MoneyControl India Stocks of the Day (January 2024)

money control It is India’s leading financial and business portal that does the job in short. (about 4 minutes) Stock of the Day Video Presentation Indian Stock Recommendations.

Indian stocks were introduced. january Today’s videos covered in this post (from newest to oldest) are:

Craftsman Automation, Asia Paints, Permanent Systems, Tata Consumer Products, INOX India Ltd, Aarti Industries, Sky Gold Ltd, GAIL, Transport Corporation of India, SBI Life Insurance, Prince Pipes and Fittings Ltd, Data Patterns (India) Ltd, Varun Beverages, Bosch Ltd, Syngene International, DCB Bank, Dhanuka Agritech, Trent Ltd, Manappuram Finance Ltd and Home First Finance.

Foreign investors are paying attention to India.

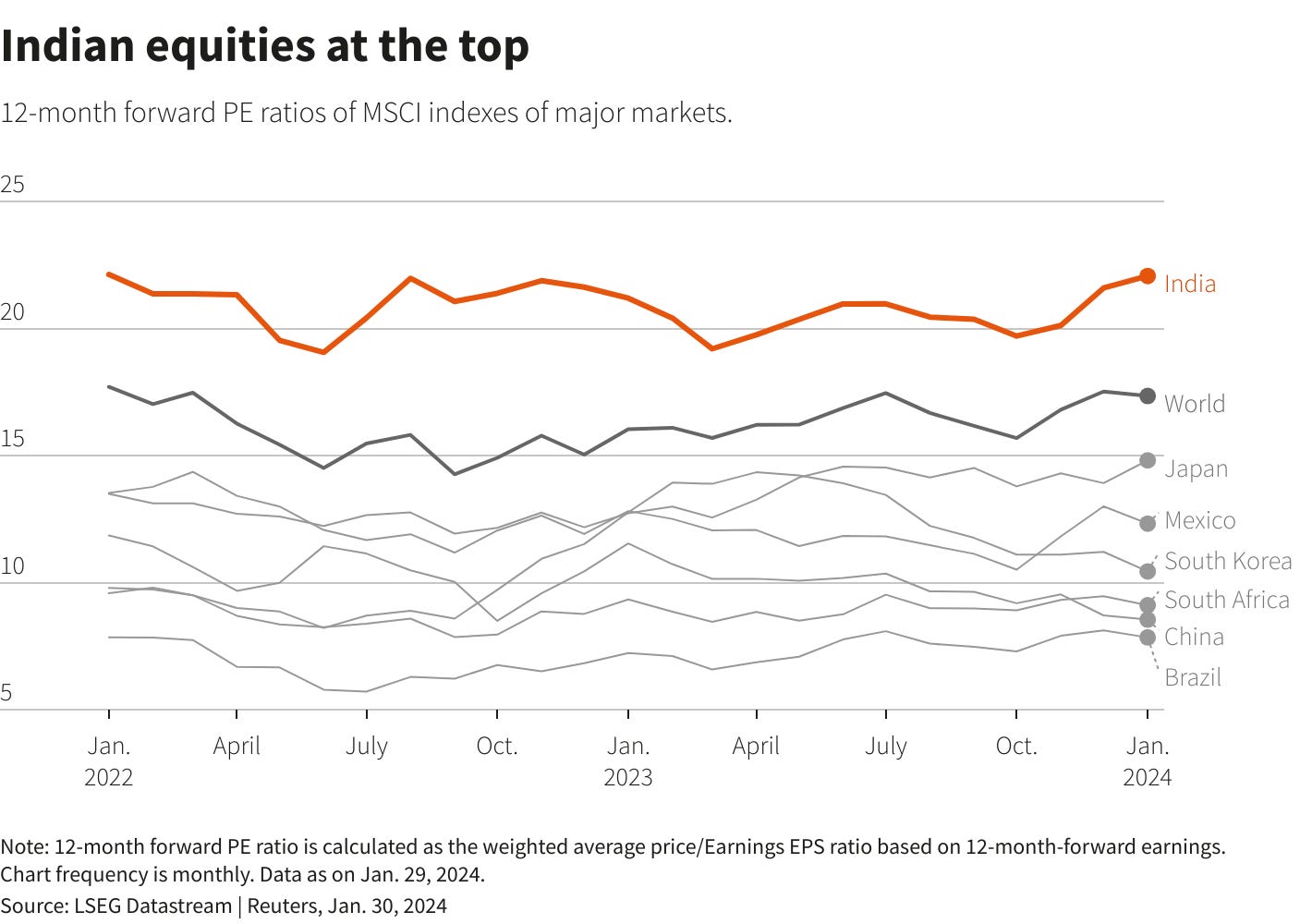

📰 Wall Street beats China over India in historic market shakeup. (SCMP) February 2024

Over the past 20 years, India’s gross domestic product (GDP) and market capitalization have increased from $500 billion to $3.5 trillion.

