My Top 9 Real Money Blue-Chip Ideas Yielding As Much As 10.2%

Jose Luis Pelaez Inc

Many appreciate that I closely track what I own in my family’s ZEUS family fund, a money portfolio representing almost all of my net worth.

Some readers have asked for an article highlighting and summarizing the fundamentals of my top real-money buys, the companies that make up 35% of my family fund and about 33% of my net worth.

These ideas are most compelling for my family’s goals and needs, and they showcase some of these companies’ important fundamentals.

Real-Time Updates On My Top Individual Blue-Chip Stock Ideas – Based on What Matters Most To You

It’s one thing to know what I own in real time, but it’s another to see if it’s a good buy for you.

Remember that I don’t give personalized investment advice. Not just because the SEC won’t permit it but because I don’t know your specific situation, goals, risk profile, time horizon, etc.

Our efforts analyze stock ideas based on whatever fundamentals matter most.

| Screening Criteria | Companies Remaining | % Of Master List | |

| 1 |

Add “12 months fundamentally justified upside, Under “Columns.” |

0.00% | |

| Under “Portfolios” Family Fund | 10 | 2.03% | |

| 3 | BHS Rating “reasonable buy, good buy, strong buy, very strong buy, ultra value buy.” | 9 | 1.83% |

| Total Time | 30 Seconds |

Real Money Blue-Chip Ideas That Yield As Much As 10.2%

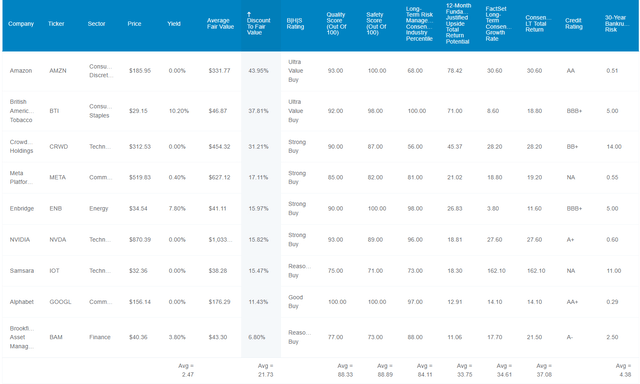

Dividend Kings Zen Research Terminal

I’ve sorted these by highest to lowest discount to fair value. Of my top 10 real-money stock ideas, only Microsoft (MSFT) is currently overvalued and a “hold.”

Fundamental Summary

The average yield for my nine top real-money buys is 2.5%, 1% more than the S&P and slightly more than the 2.3% of the dividend aristocrats.

The average historical discount to fair value is 22%, compared to a 4% premium for the S&P.

The average safety and quality score is 90%, and the quality is Ultra Sleep Well At Night or Ultra SWAN.

Think wide moat aristocrat quality.

84th percentile S&P risk management percentile = top 16% of all global companies at long-term risk management on over 1,000 metrics.

S&P’s risk management scores factor in things like:

- Supply chain management.

- Crisis management.

- Cyber security.

- Privacy protection.

- Efficiency.

- R&D efficiency.

- Innovation management.

- Labor relations.

- Talent retention.

- Worker training/skills improvement.

- Occupational health and safety.

- Customer relationship management.

- Business ethics.

- Climate strategy adaptation.

- Sustainable agricultural practices.

- Corporate governance.

- Brand management.

- Interest rate risk management.

They offer 40% fundamentally justified upside return potential in the next year.

In other words, if these companies grow as analysts expect, a 40% gain in the next year would equal their historical market-determined fair values.

While this is not a forecast, it indicates what kind of returns would be justified by existing fundamentals.

34% long-term consensus total return on average, though skewed higher by the equal weightings of Samsara (IOT) and CrowdStrike (CRWD).

- I do not recommend investing 11% into speculative blue chips like CRWD and IOT.

- 2.5% is the official DK recommended risk cap on speculative companies.

With a 2.5% yield and 34% growth, the total long-term return potential, according to the FactSet consensus of all analysts covering these companies for a living, is 37.1%, the income growth potential if you reinvest dividends and do annual rebalancing.

According to S&P, with an average 30-year bankruptcy risk of 4.38%, this group of nine real-money top recommendations is a BBB+ stable credit rating mini-portfolio.

