PepsiCo: Too Much Dividend Love (NASDAQ:PEP)

JHVEPhotography

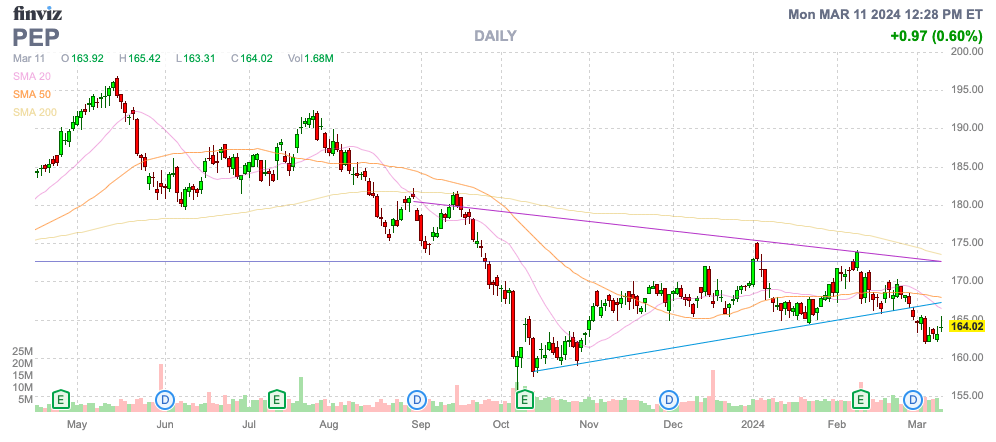

PepsiCo, Inc. (NASDAQ:PEP) has turned into one of the most overowned stocks despite consistently poor growth results. Even after PepsiCo has underperformed the S&P 500 (SP500) for several years, the stock remains largely disconnected from future growth opportunities.). My investing principle is bearish on consumer staples stocks, which are still trading at premium valuations after falling significantly from last May’s highs.

Source: Finviz

Focus on real growth metrics

PepsiCo began reporting its fourth quarter 2023 financials last month with revenue actually down from last year and missing analyst targets by $520 million. The company is now a massive beverage and snack food conglomerate with annual sales exceeding $90 billion and growth limited by rising COVID-related inflation leading to unsustainable sales growth.

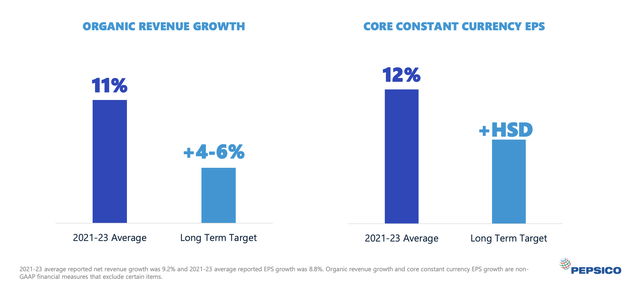

The company provided the following financial goals for 2024:

- organic revenue growth At least 4%.

- Core constant currency EPS growth is at least 8%.

Due to currency headwinds, PepsiCo forecast EPS growth of just 7% in 2024, reaching $8.15 per share. By all accounts, beverage companies are typically executing incredibly well to generate these growth measures that are consistent with the company’s stated long-term goals.

Source: PepsiCo presentation

The problem here is that stocks are not valued correctly based on these financial goals. PepsiCo has seen slightly higher growth rates during the COVID-19 period, and its latest results suggest that the inflation-driven period is unlikely to be repeated beyond the end of 2023.

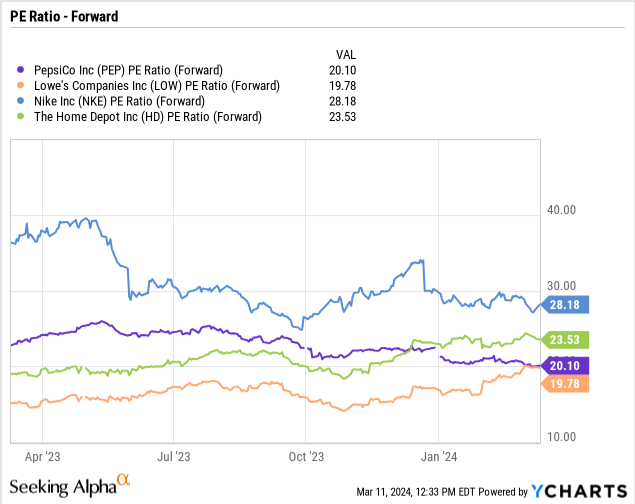

As with many dividend growth companies, investors like to overpay for the stock. Wells Fargo’s recent “Core List” includes many consumer stocks with excessive forward P/E multiples, including: Nike, Inc. (NKE) is trading at 28x EPS target. Home Depot, Inc. (HD) and Lowe’s Companies, Inc. (LOW) PepsiCo is trading close to its 20x EPS target.

Home improvement stocks have outperformed over the past year, in part because they have traded at lower P/E multiples in 2023. The market is now making the same mistake as Home Depot and Lowes, and investors in PepsiCo should pay attention to how stocks like Lowe’s are trading. With a 2024 EPS target of $12 and a drop to $180 last year, this is why investors have been able to make money on the stock over the past six months.

The 4-6% revenue growth target above creates a very difficult path for PepsiCo to generate growth that can reward investors with its 20x EPS target. Stocks trade at a growth rate of nearly 3x, when anything above 2x would be considered expensive.

