PMI often cries wolf | pursue alpha

Max Lab

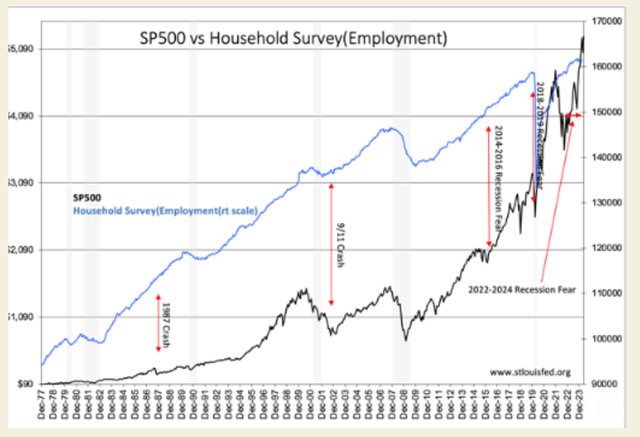

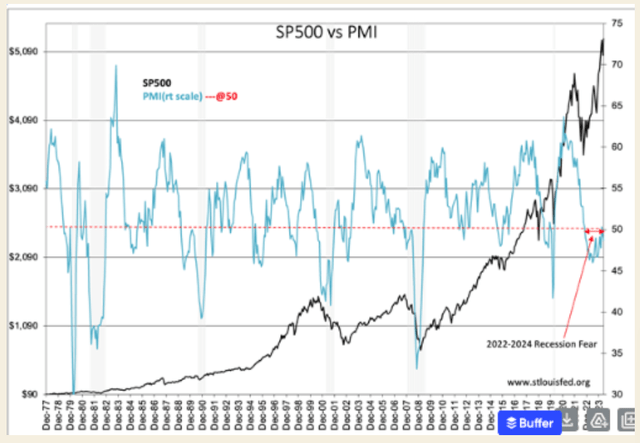

Many people consider PMI a key economic indicator. It’s not like that. This has to do with market sentiment and market prices, not the economy. Looking at history back to 1977, it is clear that declines in the SP500 are highly correlated with PMI (Manufacturing) declines below the -50 benchmark level. But PMI There have been roughly three times as many falls below the benchmark than there have been actual recessions, which is more like a shepherd boy howling in fear than seeing a wolf. For comparison, the SP500 vs. Household Employment shows that during economic cycles, investors often fear recessions for one reason or another, and recessions often don’t occur. This chart has several red arrows to identify just some of the periods where fears rose without any economic significance. Showing all these instances of head fakes during the upcycle would make this chart unreadable.

Although there are forecasts of a ‘recession’ in the current cycle, employment continues to increase. Even though the trend has slowed, real personal income continues to increase and real retail sales remain high. The same goes for total construction spending and new orders for durable goods from manufacturers. As the SP500 approaches all-time highs, the old adage “markets rise on a wall of worry” continues to hold true. This time the market could be said to be higher based on fears of a recession affecting several issues seen as safe havens for capital, namely the 10 or so over-owned high-tech issues that make up 25%-30% of the SP500. . CNBC called it Mag 7. Most of the remaining SP500 remains at a discount compared to the financial performance prices of previous investors. With a few excessively high prices and many excessively low prices, this seesaw is tipped to the extreme and ready to move back.

A PMI currently below 50 reflects market pessimism. Still, we’ve had plenty of better-than-expected earnings reports due to high guidance that was ignored by investors. These earnings reports are correlated with upward trends in underlying economic indicators. As economic indicators rise, the saying “the wolves are at the door” will fall apart. I thought that would be the case by now, but the recent decline in PMI has made me even more concerned. For PMI, mind is more important than matter, and history shows us that it takes time for fear to go away. In my opinion, the rise in PMI from the June 2023 low of 46 is telling. Pessimism appears to be easing and we could cross 50 in the next two reports. This level will trigger a long overdue investor shift towards industrial/manufacturing issues.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.