Muted Implied Volatility, Mag “3” Rally Hurts JEPI (Technical Analysis)

Torsten Asmus

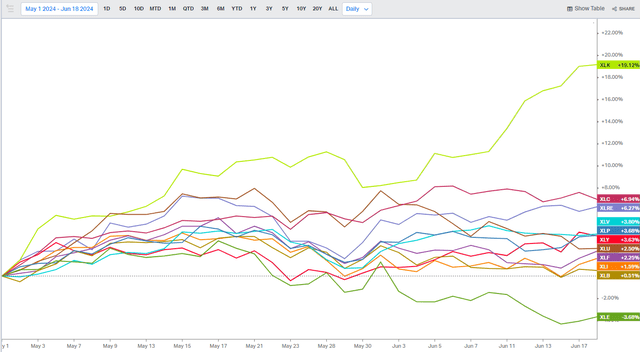

What a difference a quarter makes. Entering the second quarter, the rally in the global stock market was steadily expanding. While small-cap stocks were participating in the rally, non-U.S. stocks were actually outperforming large-cap U.S. stocks. Moreover, relative strength was seen in areas such as: Stay out of the information technology and telecommunications services sector. Niche markets such as financials, industrials and energy were ahead as the possibility of significant interest rate cuts from the Federal Reserve was erased one by one from the 2024 monetary policy blackboard.

Starting in mid-April, everything changed. Tax Day marks an inflection point for big tech companies to reassert their dominance. Another large-scale event has begun for AI-led rallies until May 1st. Fast forward to today and the Magnificent Seven have been condensed into the Terrific Triumvirate. NVIDIA (NVDA) surpassed Microsoft (MSFT).) and Apple (AAPL) into one of the world’s most valuable companies, and its IT sector now accounts for more than 30% of the S&P 500.

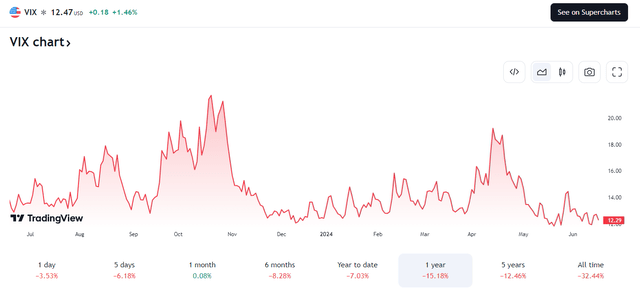

I use the JPMorgan Equity Premium Income ETF (NYSEARCA: Yes) From buy to hold. Covered call funds have performed well in the weeks since our previous analysis, but have recently underperformed amid the growth rally. Implied volatility is low in the broad market, so holding today will reduce the profits from selling options.

Tech sector dominance since May 1st

coy pin

A lower VIX reduces options selling income.

TradingView

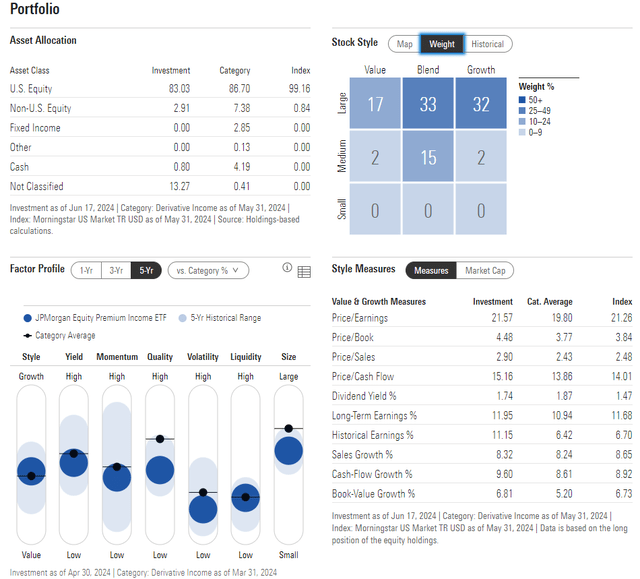

According to the issuer, JEPI generates income through a combination of option selling and investments in large-cap U.S. stocks and seeks to provide a monthly income stream through associated option premiums and stock dividends. ETF managers construct diversified, low-volatility stock portfolios through a proprietary research process designed to identify overvalued and undervalued stocks with attractive risk/return characteristics. Overall, JEPI seeks to provide a significant portion of the returns associated with the less volatile S&P 500 Index in addition to monthly income.

JEPI is a large-cap ETF with over $33 billion in assets under management as of June 18, 2024. Given the complexity of the strategy, the annual expense ratio is low at 0.35%, while the fund’s trailing 12-month dividend yield is high at 7.4%. Prospective investors should understand that most of their income comes from the sale of call options as well as cash flow from portfolio equity holdings.

Since JEPI’s allocation is similar to an equal weight strategy, recent share price momentum has been tepid. As a result, JEPI underperformed its cap-weighted fund peers with very high exposure to mega-cap growth stocks. However, JEPI scores well across risk metrics, given its diverse portfolio and somewhat modest annual standard deviation history. Liquidity is another plus, given that JEPI’s average daily volume is over 3 million shares and its average 30-day bid/ask spread is just 2 basis points, according to JPMorgan.

A closer look at the portfolio shows that Morningstar’s 4-star Bronze-rated ETF is primarily allocated to large-cap stocks. It has a better balance between value and growth than the S&P 500, and holds a significant position among domestic mid-cap stocks. This tells us that when not only Mag 7 but also the so-called S&P 493 do well, JEPI should do well as well.

