New Fortress Energy’s Recent Contracts Could Enhance The Stock Price (NASDAQ:NFE)

D-Keine

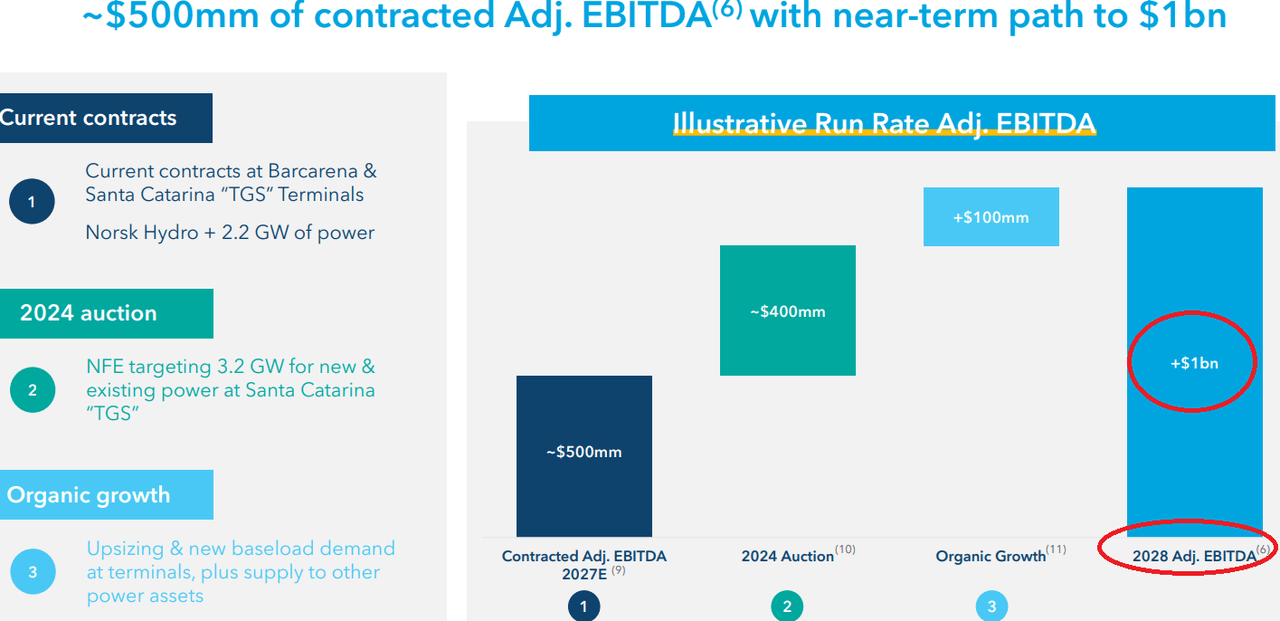

New Fortress Energy Inc. (NASDAQ:NFE) recently received a significant amount of cash thanks to plants built in Puerto Rico in 2023. Besides, management announced that there are new opportunities in Santa Catarina, Brazil, and recently signed new contracts, which may lead to 2028 adjusted EBITDA of about $1 billion. I also believe that successful refinancing of the current debt thanks to new notes could enhance the current valuation multiples. There are clear risks coming from the total amount of debt, changes in the environmental regulation, tariffs, and changes in the price of energy. With that, I think that NFE does trade a bit undervalued.

New Fortress Energy

New Fortress Energy Inc. is a company in the field of energy generation that has the particularity of having a logistics structure under its ownership that allows it to distribute its own products as well as provide services to other companies.

The company is specialized in working around liquefied natural gas, which it supplies to its clients and its own processing plants. In addition to its main facility in Miami, United States, the company also has generation and processing plants in Puerto Rico and the Caribbean: three of them in Jamaica, one in Baja California, and another in Mexico.

In addition to its LNG processing and generation capabilities, it has vessels for transportation, through a joint agreement with Energos that provides it with maritime transport vessels, as well as regasification units and 13 natural gas transportation units.

The company’s business infrastructure is completed with its own distribution and logistics network, made up of processing assets and its own downstream distribution lines through which it offers its clients the sale of natural gas and the processing of impure oils such as diesel for automobiles and petroleum.

The functions of the company are carried out via two operating segments, one that responds exclusively to the activity of ships and the other related to terminals and infrastructure.

The Vessels segment, in addition to operating its interest within January Go, offers the rental of the 10 sailboats under its ownership under long-term contracts to other companies in the sector dedicated to the transportation of natural gas and operates internationally.

