Pfizer Stock: High Dividend Yield, JN.1 Variant, And Therapeutic Innovations (PFE)

Michael M. Santiago

Pfizer (NYSE:PFE) is a blue chip dividend stock whose medications, product candidates, and vaccines play one of the key roles in the fight against various types of cancer, viruses, immuno-inflammatory, infectious, cardiovascular, and rare diseases.

Thesis

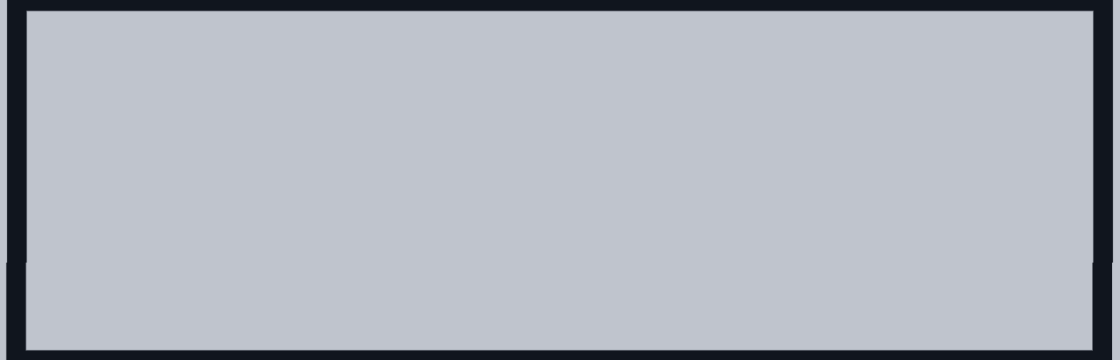

Since the end of December 2021, Pfizer’s share price has fallen more than 54%, reaching a strong support level. This decline can be attributed to the sharp drop in demand for its COVID-19 vaccine, investor concerns about losing exclusivity for some of its blockbusters in the next four years, and the release of more modest full-year 2024 guidance relative to the expectations of many of the financial market participants.

So, management expects the company’s adjusted diluted EPS to be $2.05 to $2.25 in 2024. Meanwhile, Pfizer anticipates its revenue to fall within the range of $58.5 billion to $61.5 billion, showing a slight growth compared to the analysts’ consensus for 2023.

Source: TradingView

However, despite the financial risks that will be presented later in the article and the conservative guidance, I highlight several investment theses that make Pfizer one of the most attractive assets in the healthcare sector for investors with a long-term perspective.

First, over the past decade, the $27-$28 price range has served as a zone where pessimist influence has waned and optimists have begun to establish dominance. Moreover, over the past two weeks, trading volume has steadily increased, indicating traders’ and investors’ growing interest in Pfizer.

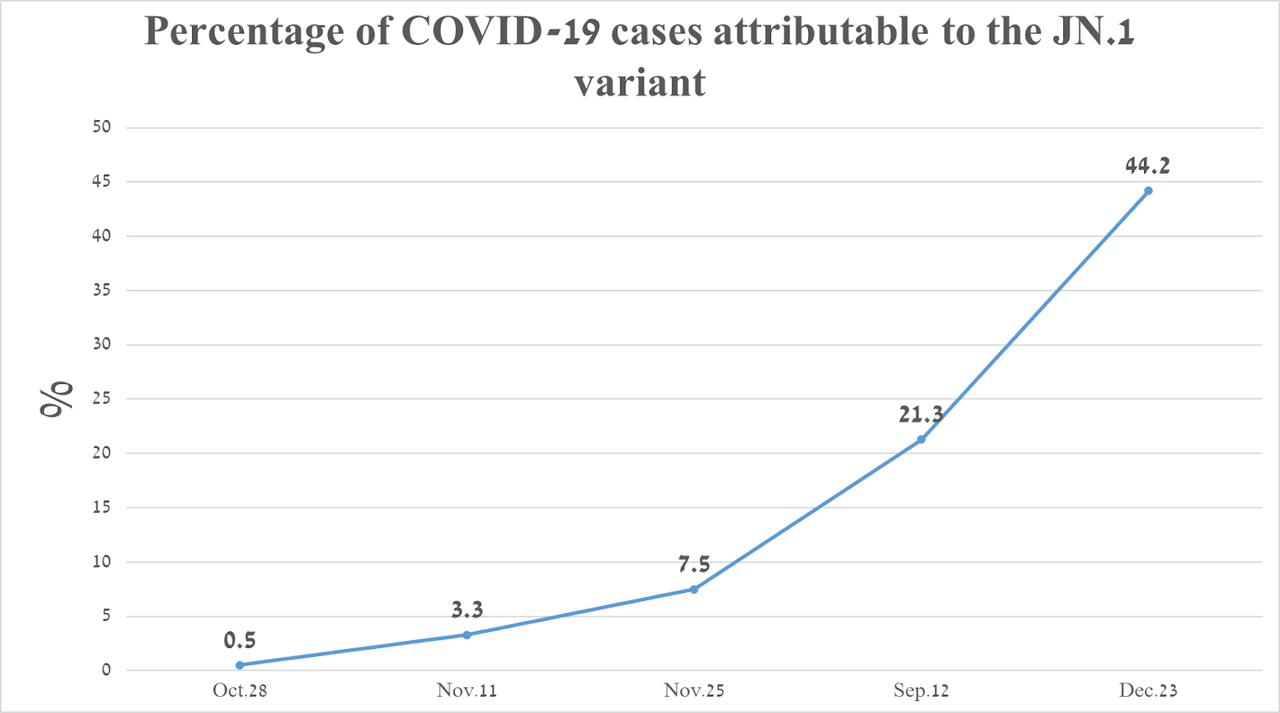

The company has an extremely high dividend yield of about 6%, a robust portfolio of experimental drugs aimed at treating cancer and immuno-inflammatory diseases, and the completion of the acquisition of Seagen will allow Pfizer to increase its presence in the fast-growing cancer drugs market. An additional investment thesis is a sharp rise in COVID-19 hospitalizations due to the rapid spread of the JN.1 variant worldwide, which will ultimately drive demand for Paxlovid.

I’m initiating coverage of Pfizer with a “buy” rating.

Completion Of The Acquisition Of Seagen And Pfizer’s Robust Pipeline

On December 14, 2023, Pfizer announced the completion of its acquisition of Seagen (SGEN) for $43 billion. As a result, the company has increased its presence in the fast-growing cancer drugs market with three FDA-approved medicines developed using innovative antibody-drug conjugate (ADC) technology and Tukysa, a HER2-targeting tyrosine kinase inhibitor. ADC is formed by combining a cytotoxic drug with a monoclonal antibody. This combination amalgamates the benefits of both drug classes, resulting in a significant therapeutic effect in the fight against cancer cells.

