Neutral View On Alpine Income Property Trust As There Are Better Alternatives (NYSE:PINE)

adventtr

Investment Thesis

The ongoing market conditions significantly limited Alpine Income Property Trust’s (NYSE:PINE) ability to grow acquisition-wise during the 2023 – 2024 YTD period. The management presented a coherent investment strategy reflected in PINE’s business decisions that the Company intends to follow until the market conditions improve or the gap between buyers’ and sellers’ expectations narrows.

While the Company offers an attractive dividend yield and has a seemingly opportunistic valuation multiple, there are also several factors limiting the upside potential and making some of its competitors within the same property sector or REITs from other niches noticeably more appealing alternatives with better risk-to-reward ratios (I’ve provided some suggestions within the later sections of the analysis). These factors include:

- unfavourable debt maturity schedule

- solid but not elite business metrics with room for improvement

- high tenant concentration

- inability to source attractive property acquisition opportunities in the current market

- turbulence in the AFFO per share growth and a modest dividend growth

Nevertheless, PINE may still unlock some upside potential upon overcoming the headwinds resulting from the current market conditions. Moreover, the dividend yield is attractive and supported by a reasonable payout ratio, which may make PINE worth holding for income-oriented investors. Therefore, I have a neutral view of the Company summarized with a “hold” rating.

Introduction

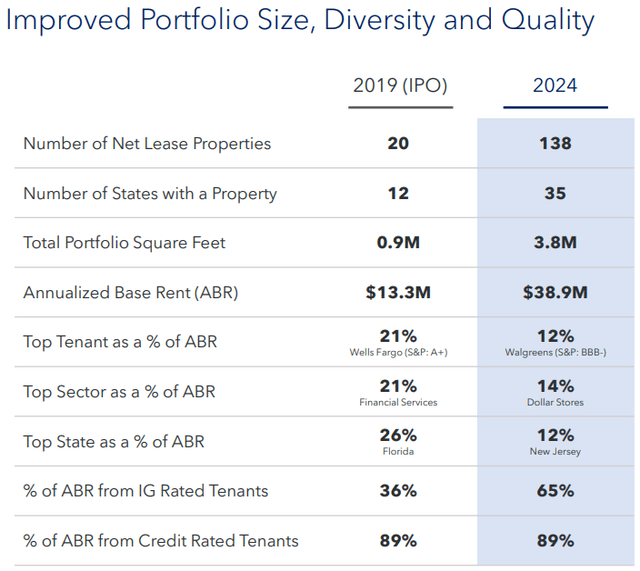

PINE is the smallest triple-net lease REIT analyzed within Cash Flow Venue. As of March 2024, the Company owned 138 properties across 35 states with a total sq. ft. of 3.8m. It had its IPO in 2019, and since then, the Enterprise expanded its portfolio by almost 120 properties and improved its key business metrics.

PINE’s Investor Presentation

Targeting the retail/service-oriented properties, PINE operates within the same property sector as:

- NETSTREIT (NTST)

- Agree Realty Corporation (ADC)

- Realty Income (O)

- NNN REIT (NNN)

However, PINE is significantly smaller than each of the entities mentioned. Please refer to the table below. In this article, I’ve analyzed PINE’s business and balance sheet and provided its valuation outlook – with each section supported by a comparison to its larger competitors (excl. O).

Table 1: Number of properties for selected entities

| PINE | NTST | ADC | NNN | |

|---|---|---|---|---|

| Number of properties | 138 | 628 | 2 161 | 3 546 |

PINE – Overview

Key business metrics

Looking at the key business metrics, including occupancy rate, weighted average lease term (WALT), and tenant structure may help investors evaluate the overall quality of a portfolio and the negotiating position of an analyzed REIT. While PINE’s occupancy rate of 99.0% is well above the historical median for S&P 500 REITs equal to 94.8%, there’s still some room for improvement as its noticeably larger competitors uphold higher levels of this metric. For reference:

- NTST – 100%

- ADC – 99.6%

- NNN – 99.4%

Looking at the WALT standing at 6.9 years, while it ensures a certain degree of cash flow predictability and safety, it stands well below the levels secured by the most popular triple-net lease REITs operating within the same segment of a retail/service-oriented property sector. For reference:

- NTST – 9.2

- ADC – 8.2

- NNN – 10.0

PINE leases its properties on a triple-net lease basis, which is a highly favourable type of agreement to the landlord. For readers unfamiliar with this term, it is a type of agreement that involves the tenant covering a substantial amount of costs related to operating and maintaining the property (including taxes, insurance, and repairs). These contracts also typically include annual rent escalations, generally ranging from 1% to 2%, which may not seem like a lot but they tend to add up over time and fall straight into the bottom line due to the triple-net lease structure.