On the other hand, the terminals and infrastructure segment, which is the company’s traditional business, covers the management and operation of its integrated natural gas generation and distribution system along with international operations in the regions indicated above.

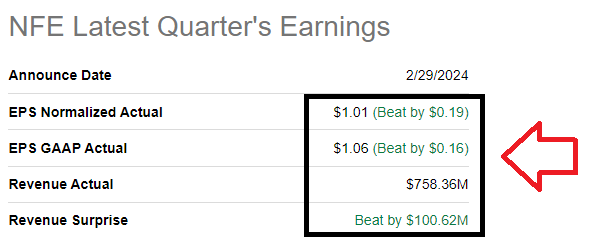

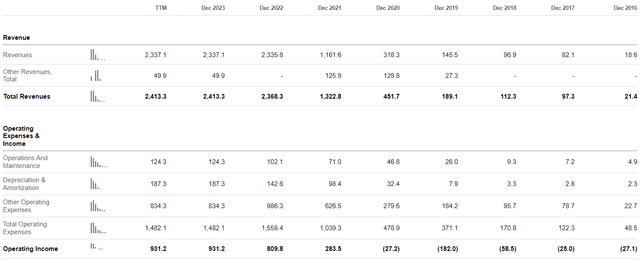

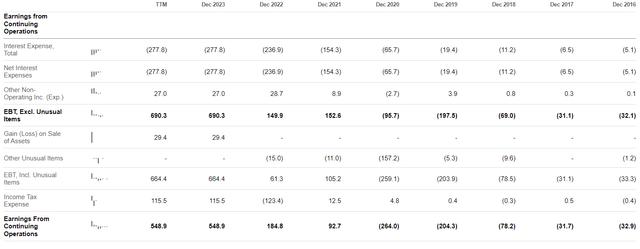

After delivering better EPS than expected and an impressive quarterly revenue surprise, I believe that New Fortress should be under our radar. The company also reports dividends, which may grow if the net income continues to grow north.

Source: Seeking Alpha

I also believe that the recent company update, which included 2028 adjusted EBITDA of close to $1 billion by 2028, is also worth considering. Recent acquisitions and new contracts outside the United States could bring significant growth.