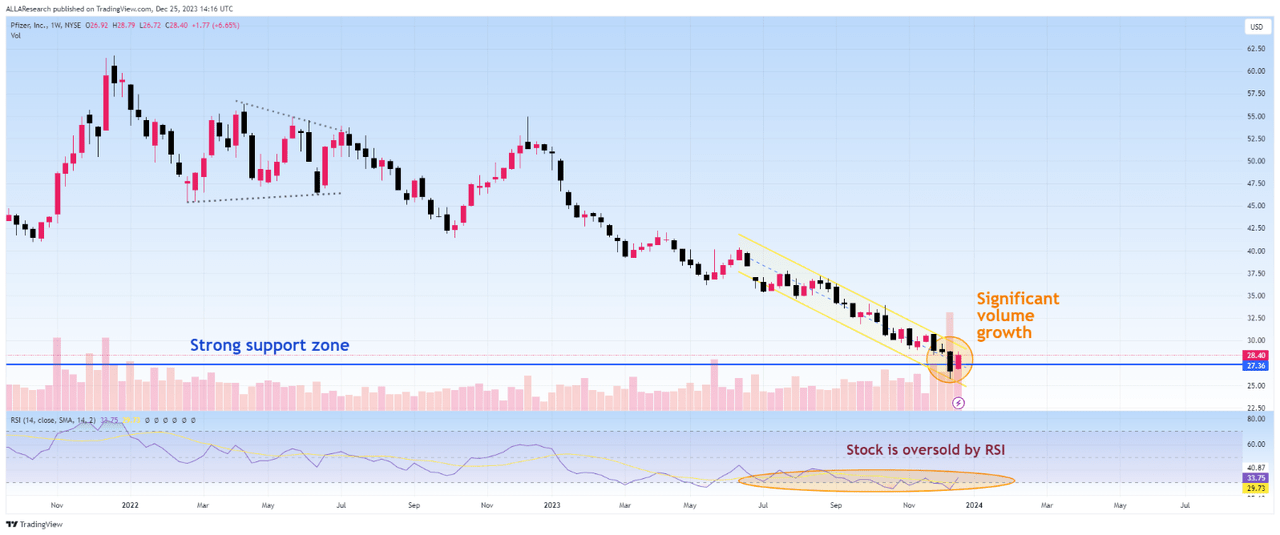

Total sales of Tukysa, Tivdak, Adcetris, and Padcev were $571 million in the three months ended September 30, up $143 million year on year due to increases in their selling prices, raised use of these drugs to treat patients with breast cancer and Hodgkin lymphoma and also label expansions. Moreover, on December 15, 2023, the FDA approved the use of the combination of Padcev and Merck’s Keytruda to treat patients with locally advanced or metastatic urothelial cancer, making it the first alternative to widely used platinum-containing chemotherapy in clinical practice.

Source: graph was made by Author based on 10-Qs and 10-Ks

In the short term, I believe this acquisition will have a negative impact on the company’s net income, as Seagen’s EBIT margin is still negative. However, given Seagen’s rich pipeline and Pfizer’s commercial capabilities, this will allow it to significantly benefit from acquiring one of the leaders in the antibody drug conjugates market.

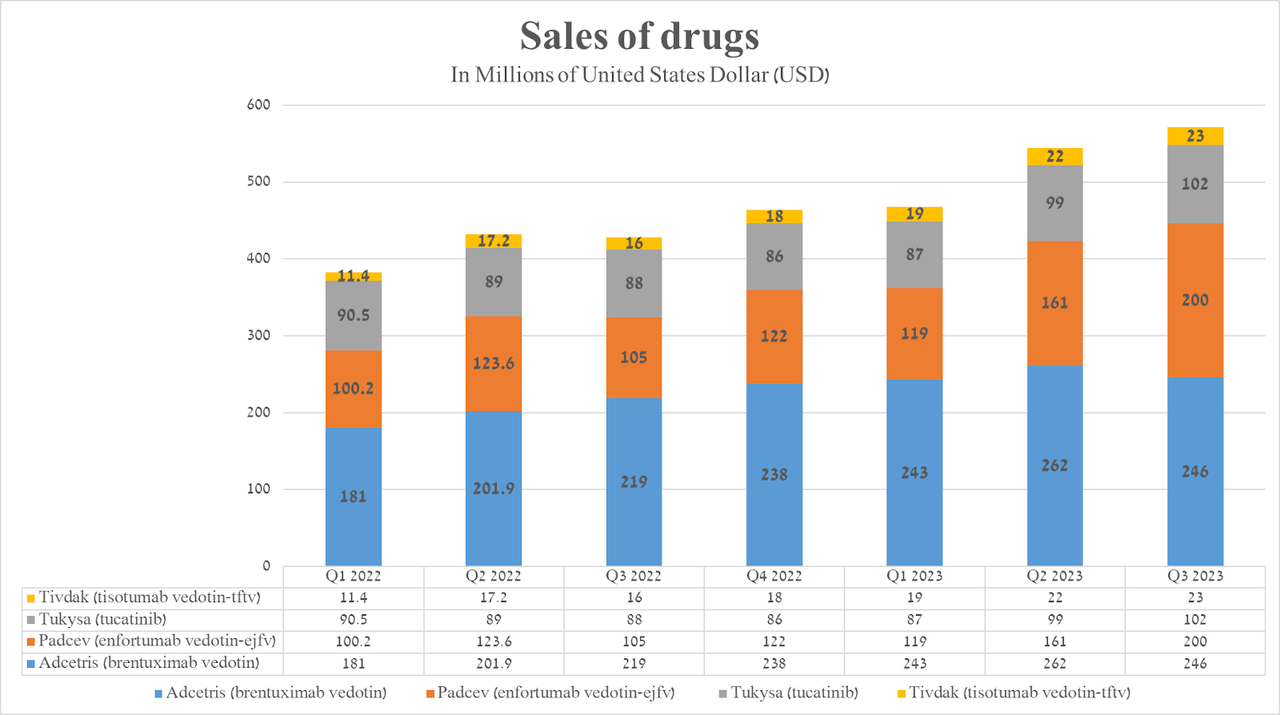

Also, I want to note that Pfizer continues to develop drugs and vaccines aimed at treating bacterial infections, autoimmune diseases, and cancer, some of which have a high chance of becoming blockbusters and minimizing the damage from the loss of exclusivity of its Inlyta, Xeljanz, and Ibrance in the next five years.

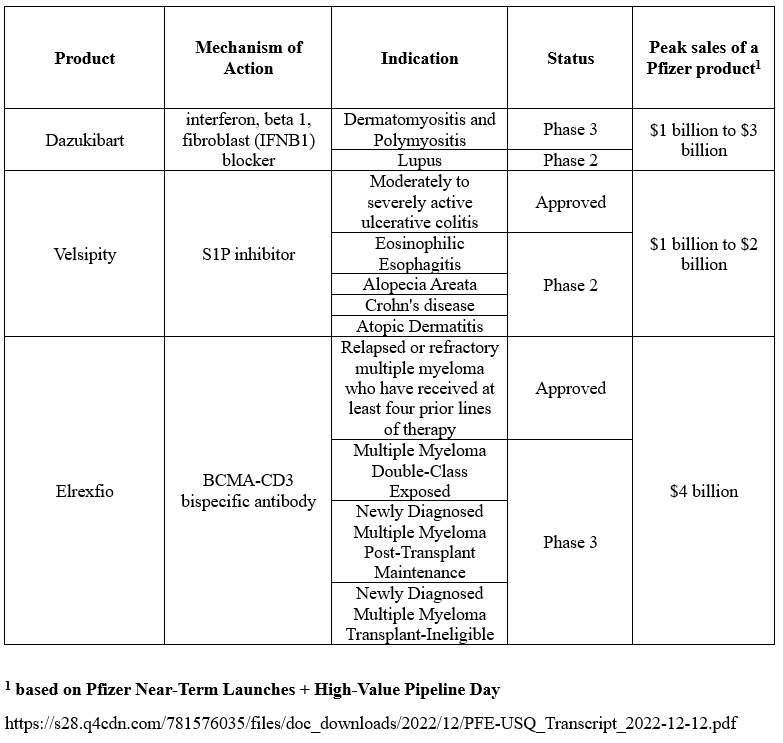

Source: Pfizer Near-Term Launches + High-Value Pipeline Day

I highlight several medicines that have the greatest commercial potential. The first is dazukibart, which is being developed to combat inflammatory diseases. The second medicine is Elrexfio, approved for the treatment of adults with relapsed or refractory multiple myeloma. The third drug I highlighted is Velsipity, which received its first FDA approval to treat patients with active ulcerative colitis and is still being developed by Pfizer to treat other prevalent medical conditions.