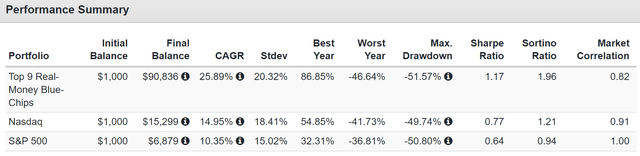

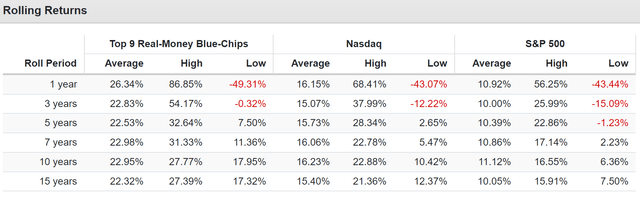

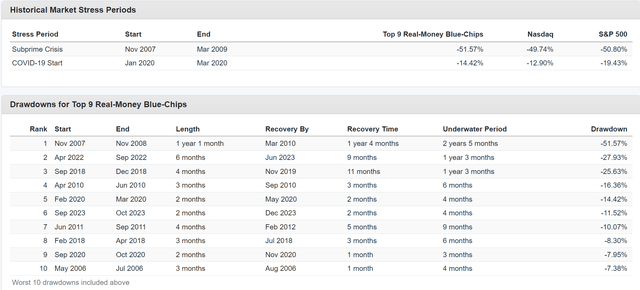

Historical Returns Since 2004

Portfolio Visualizer

While past performance does not guarantee future results, it can give us an idea of whether companies with relatively stable business models, like blue chips, have justified current analyst forecasts with historical growth.

Portfolio Visualizer

The average rolling returns show that factoring in recessions and bear markets, these nine real-money blue chips delivered exceptional returns far beyond those of the Nasdaq or S&P.

The worst five-year return was 7.5% per year or 44%, compared to the worst Nasdaq and S&P return of 14% and -7%, respectively.

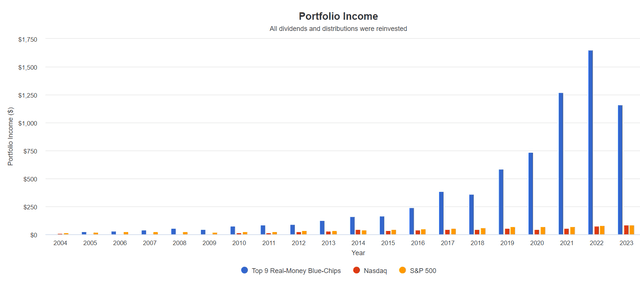

Income Growth: 24% Annually For 20 Years = 47.3X Increase In Dividends

Portfolio Visualizer

Note that just three of these companies paid dividends until Meta started paying last quarter. So, how did the yield go from 2.4% back in 2004 to a 116% yield on cost today?

How can a primarily growth-focused portfolio generate income growth of 24% annually for two decades?

Annual rebalancing of growth into value/yield means you buy more high-yield blue chips with long-term cap gains.

Rebalancing high-yield plus growth can generate more high-yield buying with “other people’s money” than you hope to buy with your income and savings.

Long-term income growth with annual rebalancing tracks total returns.

So, if you want to maximize long-term income in retirement, you need to own growth and yield.

- The effects begin to work after 10-plus years.

- A pure, high-yield income approach might be optimal if your time frame is less than a decade.

Summary Of Individual Company Investment Thesis

So, let’s look at the companies I own and the 30-second “elevator pitch” summary of why I own them. Why, out of 500 companies I track and monitor yearly, these nine earn a spot in my family fund.

I’ve linked to deep-dive articles for further research, including each company’s risk profile.

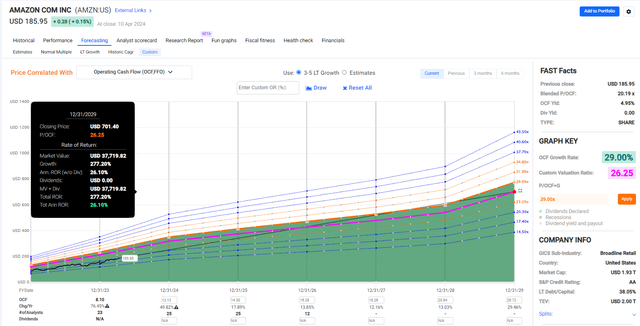

Amazon (AMZN) is the best deal in big tech. It’s a dominant name in e-commerce, streaming, advertising, and cloud computing and will invest $150 billion in AI cloud over the next 15 years.