Source: Investor Presentation

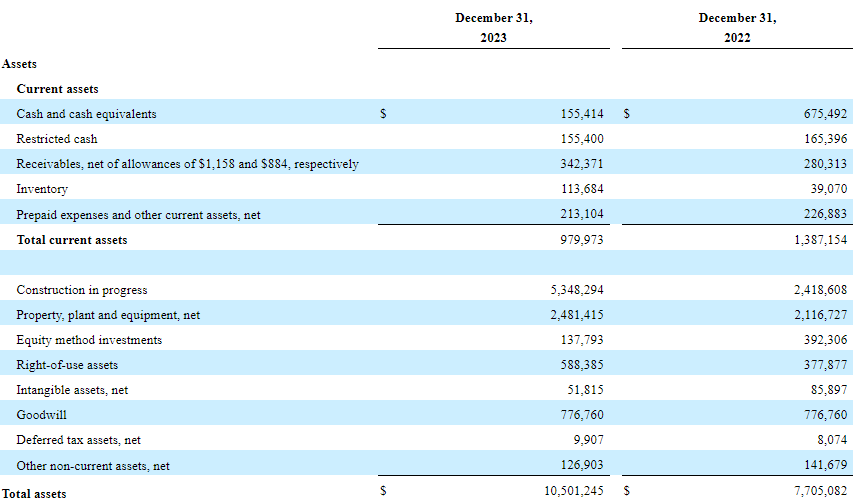

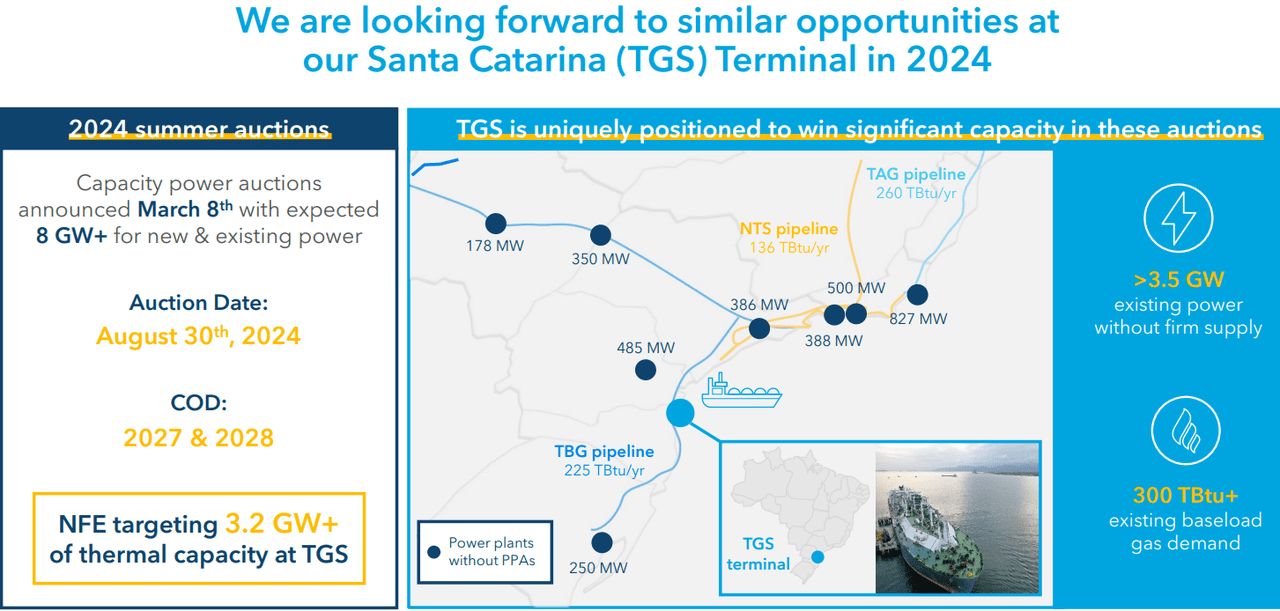

Balance Sheet: The Amount Of Debt Is Not Small

As of December 31, 2023, NFE reported cash worth $155 million, which is significantly lower than what the company reported in 2022. With that, construction in progress and property and equipment increased a lot in 2023. The new acquisitions and new projects seem pretty well reflected in the new balance sheet. The total amount of assets also increased quite a bit. I dislike that the current ratio stands lower than 1x, however the assets/liability ratio is larger than 1x. Given the total amount of property worth close to $2.4 million and construction in progress of about $5.3 billion, I think that debt holders would offer new financing if necessary.

Source: 10-k

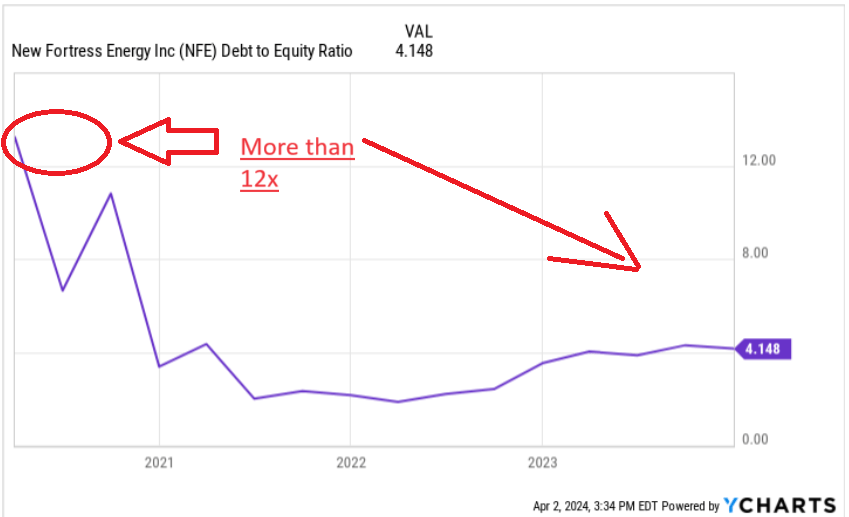

The total amount of debt is not small. Investors will do good by looking at the debt levels in the coming years. The debt/equity ratio declined from close to 12x in 2020 to less than 4.2x in 2024. However, management may need to significantly lower its debt obligations in order to convince a few market participants. As soon as the debt declines, I believe that we could see increases in the Adjusted EV/EBITDA figures.

Source: Ycharts

More in particular, the total amount of debt stands at $6.5 billion with total liabilities of about $8.7 billion. In 2023, total amount of liabilities increased at a lower rate than the total amount of assets, which appears quite ideal.

Source: 10-k

I reviewed some of the debt agreements signed by NFE. Interest rates included in those agreements are close to 6.5% and 6.75%. With this in mind, I believe that the WACC may be at least higher than 6.5%. Most analysts out there did report cost of capital higher than 6.5%.