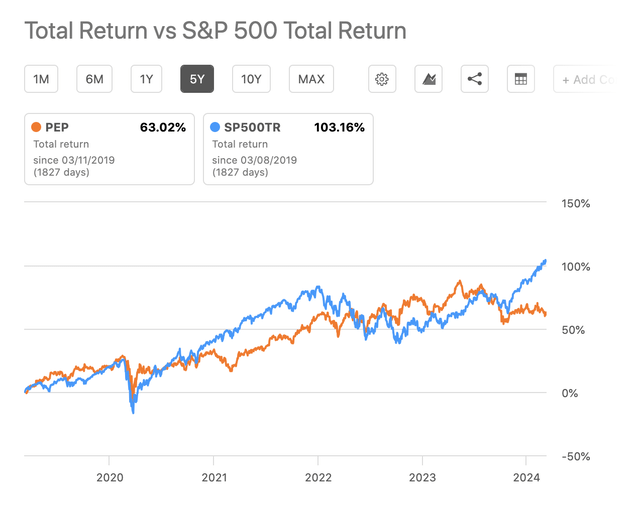

overly loved

A prime example of how much PepsiCo is loved is its inclusion on Wells Fargo’s list of outperforming companies, even though the stock hasn’t been close to its outperforming levels for several years now. While the S&P 500 has returned a total of 103% over the past five years, PepsiCo has only generated a 63% return.

Source: Seeking Alpha

Essentially, PepsiCo isn’t technically expensive relative to the dividend growth market, as some of our favorites illustrate above, the stock is just expensive relative to its growth targets. This valuation scenario is a prime example of why stock prices have performed poorly recently.

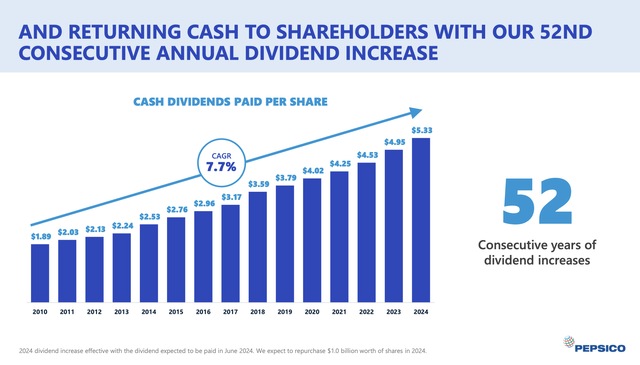

The company has consistently raised its dividend at a solid clip, leading to investors’ desire to overpay for the stock. Many investors automatically buy stocks like PepsiCo with 52 consecutive years of dividend increases, putting them in the Dividend Aristocrats concept.

Source: PepsiCo presentation

This concept pushes investors into stocks that have a history of increasing dividends for at least 25 years. The problem is that the investment concept does not ensure that investors will not overpay for those stocks as many investors pile into the same stocks, resulting in slower returns in the future.

PepsiCo’s dividend yield is only 3.1% due to excessive stock valuation. The stock has already fallen from a high of over $195 earlier this year to its current low of $164, but PepsiCo is still trading at 20 times forward earnings despite the decline.

The beverage and snack food company has a net debt balance of approximately $34 billion. If anything, one could argue that PepsiCo should be spending more cash to pay down debt than to increase its dividend yield by 7% each year. Dividend payments really shouldn’t be made on stocks with huge debt obligations, and it shouldn’t put the company in a precarious position no matter what happens to its operations or its efforts to cut back on unhealthy sodas and snacks.

Just because PepsiCo is down more than $30 from its high doesn’t mean the stock is cheap. Since more than 60% of profits are paid out as dividends, the upside potential for dividend increases due to profit growth is limited.

The key is that the stock should trade close to 15x EPS targets based on expected revenue growth. PepsiCo would trade close to $120 based on this multiple, which would allow investors to return to more market-type gains compared to the current scenario, where premium valuations have resulted in massive underperformance similar to the sector as a whole.

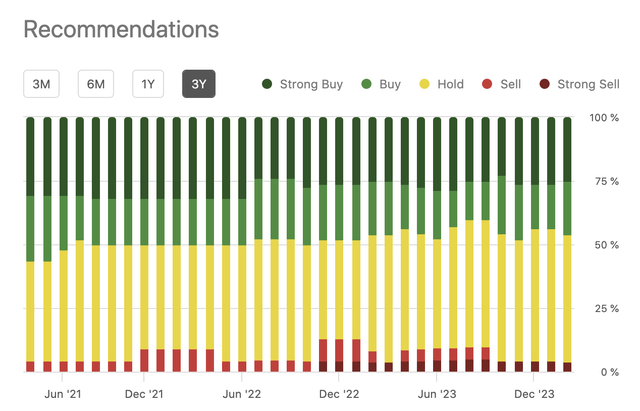

Even knowing that PepsiCo is unlikely to trade at such a high valuation and that the stock is down 15% over the past six-plus months, analysts aren’t bearish on the stock. At the stock’s peak last May, only two analysts had a sell rating on the stock, and only one analyst is still bearish today. I wonder how nearly 50% of analysts remain bullish on PepsiCo.

Source: Seeking Alpha

takeout

The main takeaway for investors is that PepsiCo, Inc. is another company that stock investors shouldn’t be very fond of. Continuous dividend increases have led investors to overpay for stocks. At the right price, the company would offer investors large returns similar to the market, but PepsiCo is expected to underperform in the coming years as its valuation is not aligned with its growth targets.