2029 Consensus Total Return Potential

FAST Graphs, FactSet

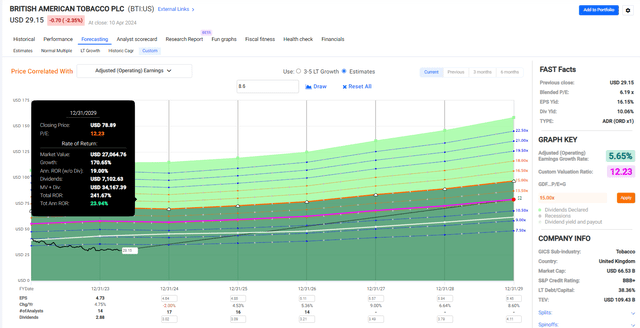

British American Tobacco (BTI) is the best Buffett-style “fat pitch” in high-yield blue-chip investing. Its 24-year dividend growth streak will make it a dividend champion later this year, and the company is well on track to achieve management’s 4% to 6% long-term growth guidance through rapid and profitable growth of reduced-risk products. Management says it will be smoke-free in the US by 2053.

BTI trades at the lowest PE in 24 years.

2029 Consensus Total Return Potential

FAST Graphs, FactSet

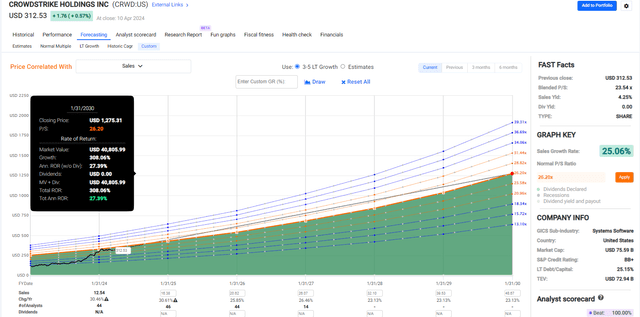

CrowdStrike Holdings (CRWD) is tied for No, 1 in the cyber security industry. They use more than 2 trillion daily data points from their customers and then apply the best AI-machine algos to update their security suite and platform exponentially. McKinsey thinks Cybersecurity could become a $2 trillion market in the coming years.

Founder-CEO George Kurtz, who, like Nvidia’s Jensen Huang, is a brilliant engineer with a deep understanding of cybersecurity. Before he founded CrowdStrike, he was the chief technology officer at McAfee.

- Speculative (BB+ credit rating): 2.5% or less max risk cap rec.

2029 Consensus Total Return Potential

FAST Graphs, FactSet

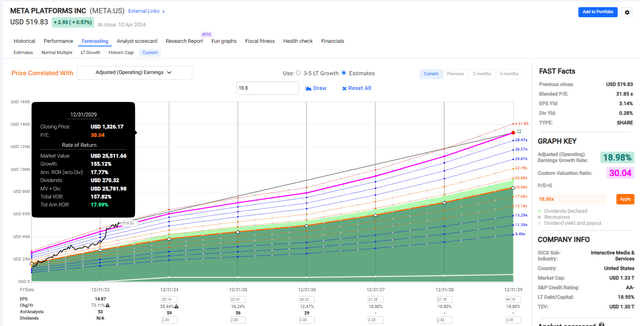

Meta (META) is the world’s largest social marketing platform and No. 2 in global digital marketing. The key to Meta’s growth is improved monetization of its emerging market users.

In much of the world, Facebook, Instagram and WhatsApp are the primary ways of accessing the internet. Much like Lowe’s (LOW) improved its margins to catch Home Depot (HD), triggering 20% earnings growth, Meta plans to ramp up revenue per user in emerging markets to converge with developed markets like the US.

The Metaverse platform is still being built and is a pure “moon shot” cherry on top. It’s not currently expected to generate significant growth. If Zuckerberg’s vision turns out to be correct, Meta’s growth potential could rise above 20% or remain near 20% for several more years.