Source: table was made by Author based on Pfizer press releases and its pipeline

The New Wave Of COVID-19 In The World Is Gaining Momentum

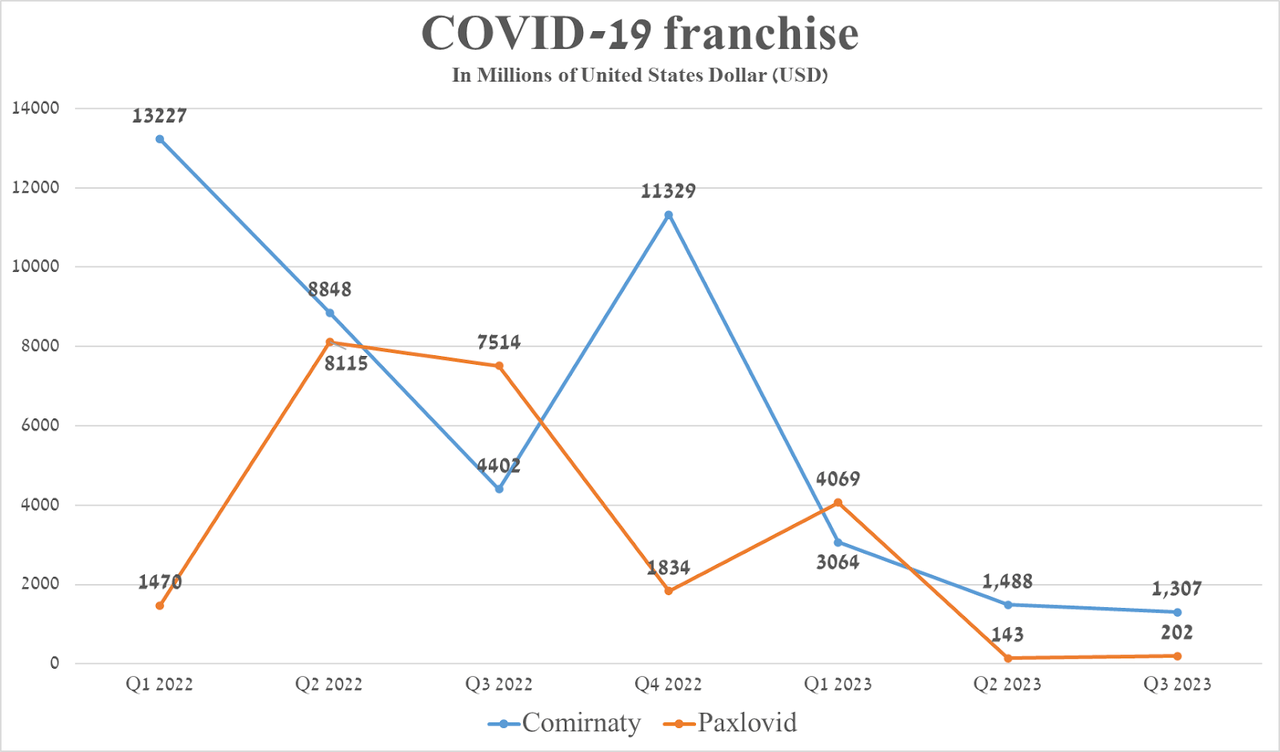

From 2020 to 2022, Pfizer became one of the key companies that significantly contributed to the fight against the COVID-19 pandemic. Its portfolio consists of Comirnaty, which remains the best-selling vaccine against the virus, and Paxlovid, an oral antiviral medication for the treatment of COVID-19.

The company’s total sales of COVID-19 franchises amounted to about $1.51 billion in the third quarter of 2023, dropping by 87% from the third quarter of 2022, primarily due to declining public interest in vaccinations. However, when looking at the financial results published in 10-Qs, sales of Paxlovid increased by 41% compared to the second quarter of 2022 due to an upsurge in COVID-19-related hospitalizations and an increase in its price.

Source: graph was made by Author based on 10-Qs and 10-Ks

Based on Pfizer’s forecast that its COVID-19 franchise will generate $8 billion in revenue in 2024, a significant increase in new cases in recent weeks, and the spread of the Omicron JN.1 subvariant, I believe sales of Comirnaty and Paxlovid have bottomed out.

Source: graph was made by Author based on CDC

At the same time, Pfizer, in partnership with BioNTech (BNTX), continues to modify the vaccine to combat potentially more dangerous variants of the virus, and the two companies are also conducting clinical development of PF-07926307, which could become the first combined vaccine against COVID-19 and influenza.

Consequently, I expect the ongoing trend in demand for COVID-19-related products, initiated in the third quarter of 2023, to persist into 2024, ultimately aiding in mitigating the short-term negative impact of the $43 billion acquisition of Seagen.

