nVent Electric: Not Convinced Current Margins Are Sustainable (NYSE:NVT)

miscellaneous photos

investment thesis

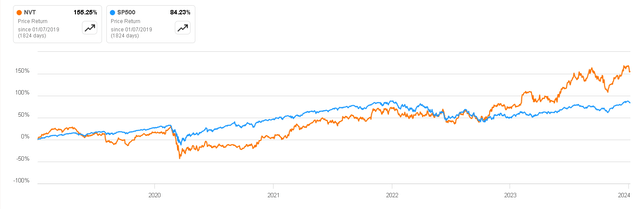

Nvent Electric PLC (New York Stock Exchange: NVT) is a company that has performed quite well since its listing in 2018, outperforming the S&P 500 itself.

In this post, I would like to look at the positive aspects of business. The model and the sector it operates in have several catalysts that could lead to tailwinds in the coming years. However, there are also doubts about whether this is sustainable as margins are currently rising primarily due to rising prices and a normalization may occur, impacting share price performance. Therefore, for me ‘holding‘Right now at this moment.

NVT Returns vs. S&P500 (Seeking Alpha)

business overview

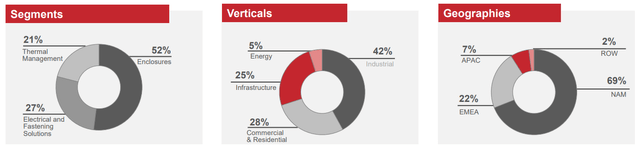

nVent Electric is a company that provides the following services: Electrical connection and protection solutions. The company serves a variety of industries that are expected to see strong tailwinds in the coming years thanks to trends. For example, the electrification of everything and AI are increasing the demand for liquid cooling in data centers. Revenues are distributed into three main segments:

- Enclosure: The Enclosures segment provides solutions to connect, protect, power and cool critical control systems and electrical equipment. The segment has grown at a CAGR of 4.8% since 2016, with an average EBIT margin of 20%. Despite being a mission-critical product, its success depends on customer capital expenditures. Because they have a very long lifespan, generating recurring revenue is difficult.

- Electrical and fixing solutions: The Electrical & Fixture segment provides solutions to connect and protect electrical and mechanical systems as well as civil structures. It operates under the Caddy and Erico brands and is primarily used by electricians, telecom installers and rooftop contractors. The sector has been growing at a rate of 2% per annum since 2016, with margins typically in the 28% to 30% range in recent years. Similar to the previous sector, it is an essential product but is struggling to generate a sustained recurring income stream (that’s not to say there aren’t interesting growth opportunities in the sector).

- Thermal Management: The Thermal Management segment provides electrical and thermal solutions that connect and protect critical buildings, infrastructure, industrial processes and people. These solutions can be utilized in the industrial sector for temperature monitoring and control of industrial processes. It can also be used for residential and commercial purposes, with fewer everyday and industrial uses including protecting pipes from freezing, defrosting roofs and gutters, and maintaining hot water temperature. The segment has experienced revenue growth of 3% per year since 2016, with an average margin of 24%.

nVent Investor Presentation

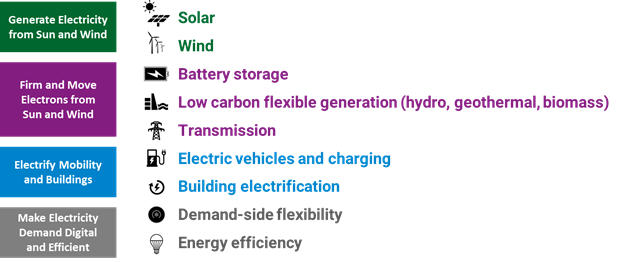

In general, the more industries and sectors electronicize their operations, the more Increasing demand for electrical infrastructureIncludes enclosure, cables and electrical protection system. nVent could benefit from increased sales of these products. Additionally, electrification often increases the use of electronic devices and systems that generate heat, necessitating thermal management solutions such as cooling systems for electronic devices.

And we must not forget that the electrification of everything is a global trend. As regions around the world invest in infrastructure electrification, nVent may find opportunities to expand its market presence. emerging economy Electrification plans are gaining momentum, although they are much less developed here than in Europe or North America.