In April 2021, we issued $1,500.0 million of 6.50% senior secured notes in a private offering pursuant to Rule 144A under the Securities Act (the “2026 Notes”). Interest is payable semi-annually in arrears on March 31 and September 30 of each year; no principal payments are due until maturity on September 30, 2026. Source: 10-k

In September 2020, we issued $1,000.0 million of 6.75% senior secured notes in a private offering pursuant to Rule 144A under the Securities Act (the “2025 Notes”). Source: 10-k

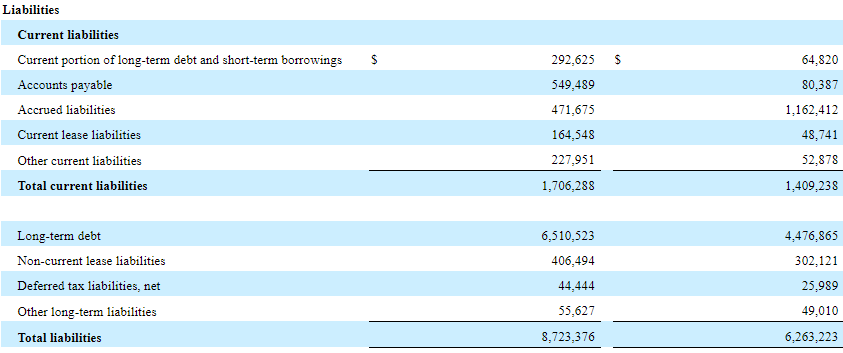

Hypothesis 1: The New Installation In Puerto Rico And Sale Could Bring Significant Amount Of Cash In Hand.

I believe that the sale of the 2 plants in Paco Seco and San Juan indicates the impressive performance of the company. The two plants were built in less than 180 days, and later sold for $373 million in cash.

Source: Investor Presentation

New Fortress Energy Inc. is pleased to announce two transactions that further solidify our commitment to providing affordable and sustainable energy solutions in Puerto Rico. The Company sold the emergency power plants it constructed on behalf of the U.S. Army Corps of Engineers in San Juan and Palo Seco to PREPA for $373 million in cash, subject to certain items and conditions. Source: Press Release

In my view, if the deal successfully brings the new cash to the balance sheet, the net debt may lower, which may enhance the balance sheet. Lower net debt may also enhance the EV/EBITDA ratio, and accelerate the demand for the stock. As a result, I believe that we could see an improvement in the cost of capital, and a WACC of 7% could be achievable. Under my base case scenario, I used a WACC of 7%.

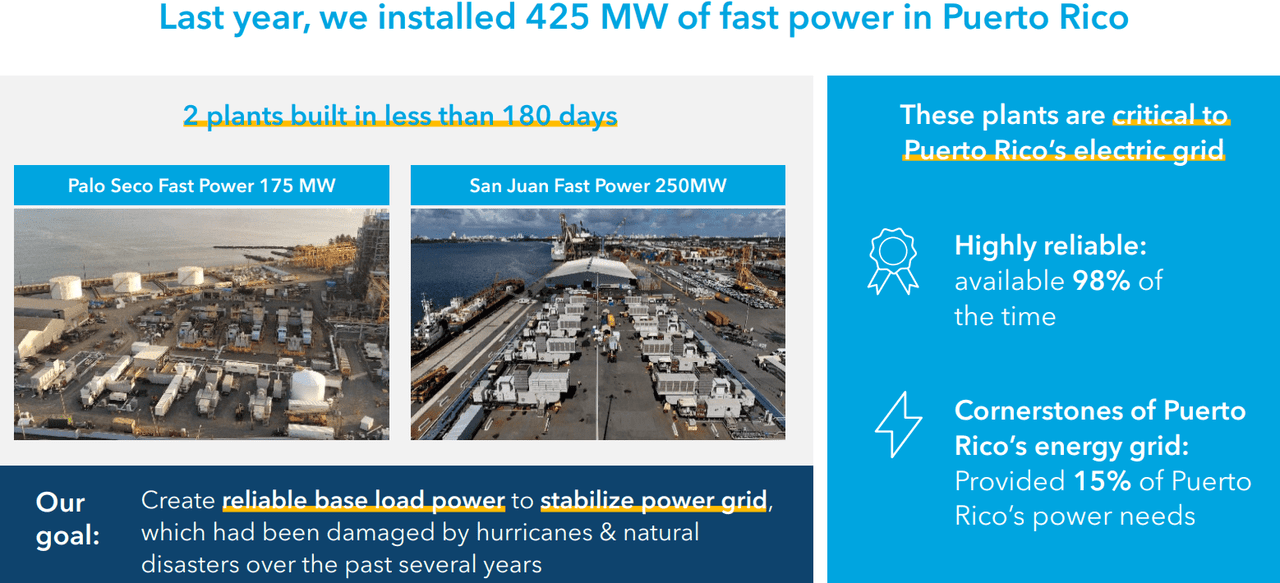

Hypothesis 2: The Transaction In Brazil, Which Includes 1.6 GW PPA, Will Accelerate Net Sales Growth