Pfizer Has One Of The Highest Dividend Yields In The Healthcare Sector

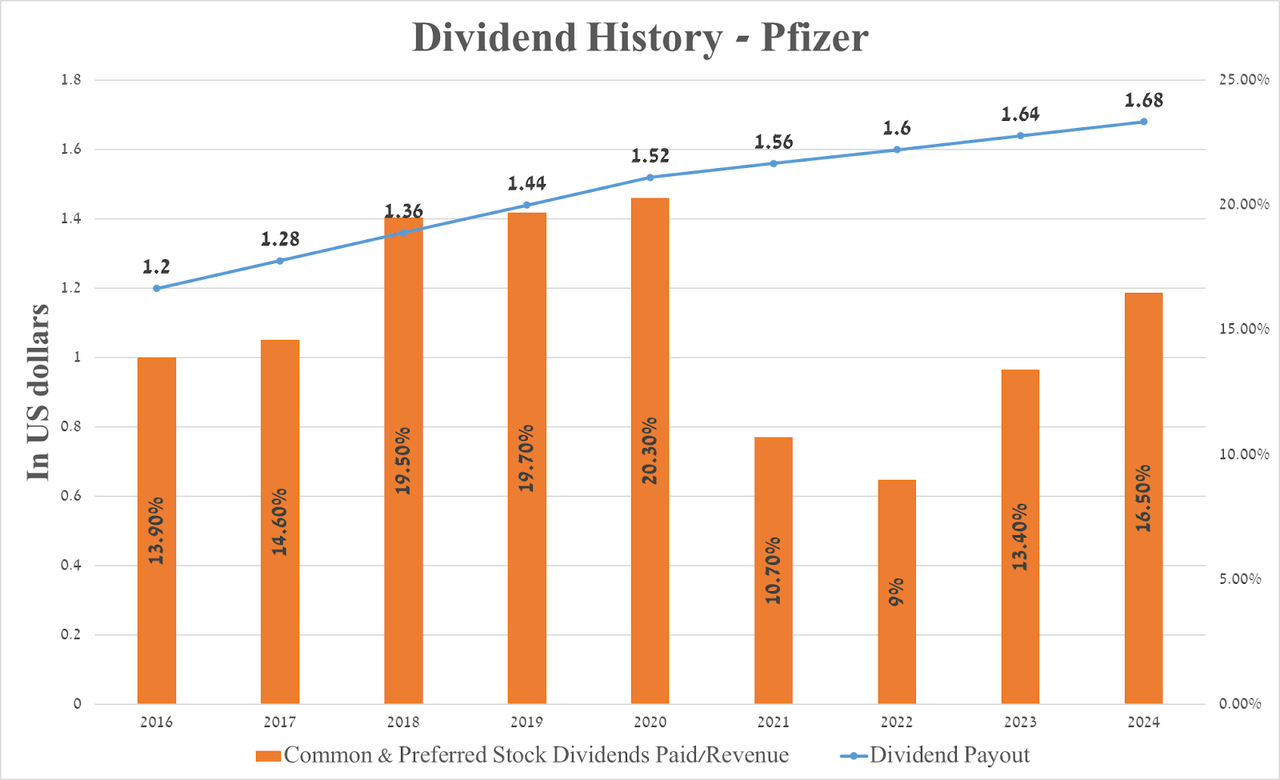

The COVID-19 pandemic has been a boon to Pfizer’s income and allowed it to generate substantial liquidity between 2021 and 2022, which it used to increase its dividend payouts in addition to acquiring pharmaceutical companies.

Source: graph was made by Author based on Seeking Alpha

At the same time, the company’s 5-year dividend growth rate is 4.95%, which, together with the payout ratio of 56.79%, indicates a reasonable dividend policy and also a low probability of its management of cash flow spending on dividend payments in the future.

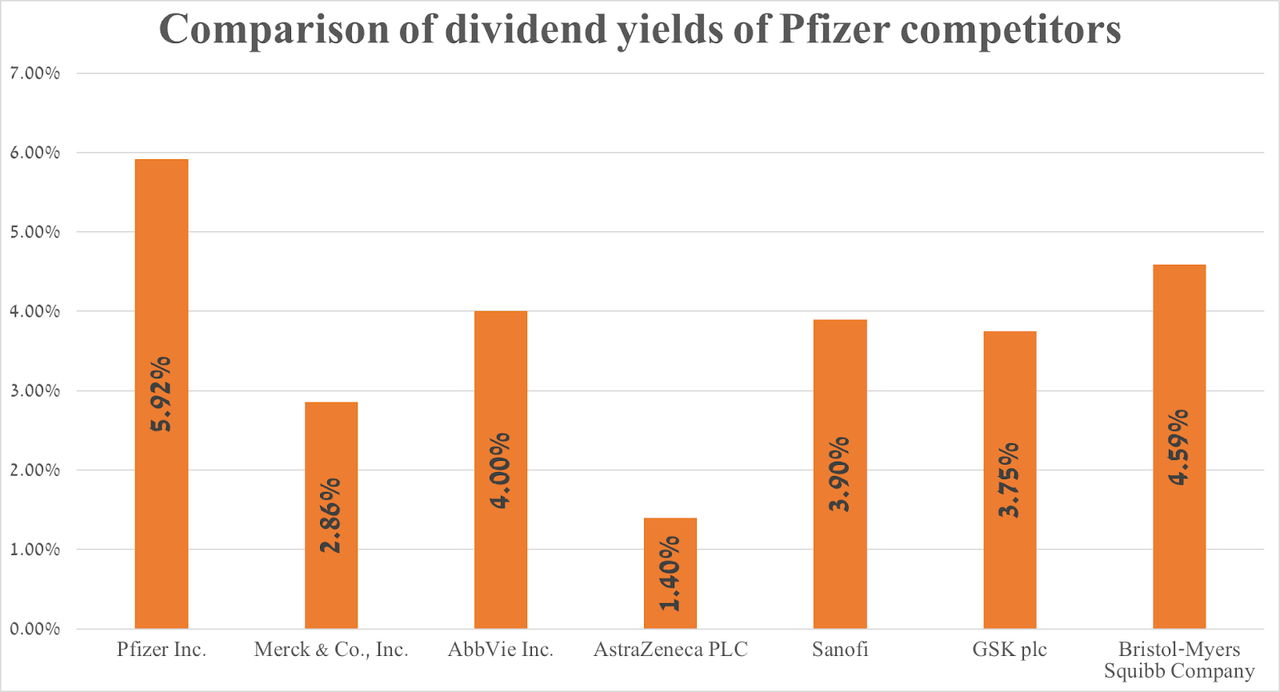

The company’s dividend yield is 5.92%, outperforming its main competitors in the pharmaceutical industry, such as Merck (MRK), Bristol-Myers Squibb (BMY), AbbVie (ABBV), and AstraZeneca (AZN).

Source: graph was made by Author based on Seeking Alpha

Given that the company’s quarterly dividend is equal to $0.41 per share, Pfizer will spend more than $9.2 billion on these purposes in 2023, about 2.4 times more than it plans to allocate for its capital expenditures. Relatively modest CapEx requirements, coupled with a significant expansion of Pfizer’s portfolio, underscore the company’s financial stability and make it an attractive asset for investors focused on dividend investing, which is one of the effective strategies for generating stable income.

Pfizer’s Financial Results And Outlook

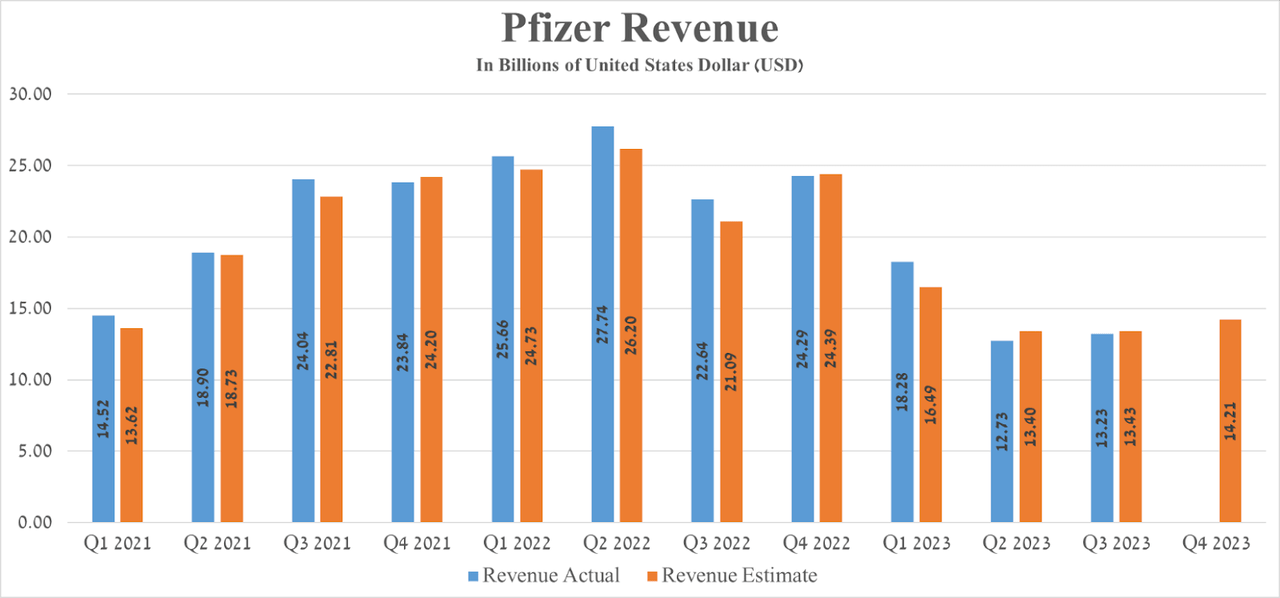

Pfizer’s revenue for the three months that ended in 2023 was about $13.23 billion, up 3.9% from the previous quarter, but it missed analysts’ expectations by $230 million.

