Mysterious 2010 Bitcoin Whale launches Bitcoin-specific market-making certificate

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

introduction:

Bitcoin Volatility Premium AMC, an innovative investment product, has quickly become the largest actively managed Bitcoin-only financial product in Europe and the second largest globally. Despite these achievements, to date, this Bitcoin-only AMC has flown under the radar and has received no media coverage whatsoever until now. What makes this investment offering particularly interesting is that it has seen a dramatic rise since 2010, fueled by a $50 million seed investment to launch from an enigmatic early Bitcoin miner. The product is designed to curb Bitcoin’s price volatility and promote its adoption as a trusted medium. exchange.

What is AMC?

AMC stands for Actively Managed Certificate. A type of structured security popular in Europe. Jurisdictions such as Luxembourg and Jersey allow asset managers to create such certificates to raise capital from investors. Certificates provide a “wrapper” for an investment strategy or specific underlying asset. Certificates are sold to investors and the capital is used to implement the strategy.

Who is the mysterious whale?

In response to inquiries about the identity of the Bitcoin whale behind the new Bitcoin volatility premium AMC, Zeltner & Co. confirmed that the seed investor is in fact an early Bitcoin miner who has been involved in Bitcoin since 2010. However, out of respect for investors’ requests, to protect their privacy and avoid public scrutiny, Zeltner & Co. declined to disclose additional details about their identities. The motivations for such large moves by individuals holding significant amounts of Bitcoin are particularly interesting. The creation of this AMC, which aims to stabilize the price of Bitcoin, demonstrates a strategic approach to digital asset management. By privately allocating their holdings to develop this investment product, Bitcoin Whales not only solve Bitcoin’s volatility problem, but also improve its viability as a stable medium of exchange. This AMC stands out as a unique market-making tool that not only seeks to manage risk, but also differentiates itself through an operational approach that aims for a more stable and predictable market for Bitcoin.

Why is this relevant to AMC?

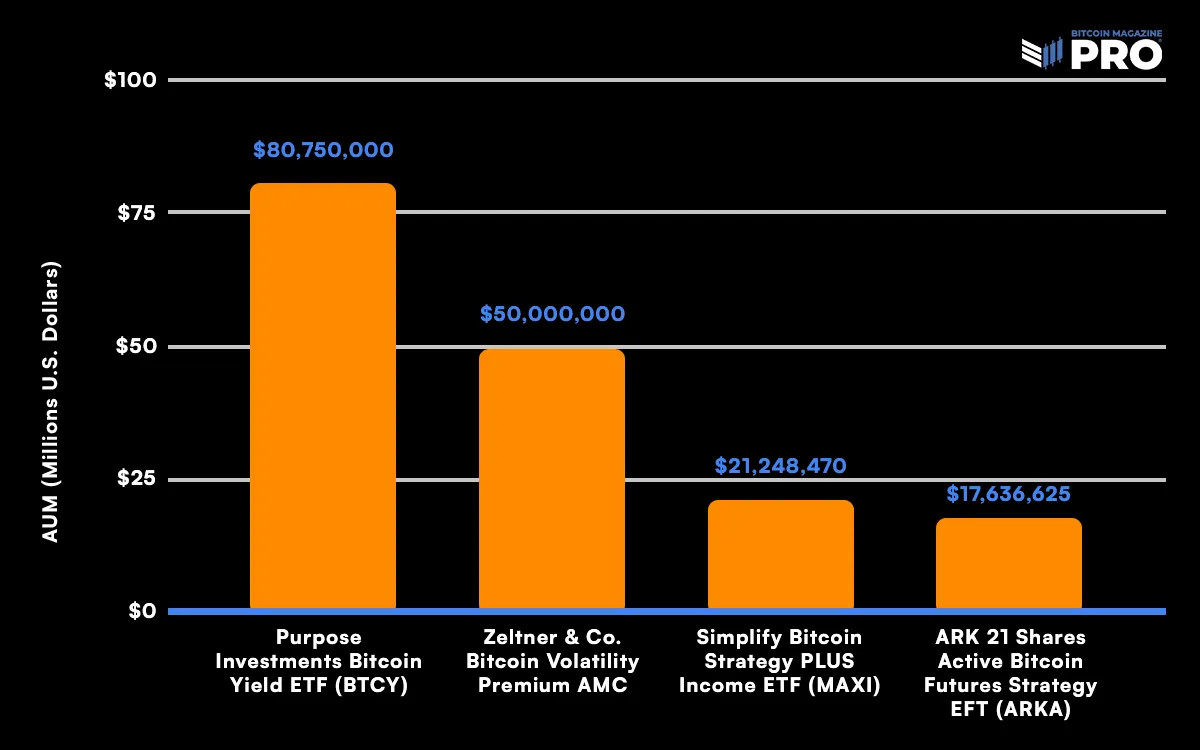

Bitcoin Volatility Premium AMC has already become the most actively managed Bitcoin-only financial product in Europe and the second largest globally after the Purpose-built Bitcoin Yield ETF (BTCY), with CAD 109 million (CAD). over 80.750 US dollars). There are several large Bitcoin ETFs that actively manage futures positions, such as the ProShares Bitcoin Strategy ETF (BITO), which manages over $2.82 billion in assets. However, these are not actively managed funds in the traditional sense. Futures ETFs aim to track the Bitcoin price 1:1 instead of outperforming or optimizing the risk/return of a direct Bitcoin investment.

