My Dividend Stock Portfolio: New April Dividend Record – 101 Holdings With 22 Buys

da-kuk

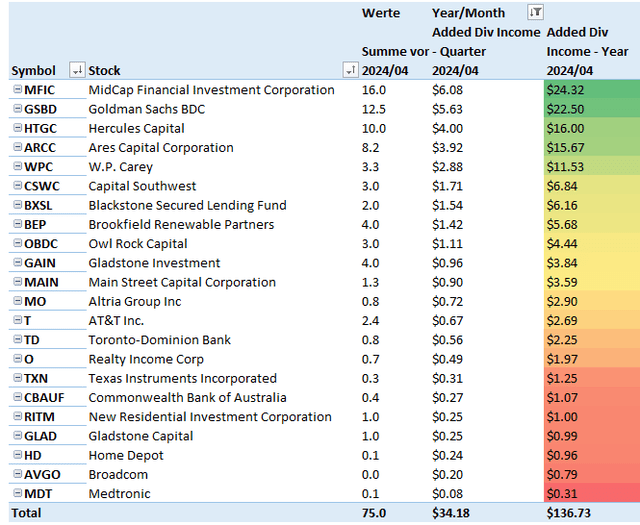

Portfolio Changes in April

Investment activity remained on a high level in April as I managed to put around $1,500 into the market, still mostly focusing on Business Development Companies. That said, opportunities become fewer and fewer as BDCs continue to rally now that the market also realizes that there won’t be any interest rate cuts anytime soon with inflation remaining sticky.

My main picks were Ares Capital (ARCC), Hercules Capital (HTGC), Goldman Sachs BDC (GSBD) and MidCap Financial Investment Corporation (MFIC), I’m not expecting any dividend hikes for all these stocks, but their current dividends are more than sufficient for my investment strategy. Instead, I’m hoping for some special dividends once the Fed starts cutting rates (although why they would do that anytime soon with the economy going strong is beyond me).

If we do get those special dividends, it could bring down stock prices, making the yields more attractive for future purchases. In April, all my moves added $136 to my yearly dividend income, kicking off the year on a positive note. My aim is to lift my dividend income by about $100 each month, mostly doable thanks to the high yields from BDCs.

Overall, the average yield on cost of my new investments in April averaged around 7.9%, reinforcing my belief in BDCs as a core part of my portfolio. I’m banking on their dividends staying steady – that’s what I’m all about when it comes to generating income. Time will tell if I’m on the money or just overly optimistic.

All these purchases break down as follows:

Added Dividend Income (Designed by author)

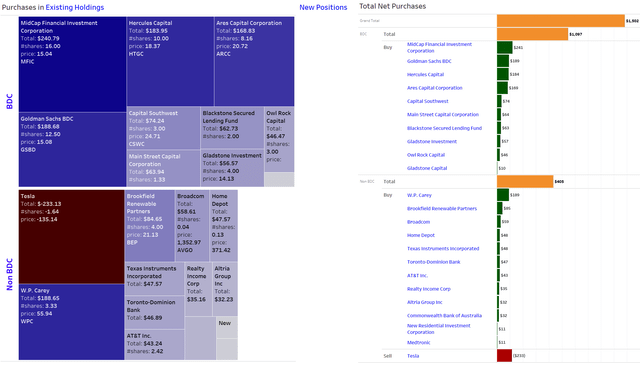

All net purchases in April can be found below:

Net Purchases in April (Designed by author)