Source: Seeking Alpha

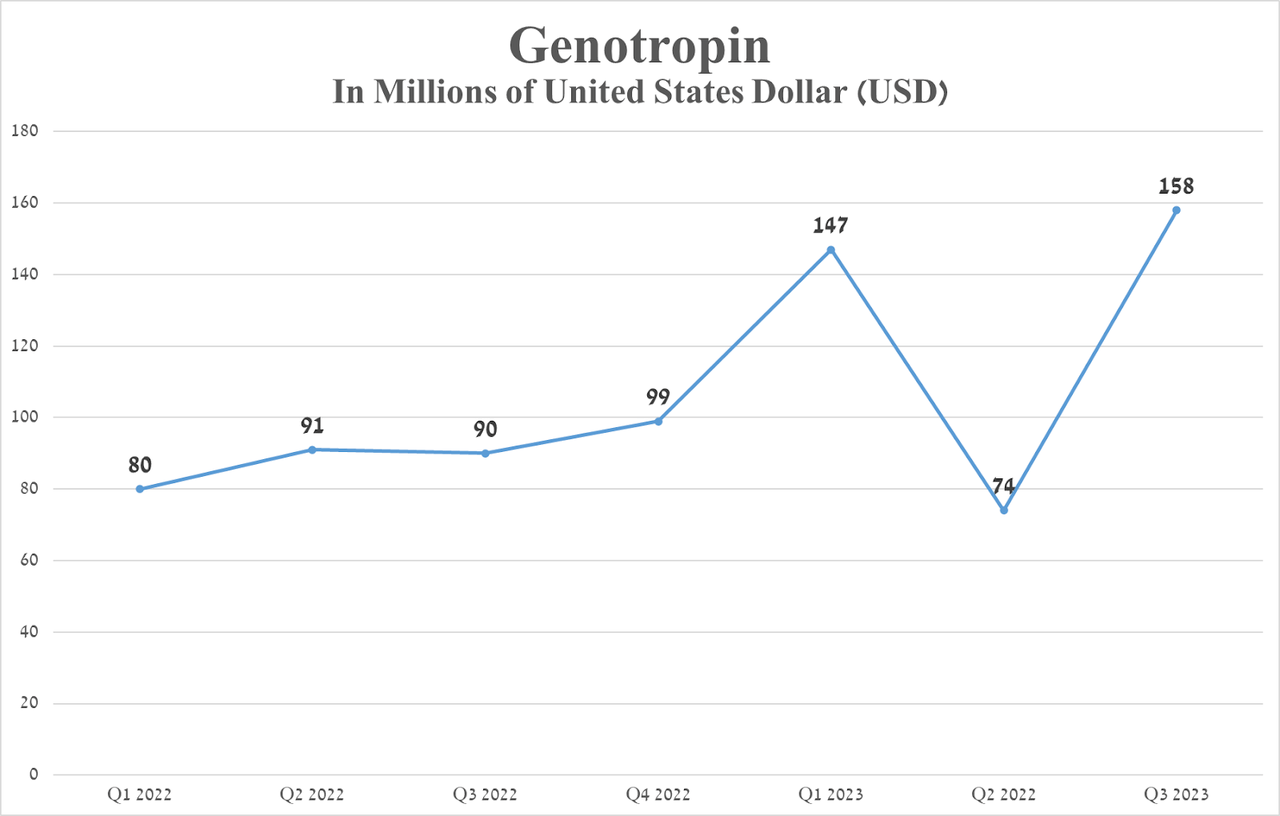

The growth of this financial metric was primarily caused by an increase in demand for Genotropin, Zavicefta, Aromasin, and Pfizer’s calcitonin gene-related peptide (CGRP) portfolio, which includes two drugs such as Zavzpret and Nurtec ODT. So, sales of Genotropin amounted to $158 million in the third quarter of 2023, an increase of 113.5% compared to the second quarter of 2023, mainly due to a shortage of Novo Nordisk’s Norditropin.

Source: 10Qs

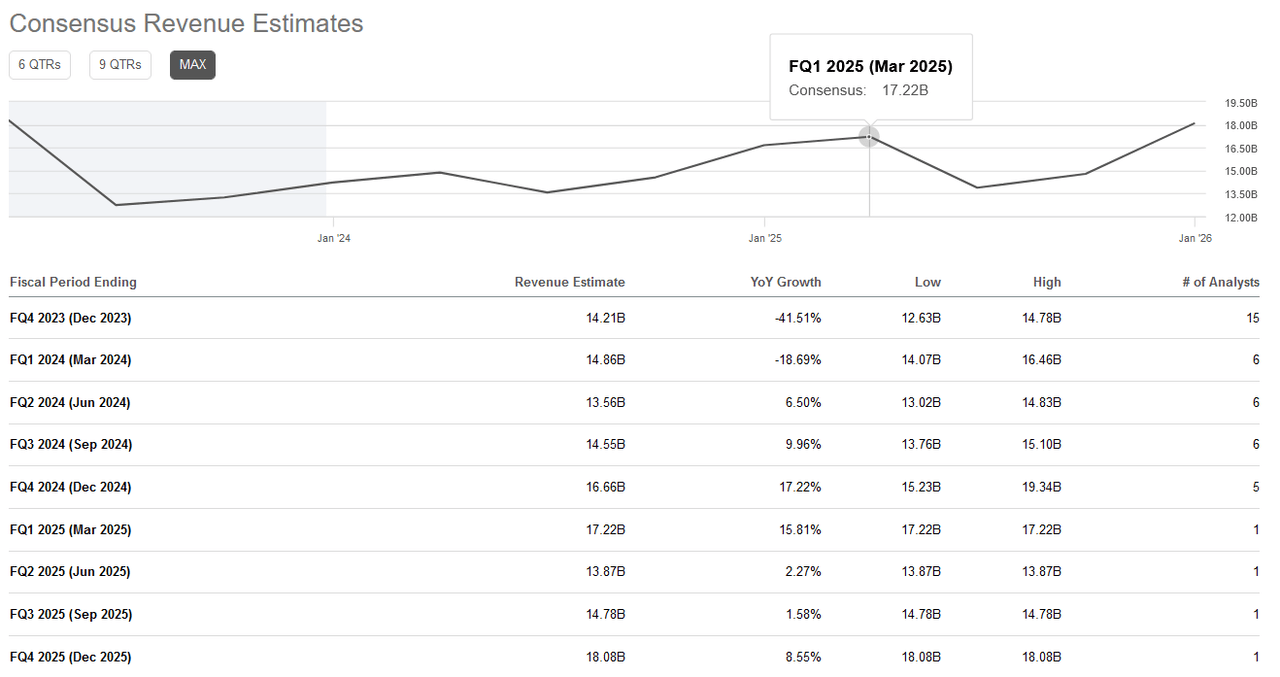

At the same time, thanks to Seeking Alpha’s platform, Pfizer’s revenue for the fourth quarter of 2023 is expected to be $12.63-$14.78 billion, which is 41.51% less than in the previous year.

