NVIDIA Tops List of Wall Street’s 20 Favorite Stocks for 2024

This is the first of a three-part series featuring a list of the best stocks selected by analysts working at brokerage firms. Part 2 selects small-cap stocks, and Part 3 selects mid-cap stocks.

Investors have seen a significant rebound in stocks over the course of 2023, and the upward trend that began in late October is gaining strength. Below is a list of stocks preferred by analysts working at brokerage firms for 2024.

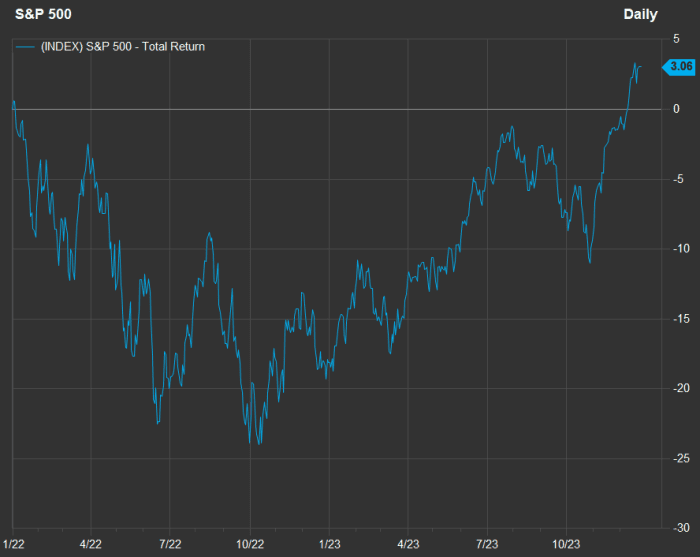

For perspective, look at the S&P 500’s returns since the end of 2021.

The S&P 500 has returned nearly 26% this year, but is up just 3.1% since the end of 2021.

fact set

All returns in this article include reinvested dividends. This chart reflects the S&P 500 SPX’s 25.9% gain this year, which puts the index up 3.1% since the end of 2021, following an 18.1% decline in 2022. The 2022 actions tracked changes in Fed policy. It seeks to push long-term interest rates higher by repeatedly raising the federal funds rate and shrinking its bond portfolio.

And now investors are confident the Federal Reserve is done raising rates, the central bank expects to cut the federal funds rate three times in 2024, and the S&P 500’s upward path has accelerated since late October.

Below is a summary of the performance of 11 sectors of the S&P 500, along with their forward price-to-earnings ratios. The full index is at the bottom.

|

sector or index |

Return in 2023 | Return in 2022 | Return from the end of 2021 | Forward P/E | Compare current P/E to 5-year average | Compare current P/E to 10-year average | Compare current P/E to 15-year average |

|

information technology |

57% |

-28% |

13% |

26.6 |

117% |

141% |

159% |

|

telecommunication services |

56% |

-40% |

-6% |

17.4 |

92% |

92% |

100% |

|

consumer discretionary |

43% |

-37% |

-10% |

26.2 |

86% |

102% |

118% |

|

industrial goods |

17% |

-5% |

11% |

19.9 |

96% |

107% |

117% |

|

ingredient |

13% |

-12% |

-One% |

19.4 |

113% |

118% |

126% |

|

real estate |

11% |

-26% |

-18% |

18.0 |

91% |

95% |

96% |

|

finance |

11% |

-11% |

0% |

14.5 |

98% |

102% |

109% |

|

health care |

One% |

-2% |

-One% |

18.1 |

109% |

110% |

122% |

|

energy |

0% |

66% |

66% |

11.0 |

100% |

59% |

68% |

|

consumer goods |

-One% |

-One% |

-One% |

19.2 |

96% |

99% |

108% |

|

utility |

-8% |

2% |

-7% |

15.7 |

86% |

90% |

99% |

|

S&P 500 |

26% |

-18% |

three% |

19.6 |

102% |

109% |

121% |

|

Source: FactSet |

|||||||

Especially at the end of the year, you will see dire warnings that stocks are always overvalued. Therefore, we compare the current forward price-to-earnings ratio with the average level over the past 5, 10, and 15 years. The forward P/E ratios in the table are based on rolling weighted consensus earnings-per-share estimates from analysts surveyed by FactSet.

