One important thing to realize in large gatherings like this | Exchange places with Tom Bowley

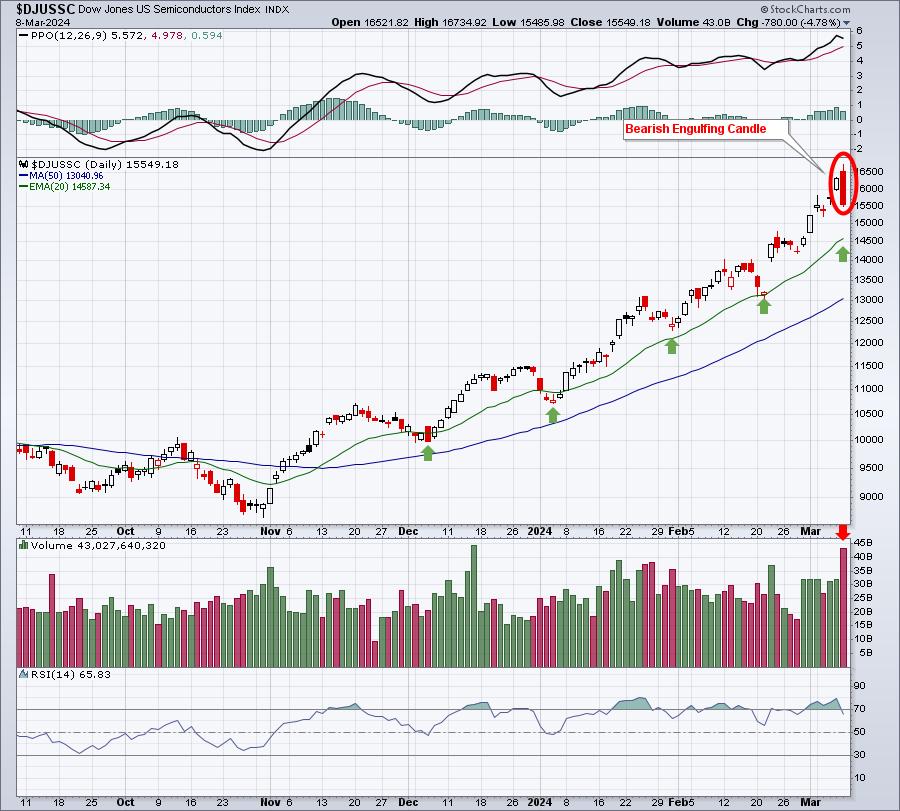

Never make a mistake. Friday was the weakest day of 2024. There was a bearish sweeping candle on heavy volume in the Semiconductor sector ($DJUSSC), and this group was by far the single biggest reason why our major indices fell. They are as advanced as they are. Check out this chart:

It’s an unpleasant bearish candle on the semiconductor chart. And it was the second-largest volume reversal in the past six months. I believe that today’s opening marks a very important summit for DJUSSC. That doesn’t mean the overall market rally is over. But I expect other areas of the market to drive the next developments. We are expecting at least a short-term merger or sale of semiconductor stocks. That’s not a bad thing, it’s a necessity. If it continues to rise in a parabolic fashion, it will end up with a much more substantial decline.

But mass gatherings do not always end in despair. In fact, most continue to drive trucks!

Let’s see how the bounce from the October 27 lows compares to other periods in the S&P 500 and the Semiconductor Index ($DJUSSC) over the past few decades.

S&P 500:

The blue dotted vertical line corresponds to every 90-day period in which the S&P 500 rises more than 25%. Before the current 25% profit in 90 days, we can see that this figure has only been achieved a few times in the last 30 years. The black arrows indicate that both of these 25% rallies occurred after significant bear market bottoms or correction lows. It is important to note that this calls a major market bottom. Because the biggest profits occur just behind this bottom.

Next, see what happens to the S&P 500 after a gain of more than 25%. It continues to rise higher! We are in a secular bull market. If you’ve been waiting to get in on this rally, I would consider taking advantage of some short-term weakness to do so. Of course that’s my opinion. I am not a registered investment advisor and therefore am not qualified to provide recommendations. I simply provide educational material based on my research. Do whatever you want.

Semiconductor ($DJUSSC):

Here, the blue dotted vertical line corresponds to a 90-day period in which DJUSSC rose at least 50%. Again, this has only happened a few times. Currently, over the last 90 days, DJUSSC is up more than 75%, which surpasses any other semiconductor rally in the past 30 years. The group needs a break.

Even if semiconductors stall here, the small-cap asset class remains very encouraging. On Monday, we’ll be analyzing a small software company that came out of the cup with a ton of handle patterns this week. We could potentially gain 40-50% over the next few months in measuring the pattern. To find out, click here to subscribe to the free EB Digest newsletter with just your name and email address. I’ll send you this small stock of software on Monday morning.

Happy trading!

tom

Tom Bowley is Chief Market Strategist at EarningsBeats.com, a company that provides a research and education platform for both investment professionals and individual investors. Tom writes a comprehensive Daily Market Report (DMR) to provide guidance to EB.com members each day the stock market is open. Tom has been providing technical expertise here at StockCharts.com since 2006 and also has a fundamental background in public accounting, giving him a unique blend of skills to approach the U.S. stock markets. Learn more