 30, 2023 |

$7,874,886 |

12.7% |

|

Fiscal Year June 30, 2022 |

$6,988,849 |

|

|

Total Profit (Loss) |

||

|

period |

Total Profit (Loss) |

% difference vs. previous |

|

Fiscal Year June 30, 2023 |

$1,094,994 |

-43.4% |

|

Fiscal Year June 30, 2022 |

$1,935,106 |

|

|

gross profit |

||

|

period |

gross profit |

% difference vs. previous |

|

Fiscal Year June 30, 2023 |

13.90% |

-49.8% |

|

Fiscal Year June 30, 2022 |

27.69% |

|

|

Operating profit (loss) |

||

|

period |

Operating profit (loss) |

operating profit margin |

|

Fiscal Year June 30, 2023 |

$ (3,288,700) |

-41.8% |

|

Fiscal Year June 30, 2022 |

$193,662 |

2.8% |

|

Comprehensive income (loss) |

||

|

period |

Comprehensive income (loss) |

net margin |

|

Fiscal Year June 30, 2023 |

$(2,817,098) |

-35.8% |

|

Fiscal Year June 30, 2022 |

$(21,736) |

-0.3% |

|

Operating cash flow |

||

|

period |

Operating cash flow |

|

|

Fiscal Year June 30, 2023 |

$(2,248,626) |

|

|

Fiscal Year June 30, 2022 |

$975,656 |

|

|

(Glossary.) |

(Source-SEC)

As of June 30, 2023, Mobile-Health had $2.2 million in cash and $2.3 million in total debt.

Free cash flow for the twelve months ended June 30, 2023 was negative ($2.4 million).

Mobile Health Network Solution IPO Details

Mobile-Health plans to raise gross proceeds of $10.125 million through an IPO of its Class A common stock, offering 2.25 million shares at a proposed median price of $4.50 per share.

None of the existing shareholders have expressed interest in purchasing shares at the IPO price.

The company is also registering approximately 3.1 million additional shares for sale by existing shareholders.

If these shares are registered and sold over a short period of time, the impact on the stock price could be significantly negative.

Assuming a successful IPO, the Company’s enterprise value at IPO will be approximately $165.5 million, excluding the impact of underwriter over-allotment options.

The ratio of float to outstanding shares (excluding underwriter over-allotments) would be approximately 6.62%, which would make the stock a ‘low float’ stock with the potential for increased volatility post-IPO.

Management stated that it will use the net proceeds from the IPO as follows:

Approximately 20% on product development to extend the functionality and value of the core technology platform

Approximately 25% for development and expansion of business and operations;

Approximately 30% for potential mergers and acquisitions, but there are currently no commitments to any acquisitions. and

For general corporate purposes, including working capital, operating expenses and capital expenditure, it is approximately 25%.

(Source-SEC)

Executive presentations for company roadshows are not available.

Regarding ongoing legal proceedings, management said the company is not currently pursuing any significant legal proceedings.

The sole listing bookrunner for the IPO is Network 1 Financial Securities.

Evaluation indicators for mobile health

Below is a table of the company’s relevant capitalization and valuation figures.

|

Measure (TTM) |

sheep |

|

Market capitalization at IPO |

$153,000,000 |

|

corporate value |

$165,512,211 |

|

Price/Sales |

19.43 |

|

EV/Sales |

21.02 |

|

EV/EBITDA |

151.15 |

|

Earnings per share |

-$0.10 |

|

operating profit margin |

13.90% |

|

net margin |

-41.76% |

|

Floating with excellent stock ratios |

6.62% |

|

Median price per share of proposed IPO |

$4.50 |

|

capital expenditure |

-$186,001 |

|

Free cash flow yield per share |

-0.12% |

|

Debt/EBITDA Multiple |

11.43 |

|

capital expenditure ratio |

0.00 |

|

revenue growth rate |

12.68% |

|

(Glossary.) |

(Source-SEC)

mHealth has turned into a loss of business due to reduced efficiency.

MNDR seeks U.S. public capital market investments to finance its operating and expansion capital needs.

The company’s financials have shown that it has generated higher sales from a smaller base, lower gross profit and gross margins, and most recently, operating losses and cash used in operations.

Free cash flow for the twelve months ended June 30, 2023 was negative ($2.4 million).

As sales increased from low levels, selling, general and administrative expenses as a percentage of total sales increased significantly. The sales, G&A efficiency multiple for the most recent fiscal year was .05x.

The Company does not currently pay dividends and plans to retain most or all of its future earnings for business operations and expansion efforts.

MNDR’s recent capital expenditures history shows that it has continued to spend capital expenditures despite negative operating cash flow.

The company’s Rule of 40 results were very negative. High operating losses slowed modest revenue growth, contributing to the negative readings for this metric.

The market opportunity for providing telehealth services sold by the Company is moderately large but is expected to grow at a high rate in the future as both providers and patients adopt more efficient service delivery methods.

MNDR also decided to be considered an ‘emerging growth company’ and a ‘foreign private issuer’. This means that management can choose to disclose much less information to shareholders.

The stocks of many of these companies have performed negatively since their IPOs.

As a public company, risks to the company’s prospects include its small size and scope of operations within Singapore and its lack of proven expertise in expanding into other markets.

The existing cash runway does not cover a year’s worth of free cash, so if the company does not receive a quick cash inflow, it will run out of funds.

Management is seeking an enterprise value/revenue multiple of approximately 21x, with modest sales growth from a small base and a shift toward operating losses and cash burn.

Given the risks involved, relatively slow growth rate due to a small revenue base, operating losses and cash burn, and unreasonably high valuation expectations, my outlook for the IPO is Sell (Avoid).

Expected IPO Price Date: To be announced.