Next Cryptocurrency Will Explode on Saturday, December 16th – Bitcoin ETF Token, Neo, XDC Network

join us telegram A channel to stay up to date on breaking news coverage

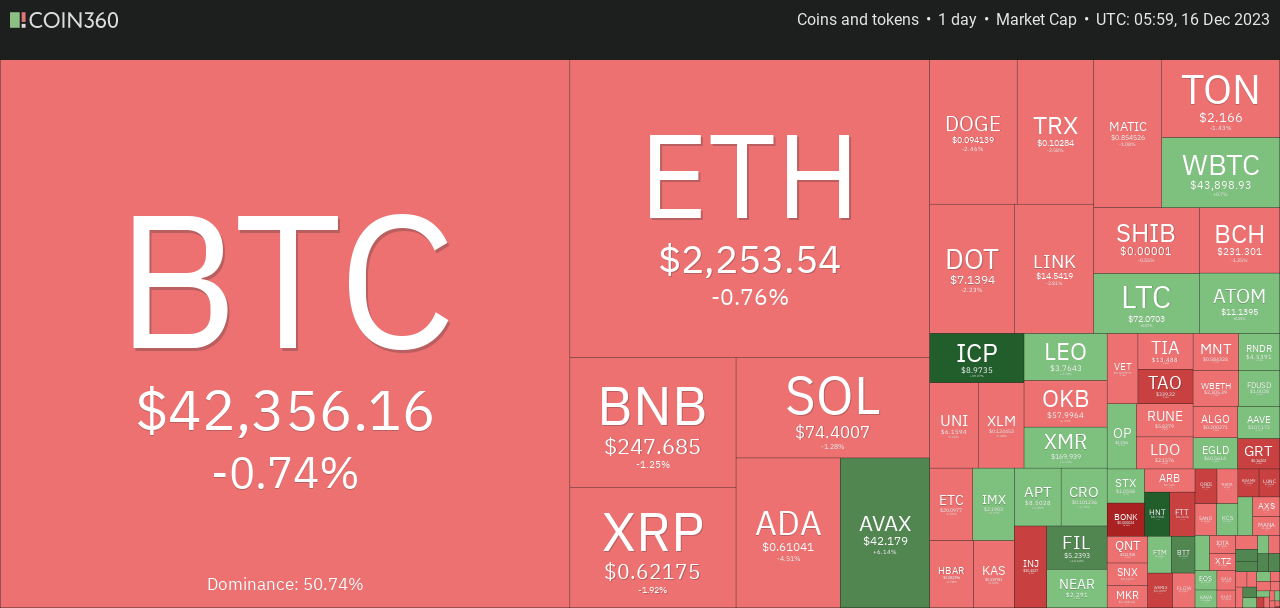

The global cryptocurrency market capitalization has shown stability despite a slight decline, currently at $1.6 trillion, down a slight 0.80% over the past day. At the same time, the total trading volume in the cryptocurrency sector over the past 24 hours reached $60.46 billion, a decrease of 10.80%.

Within this environment, decentralized finance (DeFi) continues to gain ground, accounting for $8 billion in trading volume and 13.24% of the overall cryptocurrency market 24-hour trading volume. Surprisingly, stablecoins are a significant contributor, totaling $54.11 billion, accounting for 89.50% of the overall cryptocurrency market daily trading volume.

Bitcoin, the flagship cryptocurrency, currently holds a 51.74% share and experienced a slight 0.13% decline during the day, indicating a change in market dynamics.

SEC Commissioner Hester Peirce echoed sentiments expressed by optimistic cryptocurrency investors, acknowledging that approval of a Bitcoin exchange-traded fund (ETF) should have occurred years ago. Peirce believes that regulatory barriers impede progress and emphasizes the need to address these obstacles.

Next Cryptocurrency to Explode

Peirce expressed support for a spot Bitcoin ETF, refraining from speculating about its approval. This is especially because expectations are growing ahead of the January 10th deadline for the ARK/21Shares spot Bitcoin ETF application decision. The anticipation surrounding the decision has particularly contributed to the surge in the value of Bitcoin, which has more than doubled this year, reflecting investor optimism and anticipation of the upcoming vote.

