Performance analysis for the 4th quarter of 2023 and outlook until the 4th quarter of 2024 | decision point

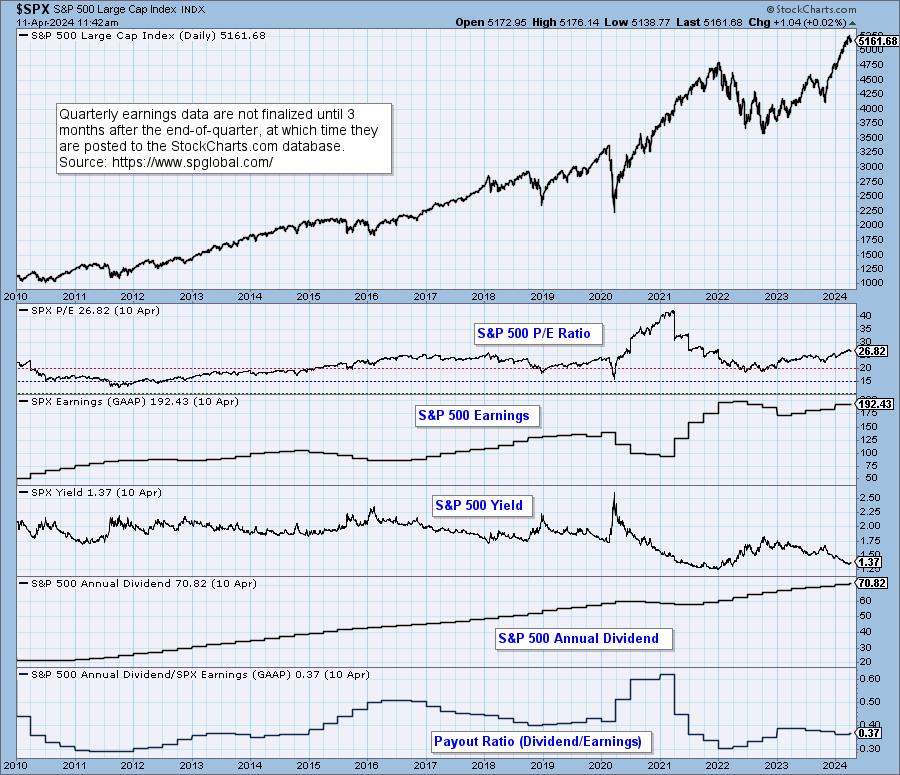

Here are the S&P 500’s fourth quarter 2023 earnings: The valuation analysis is as follows:

