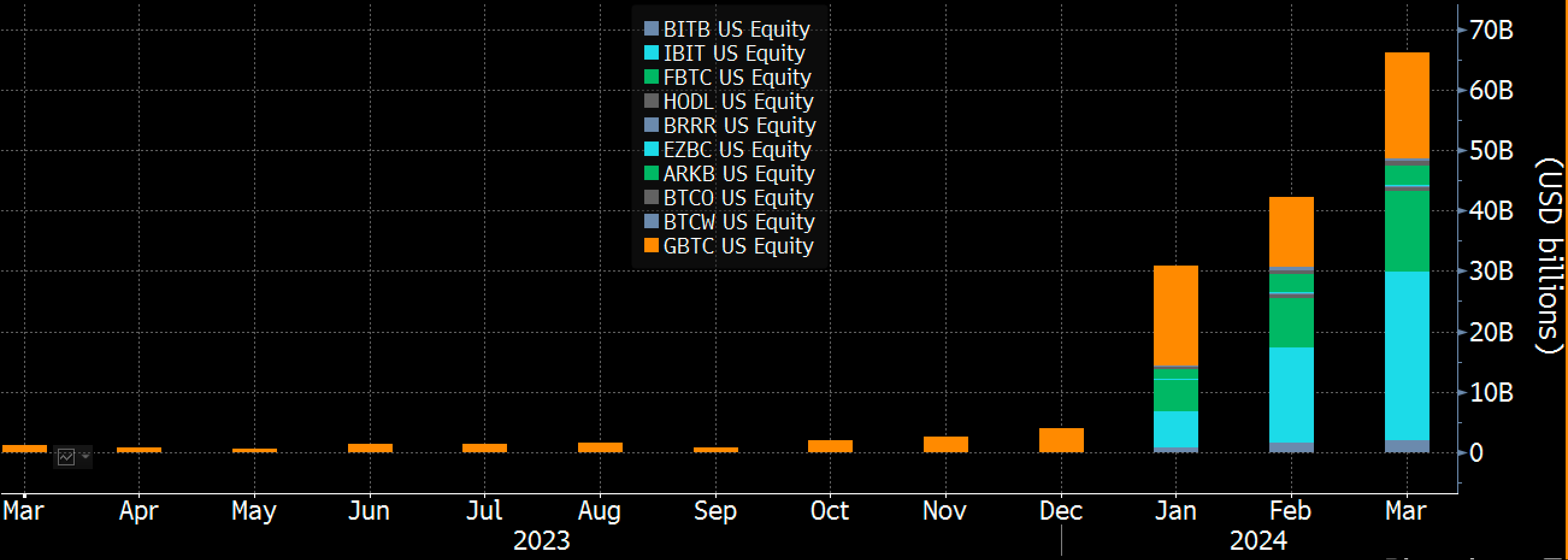

Net ETF inflows have slowed as Bitcoin retreats from all-time highs.

On Thursday, U.S. spot Bitcoin ETFs saw net inflows slow to their lowest level so far this month, with Bitcoin retreating quickly after reaching record highs.

Net inflows fell to $132.5 million yesterday, the data showed, largely driven by outflows of $257.1 million from Grayscale’s converted GBTC fund. From BitMEX Research. Total net inflows since spot Bitcoin ETF trading began on January 11th are now just under $12 billion, or over $211,000.  BTC

BTC

-6.87%

In Bitcoin terms.

BlackRock’s IBIT ETF dominated inflows Thursday, as usual, adding $345.4 million. VanEck’s HODL took second place yesterday, recording $13.8 million worth of inflows as it continued to see improved flows after temporarily reducing its fees to zero. Surprisingly, Fidelity’s FBTC Spot Bitcoin ETF, which regularly ranks second behind IBIT, fell to third place on the day with net inflows of $13.7 million. This is the lowest daily figure since launch.

However, interest in spot Bitcoin ETFs still appears to be growing, with financial advisory firm Cetera Financial Group approving the use of BlackRock’s IBIT, Fidelity’s FBTC, Franklin Templeton’s EZBC and Invesco’s BTCO on Thursday.

“As expected, we are cautiously embracing Bitcoin ETFs and have developed important guidance to help financial professionals implement these products in their client portfolios,” Matt Fries, head of investment products and partner solutions at Cetera, said in a statement. “We prioritized it,” he said.

“Financial advisory firms are now issuing press releases about the use of btc ETFs,” said Nate Geraci, ETF Store president. “In other words, it is an attempt to use Bitcoin ETFs as a point of differentiation/competitive advantage. “Things are getting rough.”

Spot Bitcoin ETF records third-biggest day in trading volume

Daily trading volume for U.S. spot Bitcoin ETFs hit its third-largest level on Thursday at $7.98 billion, as Bitcoin prices hit record highs before plunging. The ETF’s record daily trading volume remains at $9.9 billion, set on March 5, when Bitcoin first broke the previous cycle’s all-time high of $69,000.

BlackRock’s IBIT ETF led again yesterday, recording volume of $3.92 billion. This is the fund’s second-biggest trading day to date. Grayscale’s GBTC and Fidelity’s FBTC generated trading volume of $1.96 billion and $1.21 billion, respectively, according to The Block’s data dashboard.

BlackRock’s IBIT currently stands at 49.1% and is quickly approaching 50% market share by volume. Meanwhile, Grayscale’s high-fee GBTC fund fell from 50.5% market share on Jan. 11 to 24.6% as of Thursday.

Trading volume for spot Bitcoin ETFs has increased significantly this month, surpassing January and February volumes in just two weeks. “Monthly trading volumes for 10 Bitcoin ETFs are as follows: “We’re only halfway through March, but we’ve already surpassed February and January’s figure by $65 billion.” Bloomberg ETF analyst Eric Balchunas Posted At X.

Find out monthly trading volume for Bitcoin ETF. video: bloomberg.

Currently, the cumulative trading volume of all spot Bitcoin ETFs stands at $135.9 billion.

Bitcoin retreats from all-time highs

The price of Bitcoin hit a record high of $73,836 on Thursday, before a sharp sell-off sent the largest cryptocurrency by market capitalization down 11% to $65,566. Bitcoin has since recovered slightly and is currently trading at $67,696, according to The Block’s price page.

BTC/USD price chart. Image: Block/TradingView.

This correction resulted in a significant liquidation of long positions on central exchanges over the past 24 hours. According to CoinGlass data, this volatility resulted in the liquidation of more than $278 million in Bitcoin positions, most of which ($225 million) were long positions.

The overall cryptocurrency market experienced more than $667 million in liquidated long positions during the period, with total liquidations reaching $809 million across various centralized exchanges.

This decline can be seen in the broader market, with the GM30 index, which represents the top 30 cryptocurrencies by market capitalization, falling 5% from 162 to 154. Similar indices for layer 1 and layer 2 tokens also saw similar declines. That said, all three indices are still up significantly since the end of last year.

Disclaimer: The Block is an independent media outlet delivering news, research and data. As of November 2023, Foresight Ventures is a majority investor in The Block. Foresight Ventures invests in other companies in the cryptocurrency space. Cryptocurrency exchange Bitget is an anchor LP of Foresight Ventures. The Block continues to operate independently to provide objective, impactful and timely information about the cryptocurrency industry. Below are our current financial disclosures.

© 2023 The Block. All rights reserved. This article is provided for informational purposes only. It is not provided or intended to be used as legal, tax, investment, financial or other advice.