Plaza Retail REIT: A 7.6% yielding commercial REIT in Canada (OTCMKTS:PAZRF)

Arnold Media/DigitalVision via Getty Images

introduction

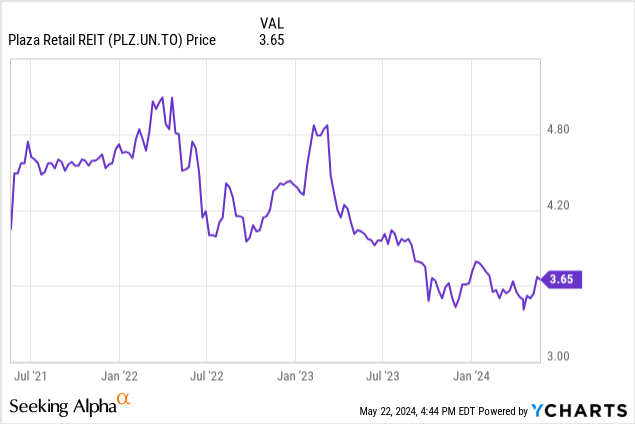

I believe good value can be found in the Canadian REIT sector, so I am watching several Canadian REITs in the retail, residential, and industrial sectors closely. I owned Plaza convertible bonds. Retail REITs (TSX:PLZ.UN:CA) (OTC: Paz RF) But fortunately/unfortunately the REIT repaid the debentures on maturity. While I’m certainly happy that REITs survived the COVID-19 pandemic, I’m also not happy about receiving decent coupons from well-run REITs. However, as interest rates in the financial markets rose, Plaza Retail also had to cover increasing debt costs. This means we need to watch Plaza’s quarterly performance closely to ensure its generous dividend isn’t at risk.

This article was written as an update to a previous article. You can find it here.

1st quarter performance

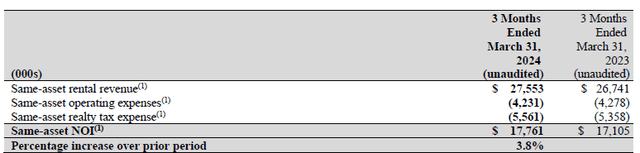

Looking at the first quarter results, it appears that the assets are performing as expected. Plaza Retail was able to record same-asset net operating profit of C$17.8 million, up approximately 3.8% year-over-year.

Plaza Investment Information

That said, Plaza has also invested in additional space and there are certain G&A items that are charged to NOI performance. As you can see below, this added nearly CA$1 million to our NOI results. Total NOI was approximately C$18.05M.

Plaza Investment Information

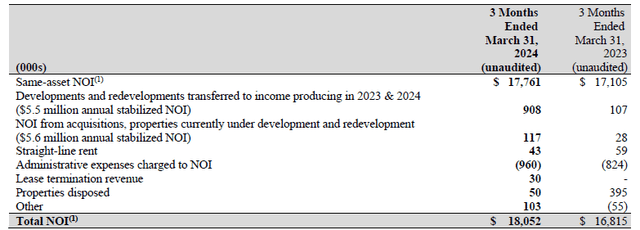

When looking at REITs, FFO and AFFO results are clearly more important than net income. As you can see below, Plaza Retail actually saw a significant increase in its FFO performance, up almost 6% to CA$9.9 million from CA$9.4 million in the first quarter of last year.

Plaza Investment Information

This resulted in FFO per share of approximately C$0.089/share. This is largely consistent with last year’s results, as higher average share counts have less impact on earnings per share.

In Canada, AFFO calculations also include maintenance capex. As you can see in the image above, maintenance investment costs were approximately C$0.95M and rental related costs were approximately C$1.6M. This certainly impacted AFFO results, which decreased by approximately 10% to C$7.3 million, representing an AFFO per share of C$0.066. Although disappointing, keep in mind that these costs were extremely high in the first quarter, with maintenance capex and lease costs more than doubling compared to the first quarter of last year. We look forward to seeing how these costs evolve over the next few quarters. We expect the trend to decline as Q1 AFFO was not enough to cover the monthly dividend of C$0.0233 per share, which would immediately lead to an increase in AFFO.