The difference between ETFs and AMCs is that ETFs are passively managed. This means tracking the underlying asset. While AMCs are actively managed, this means they seek to outperform the underlying asset in absolute or risk-adjusted returns.

Figure 1: Largest active Bitcoin-specific funds and structured products

How is your investment strategy unique?

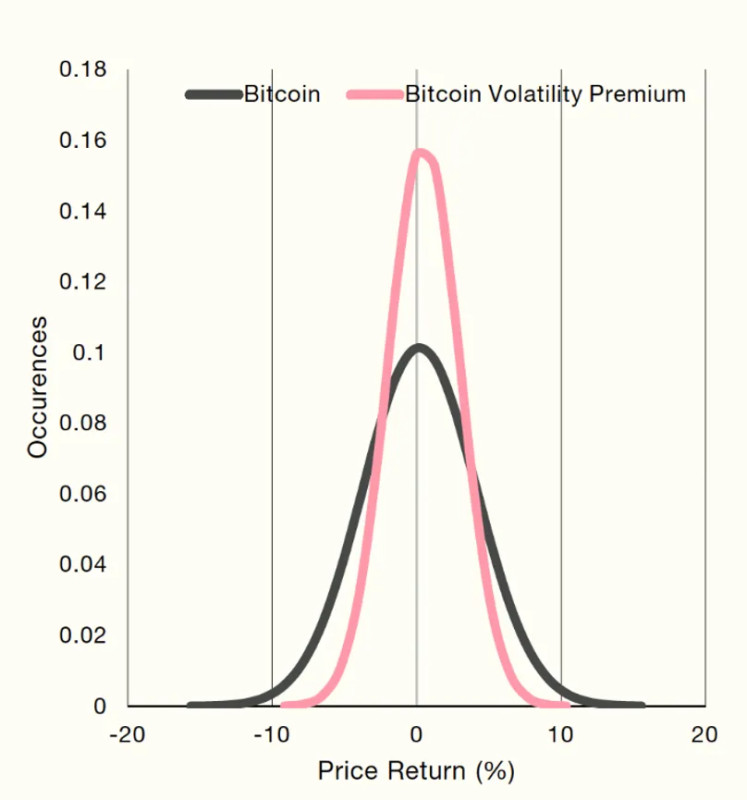

The certificate invests algorithmically in Bitcoin and the US dollar, with the goal of optimizing the risk-return profile by investing directly in Bitcoin while collecting a volatility premium. This strategy provides liquidity to the BTC/USD spot market through market making on major exchanges such as Kraken. This leads to small profits that can accumulate between 2% and 6% per year depending on volatility. Volatility premiums are created when the market moves from creating algorithmically generated buy orders to writing sell orders, and vice versa. The algorithm buys low and sells high at each dip or peak, respectively.

Figure 2: Risk Profile of Bitcoin and Zeltner & Co. Bitcoin Volatility Premium

Similar to ETFs, as more investors invest in Bitcoin Volatility Premium AMC certificates, the certificates require more Bitcoin to be purchased, increasing demand for Bitcoin, which already exceeds the newly created daily supply by several factors. Market making targets an allocation of 70% Bitcoin and 30% US Dollars, which means the strategy currently owns over 540 Bitcoins.

Market Impact and Future Outlook:

Bitcoin Volatility Premium AMC’s goal is to smooth out Bitcoin’s price fluctuations, making Bitcoin more stable and functional as a medium of exchange.

Dr. Demelza Hays, Portfolio Manager at Zeltner & Co., shared her insights with Bitcoin Magazine Pro.

“Bitcoin’s potential to become a global medium of exchange and currency largely depends on achieving stable purchasing power. The volatility inherent in the current Bitcoin price poses a barrier to widespread adoption for everyday transactions. However, Bitcoin’s “If its value stabilizes, it could emerge as a viable alternative to traditional fiat currencies, offering advantages such as decentralization, security, and low transaction costs over Bitcoin scaling solutions such as Liquid, AQUA, and Lightning Network.”

AMC utilizes algorithmic strategies to invest in Bitcoin and the US Dollar, making it the most actively managed Bitcoin-only financial product in Europe and a major player globally. This strategy aims to profit from market volatility that affects Bitcoin’s demand and price dynamics.

Swiss Family Office Participation:

The strategy is managed by Zeltner & Co., a prestigious family firm based in Zurich, Switzerland. Founded by Thomas Zeltner, Zeltner & Co. continues the legacy of Thomas’ father, Jürg Zeltner, former Chairman of UBS Wealth Management. Zeltner & Co., known for its prudence and expertise in asset management, lent credibility to this venture and solidified confidence in the legitimacy of the strategy and its potential for success.

Regulatory and geographic advantages:

AMC chose Zurich, Switzerland as its headquarters because of the region’s favorable regulatory environment and reputation as a global financial and innovation hub. This strategic location enhances the security and attractiveness of Bitcoin Volatility Premium AMC for investors looking to diversify into digital assets.

conclusion:

The launch of Bitcoin Volatility Premium AMC comes at a time of heightened interest in Bitcoin, which has recently surpassed all-time highs and captured the attention of institutional investors and mainstream media. As the market continues to mature and gain greater institutional participation, the emergence of innovative investment vehicles such as these certificates highlights the evolving nature of digital asset management.