Polestar: The Uphill Battle Continues (NASDAQ:PSNY)

Justin Paget/DigitalVision via Getty Images

The past few years have not been kind to investors in electric vehicle companies. Regardless of the size of the business, many stocks in this sector have performed poorly. I burned through a mountain of cash. Polestar Automotive Holding UK PLC (NASDAQ:PSNY) was a good example, losing more than 90% of its value since going public via SPAC in 2022. Unfortunately for shareholders, the situation here is still somewhat volatile, despite prices recently being near all-time lows.

I continued to be bearish.

When Polestar officially hit the market in 2022, I warned investors that the stock price could fall. Management wrote that it needed more capital to fund its long-term growth plans, and interest rates rose. The company It had already downgraded its full-year delivery outlook before the end of the first half of 2022, and most EV companies were struggling to grow as quickly as expected.

If you go back to earlier this year, the last time I covered the name, the situation was clearly in the Bears’ favor. Over time, the balance sheet deteriorated even further and delivery guidance continued to be cut. Rental car company Hertz (HTZ) is also taking a step back from its EV plans, potentially driving large buyers of Polestar vehicles out of the market. Polestar shares have fallen nearly 15% since January, while the S&P 500 has risen 7.5%.

Discontinuation of deliveries in Q1 2024:

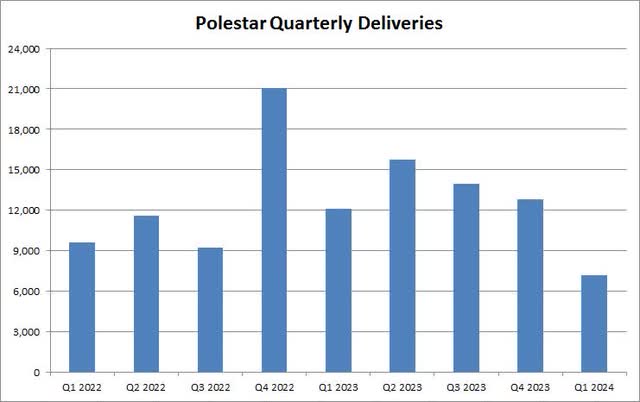

Last week, the company provided a business update to investors, but it wasn’t met very positively. Polestar delivered approximately 7,200 vehicles during the first quarter, including 1,200 new Polestar 4 China. As you can see in the chart below, this is the second consecutive quarter in which vehicle deliveries have decreased by approximately 40% compared to the previous year, despite new vehicle launches.

Polestar Quarterly Delivery (Company press release)

As in past years, management said 2024 deliveries will be concentrated toward the end of the year. The company said the new Polestar 3 has begun production in China, with additional production set to begin in the United States in the summer of 2024. The ramping of the Polestar 4 will also take place throughout the year, and production of the model will expand to Korea in December 2020. Second half of 2025.

The company maintained its outlook to deliver at least 155,000 vehicles in 2025, but remains skeptical for now given its past reduced delivery guidance. Original guidance for next year was nearly double, but was hit by poor sales and delayed model launches. The company also had to adjust its growth forecasts and reduce headcount to maintain its financial health. The strategy now is to grow the unit at a more measured pace in 2025 with decent margins and positive cash flow, rather than growing the unit as quickly as possible.

Closing the funding gap:

As I continue to elaborate, Polestar’s financial situation is unstable. Working capital ended the third quarter of 2023 with a deficit of more than $2 billion. The company ended the quarter with $950 million in total cash, but also had about $3 billion in debt. According to the latest update, it had approximately $770 million in cash on its balance sheet at the end of 2023.

However, the company has not released fourth-quarter or full-year results due to compliance issues, and its first-quarter report is not due until the end of May. Polestar closed a new three-year loan facility for $950 million in the first quarter. Management said an additional $350 million would be needed to bring the business to cash flow breakeven, which would likely have to be done through equity. This means there is more than 11% dilution at this point, and this number could certainly rise if the stock price continues to fall.

I wouldn’t be surprised if Polestar actually needs more cash until it proves it can hit its 2025 goals. We’ve seen companies like Rivian (RIVN), Nio (NIO), Lucid (LCID), and others continue to hit the debt and/or stock markets with Fisker (OTC:FSRN) on the verge of bankruptcy. Polestar has a big backer in Geely, which owns a 24% stake in Polestar. This is similar in relation to Lucid, where a Saudi investment fund owns almost two-thirds of Lucid. However, it is unknown whether Geely would be willing to invest significantly more money into Polestar as the Saudis did with Lucid. Missing delivery forecasts for next year by even a few thousand units could significantly increase capital needs, further diluting value for investors who have already suffered significant losses.

