Modern Portfolio Theory and Cryptocurrency Investment

What is the ideal mix of traditional and cryptocurrency investments?

Investing in Bitcoin and other cryptocurrencies offers the potential for huge returns, but it also carries huge risks. In ~ Bitcoin Market JournalWe aim for a balanced investment strategy that minimizes risk as much as possible.

To help you find your ideal portfolio, we Modern Portfolio Theory (MPT).

MPT is About achieving the optimal balance between risk and reward through diversification.. Instead of going “all in” on Bitcoin, we balance the cryptocurrency’s wild swings with more traditional investments. MPT will help you find the right combination.

In this article, we’ll look at two types of investor personas. balanced investor and Cryptocurrency Brothers. Who is the winner? Spoiler: This is someone who uses the MPT approach.

What is Modern Portfolio Theory?

In short, MPT suggests: Diversification is the key to maximizing returns while minimizing risk.

Think of it as preparing for a long trip where you have to be prepared for all kinds of weather. Bring an umbrella, sunscreen, and a warm jacket.

Likewise, diversifying your investment portfolio using the MPT strategy means preparing for a variety of economic “climates,” from hot cryptocurrency bulls to cold cryptocurrency winters.

By allocating across different asset classes, you can capitalize on the returns of volatile assets like Bitcoin while protecting against expected market downturns.

Who created MPT?

Modern portfolio theory was introduced by American economist Harry Markowitz in his 1952 paper ‘Portfolio Selection’. Markowitz later won the Nobel Prize for his work on this investment approach.

He called for a diverse portfolio with exposure to a variety of asset classes, including corporate stocks, bonds, real estate, commodities and hedge funds.

If he knew about cryptocurrencies, he would probably have allocated a portion of his diversified portfolio to this new asset class. This is because the low correlation between cryptocurrencies and traditional investments helps reduce risk.

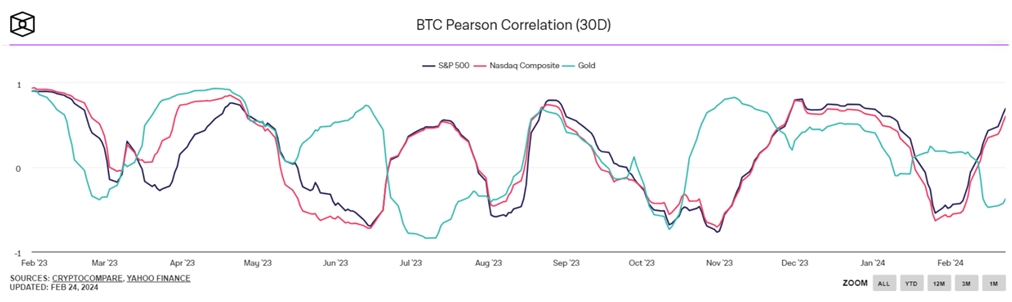

For example, let’s look at the correlation between the S&P 500 index, NASDAQ index, and gold with BTC.

If you look at the chart above, you can see that the S&P and NASDAQ are highly correlated, resulting in very little diversity. However, since gold is uncorrelated with stocks, it can act as a protection. When stocks fall, gold can rise (and vice versa).

Markowitz argued that there can be many different ways to diversify. For example, a portfolio may rely on an asset allocation model, a sector allocation model, an industry allocation model, or a geographic allocation model.

The main goals of MPT are: Maximize returns while mitigating risk..

Many mutual funds in the United States follow MPT guidelines to maximize portfolio performance.

Our vision of a balanced portfolio with a small allocation to cryptocurrencies is based on modern portfolio theory.

A practical example of modern portfolio theory

Let’s take a look at two sample investors and see who wins in the long run.

balanced investor

Imagine Alice, a balanced investor. She is an experienced captain who sails both calm and stormy seas in her well-equipped ship.