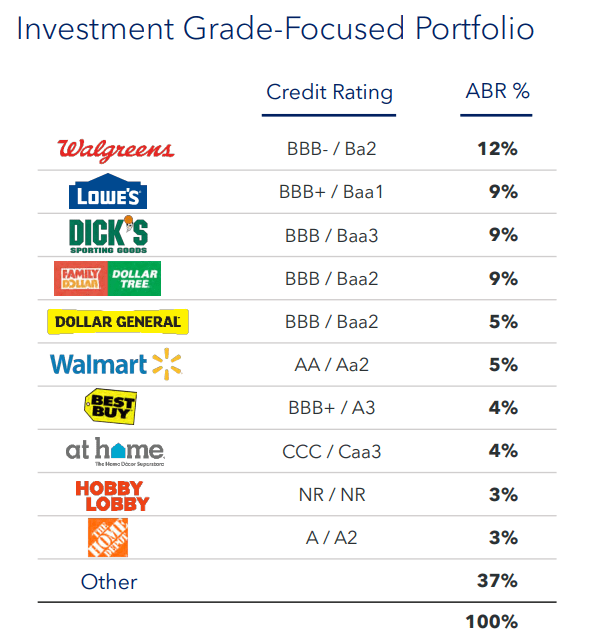

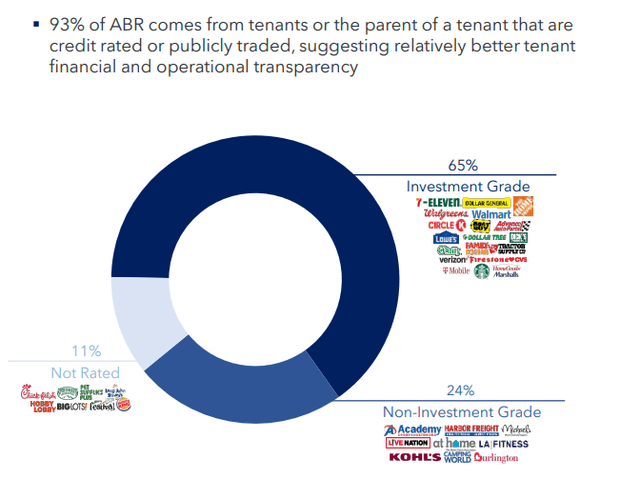

PINE has a relatively high tenant concentration with the Top 10 tenants responsible for ~63% of the ABR. PINE addresses this risk by concentrating on the investment-graded tenants that provide regular financial reports, which supports the monitoring of their financial health. However, that is still a number significantly higher than what I wish to see, as it increases the magnitude of the potential impact of any tenant issues on PINE’s financial performance. For reference, the above metric stood at:

- 52.3% for NTST

- 37% for ADC

PINE’s Investor Presentation PINE’s Investor Presentation

Dividends & Growth

During the 2021 – 2023 period (with 2020 as a base year) PINE delivered a solid AFFO per share CAGR of 12.7%. However, it is due to the dynamic increase year-over-year in 2021 amounting to 52.9%. It later slowed down to 11.3% year-over-year in 2022. Moreover, its AFFO per share declined 15.8% year-over-year in 2023. That is the first y-o-y AFFO per share decline in a retail/service-oriented REIT mentioned within Cash Flow Venue. Its competitors were capable of delivering solid growth without such turbulence, which during the same period amounted to:

- 20.9% CAGR for NTST

- 7.3% CAGR for ADC

- 9.1% CAGR for NNN

While PINE’s 2024 guidance assumes 4.4% AFFO per share growth y-o-y, the Company has a history of falling below the low end of its primary guidance. For details, please refer to the table below.

