NextEra Energy Partners: Howl, Scream, or Fold? (NYSE:NEP)

Baby can’t believe a 12% return isn’t safe

Shangarey/iStock via Getty Images

This is the last coverage of NextEra Energy Partners, LP. (New York Stock Exchange:NEP) We argued that investors would go through five stages of grief as they continued to cling to this broken retail growth story. Although having high self-confidence As for how things would unfold, we thought the rumors of its immediate demise were exaggerated.

Because the price has collapsed, NextEra Energy, Inc. (NEE) has little to gain by continuing the suspension beyond 2026. A lot can happen between now and 2026, but other than a rapid resurgence of ZIRP, I think this will follow these five moves: Stage model. Keep in mind that TC Pipelines ceased distribution in 2018 and was absorbed into TC Energy Corporation (TRP) in 2021. These things take a long time to happen.

Source: 5 Stages of Grief

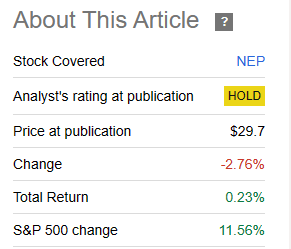

While the movement was interesting Meanwhile, a “Hold” rating is justified as NEP has posted an incredible 0.23% total return during this period, confounding both bulls and bears.

pursue alpha

We update our outlook and explain why the current distribution rate could last a little longer, but it probably shouldn’t if NEP wants a long-term future.

important events

There have been three major events in the stock since that article. The first is the quarterly earnings announcement. Adjusted EBITDA increased sharply and significantly exceeded expectations, driven by renewable tax credits. Other than that, the situation was ideal. The company stuck to its goal of maintaining the distribution growth rate.

Yesterday, NextEra Energy Partners’ board of directors declared quarterly distributions of 86.75 cents per common unit, or $3.47 per common unit on an annualized basis. This represents a 6% annual increase over the 2023 second quarter distribution per common unit. Based on Q2 2023 distributions per regular unit of $3.42 per year, we continue to see 5% to 8% per unit growth per year in LP distributions per unit, with our current target being 6% growth per year. A reasonable range of expectations should be maintained until at least 2026.

Source: NEP Q3-2023 Conference Call Transcript

It certainly helped the animal spirits. Nothing moves the distribution crowd faster than management simply saying distribution will maintain/grow, even though they have had to go back repeatedly in the past.

The next major event was the sale of Texas gas assets.

NEP has entered into an agreement with Kinder Morgan, Inc. (KMI) to sell its Texas natural gas pipeline for approximately $1.8 billion. This was in line with analysts’ expectations, although some had expected an adjusted EBITDA multiple of more than 10x. The sale will be conducted in two parts: STX in 2024 and Meade Pipeline in 2025. From our perspective, this of course reduces the big risk of buying. Total funding after taxes and debt service will be close to the required CEPF purchases in 2024 and 2025. So everything is confirmed.

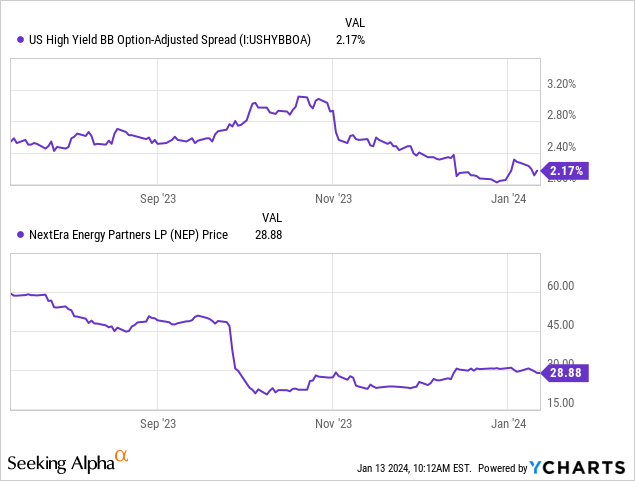

The third major event was the complete collapse of credit spreads. While October appeared to be the start of a spectacular bear market, the Powell pivot ushered in the largest easing of financial conditions in a long time. Here we only show one indicator: BB (and at the same time NEP’s credit rating) high-yield spread.

