NVDY: A Four-Legged Chair for Pricing, High Yields, Taxes and Risks

NurPhoto/NurPhoto via Getty Images

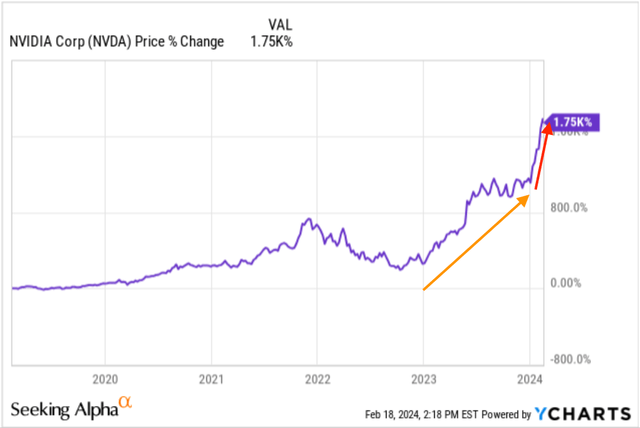

NVIDIA Corporation (NVDA) has emerged as a junior to the ‘Magnificent 7’ (M7): Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), NVIDIA (NVDA), Alphabet (GOOGL)), meta platform (meta), and Tesla(TSLA). Its stock price has soared and it has recently declared its agility. $0.04 dividend. I remember back in 2018, while working on a hardware update on my desktop with an IT colleague, we noticed that Nvidia had a new GPU chip inside. I asked him what he thought of the company, knowing very little about it, and he said he expected the company to grow tremendously in the next few years. I didn’t listen. I saw a downturn in 2019 and wrote it. I focused much more on Advanced Micro Devices (AMD) at that time.

NVDA manufactures and sells GPUs for gaming, cryptocurrency mining, and professional purposes. We have chip systems for deployment in vehicles, robotics, and a variety of other applications. With the explosion of both NVDA and call option strategy ETFs, this combination presents a unique opportunity for investors seeking high income and capital appreciation through investments in: YieldMax NVDA Option Income Strategy ETF (NYSEARCA:NVDY).

NVDA 5 Year Price Return (Alpha YCharts search)

Fund holdings, mechanisms and performance

Option income strategy ETFs have exploded in popularity due to their high income distribution during the record-low interest rates around the coronavirus crisis. Of course, now in this high interest rate environment, popularity has shifted to cash investments. But recently, a new family of thematic funds offered by the YieldMax ETF, which focuses on single companies, has taken returns to a whole new level, easily surpassing the risk-free rate.

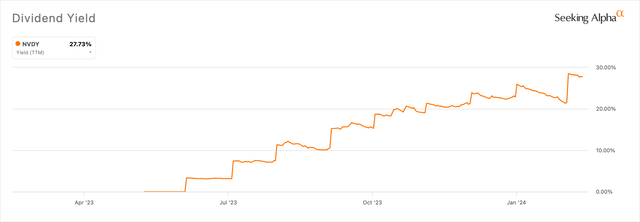

NVDY primarily seeks to generate returns through call option strategies that participate in a portion of the profits experienced by NVDA and are not dependent on price appreciation of NVDA. fund The current TTM yield is 27.73% and it pays monthly distributions. Founded in May 2023 and with assets under management (AUM) of $188.5 million, the US-based company’s general investment focus is on visual computing, accelerated computing platforms, gaming, professional visualization, and data leveraging derivatives. The goal is to gain exposure to centers and automotive-related companies. Field. I interpret this to mean that the fund will not necessarily need to invest in NVDA in the future even if the market/fundamental thesis changes.

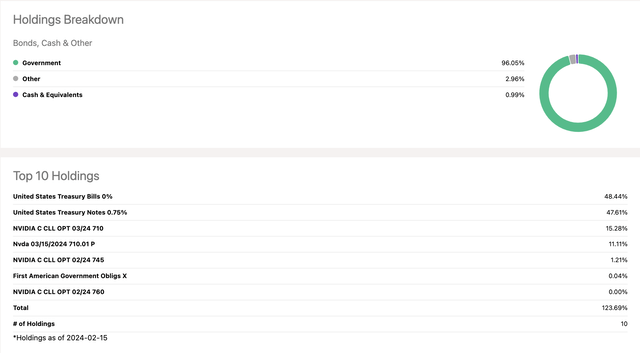

NVDY holding history (Look for alpha)

As noted in the holdings above, the Fund’s holdings are primarily cash settled within call option contracts and investments in short-term Treasury securities. As of February 15, approximately 27.5% of the fund’s assets were tied up in call option contracts, and the exercise price and exercise date were transparently disclosed. Fund managers use two different covered call option strategies.

- A traditional covered call, in which a fund sells a call option on an underlying security it owns.

- A synthetic covered call strategy in which a fund sells call options on underlying securities. Do not own. The fund will simultaneously buy and sell NVDA call and put options, respectively, to replicate NVDA’s price movements over a six-month to one-year period.