Table 2: AFFO per share of selected entities

| Entity | 2020 | 2021 | 2022 | 2023 | 2024E (on midpoint) |

|---|---|---|---|---|---|

| PINE | $ 1.04 | $ 1.59 | $ 1.77 | $ 1.49 | $ 1.555 |

| NTST | $ 0.69 | $ 0.94 | $ 1.16 | $ 1.22 | $ 1.265 |

| ADC | $ 3.20 | $ 3.51 | $ 3.83 | $ 3.95 | $ 4.12 |

| NNN | $ 2.51 | $ 3.06 | $ 3.21 | $ 3.26 | $ 3.32 |

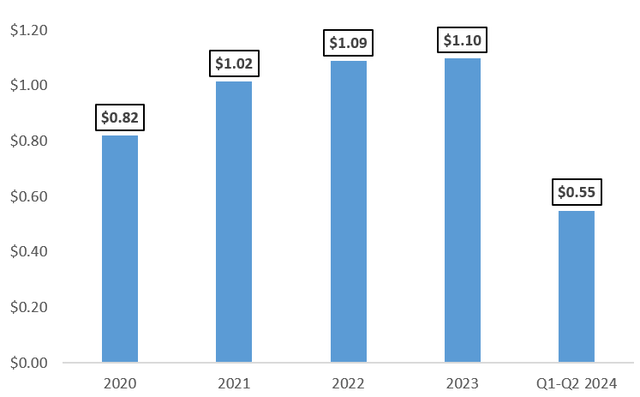

PINE’s dividend currently yields ~7.1% with a reasonable forward-looking AFFO payout ratio of ~69.6%. While it may be appealing to some income-oriented investors, the dividend growth has been negligible during the 2023 – 2024 YTD period.

Chart 1: Dividend per share of PINE

Own compilation based on PINE

Investment strategy

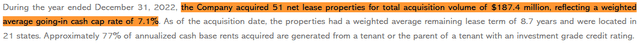

After acquiring an impressive 51 properties in 2022 for a total of $187.4m with a weighted average cap rate equal to 7.1%, the Company slowed down with property acquisitions moving into 2023 and 2024.

PINE’s Q4 2022 results press release

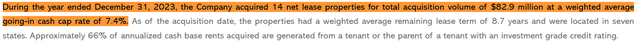

During the full year 2023, PINE acquired 14 properties for a total of $82.9m, with a weighted average initial cap rate equal to 7.4%.

PINE’s Q4 2023 results press release

Moreover, during Q4 of 2023, the Company’s investment activity was oriented around mortgage loans and share repurchases, as explained by PINE’s CEO, John Albright during the Q4 2023 Earnings Call:

Within the fourth quarter, the majority of our investment activity was concentrated in the first mortgage investments and share repurchases, and we believe these investment opportunities provide attractive risk-adjusted returns, compared to other opportunities available in the market.

During the quarter, we originated nearly $31 million of first mortgage loan investments and acquired two single-tenant net lease properties for $3 million. The initial yield on our loan investments was 9.2% and the cash cap rate of our property acquisitions was 7.3%. Our largest investment was a low leverage $24 million first mortgage secured, by 41 retail properties.

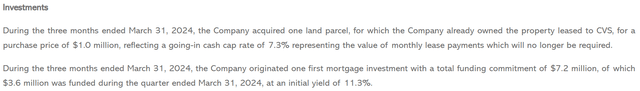

The above tendency continued during Q1 2024, as PINE committed $7.2m of a total of $8.2m to mortgage investments.

PINE’s Q1 2024 results press release

PINE intends to keep loan investments a relatively small element of its strategy. However, they do provide PINE with financial and project pipeline-related benefits, especially during the current market conditions under which buyer-to-seller expectations grew further apart. As explained by the Company’s CEO during the Q4 2023 Earnings Call:

While we intend for our loan investments, to remain a relatively small component of our overall asset base and strategy. They do provide future purchase options for our acquisition pipeline and serve as catalysts for our future partnership opportunities with sponsors, and we believe they offer compelling risk-adjusted yield supported by strong tenant credits and well-capitalized sponsors.

