Palantir: There’s no room for disappointment. AI has become too overrated (NYSE:PLTR)

Image Bank via Steven Puetzer/Getty Images

We were previously affiliated with Palantir Technologies Inc. (New York Stock Exchange: PLTR) in November 2023 to discuss management’s superior marketing approach to AIP, which is expected to accelerate revenue and customer base expansion.

with initial constructor The AI SaaS market is still poised for tremendous growth, and we continue to rate the stock a Buy even after a modest decline.

In this article, we will discuss why we chose to downgrade PLTR stock to a Hold rating, reflecting the significant premium observed in the stock’s valuation and the increased upside potential for the stock.

Although we are confident about the long-term outlook, we believe it may be wiser to wait for a gentle decline to $17, the previous resistance level for the dollar-cost average.

The generative AI investment thesis has gone too far With PLTR

Currently, PLTR reported record highs in its Q4’23 earnings call with revenue of $608.35 million (+8.9% QoQ/ +19.6% YoY) and adjusted EPS of $0.08 (+14.2% QoQ/ +100% YoY). Recorded. .

Much of the key tailwind was due to increased demand for commercial products, particularly AIP, which naturally contributed to strong commercial revenue of $284 million (+13.3% QoQ/+31.8% YoY).

PLTR’s government revenues have shown signs of slowing growth, reaching $324 million (+5.3% QoQ/+10.5% YoY) through the most recent quarter, but returns from commercial spending are likely to be sufficient to balance the headwinds.

The same can be observed with the total RPO (Residual Performance Liability) increasing to $1.24 billion (+25.8% QoQ/ +27.7% YoY). Most long-term RPO is $600 million (+40.1% QoQ/ +31.5% YoY). ), Adjusted Gross Margin expands to 84% (+2 QoQ/ +2 YoY), and Net Retention Dollar expands to 108% (+1 QoQ/ -7 YoY).

It is undeniable that there is strong demand for SaaS products, with overall customer numbers accelerating to 497 (+44 QoQ/ +130 YoY), and the high growth trend is resuming as more companies invest in generative AI. represents . Capability during an assumed global soft landing.

PLTR’s bottom line tailwind is due to the observed deceleration in operating expense growth, which reached $433.92 million (+5.7% QoQ/+2.7% YoY) in the fourth quarter of 2023.

This was helped in part by using the balance sheet during a period of rising interest rates, with net interest income slowing to $44.41 million (+22.9% QoQ/ +302.2% YoY) and share count growth slowing to $2.35 billion (+1.2% QoQ). It’s possible. / +6.8% YoY) Based on most recent quarter

PLTR management appears to have made good on its previous promise to manage its massive stock-based compensation, aided by its yet-to-be-utilized $1 billion stock repurchase program.

With balance sheet net cash growing to $3.67 billion (+11.8% QoQ/+39.5% YoY) and virtually no debt, it’s understandable why the market has been as cheery as it has been thanks to the hype surrounding generative AI. .

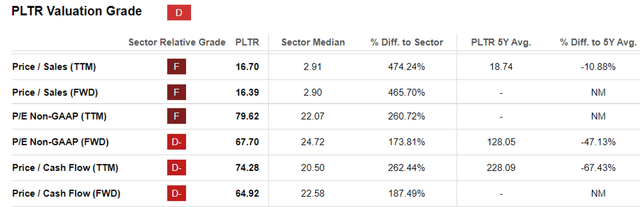

PLTR evaluation

pursue alpha

Nonetheless, we may be shareholders of PLTR, but it’s clear the stock is overinflated, with a FWD P/E valuation of 67.70x and a FWD price/cash flow ratio of 64.92x. This compares to a one-year average of 57.53x/68.97x and a sector median of 24.72x/22.58x.

Even when comparing valuations with other generative AI companies, such as Microsoft (MSFT) at 34.70x/27.42x, Nvidia (NVDA) at 56.38x/90.94x, and CrowdStrike (CRWD) at 102.28x/42.18x, at this point, generative AI SaaS It’s clear that the hype may have gone too far.