The company has guided its growth through an active acquisition strategy, especially with regard to business opportunities in regions with little development of natural gas generation and distribution infrastructure, such as areas of the Caribbean and South America where it has landed recently, specifically in Brazil. Under my base case scenario, I assumed that this new acquisition will contribute to report median net sales growth of 9% from now to 2034.

Source: Investor Presentation

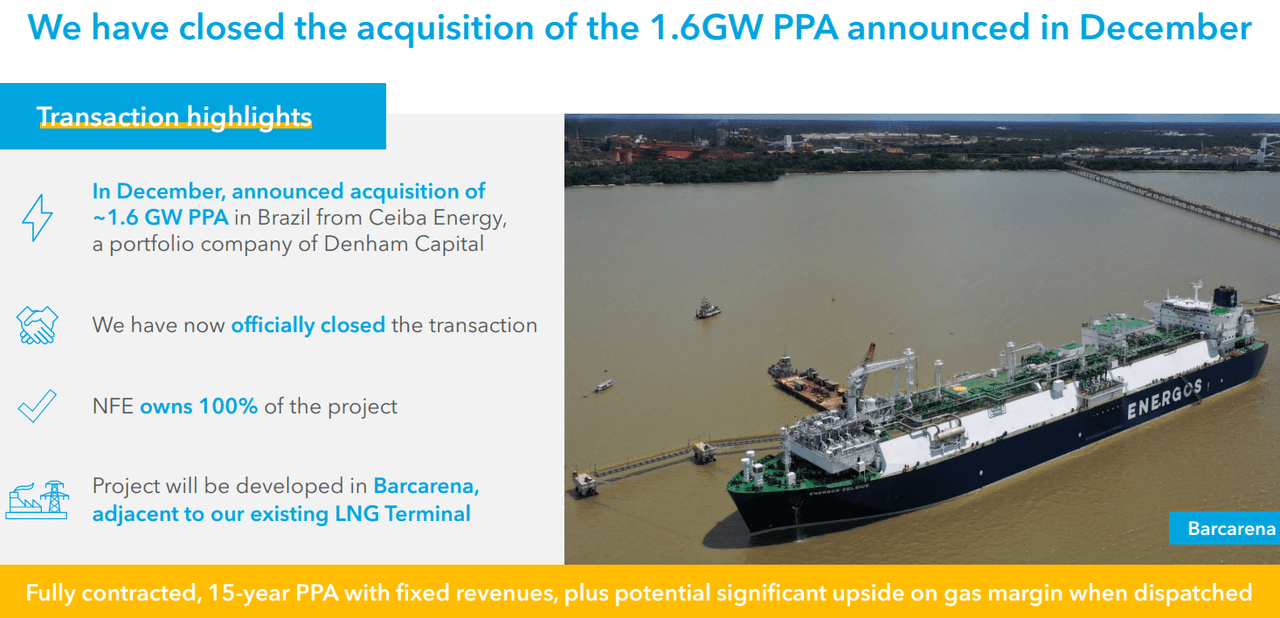

Hypothesis 3: New Potential Activities In Santa Catarina Could Accelerate Net Sales Growth

There are great expectations around new potential activities in Santa Catarina. The company has recently made a call for the discussion of its activities within this region. In a recent presentation, the company also said that it may sign a new 3.2 GW of thermal capacity. The auction date is expected to be in August 2024. Hence, I believe that we could see many investors checking the company’s announcements in summer 2024. Successful bidding could reach further net sales generation in the coming years. Under my best case scenario, I assumed that NFE could also include revenue from these new projects.