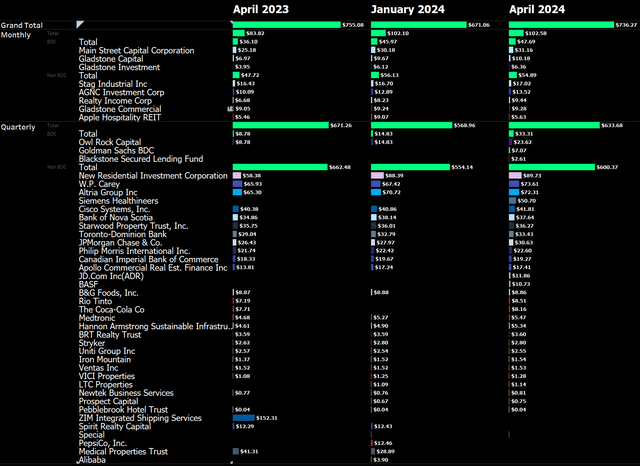

Dividend Income April 2024

Dividend income hit a new all-time record for April of $736, basically flat Y/Y and up 12% sequentially.

Monthly dividend payouts have once again crossed the $100 mark, marking the fourth consecutive month of achievement, albeit by a slim margin, at $102.58. However, reaching my next goal of $150, excluding special dividends, still lies ahead as a significant journey. While my investment strategy doesn’t exclusively center on monthly dividend stocks, my regular contributions to Realty Income (O) and Main Street Capital (MAIN) remain steadfast and will help that cause.

The stagnation in year-over-year income can be attributed to the substantial special dividend issued by ZIM Integrated Shipping Services (ZIM) in April 2023. Once we exclude this impact, along with the annual dividends from Siemens Healthineers and BASF paid in April 2024, the year-over-year performance reveals a much more robust 13%, comfortably surpassing the double-digit threshold once more.

April 2024 Dividend Income (Designed by author)

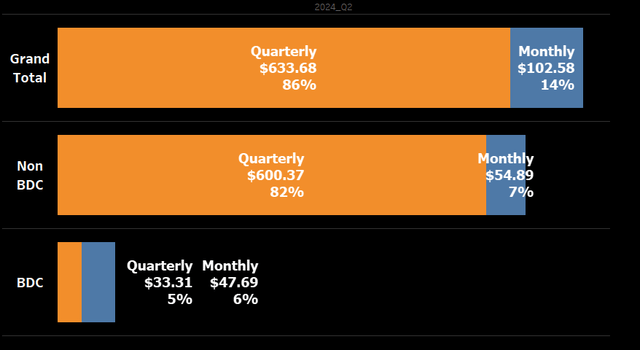

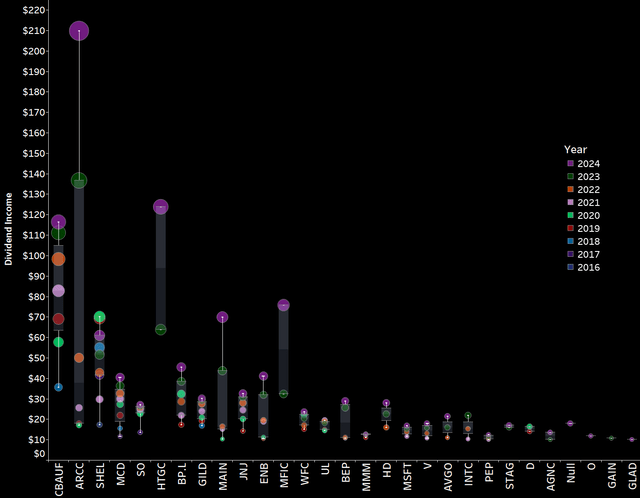

In alignment with my investment strategy, I’ve incorporated a BDC/Non-BDC breakdown into my dividend income charts. This addition allows for more precise monitoring of this critical development.

Additionally, I have created a new visualization that dissects dividend income into two distinct categories: BDCs and Non-BDCs. These categories in turn are separated by dividend payment frequency into Monthly (blue) and Quarterly (orange) in absolute and relative terms. In April 2024, BDCs accounted for just 11% of my total dividends, indicating that April tends to be a less BDC-focused month. This proportion is likely to decrease further in May despite the big dividend from Hercules Capital, before experiencing a significant surge in June when substantial BDC dividends are anticipated.

This metric is telling and will further guide me as it develops over time.

