Parex Resources: Too Much Potential To Be Ignored (OTCMKTS:PARXF)

JarnoVerdonk

Investment thesis

Parex Resources (TSX:PXT:CA) is a Canadian oil producer with a long history of increasing production levels. In the last ten fiscal years, the company has grown production at an impressive 13.11% CAGR without incurring any debt until 2023, when Parex reported $90 million of long-term debt. Even with this new liability, the debt-to-equity ratio does slightly decrease to 0.24x, so it is fair to say that Parex’s balance sheet remains strong. Parex quadrupled its land acreage in 2021 and since then, it has been increasing its SG&A expenses at a 20% per year (vs 10-year CAGR of 7.24%), mostly due to staffing for exploration and evaluation activities on the new blocks. So the company has no plans of stopping its production growth. The company’s well-guided operations have also allowed it to return $4.48 billion to shareholders in share buybacks and dividends since 2017, more than twice its current market capitalization.

Such credentials should earn Parex the recognition as a great company. However, based on its current share price relative to the company’s fundamentals and prospects, the market seemingly has a different opinion.

What’s new?

The first time I wrote about Parex Resources, I provided my points of view about the company’s highly feared risks. In that analysis, I concluded that if the company’s major risks (volatility of Brent oil prices, Colombia’s political instability, the persistence of armed groups in the country, social unrest that causes shut-ins of operations) and even the meteorological phenomenon of El Niño were to harm the company’s operations as they have at their strongest historical levels, the impact would be the equivalent of less than 10% of the company’s 2022 revenues.

Among other things, the following has happened since that analysis:

- The company reported FY 2023 and Q1 2024 results, achieving record production per share, up 12% YoY and 9% YoY respectively.

- A Q2 2024 regular dividend of C$0.385 per share was declared, increased from the C$0.375/share of Q1.

- On February 29, Parex communicated to have resumed full operations at Capachos and Arauca blocks of the Northern Llanos region, which was affected by social protests that started on January 22.

- In the Q1 2024 results communication, the company reaffirmed its average production guidance for FY 2024 between 54,000 and 60,000 boe/d. In spite of the one-month halt in the Capachos and Arauca blocks, the guidance remains unchanged due to the contingencies incorporated into it.

With the FY 2023 and Q1 2024 results now out, I would like to delve into Parex’s main growth drivers, with the intention of estimating how they will shape Parex’s future earnings. I will also attempt to calculate a fair value for the shares of the company by a different method than last time, in order to question or confirm the company’s apparent undervaluation.

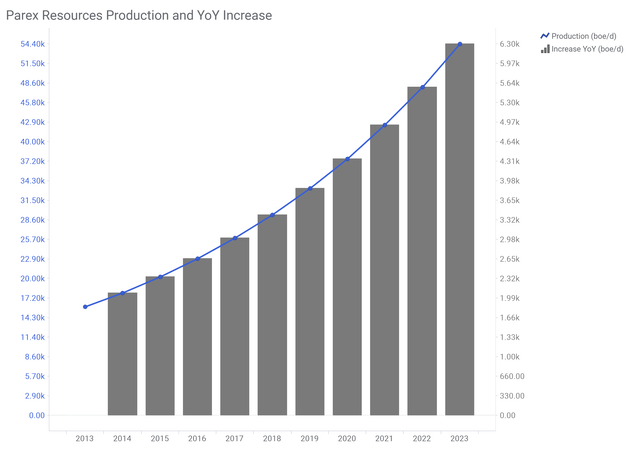

Increased production growth YoY. Parex has an impressive track record of production volumes. In the last decade, they went from 15,854 bbl/d (2013) to 54,356 boe/d (2023). But more impressively, the company has increased production also beating the prior year increase every time:

Parex Resources Production and YoY increases (Company Filings)