The Company still observes such barriers accompanying the traditional acquisition market and announced that it will uphold its loan-oriented investment strategy in Q2 2024, as indicated within its Q1 2024 Earnings Call:

On the property acquisition front, we saw fewer attractive core investment opportunities due to the reluctant sellers. However, we anticipate that as the market further adjusts to higher for longer rates, the transaction market may become more productive for us. We are seeing additional high-yielding and better risk-adjusted loan opportunities, which we expect to pursue in the second quarter.

It is worth mentioning that while PINE seems to be unable to secure attractive deals on the traditional acquisition front, some of the most popular retail/service-oriented REITs keep on expanding their portfolio (e.g. ADC, NNN, Essential Properties Realty Trust (EPRT)).

Balance sheet

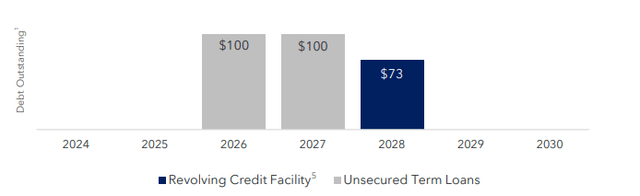

PINE has a relatively short-term weighted average debt maturity term, with its debt maturities concentrated during the 2026 – 2028 period. While the Company has no debt maturities until May 2026, its competitors have done a much better job at laddering the maturity schedule. On the bright side, the Company has no debt maturities until May 2026 and has fixed the interest rate on its outstanding debt through 2026. Nevertheless, prolonging the high interest rate environment until at least May 2026 could negatively impact PINE’s financial performance by forcing it to refinance at a higher cost. For reference, the weighted average debt maturity term amounted to:

- 3.9 for NTST

- 7 for ADC

- 11.8 for NNN

PINE’s Investor Presentation

PINE’s liquidity is supported by ~$185m resulting from cash, restricted cash, and ~$177m of undrawn revolving credit facility.

Valuation outlook

As an M&A advisor, I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking. However, it is crucial for investors to understand the business-wise determinants of a given market valuation. Only then may they be able to identify the market’s over/underestimations of a given business.

That said, please review the table below with forward-looking P/FFO ratios of PINE and selected REITs.

Table 3: Forward-looking P/FFO multiple

- hold rating for NTST – NETSTREIT: There Are More Attractive Opportunities Given Its Valuation

- buy rating for ADC – Agree Realty Corporation: Elite-Level Business Metrics With Room To Further Outperform

- buy rating for NNN – NNN: Great Pick For Stability-Seeking Investors

I am aware that the above entities are noticeably/significantly larger than PINE, however, I’ve selected them as a reference point, because:

- each of them is a triple-net lease REIT

- each of them targets retail/service-oriented properties within the same segment

- each of them is focused on this specific niche

PINE has some weaknesses when compared to the key sector players, including:

- worse balance sheet

- solid but not elite business metrics

- high tenant concentration

- inability to source attractive property acquisition opportunities in the current market

- turbulence in the AFFO per share growth and a modest dividend growth

That said, I believe that the Company’s relatively low 9.9x P/FFO multiple is justified. I don’t see much upside potential resulting from multiple appreciation, and given no major shifts in the market environment, as well as no material adverse changes, it will remain within the 9.0x – 10.5x range.

The bottom line

There are more attractive opportunities within the same property sector, including ADC, NNN, or moving a little bit further regarding the target property type – EPRT. Looking at the REIT industry as a whole, there are also far better opportunities within other property sectors, including VICI Properties (VICI), Prologis (PLD), or EPR Properties (EPR), which have so far been the only companies to receive a “strong buy rating” within Cash Flow Venue.

Nevertheless, business decisions are coherent with management communication, investors have been provided with an explanation for PINE’s current investment activities, and the Company offers a high-yielding dividend at current prices. Provided market conditions shift, there’s potential for acceleration of growth and improvement of the overall business situation.

While the potential for price appreciation is limited, the dividend yield remains attractive, making PINE worth considering for income-oriented investors. There’s room for improvement in the business and value potential. However, better alternatives also prevent me from considering PINE as a stock worth investing in. Therefore, that is a “hold” rating.