1. XDC Network (XDC)

XDC is currently surging after a brief hiatus in the cryptocurrency market and is poised to become the next explosive cryptocurrency. Current levels represent an important milestone in recent price/performance ratio.

The token surged to $0.517 on Saturday before experiencing a slight retracement to $0.513. XDC is currently trading at $0.0513, up 2.9% in 24-hour trading volume, reaching $17.94 million.

In particular, XDC’s gains against major cryptocurrencies BTC and ETH are impressive. It initially exceeded 30% and then stabilized at around 8%. Over the past week, XDC has lost 3.87% and 3.73% over the past month.

This year has been a testament to the resilience and growth of XDC, which started below $0.025 and nearly doubled in value by mid-April. However, the subsequent fluctuations were down 33.3% until mid-July, when a breakout of around $0.032 occurred, triggering a rise of around 160%.

The token has soared over 180% over the past year and over 111% in 2023, but remains down about 78% from the high of $0.192 it reached in August 2021.

XDC serves as the native token of the The project, launched in 2017 by Atul Khekade, has secured a total of $50 million in funding, per Crunchbase data.

As a utility token, XDC facilitates global and domestic transactions, provides liquidity to the financial industry, and improves business efficiency through tokenized and non-tokenized services. The XDC01 protocol hosts utility tokens such as EURS, GBEX, CGO, LBT, SRX and WXDC within the XDC ecosystem.

2023: A year of transformation #XDCNetwork! 🌟

This year marks important milestones for trade finance, regulation and ecosystem growth. 📈

A look at a year of innovation and global impact ⬇️https://t.co/p59jTHQ7Ww

Thanks to #XDC A community for all your support!

— XDC Foundation (@XDCFoundation) December 14, 2023

The XDC Network, formerly known as

The network’s hybrid architecture combines the capabilities of public and private blockchains to enable cross-chain smart contracts that support institutional applications in trade finance and tokenization. With interoperable smart contracts, rapid transaction settlement, and Ethereum Virtual Machine (EVM) compatibility, the XDC network provides a scalable infrastructure for enterprises and individual contributors.

2. Bitcoin ETF Token (BTCETF)

The pre-sale phase of the Bitcoin ETF token, a pivotal Ethereum-based coin tailored to capitalize on the anticipated acceptance of the spot Bitcoin ETF, has reached its culminating tenth and final stage. With only a few days left, investors have limited time to purchase the next cryptocurrency that will explode to a record low of $0.0068.

Amid growing fear of missing out (FOMO) surrounding the imminent approval of the spot Bitcoin ETF, traders poured $4.2 million into the BTCETF initial coin offering. Pre-sales are close to the challenging ceiling goal of $4,956,000, with less than $800,000 remaining.

The long-awaited arrival of A #Bitcoin #ETFs from @black stone can cause a revolution #Cryptocurrency It attracted institutional attention and ushered in a new era. 🚀

final step #Bitcoin ETF Things are going well now!

Stay tuned for further updates on this #Cryptocurrency Development! 📈 pic.twitter.com/AuF6wt9T4H

— BTCETF_Token (@BTCETF_Token) December 15, 2023

Enthusiasm among contributors is driven by the potential for astronomical returns, and predictions suggesting massive 100x gains highlight the palpable excitement surrounding the transformative impact the Spot Bitcoin ETF will have on the cryptocurrency investment landscape.

The Bitcoin ETF token is a strategic vehicle for optimizing investment portfolios in anticipation of approval, which is expected to occur as early as January.

Uniquely designed with a burn mechanism tied to ETF approvals, launch milestones, trading volume and assets under management, the BTCETF token promises direct benefits to holders at each critical stage of the journey from approval to market adoption.

The massive impact of the spot Bitcoin ETF approval has prompted notable changes, including Google revising its advertising rules for cryptocurrencies to allow fund managers issuing such products to promote cryptocurrencies.

Investing in BTCETF today means more than just a bet on the SEC’s approval of the spot product. This positions investors to make deeper, longer-term strategic moves in the face of impending economic change. This strategic positioning is becoming increasingly important as economies around the world undergo profound, long-term changes fueled by Bitcoin’s central role.

