NICE Stock: Riding the AI Wave (NASDAQ:NICE)

Galeanu Mihaly

Investment thesis:

The market is underestimating the exciting prospects of NICE’s cloud business. The business has a strong balance sheet position, a long history of serving the market, and is positioned to benefit from the AI wave. 11x EV / 2027 adjustment. I believe in the EBIT outlook This investment offers a good risk/reward profile.

business model

NICE Co., Ltd. (Nasdaq: Good) is one of the leading providers of enterprise software solutions that help organizations manage and improve customer experiences, ensure regulatory compliance, fight financial crime, and protect people and assets. Under its current structure, the company consists of three reporting segments and three business units. Its reporting segments are Cloud, Products and Services, and its business units are Customer Engagement, Financial Crime and Compliance, and Public Safety and Justice.

The most innovative cloud solutions segment includes revenue from cloud-based solutions: CXone (customer experience platform), X-Sight (cloud platform for financial crime detection and compliance), and Evidencentral (cloud-based public safety and law enforcement platform). This is the fastest growing sector and the one we will focus on in this article. According to company disclosures, the company serves 10/10 of the top U.S. health insurers, 5/5 of the top U.S. telecommunications companies, 9/10 of the top global financial services companies, and 6/10 of the Fortune 10 companies. The industry-leading CXone platform is a Contact Center as a Service (CCaaS) in a cloud and scalable format.

The second segment, Products, primarily consists of professional services and consulting fees associated with implementing and optimizing NICE solutions.

The third and final segment is product revenue, which consists of on-premise software licenses (old) and hardware sales.

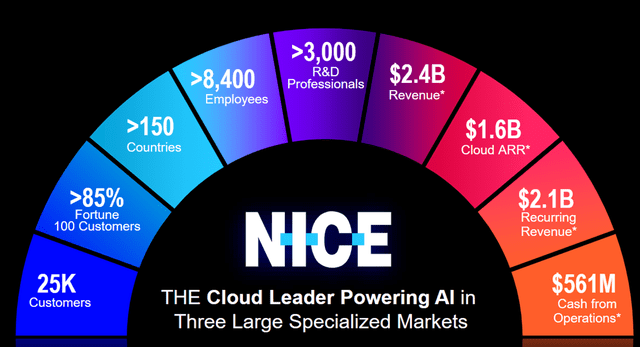

NICE Ltd investor briefing session

growth supercharger

The first and most obvious commercial use case for large language models (LLMs) and generative artificial intelligence is streamlining and effectively solving customer service interactions. This is especially true of the low-hanging fruit of simple customer questions that eat up human time that could be addressing more difficult requests. Evidence of increased productivity is hard to come by, but Klarna’s groundbreaking announcement sets the bar high. Klarna recently announced that it had processed two-thirds of its customer service chats (around 2.3 million) within its first month of operation. It is estimated that it has taken on the equivalent of 700 full-time customer service agents and reduced resolution times from 11 minutes to less than 2 minutes. If that wasn’t enough, we achieved equivalent agent satisfaction and reduced repeat queries by 25%. These customer service efficiencies are expected to deliver a $40 million revenue improvement for Klarna in 2024, according to the parent company.

Klarna’s data has shocked the corporate world, leaving many organizations scrambling to plan for customer service automation. NICE will benefit from this trend as it offers a comprehensive suite of solutions to help organizations deliver customer service across multiple channels. The CXone platform supports customers through seven capabilities:

- Omnichannel Routing: Customer interactions are routed to the most appropriate and capable agent based on the requested request.

- Self-service: AI-powered virtual assistants. It is custom-made for the customer’s purpose.

- Workforce Engagement: Forecasting and scheduling to optimize and utilize your contact center workforce.

- Analytics and Reporting: Provides insights into customer interactions, agent performance, and KPIs for improved decision making.

- AI and Automation: Provide real-time suggestions to agents during interactions.

- Unified API: CRM, ESP, and third-party data sharing.