April 2024 Dividend Income – Split by BDC vs Non-BDC (Designed by author)

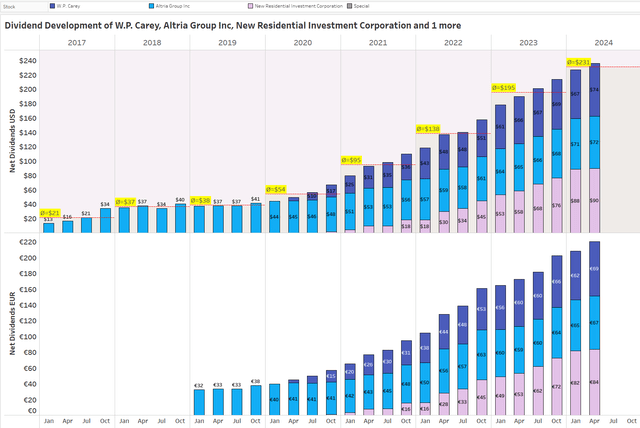

In April, the dividend income from my top three regular payers reached $236, a bump from last year’s average of $195. Looking at it quarterly, we’ve gone from $227 to $236. This uptick is primarily driven by regular investments in both W. P. Carey (WPC) and Rithm Capital (RITM).

All this is depicted below:

Top 3 Dividend Payers (Designed by author)

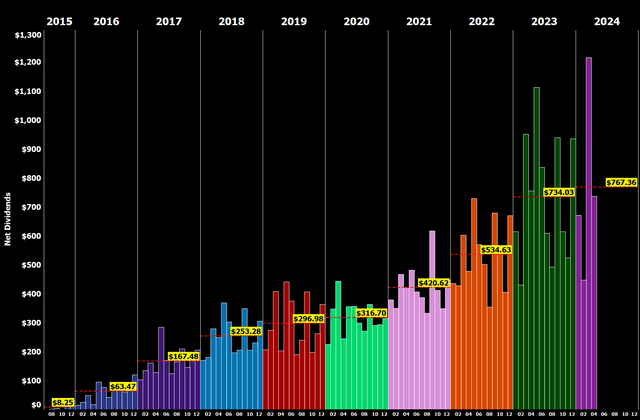

Here is a chart that shows the development of my net dividend income by month over time between 2015 and 2024. You can see the growth of my dividend income and the average annual dividend for each year:

All-time Dividend Development (Designed by author)

This chart is my favorite because it illustrates the progression of my dividend income over time and allows me to easily see the average annual dividend for each year.

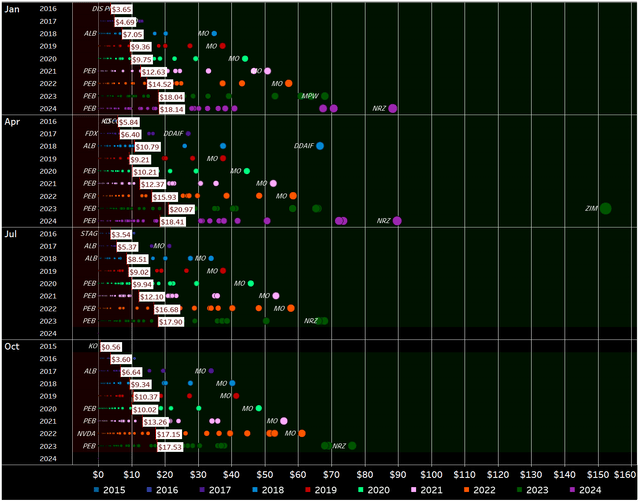

Next, I have plotted all the individual dividend payments I have received, coloring them by year and arranging the years side by side instead of horizontally as in previous updates. This visualization allows for a more comprehensive analysis of the distribution of my dividend payments over time.

Dividend Payment Bubbles (Designed by author)

By visualizing the data in this manner, we get a clear picture of how dividend payments are spread out over different years, offering valuable insights into the overall growth of my dividend income over the years.

