Over 90% of addresses are profitable.

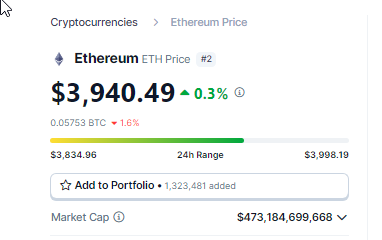

Cryptocurrency enthusiasts are celebrating a positive weekend for Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization. A 4.31% price surge over the past day has inched ETH closer to the important resistance point of $4,000. This rise comes amid a wave of optimism surrounding the Ethereum network, driven by a confluence of factors.

Ethereum whale activity signals potential rally on-chain buying

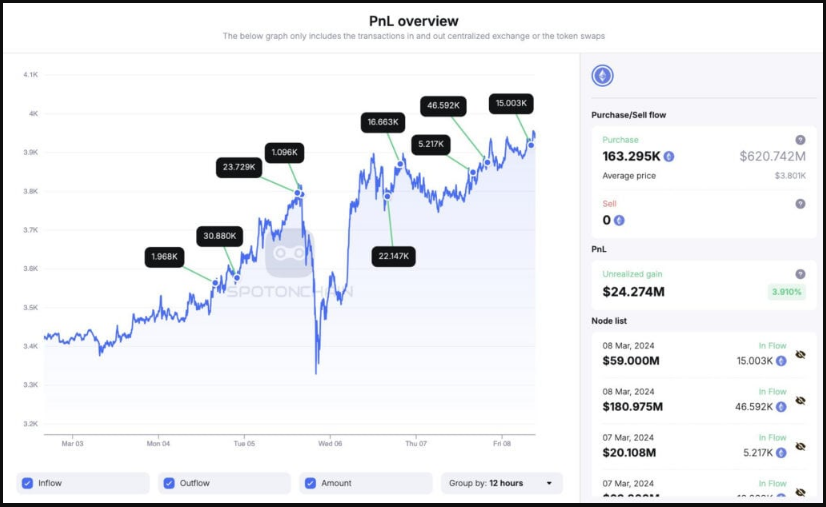

Market analysts attribute the recent surge to a significant increase in Ethereum accumulation. Wallets linked to PulseChain and PulseX have been buying ETH aggressively, accumulating a whopping 163,295 ETH in just four days, according to data from blockchain tracking firm Spot On Chain. Significant buying pressure, totaling $621 million in DAI, presents a strong foundation for a potential price increase.

Moreover, the whale trading volume of over $10 billion recorded overnight indicates a change in sentiment among major investors. Such huge volume is considered a bullish signal, suggesting that whales are accumulating ETH in anticipation of a price rise.

Ethereum investors, driven by profitability, approach ATH

Adding fire to this, over 94% of ETH addresses are currently profitable. This means that a significant number of investors are holding ETH, reducing selling pressure and potentially paving the way for price increases.

At this point, ETH is at its highest level in nearly a year, according to data from cryptocurrency analytics platform IntoTheBlock (ITB), but the upward trend experienced after the Bitcoin Spot Exchange-Traded Fund gained approval. They are clearly being followed.

Source: IntoTheBlock

Additionally, the excitement surrounding Ethereum is evident as the price approaches its all-time high (ATH) of $4,890. With minimal resistance expected, a retest of ATH appears realistically possible in the near future. This outlook is further amplified by the decreasing number of addresses holding ETH at breakeven or deficit.

Investor Confidence with Dencum Upgrade and ETF Speculation

Aside from immediate price action, the Ethereum community is abuzz with anticipation for the upcoming Dencum upgrade. This highly anticipated upgrade is designed to address scalability issues, reduce transaction fees on the layer network, and relieve congestion on the Ethereum network.

A successful Dencum upgrade is expected to significantly improve the overall user experience and potentially attract new investors, strengthening confidence in the long-term viability of the Ethereum network.

Total crypto market cap is currently at $2.5 trillion. Chart: TradingView

Adding another layer of optimism is the ongoing speculation surrounding a potential Ethereum ETF. Although regulatory approval from the SEC is still pending, the very possibility of an ETF has boosted investor sentiment. ETFs allow traditional investors to gain exposure to Ethereum without the complexities of owning and managing the cryptocurrency directly, potentially broadening the investor base and increasing demand for ETH.

Preview: The trajectory of Ether depends on many factors.

Ethereum’s prospects look bright, but there are still factors to consider. The price of ETH is approximately $1,000 lower than ATH, and the success of the Dencum upgrade and approval of the Ethereum ETF is not guaranteed. As with any investment, it is important to conduct thorough research and maintain a cautious approach.

However, increased on-chain activity, accumulation of whales, and the confluence of a profitable investor base paint a promising picture for Ethereum. With the Dencum upgrade imminent and the possibility of an ETF rising, Ethereum appears poised for potential price appreciation in the coming months.

Featured image from Pexels, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.