Source: Seeking Alpha

But even with the company’s revenue down significantly year-over-year, its P/S (FWD) is 2.72x, indicating Pfizer is trading at a discount to most of its peers in the pharmaceutical industry.

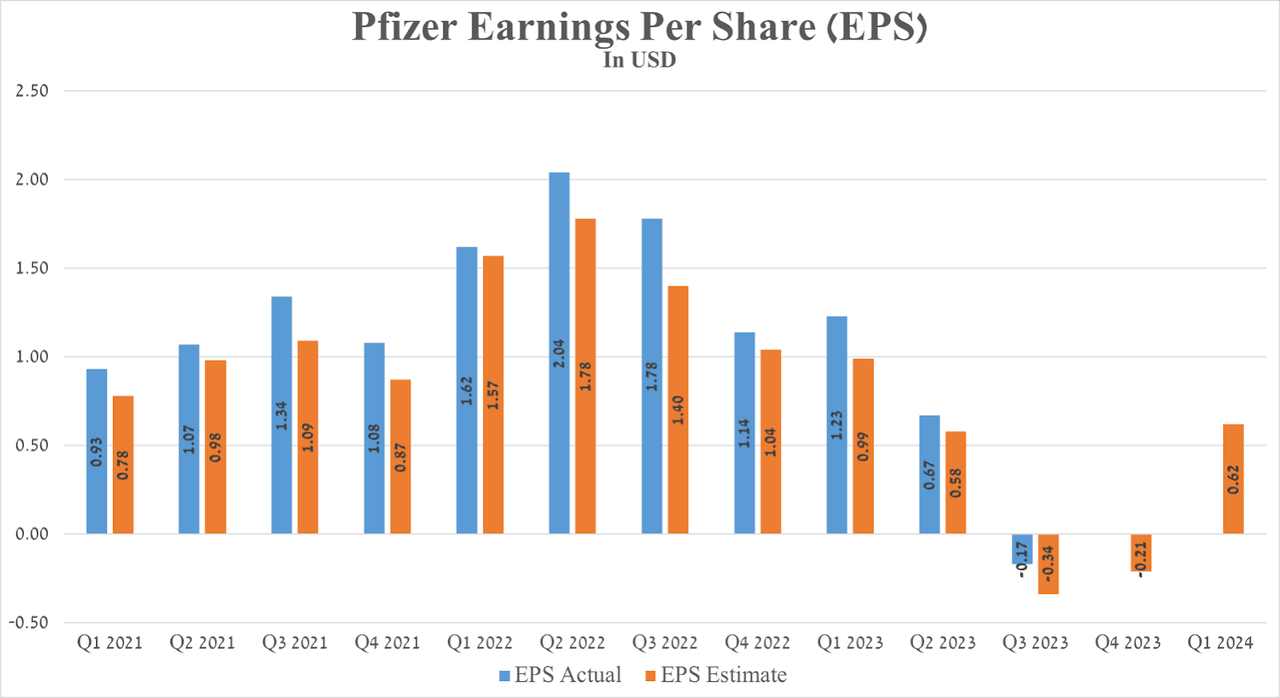

Pfizer’s Q3 Non-GAAP EPS was -$0.17, beating analysts’ consensus estimates by $0.17. This figure is expected to be in the range of -$0.55 to -$0.1 in the fourth quarter of 2023. However, taking into account Pfizer’s adjusted diluted EPS for 2024, it trades at a Non-GAAP P/E (FWD) of 13.3x, suggesting ongoing pessimism among financial market participants regarding its prospects even as sales of many of its key drugs and numerous approvals of its product candidates by the FDA.

Source: Seeking Alpha

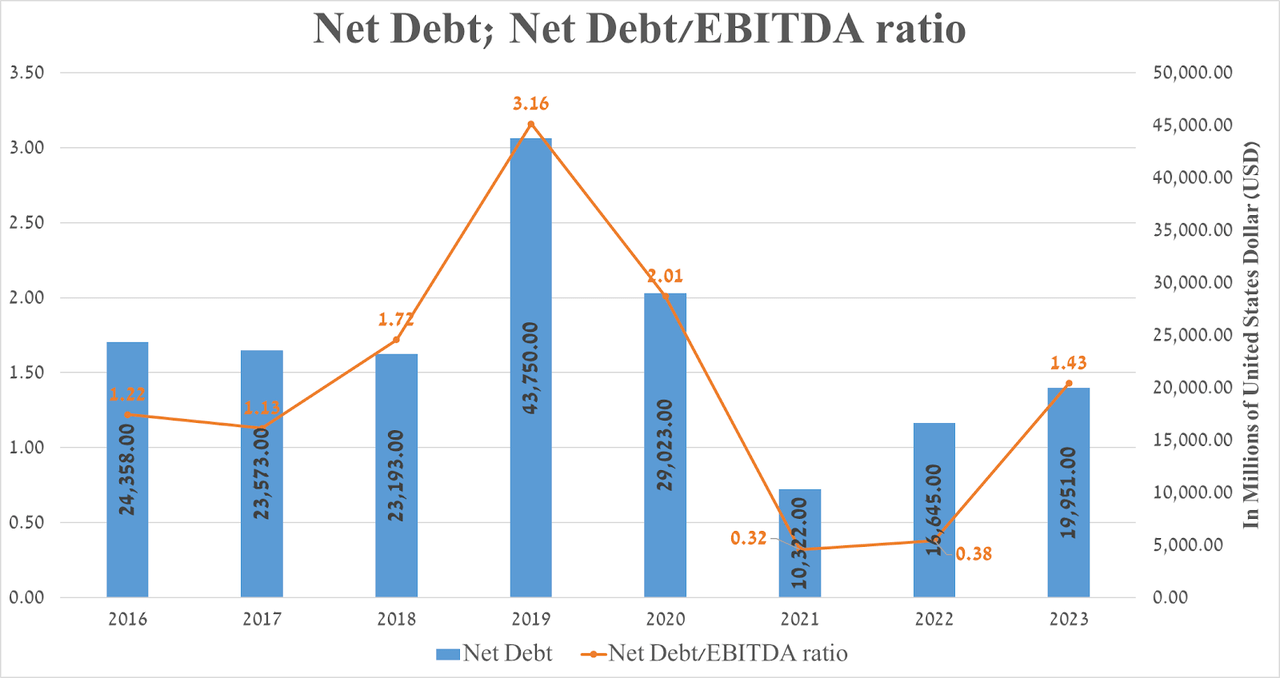

It is equally important to discuss Pfizer’s debt. Its net debt has continued to rise since 2021 due to the need to finance acquisitions of Seagen, Biohaven Pharmaceuticals, Arena Pharmaceuticals, and Global Blood Therapeutics in the last three years. Nevertheless, the net debt/EBITDA ratio remains below 2x, which indicates the company’s financial strength and emphasizes its ability to manage financial risks effectively.

