Monthly rent inflation accelerates, remaining above 6% per annum since March

Bet_Noire

The problem shown in today’s Bureau of Economic Analysis PCE price index was rental inflation. This accelerated from October to November and has recorded monthly increases for nine consecutive months since March. Annual growth rates were in the range of over 6%. This stubborn rent inflation has dealt a blow to the hopes of the Federal Reserve and economists that it will continue to fall further for 18 months, that it is lagging and “we know it will fall.” , But it didn’t come down any further, and today it accelerated.

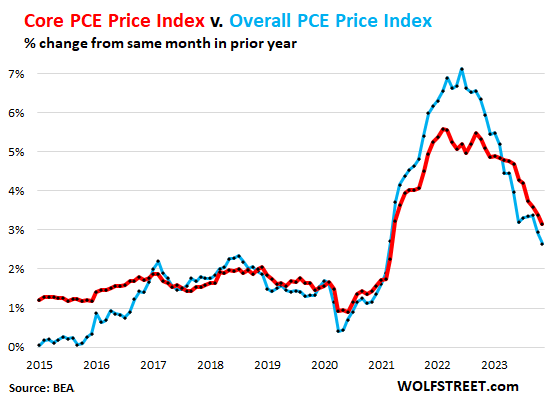

However, the overall PCE price index and the “core” PCE price index (excluding food and energy) slowed further due to the plunge in gasoline prices, monthly declines in food prices, and continued large declines in durable goods prices. Price deviating from current price Massive epidemic surge.

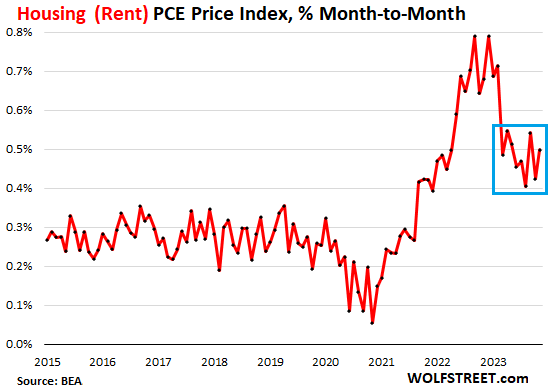

PCE Rental Price Index From October to November it accelerated by 0.50%, or an annual average of 6.2%, and has been in the same range since March. From the end of 2022 to March 2023, rent inflation declined sharply on a monthly basis. But since March – PCE rent inflation has stalled in the 6% annualized range (blue box) – with vague hopes that it will continue to decelerate, as Powell has cited several times.

The rental CPI released in early December showed a similar trend. Monthly rent inflation stopped falling in early 2023 and remained at around 6% per year. And that’s a tough nut to crack.

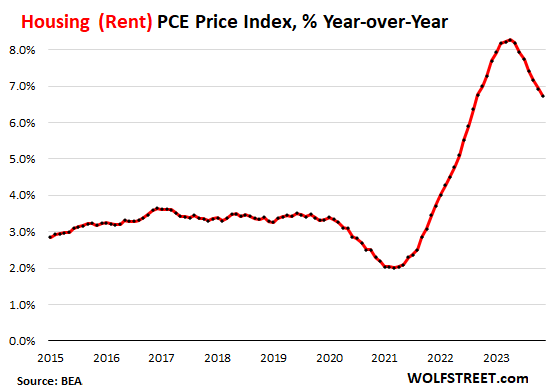

compared to previous year, PCE Rental Price Index It decreased to 6.7%. This 12-month slowdown was driven by sharp monthly slowdowns late last year and early this year.

If monthly rent inflation continues at the same trend it has since March, the year-over-year downward slope will begin to bend over the next few months and flatten out to around 6% by March 2024, close to doubling. This was before the pandemic.

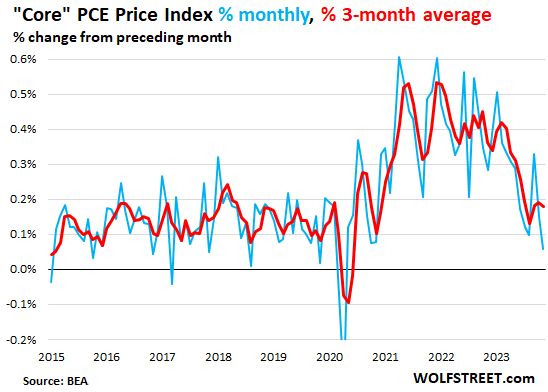

“Core” PCE Price IndexExcluding food and energy, the increase slowed to 0.06% in November compared to October (blue line), driven by a significant decline in the durable goods index (-0.43%), which is recovering from a pandemic surge.

The three-month moving average is 0.18%, little changed over the past three months (red). This translates to an annual rate of 2.2%, which is close to the Fed’s target range.

“Core” PCE Price Index Year-on-Year It has slowed down to 3.2% (red line). The overall PCE price index is, It slowed to 2.6% due to plummeting gasoline prices.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.