For example, she uses a “blockchain believer” portfolio strategy that allocates to traditional stocks (65%), bonds (32.5%), and a tiny bit of Bitcoin (2.5%).

This mix allows her to leverage the potential growth of digital currencies while anchoring her portfolio with the stability of traditional assets.

This approach has many advantages:

- Maintains stability even amid high volatility and turbulence in the cryptocurrency market.

- Mitigate portfolio volatility.

- Focus on long-term growth.

Crypto Bro

On the other side is our crypto brother Bob, who speculates on the prices of crypto assets and tries to find the next big coin. His portfolio is diverse but contains many risky assets. Almost a third are dedicated to memecoins such as DOGE, Shibu Inu, and dogwifhat. So the assets are diverse, but not risky, and apart from large chunks of ETH, there isn’t much to absorb volatility.

In a best-case scenario, his portfolio would allocate the largest proportion to Ethereum. However, many cryptocurrency investors seek quick profits by betting on riskier cryptocurrency assets such as meme coins.

Who wins in the long run?

Alice’s diversified portfolio has low volatility. The stability of traditional investments offsets her losses during the cryptocurrency market downturn. Meanwhile, her cryptocurrency exposure offers significant upside during market recoveries and bull markets.

On the other side, Bob faces a roller coaster ride. The value of his portfolio soared during the cryptocurrency market boom, but eventually plummeted during the recession cycle, erasing previous gains. This shows that there may be a better long-term strategy than putting all of your eggs in a single basket, like with cryptocurrencies.

Applying MPT to cryptocurrency investment

The cryptocurrency market provided tremendous opportunities to early investors who were obsessed with ‘holding’ rather than speculation.

Bitcoin, for example, is up more than 10,000% over the past decade.

However, with price volatility so volatile, most investors were tempted to sell to take profits or exit during the multi-month bearish trend. It’s not easy to be a hodler.

In contrast, traditional markets also rose in value, but were much more stable and balanced. During the same period, the S&P 500 Index (SPY) rose more than 150%.

Bond investments, such as Treasury bills, have provided negative returns for most of the past decade, but they still provide stability to a diversified portfolio. For example, the SPDR Portfolio Long Term Treasury ETF (SPTL) is down 15% over the same period, but is not showing extreme volatility.

We believe the best approach for risk-averse investors is to consider MPT principles and build a diversified portfolio with exposure to crypto assets. Our preferred approach:

- Invest approximately 2/3 in stock index ETFs

- Put roughly 1/3 into bond index ETFs

- It is a fraction (2-10%) of Bitcoin or cryptocurrency assets.

This mix seeks to capitalize on the growth of stock markets, the safety of bonds, and the explosive potential of Bitcoin.