India overtook Hong Kong for a while. fourth largest stock market last month; Morgan Stanley predicts this will become a global phenomenon. Third largest by 2030

📰 Investors are digging into the Indian stock market as China flounders and discount risks increase. (Reuters) February 2024 🗃️

“It’s not India or China, it’s India and China,” said Mumbai-based CEO Nilesh Shah. Kotak Mutual FundMention what investors currently think of both markets.

“India’s premium valuation arises because other markets are not doing well, so now that they start doing well, that could change.“And that means the market should continue to deliver better and more consistent revenue growth,” he said.

domestic ownership The share of Indian stocks is now 35.6%, much smaller than 16%. foreign ownership. rest of it owned by the promoteris an Indian market term referring to majority shareholders who can influence company policies. FACTBOX – How foreign investors invest in India 🗃️ )

This interview will also be of interest to investors concerned about corporate governance in India.

📰 Ramesh Damani What makes the Indian stock market so unique and resilient? (Economic News) February 2024

And the Minister of Industry was an old socialist named George Fernandes. And here we learned the law of unintended consequences. Because George Fernandez had told the then Indian multinationals to either dilute their stake to 40% or leave the company and leave the country.

So the company has the following IBM and Cola They left India because they did not want to dilute their stake. But the company is: Colgate-Palmolive (India) (NSE: Colpal / spring: 500830), Nestlé India Ltd. (NSE: nestle / spring: 500790) and Hindustan Unilever Limited (HUL) (NSE: HindunilVR / spring: 500696) While in India, he distributed shares to the public. And as history records, Stocks have become multibaggers of 100x, 1,000x, and 2,000x over a period of time. But they too Provided good corporate governance to India. People understood how good companies behave and how good companies are managed. So we were 20, 30 years ahead of China in terms of good corporate governance. This is now being reflected in the market as there is a great group of companies following best practices across the world. In China, on the other hand, even the best companies are currently trading at 20-30 year lows. So I think the law of unintended consequences happened because Mr. Fernández forced the company out because he didn’t like foreign capitalists. It has led to better corporate governance and a better pool of investable companies in India.

Back to Moneycontrol’s Stock of the Day video To make your life easier, this post includes:

-

IR page link and Yahoo! This is a brief explanation of stock prices. Jae Won.

-

Link to Wikipedia page (for what it’s worth…)

-

that much MoneyControl stock headlines of the day and their summary What makes stock picking interesting.

-

embedded video (Again, they are usually 4 minutes long).

-

Forward or backward P/E and dividend yield linked back to Yahoo! This is a financial statistics page.

-

The latest long-term technical charts financial resources linked back to Yahoo!

And as always, this post Provided for informational purposes only (And to make your life easier by providing relevant information, links and charts). This does not constitute investment advice and/or recommendations…

artisan automation company (NSE: master / spring: 543276) It has grown into a leader in its field. Precision processing in various fields. It operates through the Automotive/Powertrain & Other, Aluminum Products, Industrial & Engineering segments.

asia paint company (NSE: Asian Paint / spring: 500820) We manufacture a variety of products Decorative and industrial paints We also offer wallpaper, waterproofing, adhesives and services depending on our portfolio. The company is also involved in the home improvement and decoration sector and offers bath and kitchen products. The company has also introduced lighting, furniture and furnishings to its portfolio.

Recently, the company signed a definitive agreement with Weatherseal Fenestration to acquire a 51% stake. Established in March 2022, Weathersil will engage in the interior decoration/furniture business, including manufacturing uPVC windows and door systems. Asian Paints has also signed a definitive agreement to acquire 49% stake in Obgenix Software (commonly known as White Teak), which is engaged in the business of decorative lighting products and fans.

permanent system (NSE: persistent / spring: 533179) It is a digital engineering and enterprise modernization partner founded in 1990 by Indians who worked at HP Labs. (see: Permanent Systems (NSE: PERSISTENT / BOM: 533179): One of the fastest growing IT companies in India. You’ve probably never heard of it.).