Oakmark Global Fund: Fourth Calendar Quarter 2023 Commentary

miniseries

It would be remiss of us to not thank Clyde McGregor for his tremendous contribution to our clients and in turn the firm. Clyde would be the first to point out this was a team effort and the last to mention that he has been an exemplary teammate at Harris Associates for the last 42 years. Congratulations on your retirement Clyde! We wish you all the best as you continue to endeavor to improve the lives of those around you.

Performance review

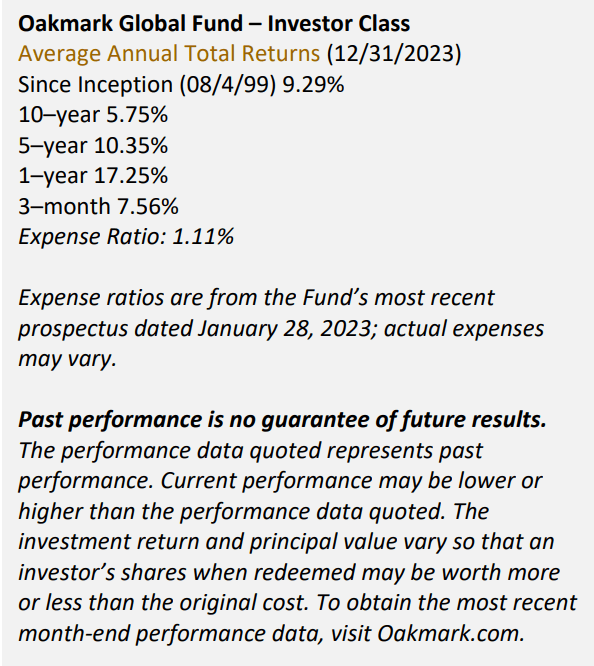

The fourth quarter reflected strong absolute returns for the Oakmark Global Fund (OAKGX)(“the Fund”). The Fund generated a 7.56% return in the fourth quarter, compared to a 11.42% return for the MSCI World Index. For the calendar year ending 2023, the Fund increased 17.25% compared to 23.79% for the MSCI World Index. Since inception, the Fund has returned 9.29% compared to 5.87% for the MSCI World Index.

The most significant individual stock contributors for the quarter were Capital One Financial (U.S.)(COF), KKR (U.S.)(KKR) and Ryanair Holdings (Ireland)(RYAAY, OTCPK:RYAOF). The largest detractors were Bayer (Germany) (OTCPK:BAYRY), Charter Communications (U.S.) (CHTR) and Julius Baer (Switzerland) (JBPCF). The most significant individual stock contributors for the calendar year were Alphabet (U.S.)(GOOG, GOOGL), Ryanair Holdings and Amazon (U.S.) (AMZN). The largest detractors over the same period were St. James’s Place (U.K.) (OTCPK:STJPF), Bayer and CNH Industrial (U.K.) (CNHI).

Capital One Financial (U.S.), which specializes in consumer finance, was the top contributor for the quarter due to strong third-quarter results. The company’s earnings per share of $4.45 was about 37% above consensus estimates, and its loan growth, net interest margin, non-interest income, operating expenses and charge-offs were all better than consensus estimates. In regard to credit quality, management noted that while portfolio-wide monthly delinquency and charge-off rates slightly exceeded 2019 levels, those trends were stabilizing. In addition, Capital One maintains sizeable capital and liquidity buffers. Overall, we appreciate the company’s value-focused management team, consistent reinvestment in technology development and stable deposit base.