This visualization is initially quite cluttered, but it contains a wealth of information. It shows every individual dividend payment I have received since I began my investment journey in 2015, represented as a circle that is colored and sized according to its contribution. The view is organized by month and year, allowing for a more comprehensive analysis of the development of my dividend income over time. For each year and month, a white rectangle indicates the average monthly dividend. The area where dividends fall below the average is filled in dark red, while the area above the average is colored dark green.

This type of data visualization allows for a detailed examination of the distribution of my dividend payments over time and enables me to easily identify trends and patterns in my income growth.

April 2024 Dividends (Designed by author)

Now, zooming in on April, we can immediately see a number of big colorful circles in a sea of black. The bigger the circle and the bigger the distance to the previous circle for the same stock, the bigger is the change in dividend income compared to the prior years.

We can clearly see the dominance and significance of Altria (MO), W. P. Carey, and Rithm Capital. They have a strong presence in the visual representation.

Taking a closer look at the dividends for 2024, I’m pleased to see mostly purple circles at the top of the scale, exactly where I want them to be. These sizable purple circles signify an increase in dividend income, aligning with my goal of maximizing growth. Yet, amidst this trend, one notable outlier stands out: the significant decrease in dividend income from Medical Properties Trust (MPW) in 2023, stemming from a substantial dividend cut. Additionally, there’s a gap in the chart for 2024, as the dividend for this year is unusually scheduled for May.

Overall, my aim is to observe numerous large orange circles positioned at the highest point on the scale. This signifies a positive trend of increasing dividend income, which is precisely what I’m striving for.

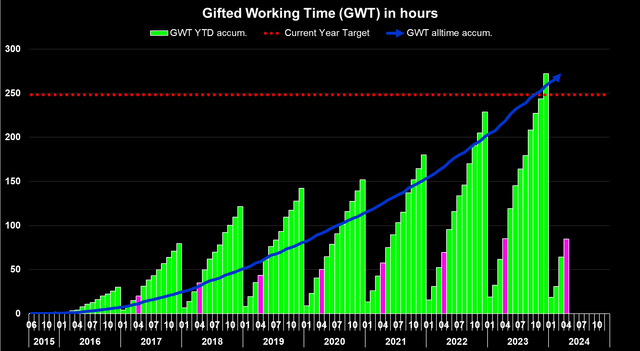

Another way to express the monthly dividend income is in terms of Gifted Working Time (GWT). Assuming an average hourly rate of $36.25 for 2024, my GWT and annual net dividends have been as follows:

- 2018: 121 hours GWT, $3,000 in annual net dividends

- 2019: 142 hours GWT, $3,600 in annual net dividends

- 2020: 152 hours GWT, $3,800 in annual net dividends

- 2021: 180 hours GWT, $5,050 in annual net dividends

- 2022: 229 hours GWT, $6,400 in annual net dividends

- 2023: 272 hours GWT, $8,800 in annual net dividends

- 2024: Targeting at least 248 hours GWT, $9,000 in annual net dividends

The overall target for the year with $9,000 in annual net dividends is very conservative, but I expect that I will have to take out some risk from my portfolio as I am eyeing to raise capital for real estate investments if I encounter the right deal. Still, as the year unfolds, I do expect to be able to pass that target and potentially even reach my next milestone of $10,000 as well. That would be a great achievement, but nothing I am banking on to reach this year – it would be the icing on the cake.