FAST Graphs, FactSet

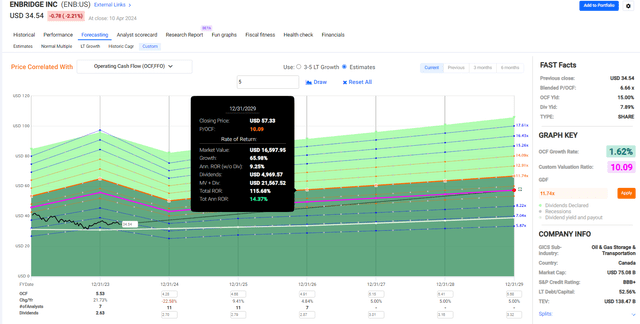

Enbridge (ENB) is the ultimate sleep well at night, a “buy and hold forever” dividend aristocrat midstream. The bond market is so confident in management’s long-term plan to transition to a green-energy future that it is willing to buy ENB bonds maturing in 2112.

This BBB+ rated industry titan is the most utility-like midstream, with 98% of cash flow regulated or under long-term contract.

Management believes it has the potential to grow by 5% for decades to come, fueled by the insatiable need for investment in new energy infrastructure.

The 7.8% yield and 5% growth is almost 13% long-term return guidance from a management team that S&P considers the 98th percentile in the world at risk management.

FAST Graphs, FactSet

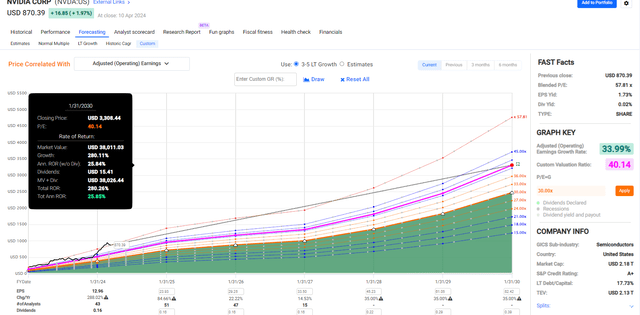

Nvidia (NVDA) is the industry leader in AI-enabling GPU accelerators and GPUs. It enables data centers, AI, crypto, gaming, and driverless cars.

Huang, the CEO, co-founded the company in 1991 and has been CEO ever since.

He says he wants to remain CEO for 30 to 40 more years and has a Master’s in Engineering from Stanford. He’s a passionate scientist and engineer with an incredible vision for future tech and the ultimate “jockey I want to bet on.”

Huang estimates the AI chip market is now $250 billion (this year) and will grow at 20% to 25% annually in the foreseeable future.

If he’s right, the 2027 AI chip market might be as high as $610 billion, with Mizuho estimating Nvidia’s market share should remain 75% through 2033, thanks to its lead in technology and the Cuda software platform.

Cuda is the iOS of AI software, with most AI software engineers learning to program applications on Cuda.

Management believes recurring revenue subscriptions will eventually become the majority of revenue, much as Broadcom is now a software company that makes chips, not a chip maker that sells software subscriptions.

Huang believes healthcare is a potentially larger market than AI chips, with more than $1 trillion per year in addressable market thanks to the ability to revolutionize medical advances. That includes Amgen using its GPUs and software suite to increase drug trial success rates for certain diseases by as much as 90%.

2029 Consensus Total Return Potential

FAST Graphs, FactSet

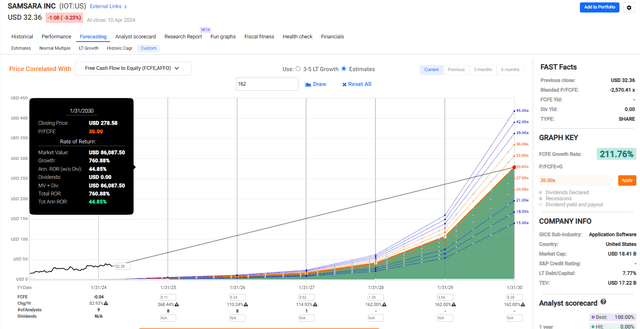

Samsara (IOT) is a leader in the Internet of Things, specifically in logistical telematics software platforms.

Customers include governments, cities, utilities, and anyone with a large fleet of vehicles who needs to maximize safety and efficiency, thus reducing costs and maximizing profitability.

IOT is a company that’s creating the link between the promise of AI and the real-world benefits to productivity that Goldman, JPMorgan, and McKinsey think could boost productivity from 1.6% to 3% to 6.2% and drive GDP growth as high as 6.5%.