Bitcoin derivative coins, such as the Bitcoin ETF token, are poised to reap the rewards of these profound economic and financial developments, and it is likely that more countries will embrace these global changes as the world navigates significant shifts in the economic paradigm. There is this.

Visit Bitcoin ETF Tokens.

3. NEO

The NEO cryptocurrency has maintained an upward trajectory for almost a week, with a gain of 2.62% in the last 24 hours. This trend signals a strong bounce from the immediate support zone and extends the rally.

NEO price is currently at $13.23 and is inching closer to challenging the nearby resistance zone. This continued upward momentum presents a potentially optimistic scenario for NEO as it strives to break through its expected upper limit.

Technical indicators provide insight into the momentum of NEO, which has a 20-day exponential moving average (EMA) of $11.94, a 50-day EMA of $11.05, and a 100-day EMA of $10.08. This upward alignment of the EMA presents a bullish backdrop, with NEO taking a strong position above this level and indicating a steady upward trend.

NEO’s Relative Strength Index (RSI) surged to 59.64, a notable increase from yesterday’s 55.02, reflecting growing buying pressure. It’s not overbought yet, but the uptrend means buyers are in control right now. In particular, with RSI below the common overbought threshold of 70, there is room for further upside before NEO becomes overextended.

Neo Global Development (NGD) October Highlights from the General Monthly Report:

🏆 #NeoAPACackathon finale in hong kong

🔗 Neo’s anti-MEV sidechain

🤝 Partnerships and Community Engagement

🚀 Neo and community project progress https://t.co/8JxrYyRAGY— Neo Smart Economy (@Neo_Blockchain) December 13, 2023

An essential development in NEO’s technical analysis is the Moving Average Convergence Divergence (MACD) histogram, which rose to 0.04 from 0.02 the previous day. This positive MACD momentum prevents a bearish crossover, which is important to avoid a potential reversal in the NEO price trend.

Market participants closely monitor the price of NEO as it approaches the horizontal resistance area between $13.36 and $14.20, coinciding with the Fib 0.236 level at $13.37, adding importance to the resistance.

A clear violation above this area would confirm the continuation of the bullish trend and potentially lead to further profits. It will solidify its status as the next cryptocurrency to explode.

4. Multibit (MUBI)

Lastly, MultiBit has emerged as a groundbreaking player in the cryptocurrency industry. This is a two-sided bridge that introduces a paradigm shift in seamless cross-network transfers between BRC20 and ERC20 tokens, marking an important milestone in blockchain interoperability.

This pioneering bridge facilitates the easy movement of cryptocurrency tokens across Ethereum Virtual Machine (EVM) networks such as the Ethereum, BNB blockchain, and Bitcoin blockchain. This innovation heralds a new era of cross-chain interoperability by promoting more seamless interactions between different blockchain networks.

With these developments, MultiBit’s native token, MUBI, experienced a massive price surge, soaring over 35% and hitting a new all-time high currently sitting at $0.2.

The Spotonchain report highlights that MUBI price has surged 76% in the last 24 hours, placing it prominently within the BRC20 trend.

🔸MultiBit new listing $voice

🔸 @foox_brc20 BRC20 meme coin based on Fox.

🔸🦊 California: 0x20fCefA41045080764C48C2b9429e44C644e5deA pic.twitter.com/mqeplM8LzW

— Multibit (@Multibit_Bridge) December 15, 2023

Digging deeper into MUBI’s ecosystem, an analysis of the top 11 token holders (excluding exchanges) revealed significant unrealized profits amounting to $9.3 million. This group strategically accumulated 44.8 million MUBI tokens worth $10.1 million across 12 addresses, including holdings in various staking programs.

These significant developments highlight MultiBit’s growing influence in the cryptocurrency domain. As it continues to redefine cross-chain interactions and accumulate significant transaction volume, MultiBit is well positioned to reshape the landscape of token transfers and interoperability between various blockchain networks. Innovation in platforms that connect different blockchain ecosystems represents a pivotal step toward a more interconnected, streamlined, and decentralized future.

Learn more

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 100% or more

join us telegram A channel to stay up to date on breaking news coverage