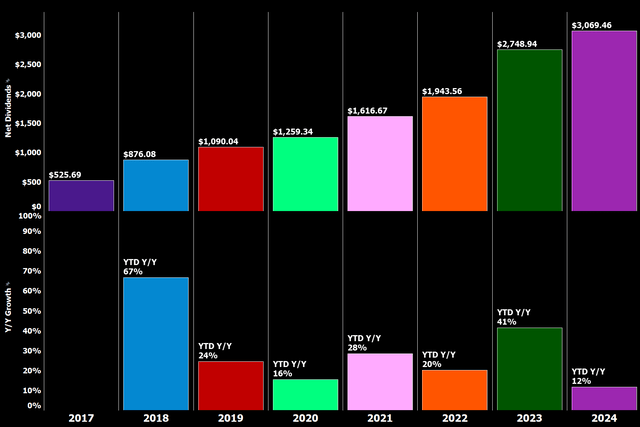

Across the years, my YTD Dividend Race has been as follows:

- 2018: Disappointing

- 2019: Phenomenal, benefiting from a low baseline in the prior year

- 2020: Fairly disappointing

- 2021: Phenomenal

- 2022: Much better than expected, fueled by the very weak euro

- 2023: Breathtaking

- 2024: Currently standing at 12% YTD and thus well on track towards achieving the $9,000 milestone. Multiplying the year-to-date dividends earned from January to April by three reveals an exciting prospect: surpassing the $9,000 target with ease. With ongoing contributions to my holdings and the anticipated surge in May dividends, courtesy of German annual dividend payers, the outlook is promising. It’s entirely reasonable to anticipate an annual dividend income soaring past $9,500 and beyond.

YTD Dividend Growth (Designed by author)

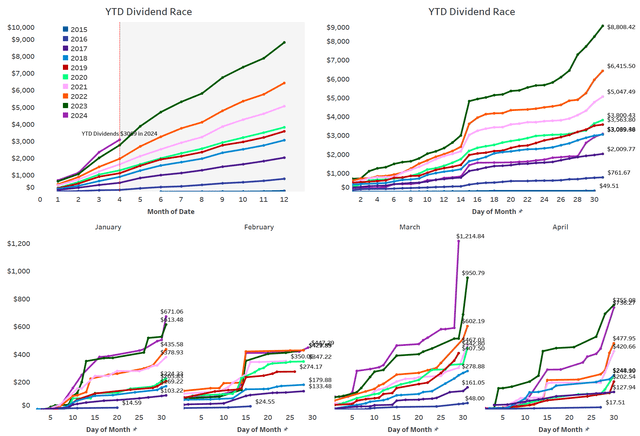

I have updated the YTD Dividend Race chart to show the development of YTD dividend income on a daily basis, allowing us to see that most of my dividend income is generated mid-month and towards the end of the month. The chart also breaks down the development by month for the current year, making it easy to identify significant jumps in income.

YTD Dividend Race (Designed by author)

Expressed in GWT, it presents itself as follows:

Gifted Working Time (Designed by author)

What this shows is as follows:

- All time (blue area) – Around 1,293 hours, or 162 days, of active work have been replaced with passive income since the start of my dividend journey. Assuming a five-day workweek, this translates into almost half a year in total.

- Full-year 2024 (green bars) – Around 85 hours, or 10.6 days, of active work have been replaced with passive income in 2024, which is basically equivalent to two full working weeks funded with dividends. That is great progress, and I can’t wait to add another month to that statistic.

- Highlighted in pink is the accumulated total at the end of the current reporting month (April).

This visualization allows us to see the overall impact of my dividend income on the amount of active work I am able to replace with passive income. It also enables us to see the progress made year-to-date, as well as the accumulated total at the end of the current reporting month.

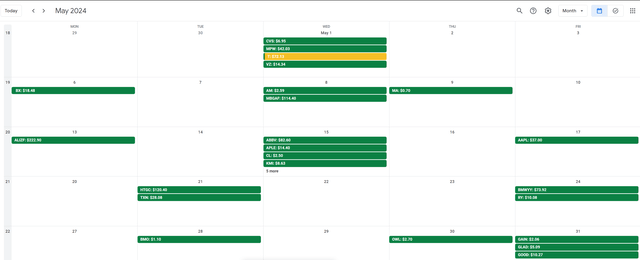

Upcoming May Dividends

Contrary to April, May features significantly fewer dividend payers, but among them are the big annual dividends from German companies as well as the still sizable dividend from AT&T (T). Beyond that, dividend payments are overall concentrated in the first half of the month, with only 1 meaningful dividend payment from the Royal Bank of Canada (RY) expected in the second half of May.

