NextEra Stock: Poised to Soar from Market Bottom (Rating Upgrade) (NYSE:NEE)

Justin Paget

NextEra Energy Co., Ltd.New York Stock Exchange: No), a leader in the energy industry, demonstrated strong financial performance in the third quarter of 2023. The company reported a decrease in GAAP net income compared to last year’s quarter. However, adjusted returns showed a significant positive trend. There was an increase compared to the previous year. This article expands on the analysis. last pieceWe focused on NextEra Energy’s financial health. 3rd quarter performance of 2023. We also examine technical aspects of stock prices to determine its future trajectory and investment potential. In particular, the stock price seems to have bottomed out at the expected support level mentioned above, so it is highly likely that the increase will increase.

An in-depth analysis of NextEra Energy’s financial performance

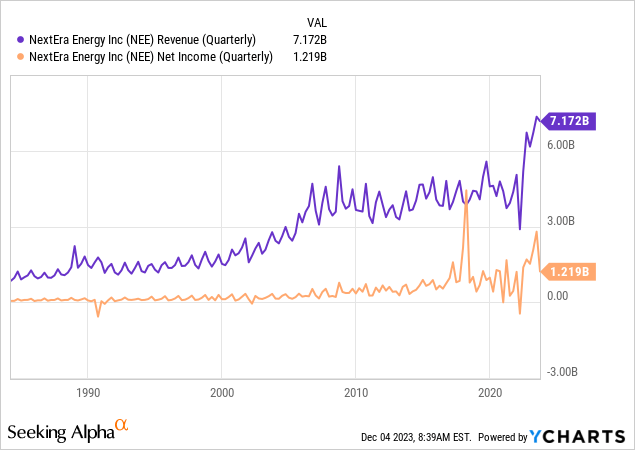

The company reported GAAP net income of $1.219 billion, down from $1.696 billion in the third quarter of 2022. But the adjusted numbers told a more optimistic story. This increased to $1.92 billion, or $0.94 per share, from $1.683 billion, or $0.85 per share, in the same period in 2022. This reflects a notable increase in adjusted earnings per share of approximately 10.8% over the first three quarters of the year. . The chart shows NEE’s quarterly revenue and net income, showing that despite the decline in net income, NEE still reported respectable revenue of $7.172 billion. Additionally, these financial metrics show a long-term upward trend, highlighting the company’s profitability.

FPL, a major subsidiary of NextEra Energy and Florida’s largest utility, contributed positively, posting net income of $1.183 billion, up from $1.074 billion in the year-ago quarter. This growth is due to significant investments in the business totaling $2.6 billion in the quarter. FPL also reported an increase in its customer base, including the addition of 65,000 customers, highlighting its expanded market presence and operational efficiencies.

Meanwhile, another division, NextEra Energy Resources, faced a difficult quarter with a GAAP net loss of $230 million. This is a significant change compared to net income of $655 million in the third quarter of 2022. This included a notable after-tax impairment of approximately $0.90. $1 billion in connection with NextEra Energy Partners, LP. But on an adjusted basis, NextEra Energy Resources showed its resilience, earning $882 million in revenue, up from $729 million the year before. The sector achieved historic results in renewable energy and storage, adding approximately 3,245 megawatts to its project backlog.

Going forward, NextEra Energy maintains a confident and stable financial outlook. The company continues to expect adjusted earnings per share for 2023 and 2024 to be in the range of $2.98 to $3.13 and $3.23 to $3.43, respectively. We also project 6% to 8% growth in 2025 and 2026 over 2024 adjusted earnings per share, with estimates ranging from $3.45 to $3.70 in 2025 and $3.63 to $4.00 in 2026. The company also aims to maintain its growth rate. Based on 2022 figures, dividends per share will be approximately 10% per year until at least 2024. This forward-looking strategy reflects NextEra Energy’s strong position in the market, highlighted by a commitment to continuous improvement, innovation and rigorous financial management.

Despite mixed results across the sector, NextEra Energy’s recent financial performance demonstrates overall resilience and a promising growth trajectory. The company’s forward-looking strategy, which emphasizes sustained revenue growth, renewable energy expansion and continued dividend growth, positions it well in the dynamic energy markets. This strategic direction, combined with our expanding operating efficiencies and market presence, particularly in renewable energy, represents a strong outlook for NextEra Energy’s future financial strength and shareholder value.

Review of rebound of solid support

summary

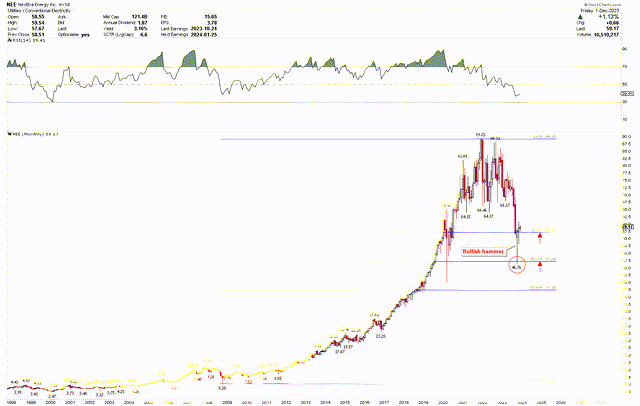

In the previous analysis, we looked at the long-term outlook for stocks using annual and quarterly chart data. The annual chart showed a 2022 internal candle tracking the bullish parabolic surge that started from the 2009 low of $6.83. This surge, which spanned 13 years, saw the stock hit a high in 2021 at a significant resistance level of $90.60, followed by a retracement seeking lower support. The bullish sentiment was further reinforced by the quarterly charts. The chart displayed a series of internal candles, suggesting price pressure was building ahead of the expected upward move. The long-term bullish scenario gained further credence by applying Fibonacci retracement levels to identify $58.04 and $47.98 as key supports amid the expected correction. The stock actually corrected to this level and bottomed at $46.78, which caused the price to bounce back quickly. In our previous article, we explored the potential for a significant correction that we believe would present an attractive buying opportunity for NextEra Energy.