But what I’m worried about is the evaluation. Now trading at close to 22 times earnings, the fund isn’t cheap. However, if long-term EPS growth is less than 12%, the PEG ratio is quite small compared to 2.0, which is not very expensive.

JEPI: Portfolios and Factor Profiles

dawn of fame

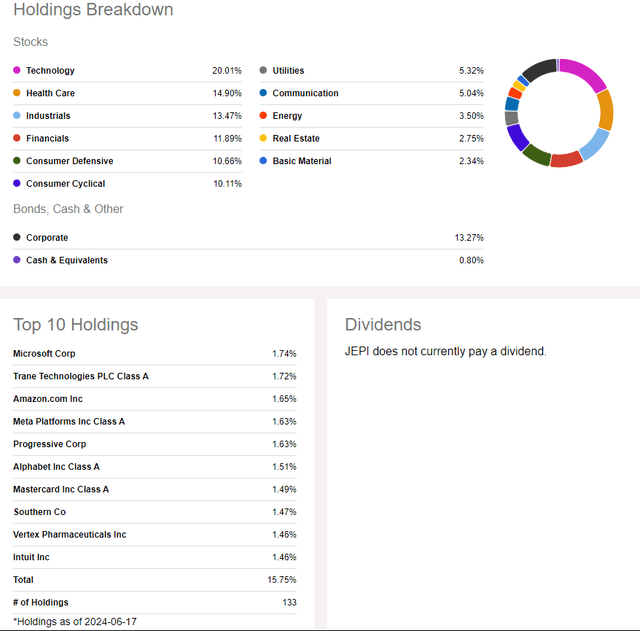

Important differences between JEPI and the domestic stock market can be found in sectoral analysis. Technology stocks make up just 20% of the ETF, which is significantly underweight compared to the SPX, while sectors such as industrials, consumer staples, and utilities are overweight. The 133-position portfolio behaves like an equal-weight product, given that the largest single stock is at 1.74% and turnover is as high as 190%.

JEPI: Sector diversification, not the highest weight allocation

pursue alpha

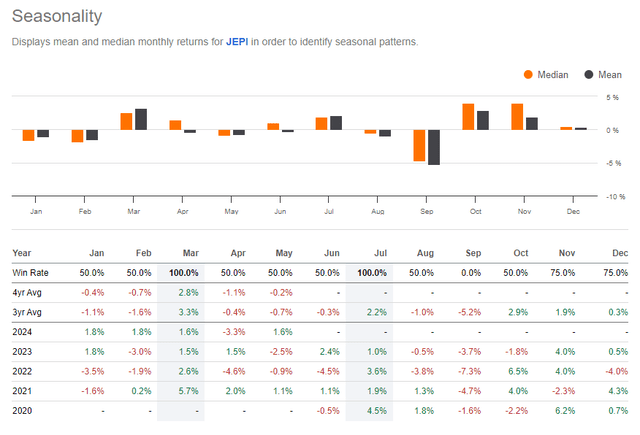

Given the fund’s short history, seasonality isn’t a huge consideration, but looking at monthly trends, July tends to be a decent month. Of course, the first month of the second half of the year is also one of the best periods for the S&P 500. A good time to buy JEPI is after implied volatility increases, which history suggests would probably be late in the third quarter.

JEPI: Optimistic July trend

pursue alpha

technical take

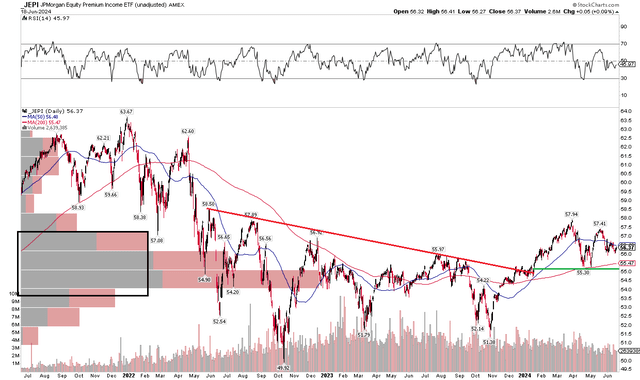

When charting a fund, you should first keep in mind that high dividends create price differentials. But you can still get an idea of the current trends and important price points to monitor. In the graph below, bulls appear to be in charge of the main trend. I make that claim given that the long-term 200-day moving average is positively sloping and the stock continues to maintain significant support at the $55 level. In the first quarter, I noted an uptick and the potential for higher prices. It was a success, but the rally died out after two months.

Today, I would like to see JEPI rise past its 2024 high of just under $58 on increased trading volume. I don’t like how trading volume has been down for most of this year. However, it is still an actively traded ETF. Additionally, the RSI momentum indicator at the top of the chart has rolled over after being strong during the first quarter. Nonetheless, healthy volume in the mid-$50s relative to the price will provide support today.

Overall, JEPI’s momentum has moderated, but its upward trend remains intact.

JEPI: Key support held, 200dma up

StockCharts.com

conclusion

With VIX near 12 and large-cap growth momentum trading showing little sign of a significant contraction, it is prudent to wait for better macro and cross-market trends in JEPI. I like the strategy for investors seeking high returns, but utilizing a call selling strategy requires patience with higher option prices.