The snapshot below is taken from my free-for-all released Dividend Calendar (make sure to follow instructions in the video) and shows my expected dividend payments in April.

My Dividend Calendar (Designed by author)

At the end of April, my dividend portfolio is composed as follows:

| Company Name | Ticker | % Market Value | Market Value (€) |

| Apple | (AAPL) | 10.00% | 23,328 |

| NVIDIA Corporation | (NVDA) | 4.85% | 11,308 |

| Visa | (V) | 4.19% | 9,788 |

| Microsoft Corporation | (MSFT) | 4.01% | 9,348 |

| Ares Capital | (ARCC) | 3.83% | 8,935 |

| AbbVie | (ABBV) | 3.32% | 7,747 |

| McDonald’s | (MCD) | 2.99% | 6,968 |

| Main Street Capital | (MAIN) | 2.54% | 5,918 |

| Commonwealth Bank of Australia | (OTCPK:CBAUF) | 2.52% | 5,878 |

| Hercules Capital | (HTGC) | 2.31% | 5,396 |

| JPMorgan Chase & Co. | (JPM) | 2.21% | 5,169 |

| Broadcom | (AVGO) | 2.20% | 5,135 |

| Cisco Systems | (CSCO) | 2.14% | 4,983 |

| Allianz SE | (OTCPK:ALIZF) | 2.10% | 4,905 |

| Shell | (SHEL) | 2.07% | 4,833 |

| W. P. Carey | (WPC) | 2.05% | 4,786 |

| STAG Industrial | (STAG) | 1.88% | 4,392 |

| AT&T | (T) | 1.83% | 4,275 |

| Texas Instruments Incorporated | (TXN) | 1.82% | 4,241 |

| Home Depot | (HD) | 1.79% | 4,180 |

| Wells Fargo & Co. | (WFC) | 1.76% | 4,111 |

| Johnson & Johnson | (JNJ) | 1.74% | 4,069 |

| Southern Co. | (SO) | 1.47% | 3,420 |

| Rithm Capital | (RITM) | 1.42% | 3,321 |

| MidCap Financial Investment Corporation | (MFIC) | 1.40% | 3,269 |

| Altria Group | (MO) | 1.37% | 3,194 |

| Blackstone | (BX) | 1.28% | 2,996 |

| Toronto-Dominion Bank | (TD) | 1.21% | 2,829 |

| Gilead Sciences | (GILD) | 1.19% | 2,769 |

| Enbridge | (ENB) | 1.15% | 2,675 |

| Bank of Nova Scotia | (BNS) | 1.14% | 2,663 |

| Siemens Healthineers | (OTCPK:SEMHF) | 1.11% | 2,600 |

| BMW | (OTCPK:BMWYY) | 0.99% | 2,304 |

| Gladstone Capital | (GLAD) | 0.93% | 2,169 |

| Morgan Stanley | (MS) | 0.83% | 1,940 |

| Realty Income | (O) | 0.82% | 1,922 |

| Intel Corporation | (INTC) | 0.82% | 1,910 |

| BP2 | (BP) | 0.81% | 1,889 |

| BP1 | (BP) | 0.80% | 1,865 |

| Procter & Gamble | (PG) | 0.79% | 1,852 |

| PepsiCo | (PEP) | 0.77% | 1,801 |

| Daimler | (OTCPK:DTRUY) | 0.73% | 1,700 |

| Philip Morris International | (PM) | 0.64% | 1,490 |

| Bank of America | (BAC) | 0.64% | 1,485 |

| Honeywell International | (HON) | 0.60% | 1,393 |

| Starwood Property Trust | (STWD) | 0.59% | 1,371 |

| Brookfield Renewable Partners | (BEP) | 0.56% | 1,318 |

| Stryker | (SYK) | 0.51% | 1,186 |

