Our Top 3 Tokens: Blockchain Investor Scorecard Summary

If you’re a Bitcoin Market Journal premium member, you’re probably familiar with our Blockchain Investor Scorecard. Over the past five years, we’ve spent hundreds of hours analyzing blockchain fundamentals to find the best tokens for long-term cryptocurrency investors.

In this guide (open to everyone!), we reveal the highest-rated tokens in our Investor Scorecard library.

These are the top-rated projects by our analysts and editors, and our peer-reviewed scorecards summarize their findings into a simple 1-5 rating system. read.

How the Blockchain Investor Scorecard Works

Understanding the value of digital assets can be complicated, especially if you are a new investor. To make things easier for investors, we developed a peer review tool called the Blockchain Investor Scorecard.

Scorecards are valuable because they provide investors with a common framework that can be used to compare very different types of tokens. The scorecard asks questions across five general categories:

- market score: The scorecard looks at factors such as market size, whether the token serves an emerging or fragmented market, whether the token helps solve a problem in the market, and whether the market size supports investment in the token.

- competitive advantage: BMJ analysts look at the underlying blockchain on which the token is built and the key players behind it to determine whether the token has built a sustainable competitive advantage.

- management team: BMJ analysts look at the performance of the team behind the token. Evaluation criteria include industry and technical experience, integrity, and team composition.

- token mechanism: How the token works, or “tokenomics,” can determine its success or failure. The scorecard looks at how tokens are allocated and whether they help create long-term value.

- User adoption: The scorecard analyzes how easy it is for someone without technical knowledge to utilize the token. This metric also includes perceived buzz and the “halo effect” around a property to predict user growth, which is all-important.

Below are our top token picks as evaluated by our Blockchain Investor Scorecard.

bitcoin

bitcoin

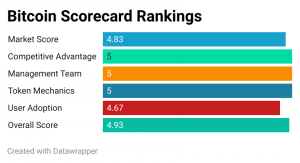

Not surprisingly, Bitcoin scores highest on the Blockchain Investor Scorecard. Bitcoin is the world’s first digital currency without banks or administrators and the first permissionless peer-to-peer payment network with a programmable native currency.

It undoubtedly has the largest market of any digital currency and has solved a huge market problem by being the first digital currency that can be sent and received without financial intermediaries. It also operates on the longest-lived and most secure blockchain network, and has a sophisticated group of volunteer coders working to keep the network running smoothly.

As an OG cryptocurrency (the gold standard), it ranks highly on our scorecard.

Market Score: 4.83

Competitive advantage: 5.0

Management Team: 5.0

Token Mechanism: 5.0

User adoption: 4.67

overall score: 4.93

USDC

USDC

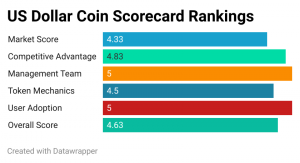

USDC, launched in 2018 by the Center Consortium, is a stablecoin that helps address market volatility. Because the coin’s value is pegged to the U.S. dollar, it has grown more steadily over time.

USDC is built on Ethereum, the world’s largest blockchain. It was developed by serial entrepreneur Jeremey Allaire, who hired a strong team of marketing, sales and legal experts to help develop and promote the coin. We rate USDC highly because it is widely available, has excellent oversight, and offers an easy and secure way to store value in cryptocurrencies.

Ethereum

Ethereum

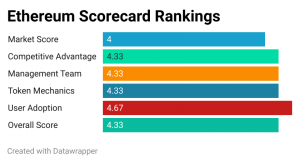

Ethereum adds significant value to the market as its blockchain allows users to develop smart contracts and build decentralized apps.

Programmers have been developing on Ethereum longer than any other smart contract-enabled blockchain. But now it faces significant opposition from other projects, threatening its competitive advantage. Additionally, blockchain adoption can be difficult for non-technical users to understand.

However, Ethereum still ranks very high because it has a team of experienced developers who have proven that they have a clear vision for the future. This means there is high potential for adoption and innovation from the world’s leading smart contract platform.

Blockchain projects to avoid

While there are many blockchain projects worth exploring, it’s also important to note which projects we recommend avoiding, including Shiba Inu, Dogecoin, and Cosmos.

- Shiba Most are meme-based tokens that don’t add much unique value to the market. It was released in 2020, and three years later, little is still known about the developers behind the project.

- while Dogecoin Although the market is large, the token was created as a joke to demonstrate how “easy” it would be to create a new cryptocurrency. The project has been criticized as having little value and few use cases. While this hasn’t stopped people from jacking up the price of DOGE, our view is that this project has little worth recommending.

- We also recommend avoiding the steering wheel Cosmos, because we believe it will be highly vulnerable to regulatory scrutiny as it grows. Additionally, Cosmos is no stranger to controversy, with reports of infighting and organizational political issues.

Investor Implications

This is just the tip of the iceberg.

We have dozens of investor scorecards for all the most popular cryptocurrency projects to save you time researching. This is a shortcut to making better investment decisions.

Whether you’re looking to reallocate your cryptocurrency portfolio or introduce a new brand to the cryptocurrency landscape, BMJ’s Scorecard can help you invest better. Sign up for a premium membership for immediate access to the entire library.