In the Q4 2023 Financial Statement, Parex’s management provided an outlook of reaching 57 kboe/d in 2024 at the midpoint. That means 2644 boe/d up from the volumes achieved in FY 2023 but also an increase as low as in 2017. In my opinion, this is nothing to worry about, since Parex’s management has recognized that they should have been more conservative with the previous -and missed-guidance of 60 kboe/d for 2023. In Imad Mohsen, Parex CEO’s words at the Q4 2023 Earnings Call:

For 2024, our long-term planning incorporates lessons learned from 2023. Our guidance is robust and incorporates layers of contingency to navigate potential volatility. The midpoint production guidance we have set is achievable and has sufficient remaining contingency despite the shut-in we faced in this past month.

And as promised, the guidance was reaffirmed in the Q1 2024 release note. So the management’s estimations were conservative enough to withstand those kinds of setbacks, at least for now. Not bad news at all. And hopefully this more prudent approach will prevail going forward. Considering this and Parex’s history of increasing production levels, I think it is conservative to assume that the midpoint production estimation for 2024 will be achieved and from there on, the increases in production could continue to grow each year at around 10% CAGR. That would mean growing production at a 9.86% CAGR over the next ten years, substantially slower than in the past decade.

Difficult-to-match skill set. Parex seems to have an expertise that is hard to match by other companies. They have been successful in areas where other companies failed because of: (1) technical and geological difficulties and/or (2) social unrest.

Below you will find some words by Alberto Consuegra Granger, Ecopetrol (EC) Executive Vice President. Mr. Consuegra was invited to Parex’s Capital Markets Day 2022 to discuss the Memorandum of Understanding between the two companies and said this (transcript sourced from www.tikr.com):

What I’m going to say from the Ecopetrol side is that we are excited. And why? Because we have seen the capabilities that Parex is delivering. When you look at the way Parex provides good results in terms of drilling in an area in which we have tried and we have not been that successful. So we need those technical capabilities, but also the focus because right now, what we see is focus in terms of Parex strategy in ensuring that light oil and gas that the country needs can deliver in that area of the country. That’s very important to us.

To provide perspective about the size of their operations, Ecopetrol is Colombia state-owned hydrocarbon company, and it produced 729 500 boe/d in the first nine months of 2023. Parex achieved 54 356 boe/d throughout FY 2023.

Parex’s highly valued technical skills make a perfect combination with the company’s ability to pick and gain access to proven, oil-rich grounds. The company has made a good reputation for itself by contributing to the communities surrounding their fields of operations and that level of trust allows Parex to quickly resolve protests, avoid most of them and access blocks that were exploited by other companies for a short period of time and abandoned because of social unrest. At this point, I can only imagine the potential that Parex’s managers saw (or knew?) under the 18 blocks -approximately 4.3 million acres- acquired in 2021.

Recently, Parex and Ecopetrol entered into definitive agreements to consolidate their position along the Llanos Foothills trend, the most prolific region of the country. As part of the agreements, the Arauca-8 well was brought online in April and has been producing 4000 bbl/d of light crude oil in the 2 weeks prior to the release of Q1 2024 results.

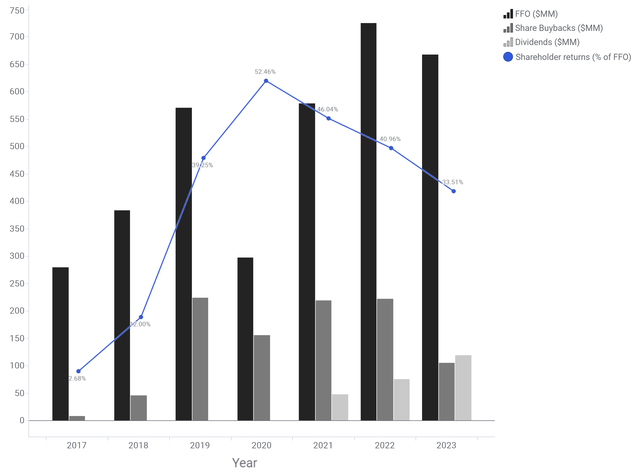

Strong shareholder returns. Parex’s allocation strategy includes returning at least ⅓ of total FFO and 100% of free funds flow (FFF) to shareholders as dividends and/or share buybacks. Both components were initiated at different points in time: dividends in Q4 2021 and buybacks in 2017. Parex’s allocation strategy as stated above was officially communicated in the release note of 2021 FY results. However, the company has achieved those levels of shareholder returns since 2019:

Parex Shareholder Returns (Company Filings)

Furthermore, Parex’s share buybacks are more meaningful than other companies’ because Parex is not issuing shares to reward its management anymore. In 2019, the executives compensation plan was changed and since then, shares granted as Cash Or Share Restricted Stock Units (“CosRSUs”) and Cash Or Share Performance Stock Units (“CosPSUs”) are bought in the open market, replacing the previous cash-settled RSU/PSU plan. A management team that diligently chooses not to dilute the shareholders’ ownership in the company is one that is aligned with shareholders’ interests.

A new Normal Course Issuer Bid (NCIB, stock repurchase plan) for a maximum 10% buyback of PXT’s outstanding was shares announced on January 16. With the Q1 2024 results the company disclosed that 919,900 shares were bought under the new NCIB, totaling 1.5 million shares cancelled year-to-date. I believe the company’s buyback activity during Q1 is very well-timed due to the low share price, which also keeps the window of opportunity open for long-term investors.

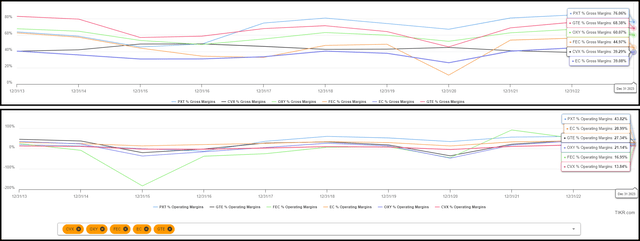

High operational efficiency. Overall, companies in the E&P sector generally exhibit high gross and profit margins. As investors, that is an interesting advantage to consider. According to a recent report, the oil and gas production industry ranks #10 by gross margins and #24 by operating margins in Q1 2024, compared with all 74 Global Industry Classification Standard (GICS) industries. But on top of that, Parex excels in controlling the impact of a very volatile commodity and the operational expenses. When compared to peers, including those that operate in Colombia like Ecopetrol, Gran Tierra Energy (GTE) and Frontera Energy (FEC:CA) as well as behemoths like Occidental Petroleum (OXY) and Chevron Corporation (CVX), Parex outperforms all of them by a considerable distance. As we can see below, this trend started in 2017 and was not even interrupted during the very difficult year of 2020. Based on Parex’s latest Q1 2024 results, in my opinion, there is no particular indication that margins will shrink moving forward.

Parex’s margins vs peers (TIKR.com)

The ‘Big E’ project. Parex has identified 15 prospects with the potential to produce up to 20,000 boe/d each. The company plans to spud 3-4 of them each year, dedicating an annual capital of $50 MM. In the Q1 2024 results, the company confirmed that the Hidra well (name just changed from “Hydra”) is expected to be spud mid-year 2024. The company started drilling the Arantes well in January and initial results are expected by mid-year. But on July 17, 2023, Parex announced the closure of the Chirimoya well because none of its 3 layers contained economic hydrocarbons. So, the ‘Big E’ project is indeed a risky bet, but an asymmetrical one when its potential rewards are considered.

Let’s assume for a moment a very conservative scenario where only half of the prospects will be successful, brought to production at half the desired speed and spending twice the capital as planned. Even in that case, the project could contribute up to 150,000 boe/d (2.75x 2023 production) after spending around $700MM (1.45x CapEx of 2023) through 7-8 years. However, Parex’s own reported 2P NAV valuations (CAD 33.57/share as of December 31) never include the potential impact of the “Big E” project. Anything these prospects add to Parex’s production levels, is merely a bonus from a company substantially undervalued by the 2P NAV metric.