eyesight

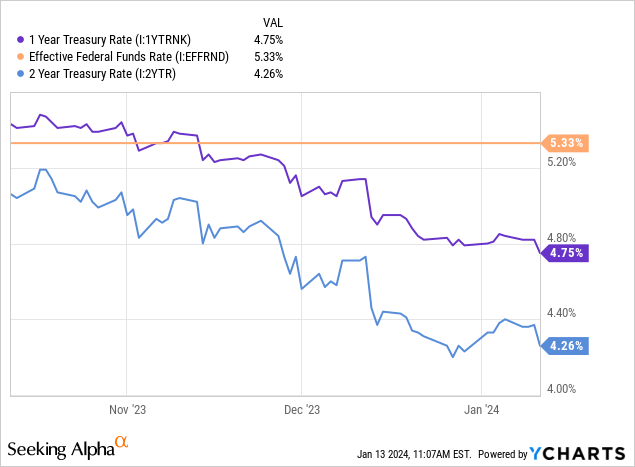

NEP can pay high distributions and pray that the market will work itself out. A correction here means an increase in the stock price above $60.00. you’re right. The stock price would need to rise above $60.00 for distributions to continue beyond 2025, when the parent company’s IDR exemption generosity runs out and more buyout funds are needed. It’s just basic math. Total purchases from 2026 to 2032 will be close to $4 billion. You can do this by comparing this to NEP’s current market capitalization and EBITDA generation. At current prices, the potential equity dilution from unit issuance would certainly require a 50% haircut on distributions over 2026 and 2027. What could raise unit prices high enough to sustain distribution? Here we speculate that a full and complete return to zero interest rate policy (ZIRP) will be necessary. Without it, deployments are not sustainable for the interim (which does not mean next quarter) period. The markets are clearly encouraging the Fed to return to its bubble-blowing ways and are currently pricing in seven (yes seven!) rate cuts by the end of 2024. For those of you who don’t enjoy reading federal funds futures but have a strong propensity for math, figure this out by looking at the difference between current policy rates and one-year and two-year Treasury yields.

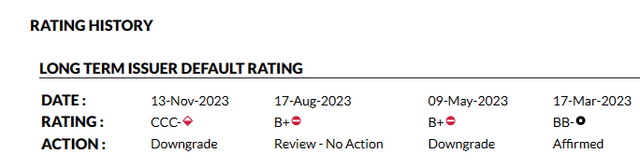

Our expectation is that inflation will prove more persistent than expected and that even a normalization of the 3-month-10-year Treasury bond relationship would suggest a 5.5% 10-year bond. If that projection is realized, the NEP and its distribution will be completely ruined by the end of 2024. In fact, in an alternative scenario that justifies a cut of more than 175 basis points, the BB spread is expected to burst because we are facing a severe recession. Once again, the NEP deployment will be successful. Of course, there is also the perfect soft landing. As you know, in a scenario where the Federal Reserve cuts interest rates seven times, there is no recession or re-acceleration of inflation. higher for longer This is a reference to the stock market. Look, this has never really happened with such dire unemployment rates and such rapid policy tightening. That certainly didn’t happen when the Federal Reserve began easing after months of falling LEIs.. So if we believe this is happening and it actually is, NEP will maintain the distribution. Realistically, if you start to repair your balance sheet, you’ll have to reduce distributions, but NEP knows that the money saved by reducing distributions is too small to be helpful. They require a higher unit price. Otherwise all hell will break down the line. It’s always about unit cost. We saw the same thing with a popular “fist-flip” stock called Enviva (EVA), which trades in the same renewable pool. Changes in your life and credit rating come quickly.

Fitch ENVIVA Credit Rating

In our view, we believe investors should take advantage of this bounce to exit this situation. We are confident that the next two distributions will be maintained, at which point management will begin to coach us on how we will be better off by lowering the distributions. The risk reward on the short side is not attractive here, so I use “Hold”, but winning $35 may be a better setup.

Please note that this is not financial advice. It may look and sound like it, but surprisingly, it isn’t so. Investors should conduct their own due diligence and consult with professionals who are aware of their objectives and constraints.

Editor’s note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.