Seven sectors are trading at weighted aggregate forward P/E ratios below their five-year averages, with utilities being the cheapest by this measure. That may not be surprising, since utility stocks typically rely on investors to pay dividends, and values for income-producing securities have fallen as interest rates have risen. Zooming out to 10 years, five industries trade below their average P/E levels, while only three sectors trade below their 15-year average P/E levels.

Stocks favored by analysts

Sell-side analysts (people who work for brokerage firms) typically set 12-month price targets for stocks. In this screen, we start with the S&P 500 and look at one company with less than five ratings among analysts surveyed by FactSet (Lowes Corp. L,

insurance company). We then narrowed the list to 92 companies that received at least a 75% “buy” rating or equivalent.

Of these 92 companies, the 20 with the most upside potential in 2024 as implied by their agreed-upon price targets are:

|

Corteva Corporation |

ticker | Share your ‘purchase’ rating | December 22nd price | consensus price target | Inherent Upside Potential | Forward P/E |

|

NVIDIA Corporation |

NVDA, |

94% |

$488.30 |

$668.11 |

37% |

24.5 |

|

First Solar Co., Ltd. |

FSLR, |

83% |

$170.39 |

$231.56 |

36% |

13.1 |

|

Halliburton Co., Ltd. |

will do, |

87% |

$36.59 |

$49.04 |

34% |

10.6 |

|

Bungie Global SA |

B.G., |

77% |

$101.64 |

$135.33 |

33% |

8.8 |

|

Bio-Rad Laboratories Inc. Class A |

Bio, |

75% |

$320.74 |

$424.00 |

32% |

27.5 |

|

Las Vegas Sands Corporation |

LVS, |

83% |

$48.92 |

$64.45 |

32% |

16.4 |

|

Schlumberger NV |

S.L.B., |

93% |

$53.08 |

$69.72 |

31% |

14.8 |

|

LKQ Co., Ltd. |

LKQ, |

75% |

$47.80 |

$61.89 |

29% |

11.4 |

|

Aptiv PLC |

APTV, |

85% |

$89.02 |

$113.96 |

28% |

15.1 |

|

Delta Air Lines Corporation |

moon, |

96% |

$41.13 |

$52.40 |

27% |

6.3 |

|

Targa Resources Corporation |

TRGP, |

95% |

$86.71 |

$107.96 |

25% |

14.5 |

|

Corteva Inc |

CTVA, |

78% |

$47.46 |

$58.53 |

23% |

15.7 |

|

Constellation Brands Inc. Class A |

STZ, |

83% |

$237.88 |

$292.37 |

23% |

18.0 |

|

Biogen Co., Ltd. |

bib, |

82% |

$257.97 |

$315.48 |

22% |

16.3 |

|

Baker Hughes Co. Class A |

BKR, |

79% |

$34.12 |

$41.58 |

22% |

16.6 |

|

Live Nation Entertainment Co., Ltd. |

lied, |

80% |

$91.43 |

$111.17 |

22% |

41.6 |

|

MGM Resorts International |

MGM, |

79% |

$44.38 |

$53.74 |

21% |

18.6 |

|

Elevance Health Inc. |

rule, |

86% |

$466.59 |

$563.67 |

21% |

12.6 |

|

Jacobs Solutions Co., Ltd. |

Jay, |

88% |

$128.07 |

$153.17 |

20% |

15.4 |

|

Synopsis Co., Ltd. |

SNPS, |

88% |

$524.46 |

$624.57 |

19% |

38.1 |

|

Source: FactSet |

||||||

Click on the ticker to learn more about each company.

Click here for Tomi Kilgore’s detailed guide to a wealth of information available for free on the MarketWatch quotes page.

Nvidia took the top spot as analysts expect the company to maintain its leading position in providing graphics processing units (GPUs) to data centers while strengthening its capabilities to support enterprise customers rolling out artificial intelligence technologies.

Here’s a sample of Nvidia’s recent coverage:

Focus on Value: 13 stocks that fell in 2023 but could bounce back in 2024 and beyond