Plan For Secure Retirement With A $100,000 Aggressive, 15-Stock Dividend Growth Portfolio

alubalish/E+ via Getty Images

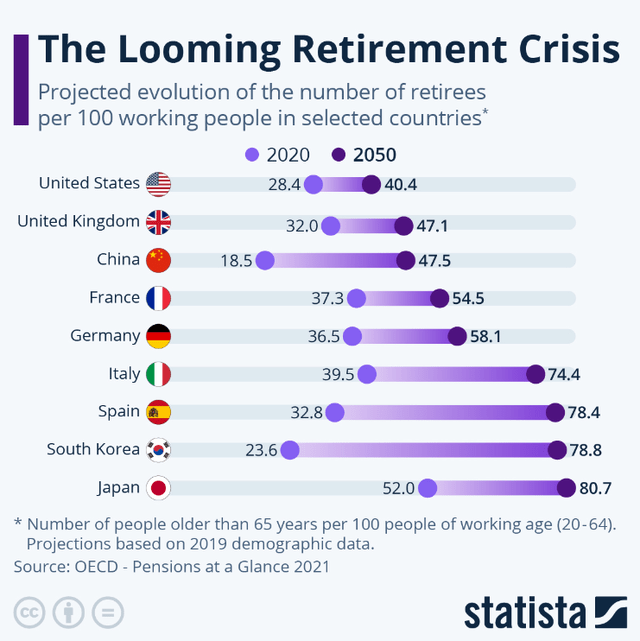

“Looming retirement crisis.”

These are the words of the CEO of the world’s largest asset manager, BlackRock, Inc. (BLK). Larry Fink has warned investors of a retirement crisis in the future as pension savings fail to keep up with the ever-increasing longevity, thanks to medical breakthroughs.

While increasing longevity is a good thing for individuals, the world’s aging population will present a significant challenge for governments, to maintain social security benefits as we know them today, given more people will be collecting benefits, than contributing. A secure and well-earned retirement is going to be one of the major challenges of the 21st century for many.

As people are expected to live longer, it’s safe to assume that the retirement age will be pushed by a couple of years in the future, yet data suggest, that more and more retirees will need to work during retirement due to insufficient savings and investments.

With the aging population and social systems at risk, it’s never been more important to think of savings and building investment portfolios to prepare us for the golden years of our lives.

The Looming Retirement Crisis (Statista)

Planning for retirement is a life-long process, the earlier an individual starts, the better. Even though I am only 30 years old, I already have my eyes set on early retirement in 20 years or perhaps I will let my already 6-figure retirement portfolio compound and retire very comfortably in your early 60s.

Don’t get me wrong, the goal of mentioning a 6-figure portfolio is not to brag, instead, I would like to encourage fellow, younger investors to start early as having sizeable capital provides a nice cushion during tumultuous times in life and versatility with life’s choices.

To give you a perspective, if you have saved up $100,000 by the age of 30, and you invested all your savings into the SPDR S&P 500 ETF Trust (SPY) without any further contributions, given it would again deliver the average return since 1994 of 10.31% CAGR, after 30 years you would have close to $2M. Perhaps not enough for retirement by the 2050s, but most likely you will be better off than most people without spending another dollar.

With the ever-increasing cost of living, young people are often feeling frustrated, expecting not to be able to save enough money for a house or retirement, instead prioritizing living at the moment, spending most of their disposable income on experiences and luxuries, and planning on working until death.

It’s everybody’s own choice how they spend or invest their hard-earned money, but starting to invest early makes a significant difference thanks to compounding effects.

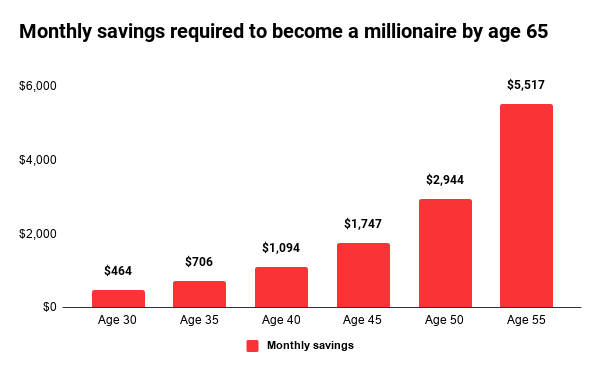

Investment Required to Become A Millionaire (Syfe.com)

From the graph above, you can see that at the age of 30, it takes as little as $464 a month to become a millionaire by the age of 65, assuming an underwhelming 8.25% annual return.

Now, determining how much money you will need for retirement is the tricky part of the equation, given the uncertain rate of inflation and everybody’s lifestyle. A good place to start is to have 25x annual expenses in one’s portfolio by the retirement age.

If you are planning on a comfortable retirement and spending $150,000 a year (for a single retiree), in the 2050s, you should be aiming to have a portfolio of around $3.75M. This means investing at least $1,740 monthly if you have 35 years to go before your retirement.