Source: Seeking Alpha

Key Risks To Consider

I will highlight several risks that financial market participants need to consider.

Pfizer’s Key Blockbuster Patents Expire In The Next Four Years

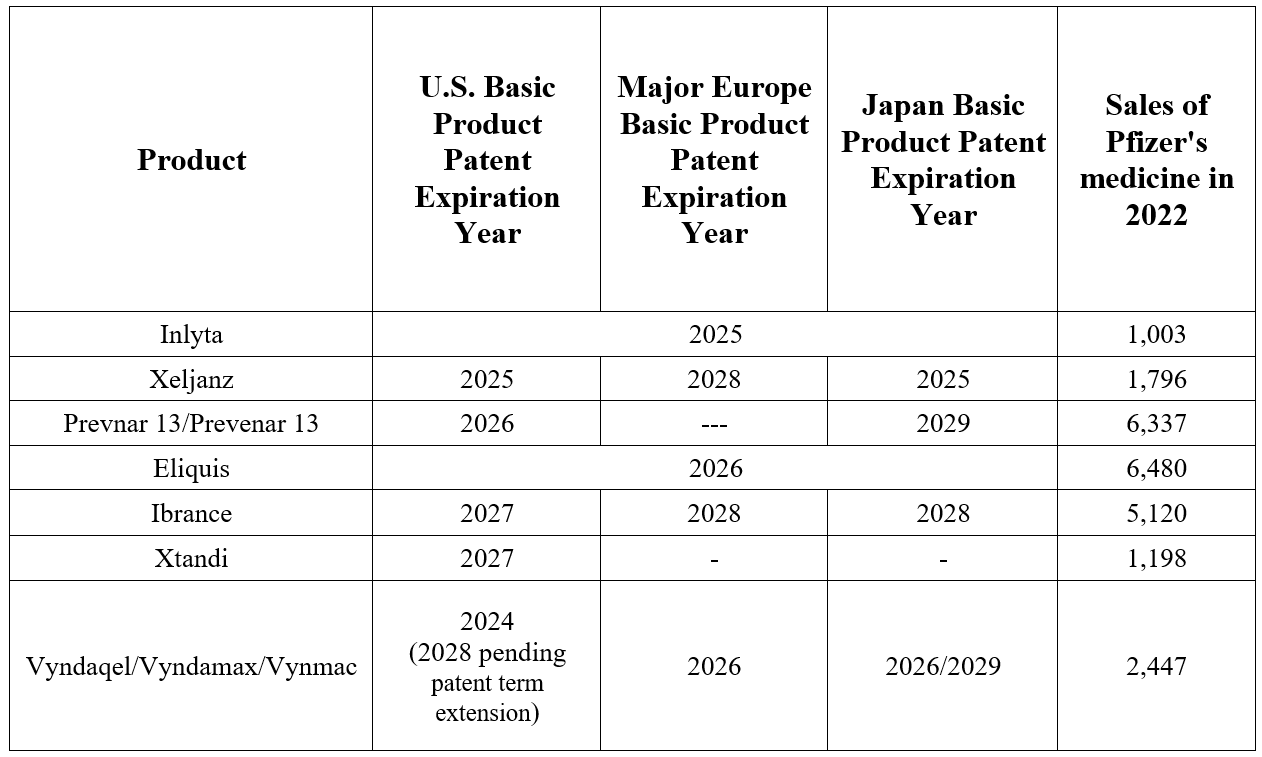

The first risk I highlight, which is crucial to Pfizer’s financial position, is the expiration of exclusivity on some of its drugs in the next four years. The expiration of patents will result in a sharp decline in sales of these products due to competition from generic versions or biosimilars, the price of which is usually significantly lower than that of branded drugs.

Source: table was made by Author based on 10-K

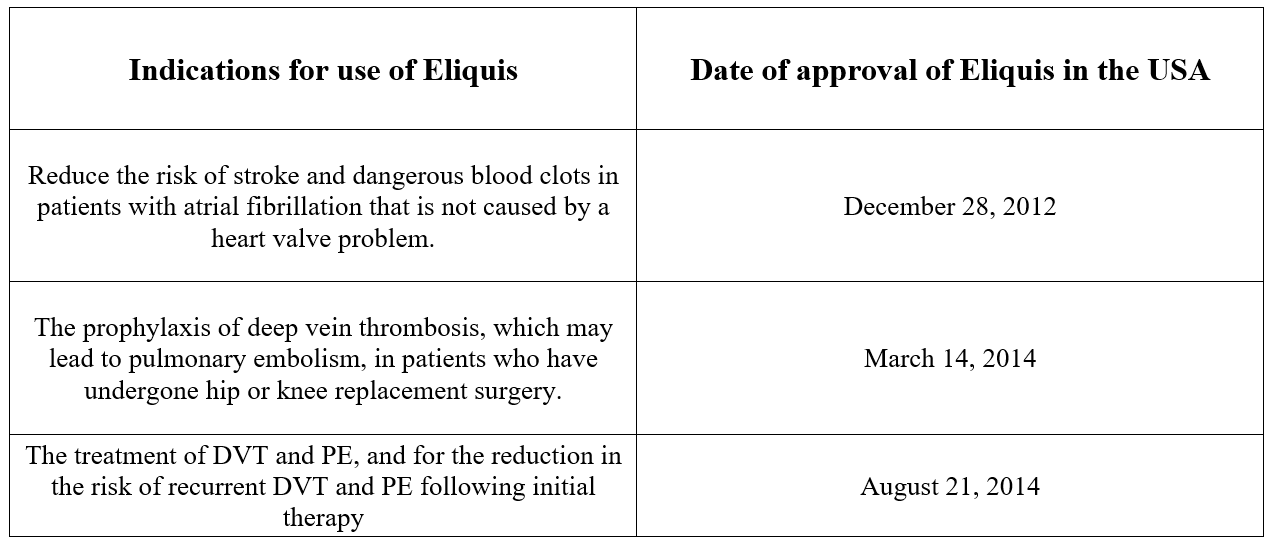

Based on the 10-K, exclusivity for seven of the company’s drugs expires in the next four years. However, their combined sales amounted to about $24.4 billion in 2022, or 24.3% of total revenue. So, one of Pfizer’s key medications is Eliquis, which prevents the formation of dangerous blood clots in patients suffering from the following diseases.

Source: table was made by Author based on Pfizer press releases

It had sales of $6.48 billion in 2022, and its patent expires in 2026 in key regions. On a more global scale, patents on another Pfizer drug, Ibrance, are set to expire between 2027 and 2028. Sales of this CDK 4/6 inhibitor totaled $5.12 billion in 2022, down 6% year-over-year due to increased competition from Novartis’ Kisqali (NVS) and Eli Lilly’s Verzenio. Based on historical data of the decline in sales of other Pfizer blockbusters after the loss of their exclusivity, I expect Ibrance’s average annual sales decline to be around 23% between 2027 and 2030.