| Gladstone Commercial Corporation | (GOOD) | 0.48% | 1,121 |

| Gladstone Investment | (GAIN) | 0.48% | 1,110 |

| The Coca-Cola | (KO) | 0.46% | 1,076 |

| Unilever NV | (UL) | 0.43% | 1,010 |

| Target Corporation | (TGT) | 0.42% | 980 |

| Sino AG | (XTP.F) | 0.39% | 912 |

| AGNC Investment Corporation | (AGNC) | 0.39% | 907 |

| Royal Bank of Canada | (RY) | 0.38% | 886 |

| NextEra Energy Partners LP | (NEP) | 0.37% | 855 |

| 3M Co. | (MMM) | 0.36% | 849 |

| Annaly Capital Management | (NLY) | 0.36% | 840 |

| Apple Hospitality REIT | (APLE) | 0.33% | 764 |

| Medical Properties Trust | (MPW) | 0.32% | 749 |

| Verizon Communications | (VZ) | 0.32% | 748 |

| Medtronic | (MDT) | 0.31% | 731 |

| NextEra Energy | (NEE) | 0.31% | 714 |

| CVS Health | (CVS) | 0.30% | 710 |

| Owl Rock Capital Corporation | (OBDC) | 0.30% | 701 |

| Dominion Energy | (D) | 0.29% | 683 |

| Antero Midstream Corporation | (AM) | 0.29% | 681 |

| Canadian Imperial Bank of Commerce | (CM) | 0.29% | 678 |

| BASF | (OTCQX:BASFY) | 0.29% | 672 |

| Vonovia | (OTCPK:VONOY) | 0.27% | 621 |

| Exxon Mobil Corporation | (XOM) | 0.26% | 597 |

| Apollo Commercial Real Est. Finance | (ARI) | 0.21% | 495 |

| Kinder Morgan | (KMI) | 0.21% | 491 |

| Goldman Sachs BDC | (GSBD) | 0.20% | 471 |

| ZIM Integrated Shipping Services | (ZIM) | 0.19% | 438 |

| Mastercard | (MA) | 0.18% | 414 |

| Colgate-Palmolive Company | (CL) | 0.17% | 408 |

| Sixt | (OTCPK:SIXGF) | 0.16% | 366 |

| Alibaba Group Holding | (BABA) | 0.15% | 343 |

| Pfizer | (PFE) | 0.14% | 337 |

| B&G Foods | (BGS) | 0.14% | 330 |

| Omega Healthcare Investors | (OHI) | 0.14% | 316 |

| Walgreens Boots Alliance | (WBA) | 0.12% | 276 |

| BRT Apartments | (BRT) | 0.11% | 264 |

| Blue Owl Capital | (OWL) | 0.10% | 239 |

| Capital Southwest | (CSWC) | 0.09% | 206 |

| Blackstone Secured Lending Trust | (BXSL) | 0.08% | 176 |

| Bayer AG | (OTCPK:BAYZF) | 0.07% | 168 |

| Fresenius SE | (OTCPK:FSNUF) | 0.07% | 162 |

| Equitrans Midstream Corporation | (ETRN) | 0.07% | 158 |

| Boeing | (BA) | 0.05% | 113 |

| Walt Disney | (DIS) | 0.04% | 91 |

| Diversified Healthcare Trust | (DHC) | 0.04% | 84 |

| The GEO Group | (GEO) | 0.03% | 81 |

| Bank of Montreal | (BMO) | 0.03% | 80 |

| Fresenius Medical Care | (FMS) | 0.03% | 80 |

| Uniti Group | (UNIT) | 0.03% | 66 |

| NewtekOne | (NEWT) | 0.02% | 55 |

| FS KKR Capital Corporation | (FSK) | 0.01% | 34 |

| Service Properties Trust | (SVC) | 0.01% | 25 |

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.