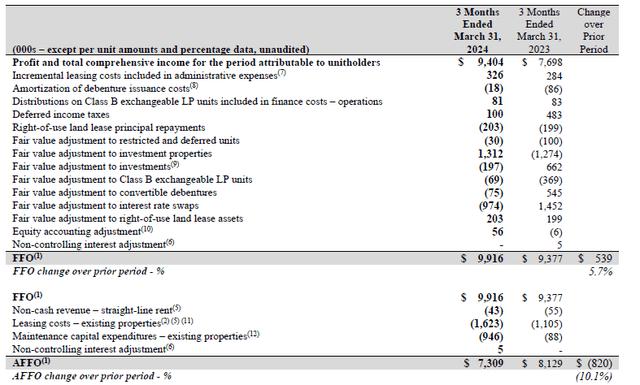

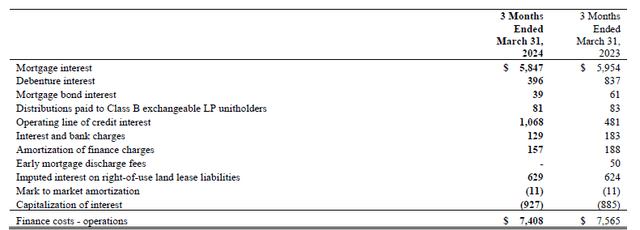

One of the key questions in the current investment environment is how interest rates will affect FFO and AFFO in the future. As you can see below, the REIT paid approximately C$585M in mortgage interest and C$107M in credit facility interest. Let’s zoom in on these two factors since they make up the majority of your overall interest expense.

Plaza Investment Information

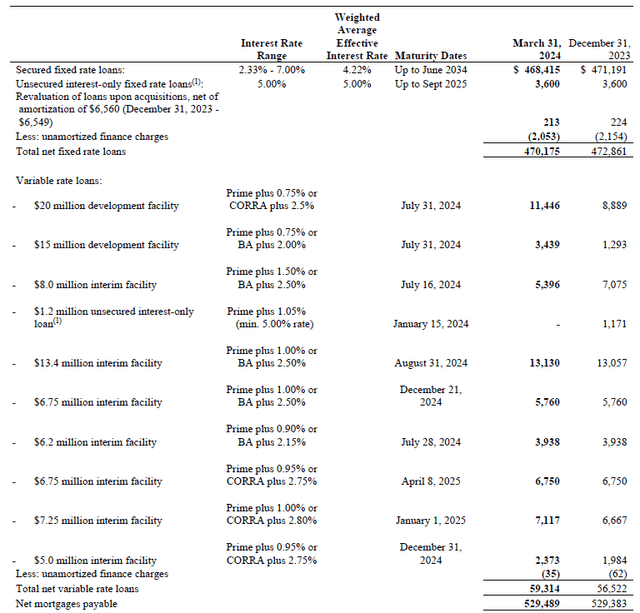

At the end of the first quarter, the REIT had less than C$530 million of mortgages outstanding. This means the average weighted cost of a mortgage is about 4.4%. As you can see below, most mortgages have fixed interest rates averaging 4.22%, but interest rates range from 2.3% to 7% and maturities spread out over the next 10 years. Plaza secured a new 10-year mortgage in the first quarter of this year and was able to secure an interest rate of 5.69%.

Plaza Investment Information

Credit facilities are a more expensive form of debt as they have interest rates of prime + 0.75% or bank approval + 2%. This line of credit expires in the third quarter of this year, and it will be interesting to watch the terms for renewing the line. I expect Plaza to once again have a floating rate credit facility to take advantage of potentially declining interest rates in the financial markets.

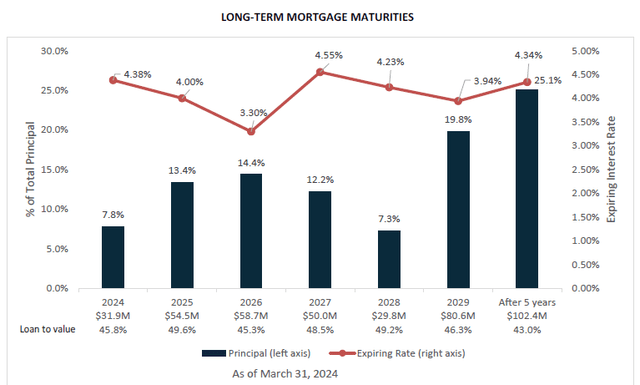

Between now and the end of 2026, the REIT will only need to refinance approximately C$145M in mortgages. Since this is a weighted average interest rate of 3.8%, we think it is fair to assume that the average cost of debt for these refinancings will increase by 100-150 basis points over the next three years (given that the company can refinance its 2026 maturities at a lower price). home). Interest rates will be higher in 2024 and 2025, taking into account expectations of lower interest rates in financial markets. This equates to approximately C$2M per year in additional interest costs through the end of 2026.