As the hype heated up, we were reminded of a similar trend previously observed at the peak of pandemic euphoria in November 2021, with the subsequent adjustment being extremely painful.

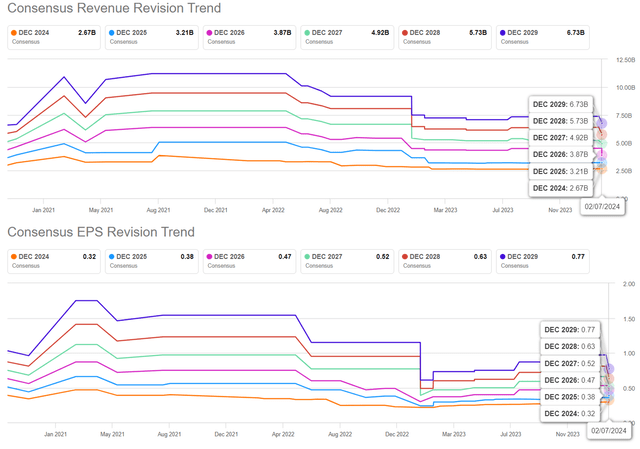

Agreed Forward Estimates

Tikr Terminal

This is especially because the consensus future estimates for PLTR have been continuously revised downward to a high/low CAGR of +20.3%/+23.2% through FY2026.

These figures represent a significant softening compared to previous estimates of +26.4%/+28.4% and historical high growth rates of +30.1% between FY2018 and FY2023.

Management’s fiscal 2024 interim revenue target of $2.656 billion (+19.3% YoY) appears to be accelerating compared to fiscal 2023 growth of $2.22 billion (+16.7% YoY), although this figure was recorded in 2020. This is still insignificant compared to the +47.2% YoY growth rate achieved. Fiscal Year 2020.

With overly inflated valuations and slowing growth trends, it appears that investors should temper their exuberance, with the market already seeing much of PLTR’s upside potential.

Based on the consensus 2026 adjusted EPS estimate of $0.47 and the one-year P/E average of 57.42x, the minimum upside to the long-term target price of $26.90 appears to be +13.9%.

So, is PLTR stock a buy?Sell or Hold?

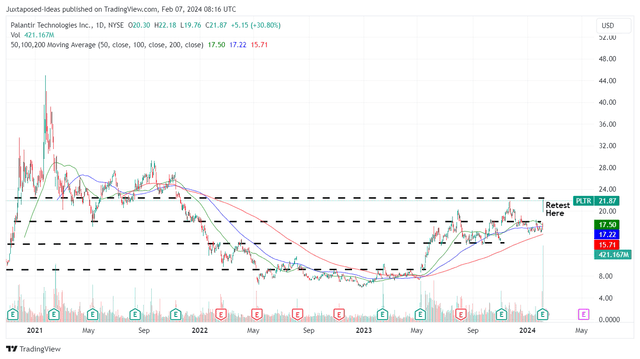

PLTR 3 year stock price

trading view

Meanwhile, PLTR reached new highs as it appeared to break the 50/100/200-day moving averages and retest the previous resistance level of $20.

Despite the up and down trends observed since the three previous earnings calls, it is also clear that the stock has been able to maintain its upward momentum since May 2023 and is likely to hit new highs/lows and $17/$18. Please be the next floor.

On the other hand, the combination of heightened market sentiment, cooling inflation, the Federal Reserve’s potential pivot to the first half of 2024, and increasingly greedy stock market indexes pose enormous uncertainty about PLTR’s excessive premium valuation and sustainability of its upward trajectory in the near term. .

This is where the saying, “A trend is your friend until it bends” can be applied. In a situation where the upward trend appears to be gaining momentum, the upward trend in stock prices may be prolonged and short-term trading profits may occur.

However, we believe there may be near-term volatility, with equity markets likely to decline after earnings season expectations have eased significantly.

As a result of the potential volatility, we prefer to cautiously rate the stock as a Hold here, and would recommend interested investors observe lower entry points depending on dollar-cost averaging and risk appetite.

Don’t chase this meeting here.