Bayer (Germany), a life science company with pharmaceuticals, consumer health and crop science divisions, was the quarter’s top detractor. During the quarter, the company announced its decision to stop its OCEANIC-AF trial for asudenxian early due to lack of efficacy. The company was ordered to pay $1.5 billion to three plaintiffs in a recent RoundUp case. While both events were disappointments, the asundexian news is more relevant to us because we expected both wins and losses in the RoundUp legal saga and anticipate this recent verdict will likely be reduced significantly on appeal. Asundexian was Bayer’s largest late-stage pharma pipeline opportunity and had potential to be a next-generation Xarelto, but the trial was riskier than usual due to its data profile in earlier stages. We have modestly reduced our estimate of Bayer’s intrinsic value, but we still believe the stock is attractively priced, trading at around 6 times 2024 earnings. We continue to monitor the situation and will adjust our analysis, if necessary. We met with new CEO Bill Anderson after the news, and we are impressed by his thoughtfulness, strong background in pharma, and urgent desire to improve the areas of the company that have held it back from its full earning potential.

Portfolio Activity

Through the fourth quarter, we purchased new positions in Agilent Technologies (A), Kroger (KR) and Roche Holding (OTCQX:RHHBY). We sold positions in Oracle (U.S.)(ORCL); Sandoz (Switzerland)(OTC:SDZNY), a spin-off from Novartis (NVS); and Veralto (U.S.)(VLTO), a spin-off from Danaher (DHR), in favor of names that we believe offer more upside potential.

Agilent Technologies (U.S.) sells analytical instruments primarily used by research scientists and quality control labs. Agilent’s portfolio has transformed dramatically since the company was spun off from Hewlett Packard (HPE) in 1999. Since then, the company has pared back cyclical business lines in semiconductors, electronic measurement and communications. Agilent is now a pure-play focused on life science and diagnostics. Most of its current sales are derived from recurring sources, such as consumables, services and software, which are more profitable and less volatile than capital equipment orders. Since slimming the company down, Agilent’s management has delivered consistent market share gains, robust organic growth and solid margin expansion. We also like that the company competes in large, consolidated end markets that possess attractive growth rates, robust profitability and resiliency. Company executives are talented operators, driven by a long-term mindset and a commitment to build shareholder value through balanced capital allocation, which adds to our confidence in our investment. We believe the market is overlooking the company’s transformation and still sees Agilent as a cyclical business. The share price has been hurt by short-term concerns about soft capital equipment orders following a robust post-pandemic selling period. This has allowed us to purchase shares of this high-quality business at a discount to its life science peers and to relevant private market transactions.

Kroger (U.S.) is the second-largest grocery retailer in America, behind only Walmart (WMT). Although the grocery industry is highly competitive, Kroger’s scale advantages allow it to offer a more compelling value proposition than smaller peers and earn higher returns on capital. In recent years, the market has assigned Kroger a lower multiple due to concerns that e-commerce would disrupt traditional brick-and-mortar grocery businesses. However, we believe Kroger’s performance through the pandemic highlighted that its store footprint, distribution infrastructure, technology investments and strong brand all position the company well for a world with higher online grocery adoption. The stock trades for just 10x our estimate of next year’s EPS, which we believe is attractive given Kroger’s competitive positioning and earnings growth outlook. The pending merger with Albertsons (ACI) could accelerate the company’s earnings growth and produce additional scale advantages. If the merger is not approved, the company will have the capacity to return over 25% of its market cap to shareholders.

Roche Holding (Switzerland) is a health care company focused on pharmaceuticals and diagnostics. Roche is an above-average innovator in pharma with a solid track record of new drug development underpinned by a market-leading budget both in absolute terms and relative to its sales base. Its shares are trading at a discount to the net present value of the company’s on-market portfolio after a handful of unlucky misses in late-stage development, meaning that this innovation engine is free. Moreover, the on-market portfolio provides a solid mid-term growth and cash generation outlook, which should give the company’s pipeline time to deliver and should provide the financial capacity for the company to pursue selective, accretive bolt-on acquisitions.

We sold the remainder of our long-time holding in Oracle (U.S.) during the quarter. The Fund first purchased shares in the company in 2006, back when it had ambitious plans to integrate all of its enterprise software applications into a simple solution named Fusion. Now Fusion is the perennial market leader, and management’s stewardship has greatly benefitted shareholders. More recently, the company enjoyed successes through its merger with Cerner and the acceleration of its cloud infrastructure business. We exited our position as it approached our estimate of intrinsic value.