The key to how much money you will need to invest from your pocket and for what duration is the return you will earn. Determining the rate of return, or ROR, is impossible given the markets are inherently volatile, but depending on an investor’s risk appetite, younger investors should consider more aggressive positioning as underwhelming performance early on, can lead to having significantly less capital in the future.

Even a small 1-2% change in the ROR for 30 years can lead to significantly different results at the end of the duration as shown below:

| Invested | Annual ROR 8% | Annual ROR 10% | Annual ROR 12% |

| $100,000 | $1,006,265.69 | $1,744,940.23 | $2,995,992.21 |

Given that dividend growth investors do not need to rely on the distributions, instead, the distributions are generally reinvested alongside investing earned income, I always advise instead of chasing yield to focus on aggressive dividend growth, benefiting from compounding capital and DGR over long durations.

Ultimately, the ROR of successful aggressive dividend growth investing comes 90% from capital appreciation and “only” 10% from distributions.

Take for instance Mastercard Incorporated (MA), a major dividend compounder. $10,000 invested back in mid-2007 without reinvesting the dividends would turn into $454,000 today, alongside another $14,000 in dividends with a 38.5% annual dividend growth rate. In this example, only 3% of the total return is generated through dividends, while the rest is capital gains.

Some might ask why stick with a dividend growth strategy if less than 10% of the return is earned through distributions, instead of buying quality growth stocks without distribution right away.

The truth is that collecting dividends “feels good”, keeping the same number of shares and getting some extra cash to reinvest. During market downturns, dividend investors are collecting the same amount of cash (given no-dividend cuts), making them less likely to sell shares during periods of poor performance.

Yet, many popular high-yielding companies (which often find their way into dividend growth portfolios for one reason or another) have inherently underperformed the market, costing investors dearly in terms of opportunity cost.

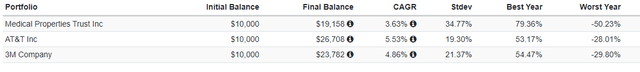

Good examples of heavily underperforming companies, despite reinvesting dividends since 2006 are:

- Medical Properties Trust, Inc. (MPW): Yield of 12.6%, Annual ROR of 3.6%.

- AT&T Inc. (T): Yield of 6.8%, Annual ROR of 5.5%.

- 3M Company (MMM): Yield of 6.6%, Annual ROR of 4.9%.

ROR since 2006 (Portfolio Visualizer)

While companies with yields lower than 1% are by many investors considered not to be a good addition to a dividend growth portfolio, I tend to differ.

Companies with low yields and low payout ratios have a significant runway to reinvest into the business driving capital appreciation, alongside paying ever-increasing dividends, which after a long duration will result in a major yield-on-cost.

Building A Dividend Growth Portfolio

As a natural-born stock-picker, instead of buying indices, I enjoy the thrill of building my investment portfolio and beating the crowd. Over the last five years, my investment portfolio has beaten the market by 3% on an annualized basis, give or take.

3% may not sound like much, but I have already explained above how even a small percentage advantage, compounded over a long period can lead to significantly more capital in the future.

Yet, I fully understand and generally recommend my friends and family members to instead consider buying indices, given their lack of investing experience and no willingness to commit hours to do due diligence.

For those, who prefer passive investing in diversified ETFs, great picks for dividend growth are:

| Ticker | Fund | Expense Ratio | Yield |

| (VIG) | Vanguard Dividend Appreciation Index Fund ETF Shares | 0.06% | 1.72% |

| (VYM) | Vanguard High Dividend Yield Index Fund ETF Shares | 0.06% | 2.82% |

| (SCHD) | Schwab U.S. Dividend Equity ETF | 0.06% | 3.80% |

Investing in indices provides better industry and geographical diversification, by owning significantly more equities (the good ones and bad ones alike), but takes away the possibility to beat the returns of the crowd.

If you are similarly minded as I am and want to build your unique portfolio, focus on these key criteria when selecting stocks:

- Buying only durable businesses (Even cyclical businesses for investors with long time horizons): These are companies that have strong management with a proven track record of successful product releases mindful of underlying costs, a sustainable business model capable of scaling (e.g., subscription-based businesses, tech businesses with a large addressable market), and strong financials with industry-leading profitability and ROIC above market returns of 10%. Buying fast-growing cyclical businesses such as semiconductors gives investors the opportunity, from time to time, to accumulate more shares when the market is depressed.

- Strong Balance Sheets with Little Leverage: I already mentioned strong financials above, but I cannot stress enough that buying businesses with little leverage is key to scaling and unlocking compounding, given that too much leverage acts as an anchor on growth.

- Double-digit DGR and Low Dividend Coverage: To build an aggressive dividend growth portfolio, I am considering only companies with double-digit DGR to unlock the long-term potential of compounding the dividends. Generally, companies capable of delivering double-digit DGR over extended periods have lower yields and automatically low dividend coverage, but it’s key to do the due diligence.

