Nvidia Earnings: Bulls Pull the Trigger (Technical Analysis) (NASDAQ:NVDA)

dizzy 3d

My history charting the latest stocks on Wall Street is quite simple. There have been financial markets that I have charted, particularly in bear markets, where I have reached within a range of my target amount. NVIDIA (NASDAQ:NVDA), showed this. The wave pattern has landed within reach or, in the case of recent bulls, exploded onto the target every time.

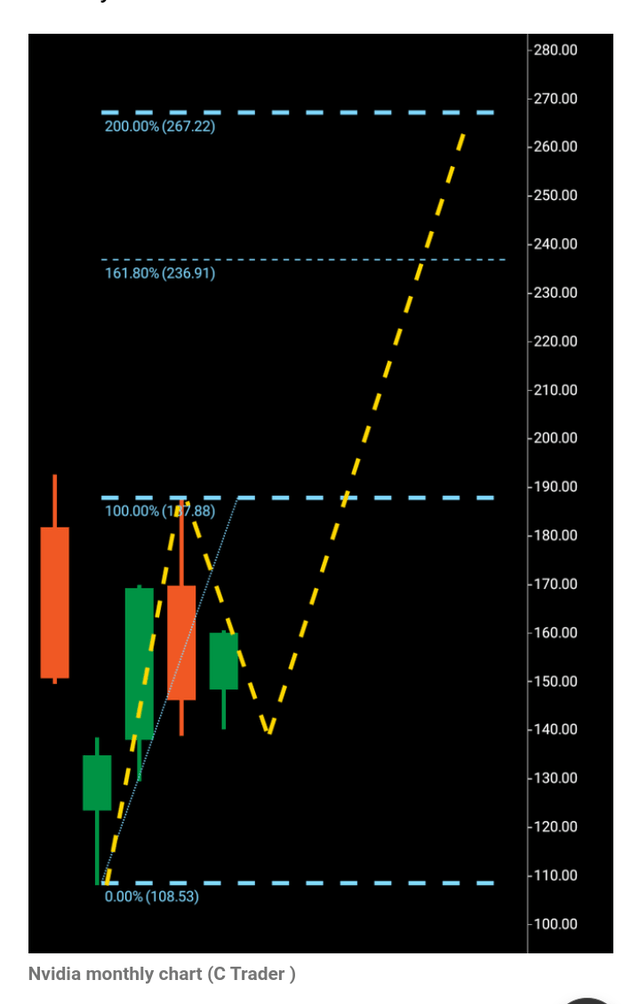

In September 2022, I outlined a scenario where Nvidia would fall from $143-$121 in a bear market, with a real bottom of $108. However, as the saying goes, “People usually make money when things are going well,” and we have identified a potential macro bullish turn. For the January 2023 Monthly, I published an article exclusively with Seeking Alpha explaining that if this stock breaks $187, I would look for $267 as my next stop.

NVIDIA Breakout Chart (CTrader)

you can see View the original chart above and find the link to the chart. here.

But $267 is a far cry from where the tech giant is today. Because those of you who follow me on LinkedIn will know that the additional recommended target is $445, $700/800. It is the highest since it bottomed at $108.

I’ve met many analysts during this period explaining that Nvidia won’t go any higher on various levels, and some have taken to Seeking Alpha to explain why they’re wrong.

The reality is that none of us have a crystal ball to read where financial markets will go in the future. Over time, it may become difficult to understand, as evidenced by the invention of boats, trains, airplanes, and automobiles. , phone, internet and now AI…

This is how these inventions, designed to transport us, products, or information at faster speeds, arrive through time, taking the human universe to the “next level.”

For example, in this case, the “next level” of AI is largely responsible for propelling the S&P500 into a new stratosphere, along with Nvidia, and a handful of others have also made our daily lives more robotic.

Now, let’s look at Nvidia more specifically from a business perspective before jumping into the charts to analyze the technical setup that could move this asset even further north.

The world’s leading GPU manufacturer holds an 80% market share in this space and has contributed significantly to the advancement of AI technology, outpacing its major competitors AMD and Intel.

The company’s last 12 months of revenue alone have seen an average return of 19.5%, and with AI still in its infancy, we can assume there’s potential for even more gains in the future. The market is waiting for this set of numbers to see if it can surpass the recent high of $965 and, if that happens, a potentially massive third wave.