Troublesome EV landscape:

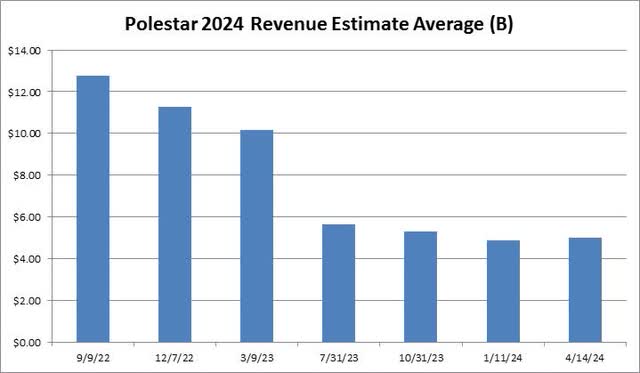

Polestar is seeking new models that will allow it to nearly triple its deliveries between 2023 and 2025. However, higher interest rates in the U.S. have certainly impacted EV sales overall, and the Chinese EV market is seeing more competition almost every week. As you can see in the chart below, analysts have been cutting Polestar’s 2024 revenue estimates quite easily over the past year and a half, and first-quarter delivery numbers aren’t going to help that average bounce back any time soon.

Polestar 2024 sales forecast (Look for alpha)

The problem with Polestar is that even with all the discounts and promotions, the prices of the vehicles can still be too high. The Polestar 2 costs about $48,000, nearly $10,000 more than the Tesla (TSLA) Model 3, while the Polestar 4 starts at $54,900 and the Polestar 3 starts at $73,400. For example, the Polestar, which currently has manufacturing in China, won’t be eligible for valuable U.S. EV tax credits like Tesla does for the Model Y. A trade war between the two countries could make the situation worse until the company secures more production in the United States. Still, Polestar doesn’t have the brand recognition that many EV players have, nor the financial resources that traditional automakers have to invest in marketing.

Assessment/Risk:

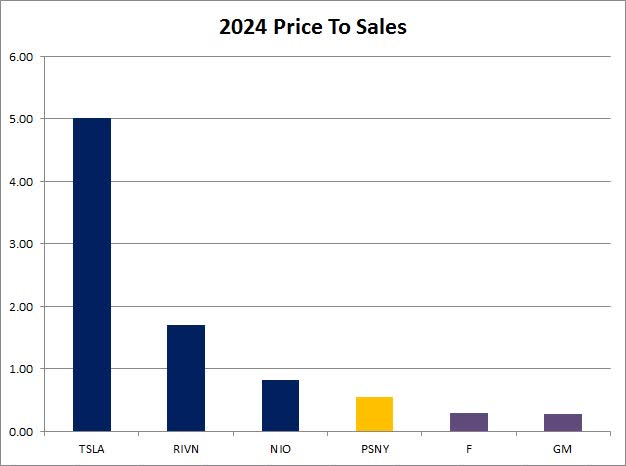

Given its ongoing struggles, it may not be surprising that Polestar’s valuation is low. The stock is currently trading at 0.55 times expected sales in 2024. As you can see in the chart below, this is well below the trading price of industry leader Tesla. In fact, Polestar isn’t even doing what Nio or Rivian are doing right now, as the company is trending more toward valuations of established automakers like Ford (F) and General Motors (GM).

Sales price in 2024 (Look for alpha)

The valuation here certainly seems low, but it could always go lower. When we first covered Polestar a few years ago, the stock was trading at mid-single-digit prices relative to its sales figures for the year. Today, the stock trades for just over half of its projected 2024 sales. Shares of Fisker, an EV name that has been struggling recently, were trading at less than 0.2 times projected sales before the delisting. I’m not sure Polestar will fall that low, but the impending capital raise could push the stock trading down to about 0.3x, which is what established automakers seek, if results don’t improve in coming quarters.

The biggest risk here is that Polestar may finally achieve its goal by 2025. At that point, if cash flow reaches positive territory, it will likely separate from several other electric vehicle companies, which could revalue the stock to higher levels. . The current average market price target is $3.17, meaning the stock has more than doubled from here, even though analysts have lowered their targets in the low teens over the past two years. Even if price to sales numbers remain around 0.55 next year, with sales expected to nearly double this year and another big jump next year, the stock could rise significantly from here.

Recommendations/Conclusions:

Until Polestar actually starts hitting some of its financial goals, I’ll continue to rate the name as a Sell. We expect losses and cash burn to be present for at least a year, and we don’t want to buy the stock ahead of the necessary capital raising. With the Federal Reserve unlikely to cut interest rates any time soon, companies like Polestar could continue to struggle, and the potential for a reverse split could be another negative catalyst if the stock falls below $1. I would consider reevaluating my rating later this year if the company makes some progress on its losses and cash burn situation along with raising the capital it needs to get through 2025.

Ultimately, Polestar’s uphill race will continue throughout 2024. The company posted its weakest quarterly vehicle delivery performance in more than two years despite launching new models. The recent debt raise will help fund the company for a few quarters, but the company will need a sizable capital raise to meet its aggressive 2025 goals. With the financials here shaky and the overall EV space failing to live up to the hype, it wouldn’t be surprising if Polestar stock hits new lows in the coming days.