NextEra’s next move and investment outlook

An expected decline in NextEra’s stock price has found significant support at the important 50% Fibonacci level marked at $47.26. The stock fell slightly to $46.78 before experiencing a notable recovery. This reversal was indicated by a bullish hammer candlestick on the monthly chart, which is a positive indicator for traders. Impressively, this bullish hammer closed above the 38.2% Fibonacci retracement line at $57.17. These developments indicate that a strong foundation has been laid around these numbers and that an upward trend in NextEra stock is possible.

NEE monthly chart (Stockchart.com)

Moreover, RSI has reached levels not seen since the lows of 2009 and is now showing signs of recovery. The pronounced tail of a bullish hammer emphasizes the strength of the price. According to our previous article, the red arrow highlights an expected buying opportunity, and the stock is poised to rise from this point.

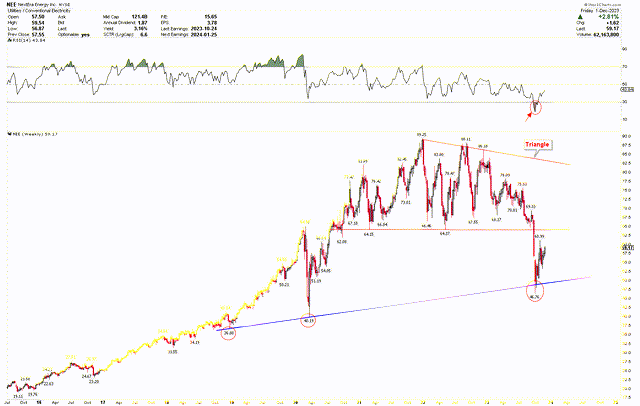

The weekly chart below shows a notable price correction, with the blue trend line indicating support. This trend line was successfully held at $36.80 and $40.19, as indicated by the red circle. A lively reaction at this key support level suggests a potential price increase. However, the challenge for this rally lies around $64 and the price will probably continue its upward trajectory, potentially hitting a new all-time high. RSI, recovering from extreme oversold conditions, complements the bullish hammer pattern on the monthly chart.

NEE weekly chart (Stockchart.com)

A strong price bounce from the 50% Fibonacci retracement level, support from the blue trend line on the weekly chart, and oversold conditions in the market signaled that a bottom has likely formed, paving the way for the market rally. It is clear from the previous discussion that historical price patterns are decidedly bullish and any downward correction is expected to be countered by a strong rebound and rising prices. Investors may consider purchasing NextEra Energy stock at current prices in anticipation of a potential market surge.

market risk

The decline in GAAP net income in the third quarter of 2023 highlights the company’s vulnerability to market fluctuations and operational issues. Despite the increase in adjusted earnings, the net loss reported by NextEra Energy Resources is primarily due to after-tax impairment, highlighting the risks associated with investment decisions and market volatility. Although its core segment, FPL, is showing promising growth, NextEra Energy’s overall financial health is affected by the fluctuating dynamics of energy markets, regulatory changes and global economic conditions. These factors can have a significant impact on a company’s revenue stream and profitability.

NextEra Energy faces external and operational risks that could affect its operating costs and profit margins, including regulatory changes, particularly in the energy sector. The Company’s ambitious growth plans in renewable energy and storage are subject to technological advancements and competitive risks. From a technical standpoint, NextEra Energy’s stock has shown resilience, evidenced by the recovery from significant support levels and the formation of a bullish hammer pattern. However, a monthly close below $46 would run counter to the bullish outlook and suggest further downward revisions are possible.

conclusion

In conclusion, NextEra Energy had mixed financial performance in the third quarter of 2023, with GAAP net income decreasing but adjusted earnings increasing. The company’s main subsidiary, FPL, reported growth, while NextEra Energy Resources faced challenges but showed resilience on an adjusted basis. NextEra Energy projects a growth in adjusted earnings per share over the next few years and presents a stable financial outlook with a commitment to dividend growth.

Technical analysis of NextEra Energy’s stock indicates a potential upward trend. The stock has bounced back from significant support levels, as evidenced by the bullish Hammer candlestick and recovery in the RSI, presenting a solid foundation for future growth. However, the Company faces market risks, including volatility in the energy sector, regulatory changes and global economic conditions, which may affect its financial strength and stock performance. Despite these challenges, NextEra Energy’s strategic focus on renewable energy and operational efficiency positions us well for future success. Investors may view the current market conditions as a promising opportunity for investment, considering the bullish hammer appears at a significant long-term support level. This formation suggests a clear bullish scenario and indicates a potential market surge.