Electrification of all processes (medium)

key ratio

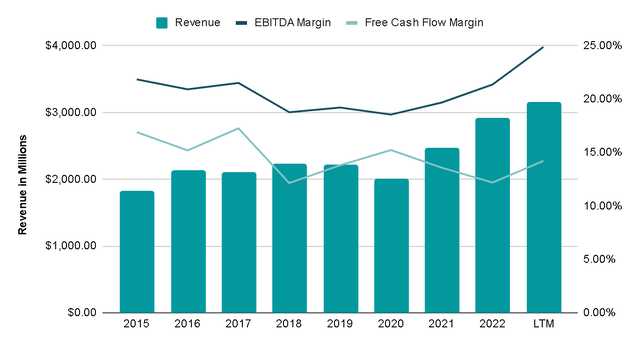

Overall, the company’s sales have grown at an average annual rate of 7% since 2015. Even in a difficult year like 2020, when the economy was paralyzed by the COVID-19 virus, sales only decreased by 9% and margins decreased by 9%. I didn’t suffer much.

What’s particularly shocking to me is that profit margins over the last 12 months have been much higher than average This is because the company raised its prices. For example, in the enclosures segment alone, margins increased from 21% to 26%. However, according to the last quarterly report, 4.5% of these improvements were due to price and 1.2% were due to improved operational efficiency. Therefore, in the future, these margins will be normalize We will reflect this in our evaluation soon.

author’s expression

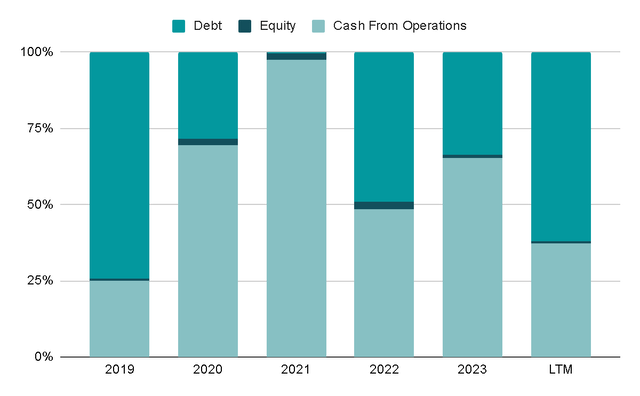

Over the past five years, this growth has been funded approximately 50/50 by debt and cash generated from operations. The company hasn’t issued that much debt for a while, but it did issue $800 million in the past 12 months, in part to finance its acquisitions of ECM Industries and TEXA Industries.

author’s expression

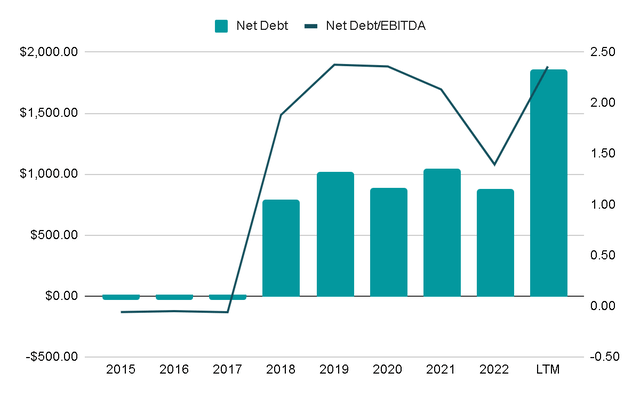

As a result, the company now has net debt of $1.8 billion, calculated by subtracting cash on the balance sheet from total debt. This is 2.4 times the EBITDA generated over the past 12 months. Although it is a high percentage, it is still controllable and justifiable because it is a percentage allocated for growth.

author’s expression

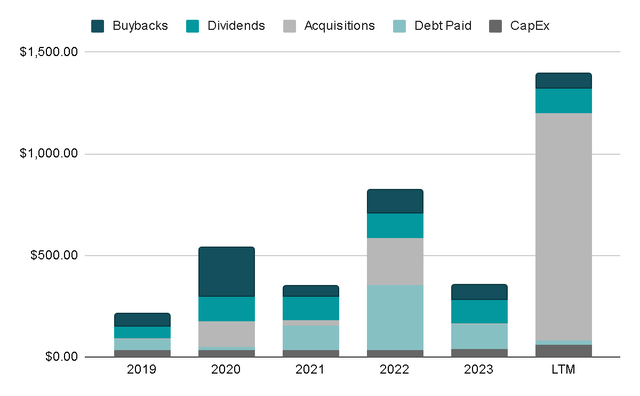

When it comes to capital allocation, it is true that growth through acquisitions has diversified significantly. Over the past 12 months, the company has allocated $1.1 billion in cash payments for acquisitions, reinvesting in its businesses, and rewarding shareholders through share buybacks and dividends. This may be unexpected, considering the company has growth opportunities, but it has allocated $1 billion over the past five years to pay dividends with a current yield of 1.35% and repurchase shares at an average annual rate of 1.4%.