- Compliance and Security: Comply with regulatory standards, including PCI-DSS, GDPR, and HIPAA, to protect customer data and more.

In its most recent Q4 2023 results, NICE reported a 20% YoY increase in cloud revenue in 2023 and a whopping 300% increase in the number of AI transactions. Gross margin on cloud revenue is approximately 66% (71% non-GAAP), which has similar characteristics to software, but with more upside ahead. Management is targeting 15% revenue growth and 19% reconciliation. Midpoint of overall EPS growth in 2024. The guidance assumes a conservative decline in cloud growth of 18% for the full year, excluding the LiveVox acquisition. Since the cloud segment grew by 30%, 31%, 27%, and 22% in 2020, 2021, 2022, and 2023, respectively, executives are likely to underestimate the growth potential of cloud in 2024. This sector is getting a boost from all the inbound interest related to AI.

According to company documents, management expects Cloud TAM to grow at an annual rate of 18% from approximately $8 billion in 2023 to $22 billion in 2028. Currently, only 5% of interactions include conversational AI and only 20% of businesses do so. Migrated to CCaaS. Gartner research predicts that by 2025, 80% of customer service organizations will apply generative AI technologies in some way to increase agent productivity.

NICE has the upper hand in CCaaS.

Assuming the market grows at a CAGR of 18%, we believe NICE’s Cloud division will grow faster than the market, driven by the competitive advantages of having been active in the customer experience industry for over 35 years. The CXone platform has been recognized as an industry leader in the CCaaS Quadrant by Forrester Research, Ventana Research, Opus Research, and Garner Magic Quadrant. The company has a long-term track record built on resolving customer inquiries over many years, giving it a data advantage over its competitors. Eighty-five of the Fortune 500 companies do business with NICE Ltd, and management currently invests 12-14% of sales in R&D to innovate their product offerings.

NICE has built long-standing customer partnerships and solved trust issues for data, security and case resolution. Leading IT services companies such as Cognizant, Infosys and Microsoft have partnered with NICE to provide cutting-edge CCaaS solutions to their customers. Large organizations prefer to partner with large vendors like NICE instead of trusting smaller vendors to handle interactions with their valued customers. An example of a problem that can arise when automatically processing customer inquiries is the case of Air Canada, where passengers are promised discounts that do not exist. This case corresponds to an AI hallucination in which an AI chatbot can provide inaccurate information.

evaluation:

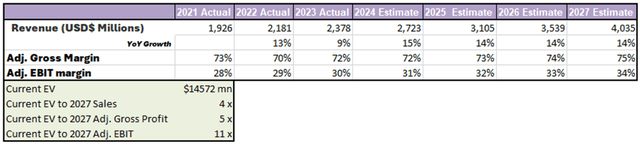

Author’s Expectations

Based on the aforementioned reasoning, we assume that cloud revenues will continue to exceed services and product revenues. This will bring the company’s annual revenue growth closer to 14-15% by 2027. As its cloud business expands, the company’s underlying profile will steadily shift to a software-like business with higher gross margins and improved operating leverage, which will result in higher margins. These assumptions yield an attractive valuation of 11 times the adjusted 2027 valuation. EBIT forecast.

danger:

Artificial intelligence is expensive and projects related to its applications are somewhat arbitrary in the current environment. This exposes NICE to an economic slowdown that could delay discretionary spending. Klarna, on the other hand, has demonstrated that cost savings from applying AI can be significant.

CCaaS is an attractive and profitable industry that could attract new competitors. For example, RingCentral recently announced a new CCaaS product that will compete with NICE. As technology becomes widely deployed, monitoring the competitive environment is essential.

conclusion:

NICE’s 35-year history in the customer experience industry positions us critically to leverage the data benefits we have built through ongoing relationships with our customers. The growing wave of AI and generative AI will play a catalytically important role in accelerating the growth of the cloud sector. 11x EV for my 2027 Adj. EBIT projections are a good multiple for companies with excellent competitive positions, net cash balance sheets, and AI benefits.