Diversification is key to successful investing for many, but instead, I prefer to concentrate my portfolio on my “top ideas”, rather than committing my capital towards mediocre convictions. There are always good opportunities in the market, but I am trying to pick only the best ones, hence my portfolio generally has no more than 10 to 15 holdings at a time, without compromising on industry and geography diversification.

A portfolio of up to 15 holdings, enables me to do more in-depth tracking compared to a portfolio of 50 holdings where I would hardly scratch the surface.

Here is an example of a 15-stock aggressive dividend growth portfolio with a 5Y DGR of over 15.3% with equal weight allocation across all holdings and a dividend yield of 1.39%. I own most of these holdings in my portfolio.

| Investment | % Weight | $ Allocation | % Yield | 5Y DGR | Forward 3Y EPS Growth | Potential Return |

| (UNH) | 6.7% | $6,667 | 1.69% | 15.9% | 12.2% | 13.9% |

| (V) | 6.7% | $6,667 | 0.77% | 16.1% | 13.3% | 14.0% |

| (AVGO) | 6.7% | $6,667 | 1.60% | 17.5% | 15.7% | 17.3% |

| (MSFT) | 6.7% | $6,667 | 0.73% | 10.2% | 17.1% | 17.8% |

| (SPGI) | 6.7% | $6,667 | 0.89% | 12.5% | 12.8% | 13.7% |

| (COST) | 6.7% | $6,667 | 0.65% | 12.3% | 10.0% | 10.7% |

| (LIN) | 6.7% | $6,667 | 1.25% | 13.8% | 10.2% | 11.4% |

| (OTCPK:LVMHF) | 6.7% | $6,667 | 1.22% | 16.1% | 10.0% | 11.2% |

| (LLY) | 6.7% | $6,667 | 0.69% | 15.0% | 25.0% | 25.7% |

| (FDX) | 6.7% | $6,667 | 1.89% | 14.2% | 18.7% | 20.6% |

| (HD) | 6.7% | $6,667 | 2.66% | 13.9% | 10.5% | 13.2% |

| (PLD) | 6.7% | $6,667 | 3.32% | 12.6% | 11.0% | 14.3% |

| (ASML) | 6.7% | $6,667 | 0.59% | 31.1% | 19.1% | 19.7% |

| (DPZ) | 6.7% | $6,667 | 1.24% | 17.5% | 10.7% | 12.0% |

| (NKE) | 6.7% | $6,667 | 1.59% | 11.1% | 11.3% | 12.9% |

| Total | 100.0% | $100,000 | 1.39% | 15.3% | 13.8% | 15.2% |

The dividend yield is naturally on the lower end of the spectrum, given many of the holdings have yields below 1.39% with a total annual income of $1,390 per $100,000 invested.

But do not be fooled by the low dividend yield, if you have a long investing horizon ahead of yourself and planning on re-investing all the dividends anyway, this portfolio has expected forward 3Y EPS growth of 13.8% to drive capital appreciation.

If we combine the dividend yield and EPS growth, assuming the underlying valuation of each security stays flat, investors could see up to 15.2% annual total returns, well outperforming the market’s historical average and most dividend-focused indices.

Achieving 15% annual returns over long periods is very challenging without taking unnecessary risk and requires active management of the portfolio, eliminating holdings whose growth slows and adding new ones instead. If one achieves 15% over 20 years, the $100,000 portfolio would grow to $1.6M and after 30 years to $6.5M.

While the DGR of the past five years has been 15.8%, naturally as growth slows we need to adjust our expectations. To avoid stretching the payout ratio, the expected DGR over the next three years should equal the 13.8% forward-EPS growth rate.

If the DGR continues at a rate of 13.8% over the next 10 years, investors could expect a yield-on-cost of 4.8% and after 20 years, 16.8%, ultimately resulting in a very high-yield portfolio with high-quality holdings.

Keep in mind, that not all stocks mentioned in the portfolio are trading as bargains today. Building your dividend growth portfolio requires patience and persistence to not overpay for quality businesses which are often trading at stretched valuations, which could harm your results in the long term.

Recently, two of my favorite growth stocks, Meta Platforms, Inc. (META) and Booking Holdings Inc. (BKNG), announced their first-ever dividend payments and if history provides us with a good lesson on dividend growth, I expect these companies to become great DGR contenders over the next few years.

Takeaway

Building your dividend growth portfolio is a challenging task, but the satisfaction of beating the crowd’s returns well compensates for the efforts.

With the ever-increasing cost of living and longevity, thanks to medical breakthroughs, many people are facing dire retirement prospects, perhaps having to work during what should have been the golden years of life.

Instead, I encourage all fellow investors to be mindful of their retirement and start planning as early as possible, given the compounding effects can work wonders, especially if choosing a more aggressive investment path.

For investors with long time horizons before retirement, investing as little as $100,000 in their 30s with the right strategy, can yield substantial results and provide for a good retirement.

The sample aggressive dividend growth investment portfolio I built has a potential for 15% annual returns over the next few years, with a rather low yield of 1.39% as of today, but the double-digit DGR has the potential to drive the yield-on-cost up to 17% if compounded over the next 20 years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.