It was recently told to me that the stock is up 435% in the last 15 months, and it is well documented that AI is still in its infancy, so is the expected upside reflected in the price? Answer: Maybe. The problem is that there must be a rejection candle or candle at the top of a bullish run, especially when described by a period of the same type as a monthly candle to measure the probability of future prices.

In this case, Nvidia has started a bullish/bearish picture, as we will see in the chart below. Months of strong demand lead to a moderate sell-off, pushing prices to the next level, beyond what looks like an “auction” picture.

Now let’s jump to the charts and see the technical path Nvidia is taking upwards.

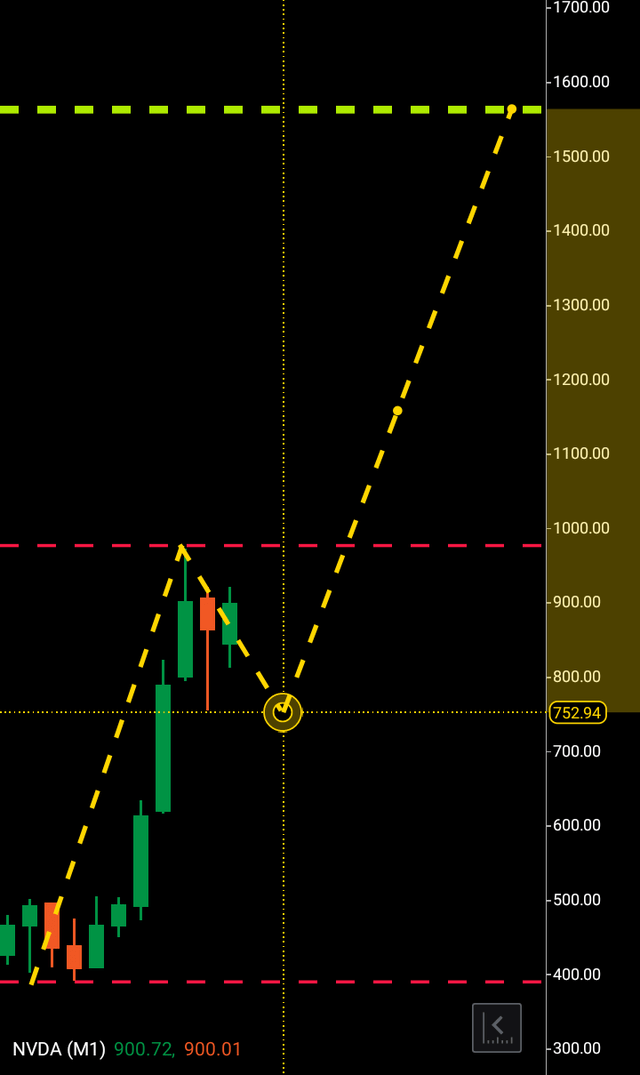

Nvidia current monthly chart (CTrader)

The lower starting point of this wave can be seen in the $400 area, while the high is located at $965. Wave 2 extends from the latter to the $750 area, where we can see a distinct bullish versus bearish appetite. A bearish rejection candle with a heavy wick signifies decision rather than indecision. Generally, if a reject candle has more wicks than body, there are fewer sellers to be found during this period, and in this case the supply and demand picture looks like this: obvious.

According to the three-wave theory, the third wave appears to numerically replicate the full parameters of the 1/2 wave. In this case, if the price in the financial market moves from $400 to $965, we can look at the highest printable period (monthly candle) and measure if the price rises above the rejected level before finding the rejected price point. Provide an accurate price target for a third wave breakout by replicating the exact numbers again in all probability before being rejected again.

This potential third wave is poised to continue the bullish traction and break $965, launching the tech leader at close to double its current level.

So what could go wrong? Is there a case for weakness?

Geopolitical uncertainty, competitors developing products that the market doesn’t like that could threaten Nvidia’s dominance or profits. While there is technically a bearish case that could push Nvidia to $660 if $760 is broken, this asset does not lend itself to this scenario we are talking about.

Ultimately, we expect Nvidia to pull out at $965 and find the $1600 region within the next 240-300 days. As usual, there is a scenario where $965 is above and there may not be a direct move to $1600. For example, as we see in many cases, the stock price may rise before seeking approval for the target again, reverting to a wave structure. As long as Nvidia stays above $400 and breaks the $965 resistance, I believe there will be a massive buying wave.