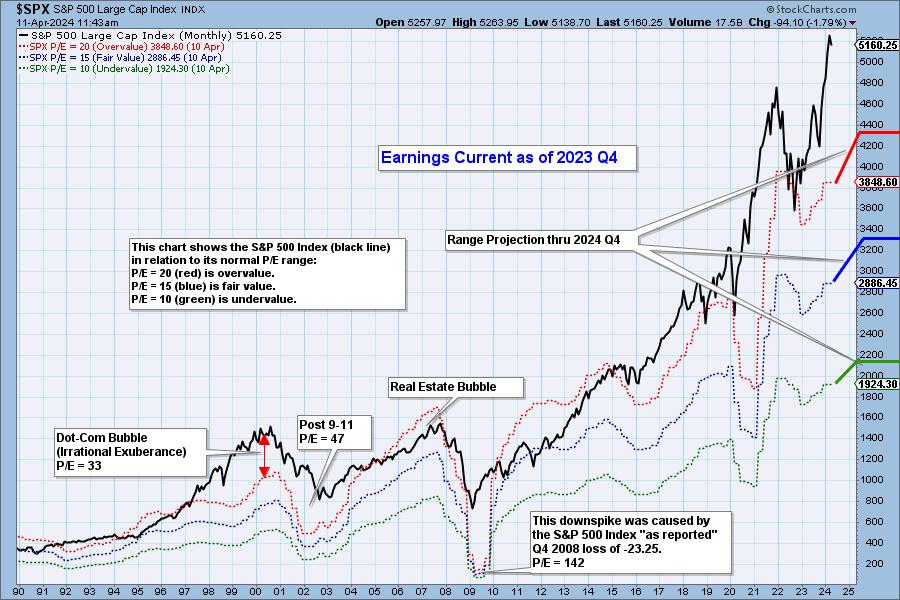

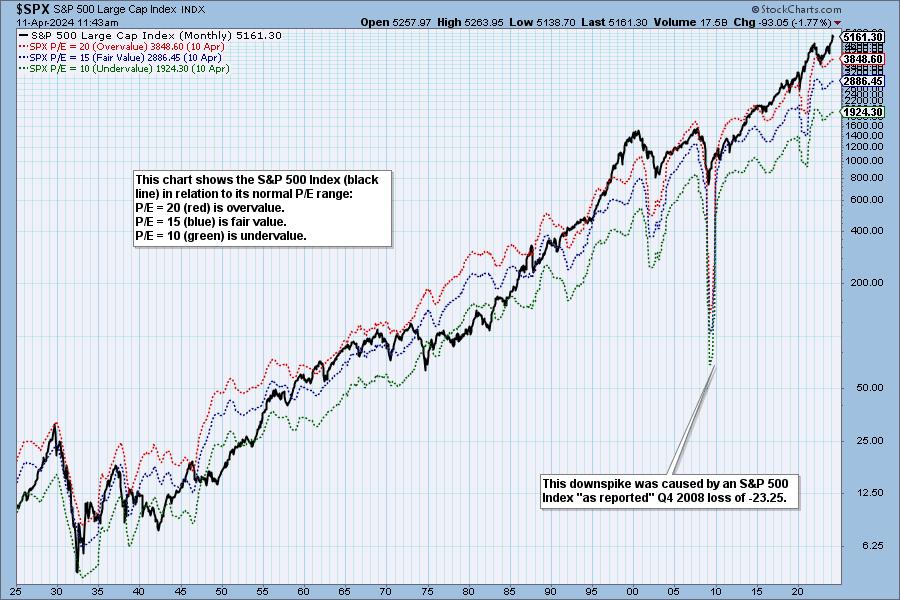

The following chart shows the normal value range for the S&P 500 Index. This indicates where the S&P 500 should be. overrated P/E 20 (red line), quite valuable P/E 15 (blue line) or underrated P/E is 10 (green line). The annotation to the right of the chart shows where the range is expected to be based on revenue estimates from: 4th quarter 2024.

Historically, prices have typically remained below the upper end of their normal value range (red line). However, since about 1998, it has not been uncommon for prices to exceed normal levels of overvaluation, sometimes well above. Most of the market overrated Since 1992, it hasn’t happened. underrated Since 1984. We might say this is the “new normal,” but it’s not. normal Follows Generally Accepted Accounting Principles (GAAP) standards.

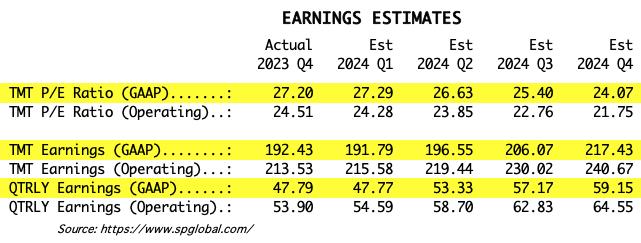

We use GAAP earnings as the basis for our analysis. The table below shows revenue projections through 2012. December 2024. P/E estimates are calculated based on the current S&P 500 closing price. December 29, 2023. It will change daily depending on where the market goes from here. It is noticeable that PER is outside the normal range.

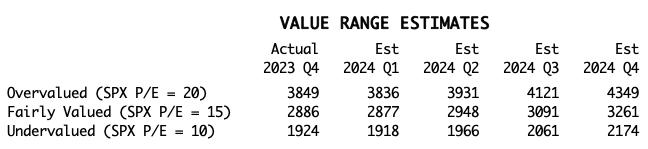

The following table shows where the bands are expected to be based on revenue estimates through the fourth quarter of 2024.

This DecisionPoint chart tracks S&P 500 fundamentals, P/E, and returns and is updated daily. You don’t need to watch it closely, but it will be updated whenever you need it.

conclusion: The market is still very overvalued and the P/E is still above its normal range. Revenues continue to grow, are trending upward and are expected to rise further by the end of the year. While overvaluation does not necessarily require an immediate decline to bring valuations back to a normal range, high valuations do put negative pressure on the market environment.

Watch the latest episodes decision point On StockCharts TV’s YouTube channel here!

(c) Copyright 2024 DecisionPoint.com

Technical analysis is a windbreaker, not a crystal ball.

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletter, blog or website materials should not be construed as a recommendation or solicitation to buy or sell any security or to take any particular action.

Useful DecisionPoint links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

DecisionPoint Chart Gallery

trend model

Price Momentum Oscillator (PMO)

balance volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear Market Rules

Carl Swenlin is a veteran technology analyst who has been actively involved in market analysis since 1981. A pioneer in creating online technical resources, he was the president and founder of DecisionPoint.com, one of the leading market timing and technical analysis websites. knitting. DecisionPoint specializes in creating stock market indicators and charts. Since DecisionPoint merged with StockCharts.com in 2013, Carl has been a consulting technology analyst and blog contributor. Learn more