Geographically, we ended the quarter with 49.9% of the portfolio in the U.S., 31.5% in Europe, 14.5% in the U.K. and 4.1% in Asia as a percent of equity. In the fourth quarter, Ireland, South Korea and Belgium were the top contributors to relative performance of countries owned. Germany, the U.K. and Switzerland detracted the most from relative performance. For the calendar year, the U.S., Ireland and South Korea were the largest country contributors to relative performance of countries owned. The U.K., Germany and France were the largest detractors.

The Fund did not have any currency hedges in place at quarter’s end. We defensively hedge a portion of the Fund’s exposure to currencies when we believe they are overvalued versus the U.S. dollar, but do not find such overvaluation today.

As always, we thank you for your partnership with the Oakmark Global Fund. We invite you to send us your comments and questions.

David G. Herro, CFA | Tony Coniaris, CFA | Jason E. Long, CFA | M. Colin Hudson, CFA | John A. Sitarz, CFA, CPA | Clyde S. McGregor, CFA

The securities mentioned above comprise the following preliminary percentages of the Oakmark Global Fund’s total net assets as of 12/31/2023: Agilent Technologies 1.2%, Albertsons 0%, Alphabet Cl A 3.5%, Amazon.com 1.5%, Bayer 2.6%, Capital One Financial 3.0%, Charter Communications Cl A 2.4%, CNH Industrial 3.9%, Danaher 1.3%, Hewlett Packard 0%, Julius Baer Group 2.7%, KKR 2.1%, Kroger 1.2%, Novartis 0.9%, Oracle 0%, Roche Holding 1.1%, Ryanair Holdings ADR 1.9%, Sandoz 0%, St. James’s Place 2.1%, Veralto 0% and Walmart 0%. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks.

Access the full list of holdings for the Oakmark Global Fund here.

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate.

Certain comments herein are based on current expectations and are considered “forward-looking statements.” These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements.

EPS refers to Earnings Per Share and is calculated by dividing total earnings by the number of shares outstanding.

The compound return is the rate of return, usually expressed as a percentage that represents the cumulative effect that a series of gains or losses has on an original amount of capital over a period of time. Compound returns are usually expressed in annual terms, meaning that the percentage number that is reported represents the annualized rate at which capital has compounded over time.

The percentages of hedge exposure of each foreign currency are calculated by dividing the market value of all same-currency forward contracts by the market value of the underlying equity exposure to that currency.

The MSCI World Index (NET) is a free float-adjusted, market capitalization-weighted index that is designed to measure the global equity market performance of developed markets. The index covers approximately 85% of the free float-adjusted market capitalization in each country. This benchmark calculates reinvested dividends net of withholding taxes. This index is unmanaged and investors cannot invest directly in this index.

On occasion, Harris may determine, based on its analysis of a particular multi-national issuer, that a country classification different from MSCI best reflects the issuer’s country of investment risk. In these instances, reports with country weights and performance attribution will differ from reports using MSCI classifications. Harris uses its own country classifications in its reporting processes, and these classifications are reflected in the included materials.

The Fund’s portfolio tends to be invested in a relatively small number of stocks. As a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund’s net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund’s volatility.

Investing in foreign securities presents risks that in some ways may be greater than in U.S. investments. Those risks include: currency fluctuation; different regulation, accounting standards, trading practices and levels of available information; generally higher transaction costs; and political risks.

The compound return is the rate of return, usually expressed as a percentage that represents the cumulative effect that a series of gains or losses has on an original amount of capital over a period of time. Compound returns are usually expressed in annual terms, meaning that the percentage number that is reported represents the annualized rate at which capital has compounded over time.

The percentages of hedge exposure of each foreign currency are calculated by dividing the market value of all same-currency forward contracts by the market value of the underlying equity exposure to that currency.

All information provided is as of 12/31/2023 unless otherwise specified.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.