Source: Investor Presentation

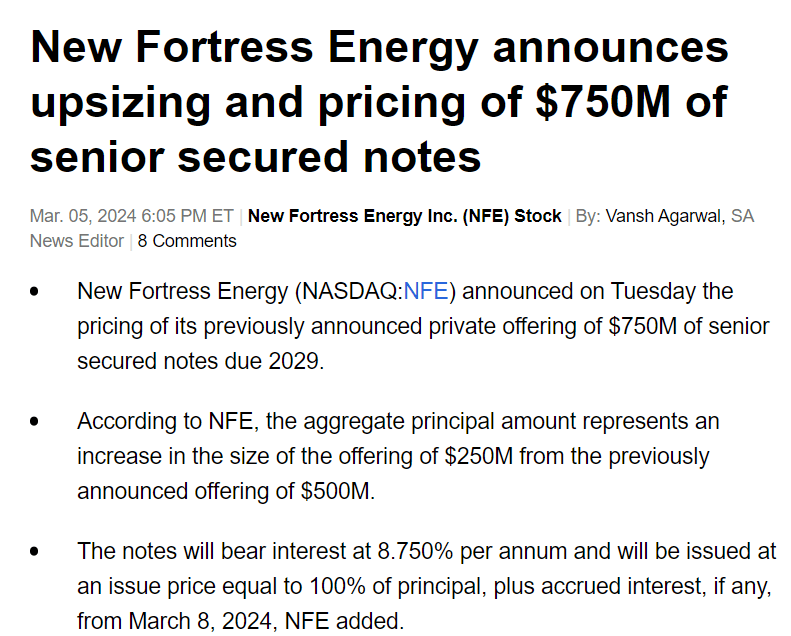

Hypothesis 4: New Debt May Accelerate Demand For The Stock

It must be taken into account that operations within the energy industry require a large amount of liquidity to remain active. For this reason, obtaining sources of financing and entering into joint agreements with other companies to sustain infrastructures reflect a fundamental element of the business. In this regard, the company has made an announcement of growth in its public offering for the senior notes, increasing the initial capital available, which shows an ambitious expansion plan in financial terms.

In my view, market participants will most likely celebrate the recent upsizing and pricing of $750 million of senior notes. New liquidity means that more financing for new projects transmits a lot of optimism to market participants. As a result, I believe that we could see new equity investors acquiring shares of NFE.

