OXLCM: As CEF securities mature, we are looking for high-yield alternatives. (NASDAQ:OXLCM)

-Oxford-/E+ (via Getty Images)

proposition

6.75% Series 2024 Term Preferred Stock (Nasdaq: OXLCM) is the publicly traded term preferred stock of the Oxford Lane Capital Corporation (OXLC) closed-end fund. We covered and allocated to this security here last year. We give it a ‘Buy’ rating based on its short maturity, reduced risk and high yield. Since then, these securities have provided a steady stream of returns that outperform Treasury funds. With the security redemption date soon approaching at the end of June, investors should begin to outline what alternative securities they will adopt after receiving full principal on the bonds in their accounts.

This article will provide a macro overview of CLO equity CEFs, the ongoing need for leverage, and explore the alternatives available in the larger market that can be used for OXLC capital structure and replacement. OXLCM of investor portfolio.

Macro settings for CLO stock fund

CLO stocks have become a popular asset class over the past year, with many institutional pension funds allocating more capital to the sector.

In recent months, pension systems and insurance companies have increased the number of funds that invest in equity installments of loan collateral, according to several asset managers who spoke on condition of anonymity. The inflows came from GoldenTree Asset Management, Sculptor Capital Management and Carlyle Group Inc. and CVC Credit Partners, which helped raise at least $3.1 billion in less than a year for strategies dedicated solely to these investments. .

Source: Bloomberg – “Hedge funds attract pension funds to riskiest part of $1.3 trillion credit market“

The combination of a low default rate environment and high risk-free rates has favored CLO stocks. But OXLC doesn’t just aggregate CLO assets, it purchases them using additional leverage. OXLCM is a form of leverage for the fund.

Continued demand for the asset class translates into CEFs maintaining the same level of leverage, so there is the potential for new issuances to their names to replace maturity preferred securities, even though the fund has issued a significant amount of common stock. As of late, as we will soon see.

funds adjustment

Let’s take a quick look at how the leveraged portion of CEFs is currently stacking up.

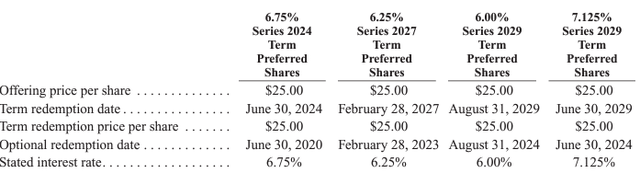

Term preferred stock (annual report)

According to CEF’s annual report, the above represents the current preferred stock issued by CEF. The fund also has the following bonds outstanding:

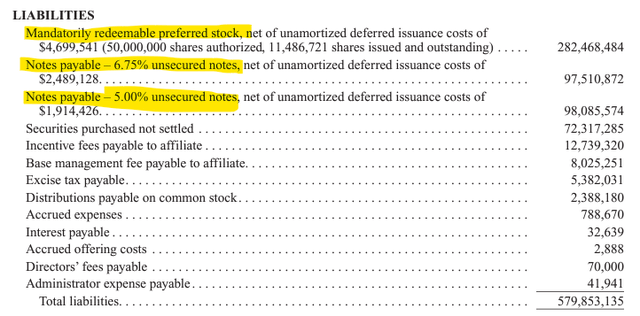

- $100 million principal amount of 6.75% unsecured notes due 2031. The 6.75% notes mature on March 31, 2031 and are redeemable in whole or in part on or after March 16, 2024.

- $100 million principal amount of 5.00% unsecured notes due 2027. The 5.00% Notes mature on January 31, 2027 and are redeemable in whole or in part at any time after January 31, 2024.

You can see above that these liabilities are neatly summarized on the fund’s balance sheet.

CEF Debt (annual report)

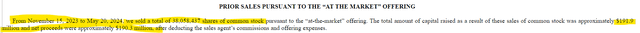

OXLCM has $68 million in funding that will soon expire. However, the Fund has been very active in issuing new common stock.

Issuance of new stocks (SEC Notice)

To maintain the same level of leverage as before, mathematically this suggests that a CEF would need to issue tranches of preferred stock, an alternative term. However, because spreads in the credit markets are so tight, CEFs may choose to operate lower leverage ratios for a while.

What are the alternatives?

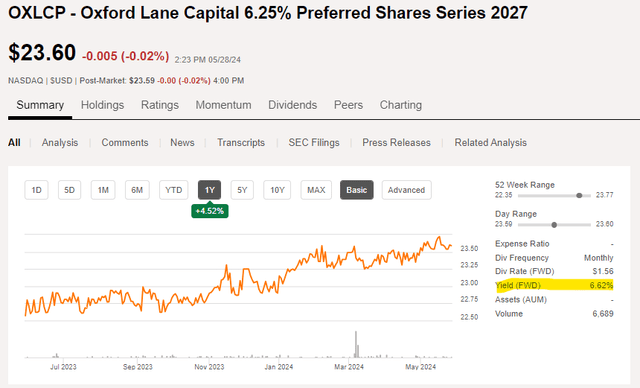

We initially chose OXLCM because of its very short maturity and higher yield than what was available in the government bond market. If the CEF does not issue additional debt (in the form of bonds or preferred stock), the lowest duration securities for the CEF are 2027 preferred stocks and bonds.

Both have very similar maturity dates, but preferred stocks have higher coupons and therefore higher current yields.

OXLCP Details (in)

Nonetheless, the term preferred stock refers to investments with very different term profiles and therefore both credit spread and interest rate risk. We would have preferred to see CEF securities with a one-year time horizon, but there aren’t any.

Since OXLCP is not repaid before its maturity date, a term profile closer to 2.5 years is expected here. Although brief, hedging events may nonetheless occur.

There have been a number of new issuances in this space, some of which are covered with a ‘buy’ rating.

- ‘EICC: CEF’s new preferred stock’

- ‘PMTU: Attractive Debt for This mReit’

However, the term profile of new securities is much longer than one year. Investors looking for a ‘cash-like’ product may want to read our article on liquid government bond funds and short-term bond funds, which are better suited to risk-averse investors.

- ‘USFR: Floating rate government bonds come to market turmoil’

- ‘PULS: Keeping cash pays off’

It is yet to be seen whether the CEF will issue new debt in the form of preferred stock to replace maturing bonds or opt for a lower leverage ratio. However, the new security will have a longer duration profile compared to OXLCM. There are no ‘one-to-one’ alternatives here, but the alternatives above are good choices for assigning a ‘Buy’ rating and explaining the risks and rewards associated with each name.

Additionally, the fund’s last “dividend” date is June 14. Therefore, if you are thinking of selling the name early, it is best to wait until that date to secure the final interest payment on the name. .

conclusion

We own OXLCM and have had it in our ‘cash’ bucket for investment so far. Given the lack of very short-duration alternatives in the CEF preferred stock segment, we could allocate this cash to Treasury funds or short-term bond funds, as highlighted in the article above. We are holding your name awaiting the final interest payment until the maturity date at the end of June when you will receive your principal back.