Money Market Funds: Set to Fuel Rally in Risk Assets in 2024

Tadamichi

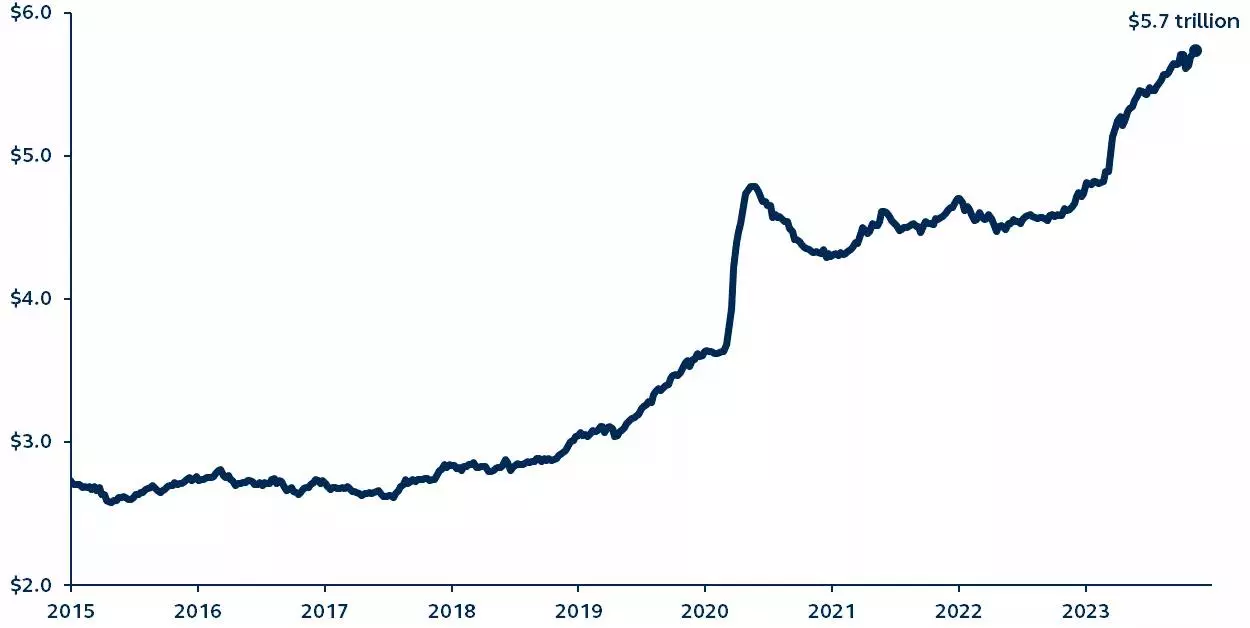

Money market flows have surged recently and have now reached a record $5.7 trillion as investors seek refuge from economic uncertainty while enjoying high yields.

As the economic downturn progresses rapidly, the situation stabilizes, With the Federal Reserve potentially likely to cut interest rates next year, these significant cash pools are poised to fuel a significant upside in risk assets, giving investors an opportunity to potentially take advantage of improving sentiment and market dynamics. .

Total U.S. Money Market Fund Assets

Aquarium, 2015 to present

source: Federal Reserve, Investment Company Institute, Bloomberg, Major Asset Management. Data as of November 15, 2023.

Assets in money market funds hit a record high of $5.7 trillion, with investors attracted by the high returns and partly sheltered from an uncertain U.S. economic outlook. This could represent a potential tailwind for the focus on risky assets. Cash begins to change hands.

The economic conditions of recent years have created the perfect environment for money market funds (MMFs). Safe haven flows surged in 2020 due to the COVID-19 outbreak, lockdowns, and resulting concerns about the U.S. economy.

Investor interest in money market funds has since sustained as yields have risen sharply due to a surge in inflation and the Federal Reserve’s aggressive response.

Moreover, money market fund inflows expanded earlier this year as the regional banking crisis triggered another flight to safety.

Despite concerns about the banking sector easing in recent months, inflows have continued across the board due to the explanation for “long-term rising” interest rates and continued uncertainty about the economic outlook.

2024 will be the year when many of the concerns and questions of recent years will finally be addressed. The long-awaited recession should come and go without leaving much damage, and inflation will continue to slow.

Most importantly, the Fed will likely open the door to rate cuts, making cash less attractive. Investors prepare. Improving economic conditions will spark a boost in sentiment, with a massive $5.7 trillion in cash available to fuel a rise in risk assets.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.