Source: Seeking Alpha

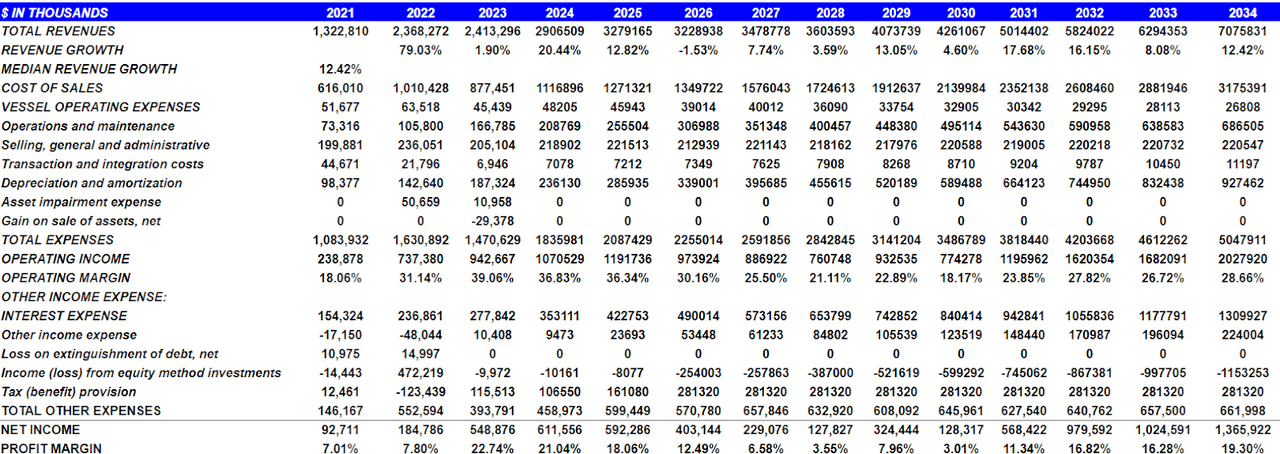

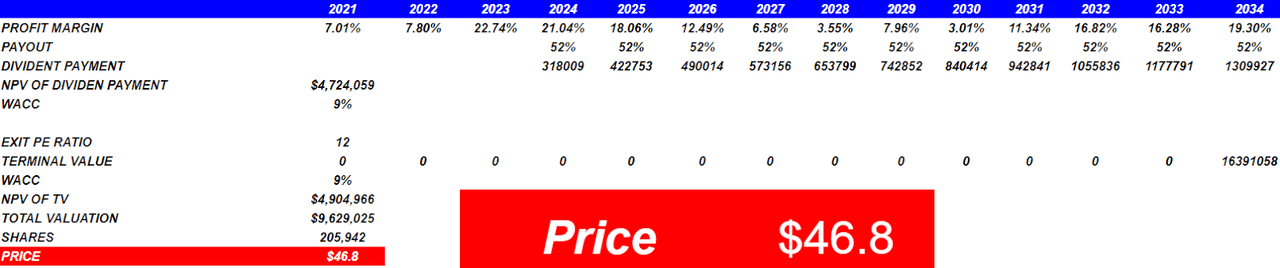

Expectations Under My Base Case Scenario, In Which My Hypotheses Are Successful, Could Imply Valuation Close To $46 Per Share

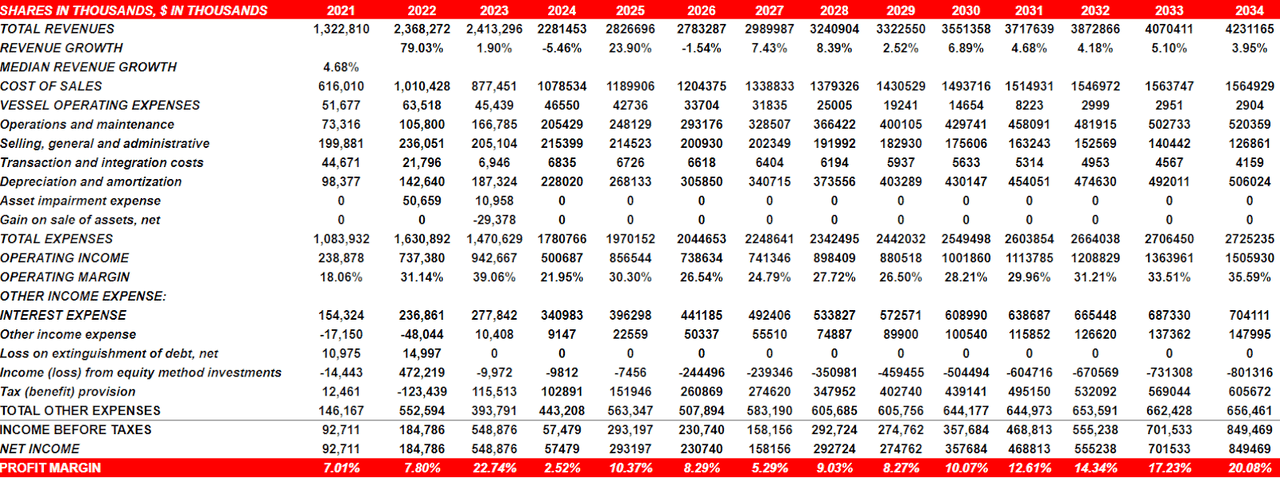

Given the previous assumptions and hypothesis, under this case scenario, I included net sales growth as well as net income growth. I also took into account previous income statements, operating margin, and profit margin growth. In my view, my numbers are conservative. The results include a total valuation per share that is significantly higher than the current market price.

Source: Seeking Alpha

Source: Seeking Alpha

Under this case scenario, I assumed 2034 total revenues of $7075 million, with median revenue growth of about 12%. In addition, with a 2034 cost of sales of close to $3175 million, vessel operating expenses of about $26 million, and operations and maintenance worth $686 million, I also included selling, general, and administrative costs of close to $220 million.

In addition, I assumed 2034 transaction and integration costs worth $11 million, 2034 depreciation and amortization of about $927 million, and total expenses of close to $5047 million.

Furthermore, with 2034 operating income of about $2027 million, I included an operating margin of about 28%. Moreover, with 2034 interest expense of close to $1309 million, I included tax provision of close to $281 million, 2034 net income of $1365 million, and 2034 profit margin worth 19%.

Source: My DCF Model

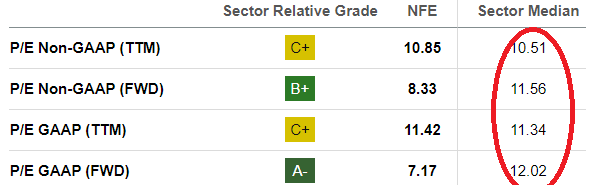

Besides assuming 2034 payout of 52%, which is conservative, I included 2034 dividend payment of close to $1309 million. In addition, with a WACC of 9% and PE ratio of 12x, the terminal value stands at close to $16391 million. Note that that the sector median PE ratio is close to 12x. Finally, the total valuation stands at about $9 billion, and the fair price is close to $46 per share.