Low Effectiveness Of Pfizer’s Anti-Obesity Drugs Relative To Competitors

On June 26, 2023, Pfizer announced the termination of clinical development of lotiglipron, an experimental drug for treating patients with obesity and type 2 diabetes.

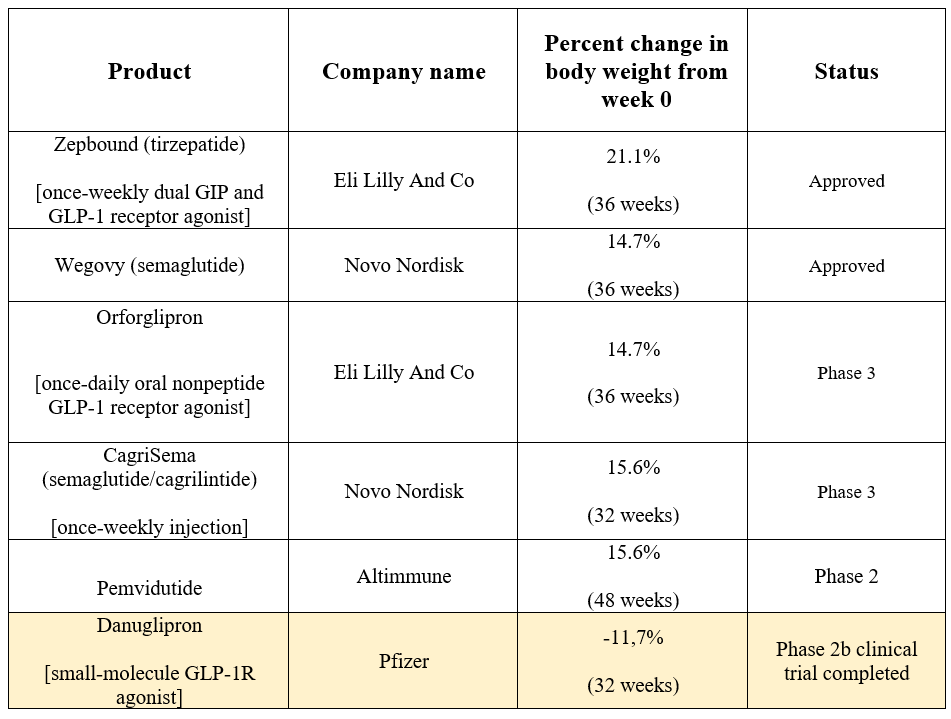

However, the company is not going to give up and will continue to develop another product candidate, danuglipron. On December 1, 2023, Pfizer published the results of a phase 2b clinical trial, in which patients taking danuglipron twice a day had a body weight loss between -6.9% and -11.7% after 32 weeks of taking it.

At first glance, these were excellent results, but in my opinion, this was far from true due to the higher weight loss values demonstrated by both the FDA-approved drugs and the product candidates of Eli Lilly (LLY), Novo Nordisk (NVO), and Altimmune (ALT).

Source: table was made by Author based on press releases by pharmaceutical companies

The Impact Of The Inflation Reduction Act On Pfizer’s Financial Position

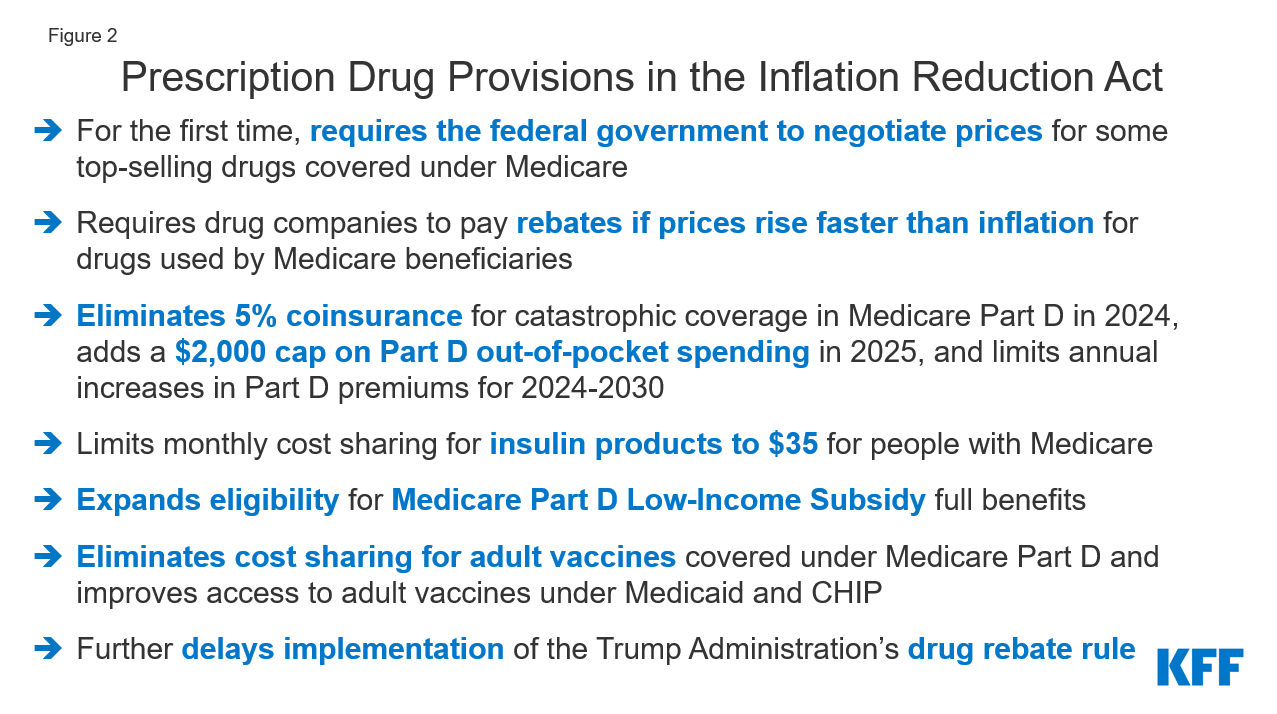

Government regulation and the impact of the Inflation Reduction Act adopted in 2022 may negatively affect Pfizer’s business. Currently, these changes include negotiating with Medicare, introducing discounts on drugs covered under Medicare Part B and Medicare Part D, and introducing penalties if drug prices rise faster than inflation.

Source: KFF

In my assessment, the impact of the Biden administration’s regulations and reforms on the pharmaceutical industry could slow Pfizer’s revenue growth from 2025, and as a consequence, its management will need to revise its business model to minimize this risk. I see that one of the solutions to this problem is increasing R&D spending on the development of medications aimed at treating orphan diseases, which potentially have a high price and are less dependent on the Inflation Reduction Act.

Takeaway

Pfizer is one of the largest American pharmaceutical companies, developing medicines and vaccines using cutting-edge technologies to save and improve the lives of millions worldwide.

Despite the decline in sales of the company’s COVID-19 products in 2023 and various financial risks that have negatively affected its stock price, I highlight several investment theses that make Pfizer an attractive asset for investors with a long-term perspective. These include an extremely high dividend yield of approximately 6%, the launch of several of the company’s drugs and vaccines in 2023, the rapid expansion of the JN.1 variant worldwide, and the completion of the acquisition of Seagen, the leader in the antibody drug conjugates market.

I’m initiating coverage of Pfizer with a “buy” rating.