This is one of just five companies Marc Andreesen, legendary venture capitalist, owns, sits on their board, and has 8% of his net worth invested in IOT.

Baillie Gifford, a legendary asset manager known for successful tech investing, is the second-largest shareholder.

CEO and CTO are co-founders with a successful history of scaling AI businesses to $500 million in sales before selling to Cisco and using those proceeds to found Samsara.

Free cash flow is positive, and FCF is expected to grow 162% annually through 2026.

- Speculative (relatively new company, highly uncertain valuation): 2.5% or less max risk cap rec.

2029 Consensus Total Return Potential

FAST Graphs, FactSet

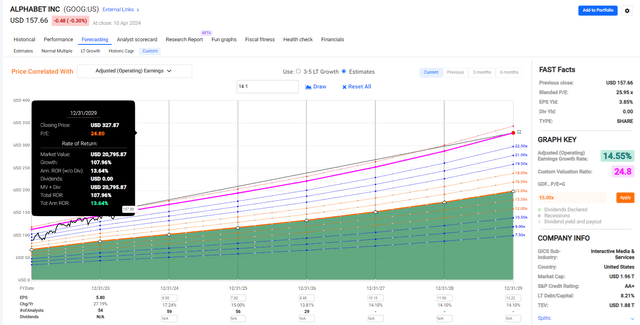

Alphabet (GOOG) (GOOGL) is No. 1 in online advertising, No. 3 in cloud computing, and is a leader in AI.

Gemini is the new AI model integrated into Google’s other services, such as Google Office. Apple is in talks to license Gemini for iPhone, making it the default AI software for a 1 billion phone installed base.

It’s the second most undervalued Mag 7 name behind Amazon.

2029 Consensus Total Return Potential

FAST Graphs, FactSet

Brookfield Asset Management (BAM) is a global infrastructure and green energy leader. BAM started investing in Brazilian hydropower in 1902 and has generated 20% annular returns for 40 years, over 20 of those under CEO Bruce Flatt.

BAM is the second-largest alternative asset manager in the world, and management sees a clear path to similar returns as the past for the next 20 years thanks to expansion into new business areas like credit.

The acquisition of Oaktree brought legendary Howard Marks into the BAM empire.

A nearly 4% yield and 15% to 20% long-term growth guidance (out to as much as 20 years) is the highest and longest total return guidance of 19% to 25% of any blue chip I know of.

My confidence is so great in BAM that it’s 100% of my SEP IRA.

2029 Consensus Total Return Potential

FAST Graphs, FactSet

My Favorite “Fat Pitch Combo”

Dividend Kings Zen Research Terminal

Combining British American and Amazon equally into a mini-portfolio creates a 5.1% yielding ultra-swan combo that’s 41% historically undervalued, has 74% upside to fair value total return potential within 12 months, and has 25% long-term income growth and total return consensus.

- 13.5% of my family fund is in this combo.

Risks To Consider

Remember that I’m not providing personal investing advice. These are my nine biggest real-money holdings, my highest-conviction ideas for my family’s needs and goals.

Portfolio Visualizer Premium

This is not my entire portfolio; this is 35% of the family fund. The high volatility of these individual companies is beyond what my family’s needs can tolerate, and that’s why we diversify with ETFs, bonds, and managed futures.

Remember that prudent long-term investing doesn’t start with stock picking.

- What are your goals?

- What’s your time frame and risk profile based on your income and life circumstances?

- What asset allocation (mix of stocks, bonds, and alternatives) will most likely get you to your goals?

- What ETFs, if any, are optimal for your goals and needs?

- What individual stocks can enhance your diversified and prudently managed portfolio to optimize for your goals and needs?

Just like 80% to 90% of athletic success is diet, not training, stock picking, while popular and “sexy” on TV and other platforms, ultimately is the final step, the fine tuning of a prudent strategy that is comprehensive and holistic.

Bottom Line: My Top 9 Real-Money Blue-Chip Ideas Yield As Much As 10.2%

These are the ideas I’m most convinced of for my family’s goals and needs.

My top ideas regarding safety, valuation, short — to medium-term growth prospects, and short—to medium-term total return potential are BTI and AMZN. Together, they create a 5% yield and an incredible 24% long-term income consensus growth/total return potential.

I hope these nine top ideas can provide you with some investing ideas to consider and an example of the thought processes that can help you make better investing decisions.