Source: Seeking Alpha

Source: My DCF Model

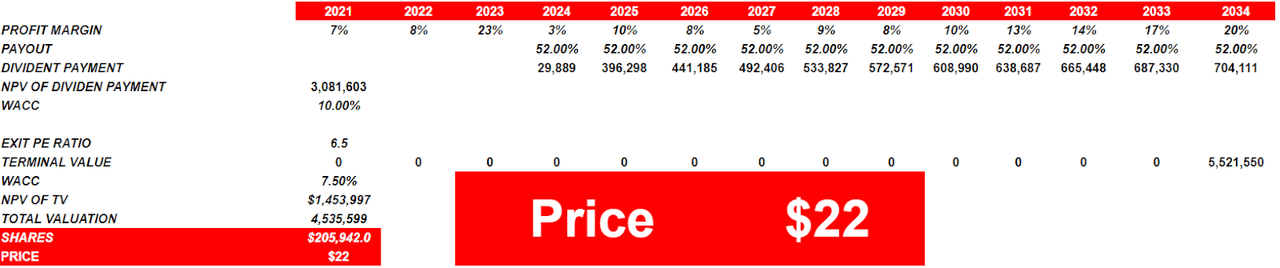

Under My Worst Case Scenario, My Hypotheses Would Not Be Correct, And The Implied Fair Price Would Be Close To $22 Per Share

Under this case scenario, I included lower net sales growth, lower net income growth, and lower profit margin than that in the previous case scenario. My numbers are still related to the income statement figures reported by NFE.

I included 2034 total revenues of $4231 million, with 2034 revenue growth of 3% and median revenue growth of close to 4%. Besides, with cost of sales of about $1564 million, 2034 vessel operating expenses worth $2 million, and operations and maintenance of close to $520 million, I also assumed selling, general, and administrative expenses of $126 million.

I did not assume asset impairment expenses or gain on sale of assets because I believe that they are not a recurrent part of the business model.

With total expenses of about $2.725 billion, I obtained 2034 operating income of $1505 million and operating margin of 36%. I also assumed income from equity method investments worth -$802 million, tax provision of close to $605 million, and total other expenses of $656 million. Finally, 2034 net income would be close to $849 million.

Source: My DCF Model

If we assume payout of 52%, 2034 dividend payment would be close to $704 million. Besides, by assuming a WACC of 7.5% and an exit PE ratio of close to 6.5x, I obtained a total valuation of $4.53 billion. Finally, the price under this case scenario would be close to $22 per share.

Source: My DCF Model

Competitors

The competition varies depending on the market which we are going to analyze since each of these has particularities in relation to the participation of companies oriented towards the distribution and sale of liquefied natural gas. Among the competitors, we can name large multinational companies, medium-sized companies such as Fortress, and small regional producers.

The same happens in relation to the search segment since the offer in this sense is large and is conditioned by the offer of prices and routes according to international standards.

In any case, due to the business strategy regarding the relationship with its clients, the company maintains long-term contracts on its gas production as well as the rental of its transport ships, so this competition is not significant at present, but it may be significant at the time of expiration of these contracts and the renewal of ties with its clients.

Risks

At present, the risks that we observe have to do with the development of its activities in Brazil, implying a large initial capital investment and the need for liquidity to finance operations. A part of this depends on the success of the company’s latest announcement of public offer for its shares as well as the conduct of the regional economy and the South American markets. The flip side of these investments could affect the company’s recent business in terms of the development of other competitors and the scale of their position in the markets.

Finally, it is good to add that changing energy prices, or exposure to international markets in itself generates a risk for the company. In particular, the regulatory frameworks for each region, political decisions mainly related to investments in the sector, increases in tariffs and import taxes, and export could affect operating margins and the projections that have been made for the year 2024.

Conclusion

New Fortress Energy recently surprised investors out there not only with better EPS than expected, but also building plants in Puerto Rico in 2023 and selling them recently for $373 million in cash. With new cash for new developments and new capital expenditure opportunities in Santa Catarina, Brazil, I believe that company could deliver net sales growth in the coming years. Besides, if debt holders continue to successfully finance the new projects offered by NFE, I do not see why the total amount of debt would be a problem. There are some risks related to changes in the regulatory frameworks, tariffs, and import taxes as well as changes in the energy prices. With that, I believe that the company remains undervalued at its current price mark.