Valuation

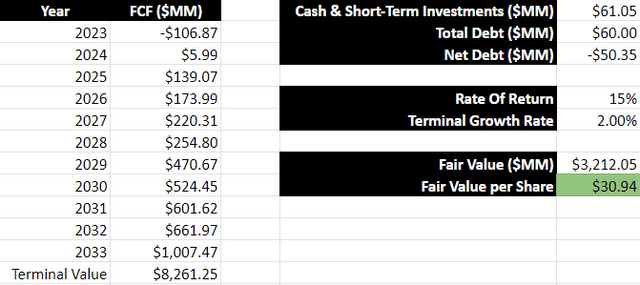

In order to arrive at a fair value for Parex’s shares, we could incorporate the impact of the growth triggers discussed above in order to develop a model for the company’s earnings through the next ten years. The ultimate goal of this model would be to obtain the free cash flow values for a DCF analysis. The model does not include any potential outcome from the “Big E” project. Besides the assumption made about the company’s future production levels, the other main assumptions are the following:

- Future Vasconia oil prices are estimated by subtracting historical differentials and the average miss from the Brent oil prices forecasted by Parex’ independent reserves evaluator (GLJ Ltd.). For 7 of the last 10 years, GLJ has forecasted Brent oil prices at or below their actual values.

- Royalties are calculated as mandated by Colombia’s Agencia Nacional de Hidrocarburos (ANH): a sliding scale of 8% – 25% based on the average monthly production level of each field. Last 10 years royalty payments were on average 12.35% of oil and gas sales (min.: 7.17%, max.: 20.25%). Future royalties are estimated to be on average 17.39% of future oil and gas sales.

- Capital expenditures for 2024 and 2025 are as provided in the latest 3-year plan, plus 10% to account for unexpected expenses. Afterwards, CapEx is assumed to grow at a 5% CAGR until 2033.

- Cash balance and bank debt values used were those reported in Q1 2024. In the period, $30M were used to partially pay down the $90M bank debt outstanding at the end of FY 2023, bringing it down to $60M. Cash came in at $61.05M, far from the $140M reported in FY 2023.

- The DCF analysis incorporates a 15% desired annual rate of return and assumes Parex’s FCF will grow at a 2% per year after 2033.

Those assumptions allow us to run the DCF analysis below and estimate a fair price for PXT:CA shares at around $30.94 or CAD 42.47 (exchange rates of May 9, 2024):

DCF Analysis of Parex Resources (Analyst’s own estimations)

Conclusions

After analyzing some of Parex Resources’ growth engines, it becomes clear that the company has been performing impressively and that it is poised for greater achievements. Parex grew its production levels at a 13.11% CAGR in the last 10 fiscal years and has maintained top-level margins even through 2020 when oil prices tanked to negative values, among other achievements mentioned here. The results of the DCF analysis provided here also show that Parex’s shares might be trading at a 44.2% discount to their fair value.

In my personal view, the main risks the company faces (e.g.: dependency on oil prices, political and social instability in Colombia) do not justify the current undervaluation. In the press release of January 17, 2024, the company said that it believes PXT share price has not been fair to the company’s value and therefore the approved buyback program will be advantageous to shareholders. Personally, I could not agree more with the company’s assessment. Its ability to increase production and to return value to shareholders remain solid as shown by the latest results. All those elements combined should greatly reward investors in the long term.

There is another component of Parex I would not call a growth trigger per se, but it is certainly responsible for the company’s success: its management team. I only briefly mentioned it above, but Parex’s management has proven to be very skilled and aligned with our interests as shareholders. Discussing how they run the business deserves a whole analysis on its own. In my opinion, doing that might only help to further realize the investment opportunity Parex is currently offering us.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.