Modern Portfolio Theory and the Baby Believers Portfolio

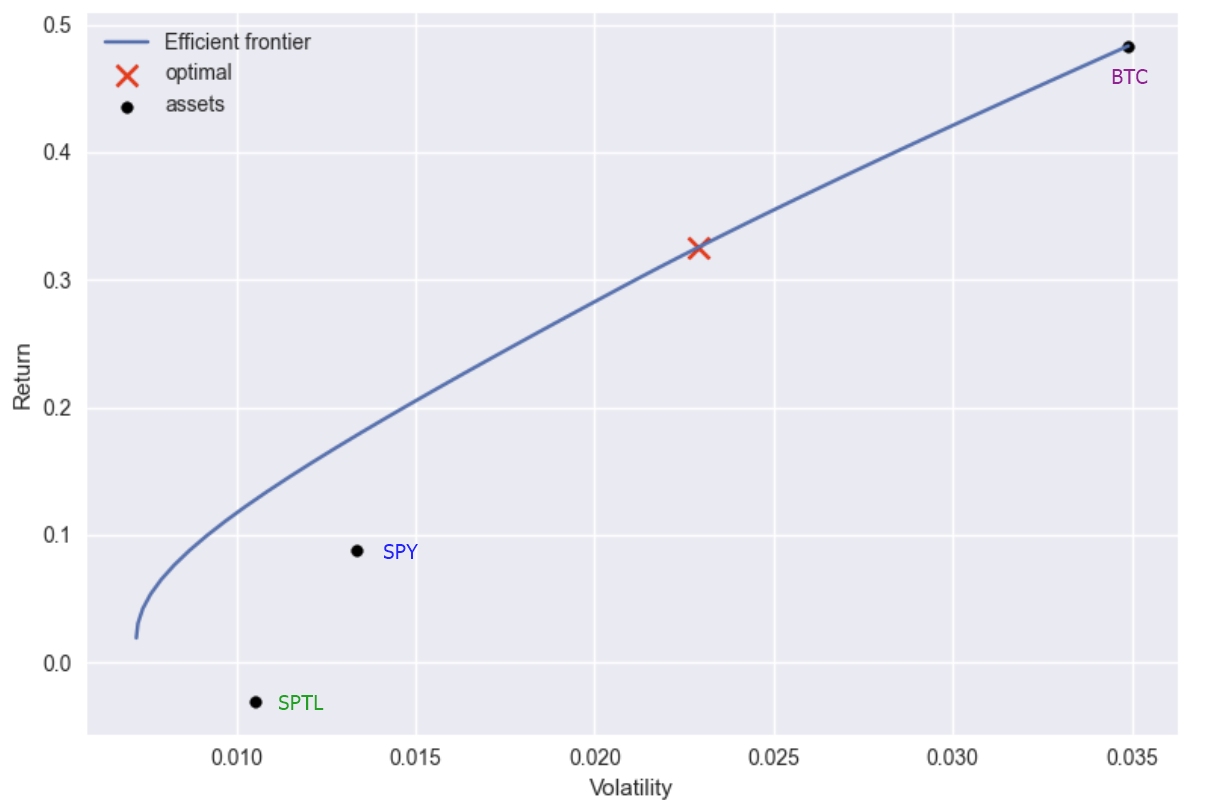

We tested our own version of the Baby Believers portfolio as an experiment. We used the last five years of data for SPY (stocks), SPTL (bonds), and BTC (bitcoin) to find the “optimal” portfolio using the MPT formula to balance risk and return.

The “optimal allocation” (indicated by a red X) includes:

- Expected Annual Return: 32.6%

- Annual volatility: 2.3%

- Sharpe Ratio: 13.34

By any standard, a 32.6% annualized return is very respectable, especially when your portfolio is only exposed to 2.3% annualized volatility. This is a very good risk/reward ratio, as can be seen from the relatively high Sharpe ratio. Typically, the higher the Sharpe ratio, the more attractive the risk-adjusted returns.

But let’s take a look at the portfolio allocation recommended by this MPT model.

- BTC: 72.5% of portfolio

- Spy: 27.5% of portfolio

- SPTL: 0.0% of portfolio

This is a far cry from our standard approach, where almost three quarters are allocated to cryptocurrencies! However, the annual volatility of this very BTC-heavy portfolio would have remained reasonable.

Remember: This is a retrospective model based on past performance and past performance is not indicative of future results.

Most investors are unsure about investing 75% of their savings in Bitcoin. That’s why our Blockchain Believers model offers an alternative to help you sleep better at night.

Implications for Investors

Modern portfolio theory is a strategy that applies to a variety of asset classes, especially for long-term investments. This highlights the power of diversification in reaching the optimal balance between risk and reward.

While the “optimal” portfolio over the past five years may have been 75% Bitcoin and 25% stocks, we stick to a more conservative investment strategy that only invests a very small portion of cryptocurrency assets, which still leaves us with more money than traditional investors. It’s much better.

Subscribe to the Bitcoin Market Journal newsletter to receive regular updates on the performance of the Blockchain Believers portfolio.