author’s expression

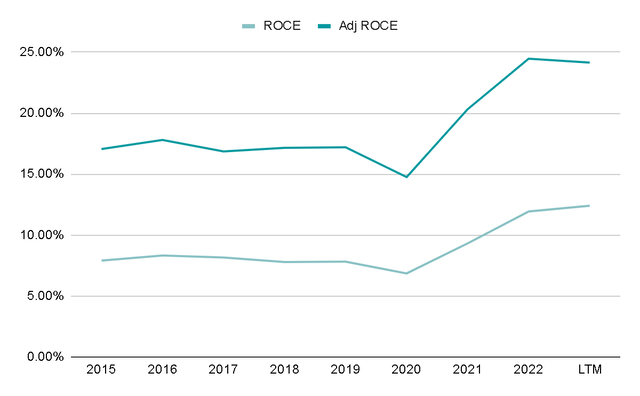

We can look at return on capital employed to assess how efficiently management has allocated capital. However, considering that the company mainly engages in regular M&A activities, it would be useful to examine the adjustment ratio by removing the goodwill arising from acquisitions. The company will likely continue to be active in M&A, but this gives a good idea of its purely operating revenues and would be indicative of the ROCE it could achieve if it made fewer acquisitions.

In this regard, ROCE has averaged 9% since 2015, but adjusted ROCE is around 19%, showing a clearly profitable and efficient business in terms of capital deployment.

author’s expression

evaluation

According to its most recent guidance, the company expects to grow revenue by 12% starting in the third quarter, a very achievable number considering there is only one quarter left until the end of the year.

Reported revenue growth is expected to be in the range of 12-13%, compared to previous guidance of 13-15%. This reflects annual organic growth of 3-4% compared to our previous guidance of 4-6%.

Conference call for the third quarter of 2023

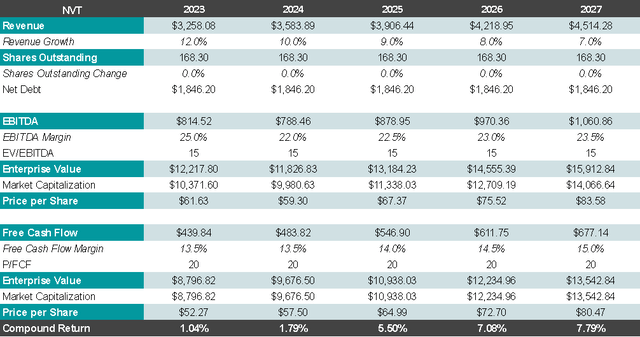

Over the next few years, I expect a compound annual growth rate of 8.5%. This is higher than the growth in recent years. But I think it’s feasible thanks to a mix of acquisitions and tailwinds in AI and data centers, for example. We will also adjust margins later, assuming they will be adjusted slightly higher than FY2022 margins following significant price increases this year.

With an exit multiple of 20x free cash flow and 15x EV/EBITDA, The expected rate of return is likely to be around 7-8%., plus a 1.35% dividend, which makes it completely unattractive. If the company reduces its debt and the stock price adjusts by about 100% US$45 These days, yields including dividends are already around 15%, which would be very attractive.

author’s expression

danger

While the company is pretty good business, the reality is that we are not immune from economic downturns, which could lead to a decline in demand for construction and industrial products, directly impacting nVent’s sales and profitability. Additionally, as mentioned above, the company’s products are often Associated with capital expenditure project. Reductions or delays in a company’s capital spending can also hurt its growth.

Ultimately, nVent is an industrial company exposed to disruptions in its supply chain due to events such as natural disasters, geopolitical tensions, or global health crises (as seen with COVID-19). This can affect the availability of components, affect production and, in turn, affect sales. . Therefore, this should also be taken into consideration when evaluating a company. In my opinion, the biggest flaw of the company is somewhat high level of circularity.

final thoughts

the company’s business Solve important problems For clients, the key differentiation usually lies in reputation and trustworthiness. This makes it more difficult to start a price war to monopolize market share because customers do not want to take systemic risks. Additionally, the nVent market is growing and fair winds. Additionally, it is a fragmented market with small regional or niche competitors that can buy and consolidate, making inorganic growth strategies quite profitable.

On the other hand, as previously mentioned, the company is much more cyclical than it appears and has not been able to build recurring revenue streams that could increase predictability and improve the quality of its earnings. This doesn’t automatically rule it out, but I think we’re buying into it to some extent at the moment. inflated profits Due to price increase. If this becomes normal, it could become a factor that significantly reduces the performance of our stocks. Therefore, I would prefer to wait a few more quarters to assess whether margins are sustainable, but until then, ‘holding‘ This is an evaluation of the company.