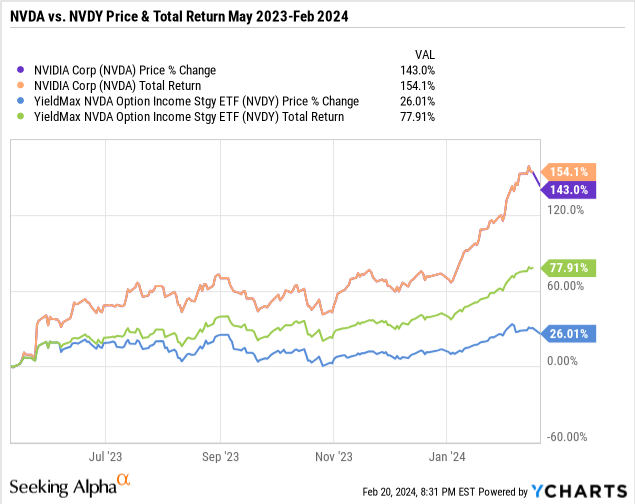

Since its inception, NVDY has underperformed its underlying stock, NVDA, by about 50% in total returns. However, this is expected because call options provide investors with higher returns by limiting the upside of the option premium. NVDY’s performance remains impressive. Price return and total return over the last 9 months are approximately 26% and 78% respectively. In ~ averageThe market returns 10% per year.

NVDY dividend yield history (Look for alpha) NVDY Return History (Look for alpha) NVDY return on cost (Look for alpha)

I think the fund’s distribution profile is still trying to find its footing. The rate of return has been continuously increasing, and the rate of return on cost has fluctuated between 30 and 35%. Average yields for 2023 and 2024 are unreliable because both do not have data for a full year. That makes sense. While 2023 saw the price rise about half the time and be flat about half the time, 2024 has been a rocket ship so far, with the latest distribution on 2/6 bringing the price to $1.53 per share for just one month. I calculated the average distribution to be $0.80 per share, or a return of almost 38% based on the current stock price. Due to this high-yield income, the 2023 tax impact has been reported to be 97% of ordinary income, so investors should consult their marginal and effective tax rates before investing in this fund to ensure it fits their objectives and risk tolerance.

Risk Analysis

According to the NVDY Summary Prospectus, investors should highlight the following:

- The fund’s strategy limits potential gains if NVDA stock rises in value.

- If the value of NVDA shares declines, the Fund’s strategies may suffer potential losses, which may not be offset by income received by the Fund.

- The Fund does not invest directly in NVDA.

- Fund shareholders are not entitled to receive NVDA dividends.

Options-based investments, such as those used by NVDY, serve as a risk management tool for portfolio diversification and speculative positioning of single stocks. Nonetheless, it is important to recognize that investing in options, including YieldMax funds, carries inherent risks similar to owning the underlying stocks themselves. Although NVDY does not invest directly in NVDA, stock price movements have a significant impact on the fund’s net asset value (NAV).

Moreover, NVDY’s options investment strategy not only limits upside gains primarily through call options, but also prioritizes distribution consistency over maximizing the returns of the underlying companies. This approach persists even during market downturns because the fund management does not adopt a defensive stance. The lack of diversification in funds that focus solely on NVDA inherently increases volatility, contributing to the potential for high returns. However, this strategy also leaves investors with increased vulnerability to loss if NVDA stock declines, a risk that cannot be offset by the income generated by the fund.

move forward

YieldMax NVDA Option Income Strategy ETF’s innovative approach to options-based income investing offers a promising path to high income generation and capital appreciation. While the fund’s performance is noteworthy, it is important to understand the risks of investing in single stocks. I believe an effective way to mitigate the risk of owning NVDY would be to own the YieldMax Magnificent 7 Fund of Option Income ETF (YMAG). YieldMax Universe Fund of Option Income ETF (YMAX), both include NVDY.

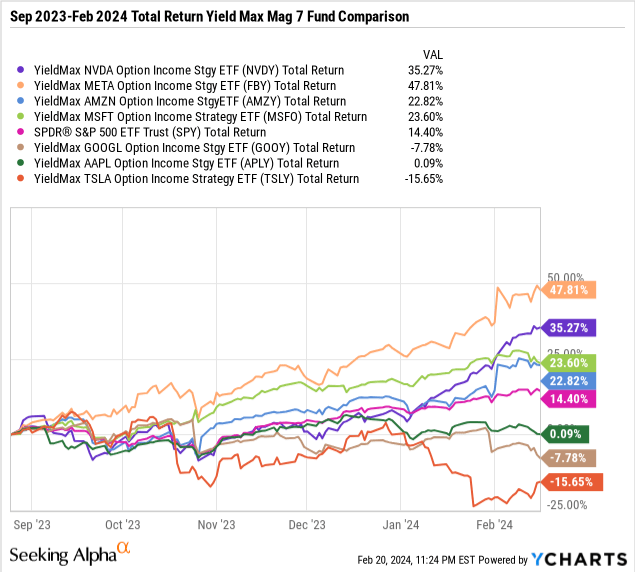

NVDY has been an outstanding performer, but other funds in the Mag 7 trade have outstanding total returns. Many of the Mag 7 YieldMax funds have outperformed the S&P 500 over the past five months. Personally, I feel most comfortable owning funds to increase diversification and smooth returns over the long term through investing in option income strategies compared to single issuer stocks.