Plaza Investment Information

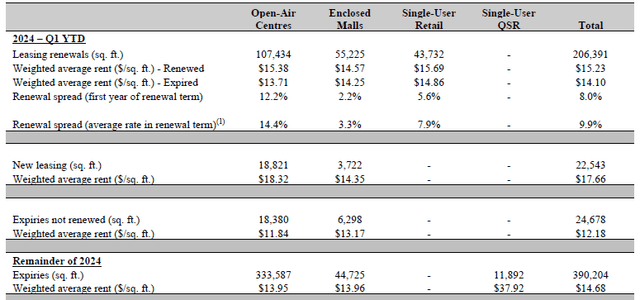

REITs expect to be able to compensate for their high interest expenses with high rental yields. Lease spreads were very impressive in the first quarter of this year, as Plaza reported an average renewal spread of 9.9%, driven by outdoor centers where renewal spreads exceeded 14%.

Plaza Investment Information

As you can see in the image above, we have over 330,000 square feet of space scheduled for renewal over the remaining three quarters of this year. It will be interesting to see the spread of these renewals, as some will have contractual terms while others will be repriced in the market. As seen below, an additional 1.47 million square feet are scheduled for renewal in 2025 and 2026, and the additional rent increases will allow the Plaza to cover the previously mentioned increase in projected interest expenses.

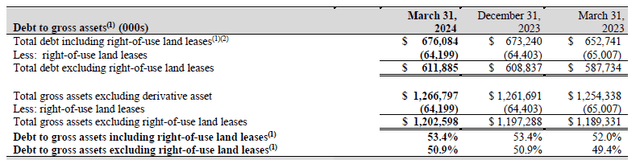

At the end of the first quarter, the REIT had approximately C$9M in cash, C$676M in debt, and approximately C$667M in net financial debt (including lease liabilities). LTV ratio is approximately 54.5% with approximately C$12.3B offset in assets and investments. The REIT reports a total debt-to-asset ratio (which is not quite the same as keeping cash as assets instead of calculating a net debt position), giving it a debt-to-asset ratio of 53.4% including leases and 50.9% excluding leases.

Plaza Investment Information

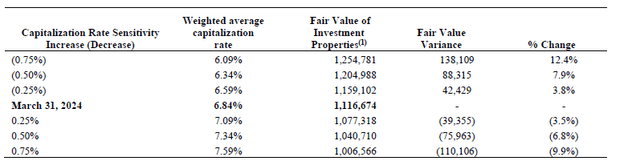

Keep in mind that although this is a relatively high LTV ratio, the property is valued at a very reasonable capitalization rate. As you can see below, the average Cap Rate was 6.84%. And even if we increased the cap rate to 7.59%, we would only lose about C$110M in balance sheet value. This is less than 10%, which means your LTV ratio will remain below 60%.

Plaza Investment Information

On the other hand, if interest rates and capitalization rates ease in the future and the REIT can use a lower cap rate of, say, 6.50%, the value would likely add about C$58 million.

investment thesis

As of the end of the first quarter of 2024, the book value per share was approximately C$4.95 (including the share count impact of the C$4.2 million Class B exchangeable LP units). This means the stock is currently trading at about a 25% discount to book value. The dividend yield based on the current stock price is approximately 7.6%, and although dividends have not been fully covered as a result of AFFO in the first quarter of 2024, dividends are expected to be covered in annual performance through investment in maintenance facilities and rental costs in the first quarter of 2024. The first quarter of this year was relatively high.

I currently have no positions in Plaza Retail REIT, as I have recently preferred other Canadian REITs. Plaza is affordable from a NAV perspective and attractive from an income perspective. However, based on my expectations of seeing AFFO performance of C$0.291 per share in fiscal 2023 and AFFO of C$0.30 this year, the earnings multiple is not that low. However, as mentioned earlier, renewal spreads are very strong and this may improve returns somewhat.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.