Popular hiring data sends stock markets into a tailspin, ending nine straight weeks of gains | chart watcher

key

gist

- The stock market index ended the day in an upward trend, but ended the week in a downward trend.

- The 10-year government bond yield closed higher at 4.04%.

- Despite the decline in stocks, stock market indices remain technically strong.

You can’t blame the markets for taking a breather after nine positive weeks.

The first trading week of January closed on a downward note, which may have raised concerns among investors. Looking at the market’s reaction to the December jobs report, you can understand how nervous investors are. The better-than-expected jobs data sent waves through Wall Street. Shortly after the data was reported, stock futures fell and Treasury yields rose.

But investors got over their shock after digesting the information and looking at the data more closely. And given the lower-than-expected ISM figures and the two major strikes and their impact on employment figures, that may have calmed investors for a while. Stocks rose and Treasury yields fell. The market continued to see-saw between profits and losses throughout the trading day.

Don’t be surprised if the markets see similar moves next week as investors await December CPI data and the start of earnings season. This won’t happen until the end of the week, so expect more of the same through Thursday.

According to the CME FedWatch tool:According to , the probability of an interest rate cut at the March Federal Reserve meeting is 64%, lower than before today’s data was released. 2024 is 50-50 with elections and Fed interest rates. Elections are scheduled to be held in many countries around the world. And with more than half the world’s population heading to the polls this year, it’s bound to bring some volatility to stock markets.

From a seasonal perspective on US markets, the first quarter of an election year tends to be very volatile. Stocks are likely to sell off before the election, but they generally tend to rise after the election. Just because 2023 performed as expected seasonally, that doesn’t mean you should expect your portfolio to grow at the end of the year. Keep an eye on the broader market.

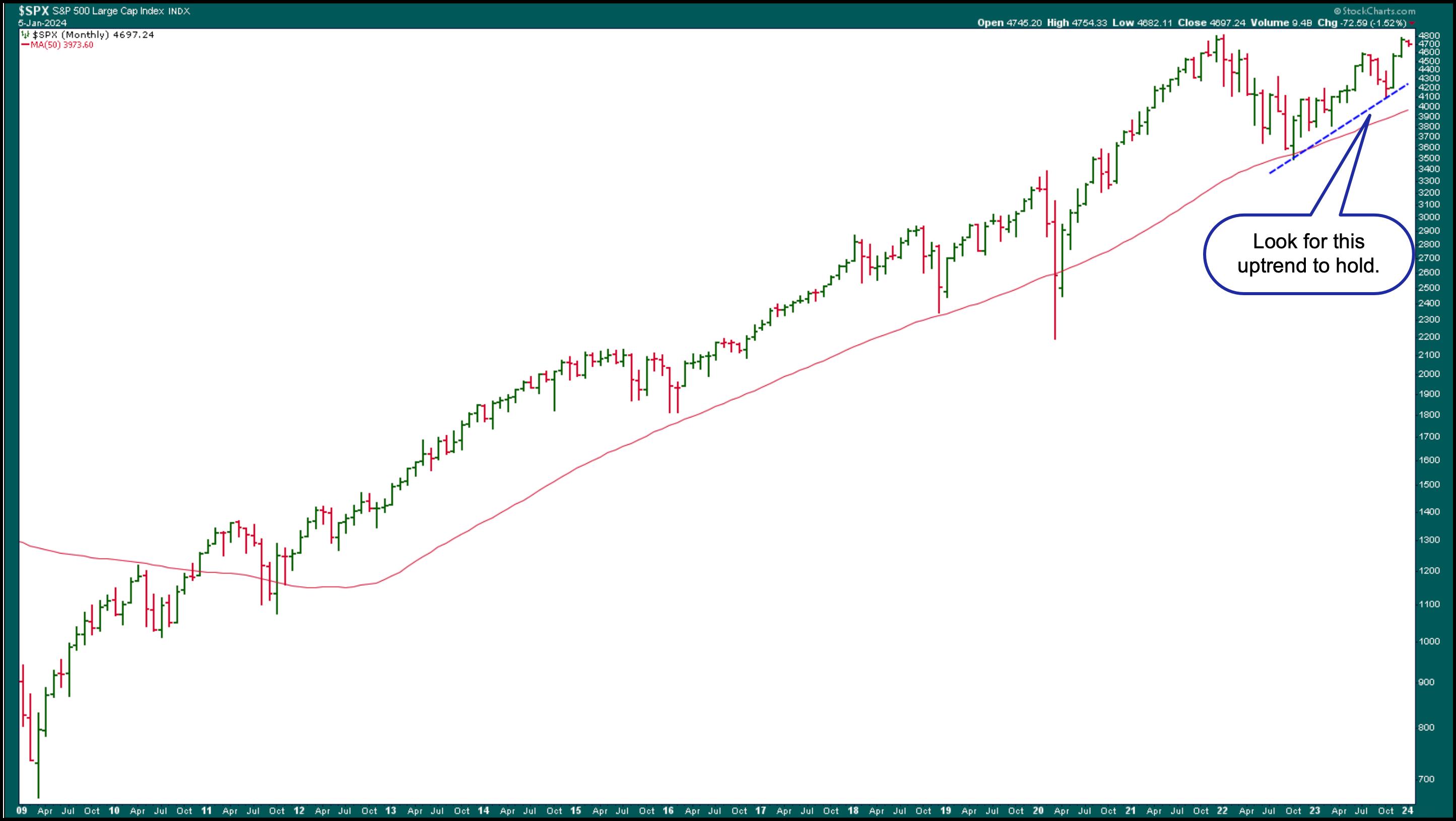

Considering that the S&P 500 Index ($SPX) is trading above its 50-month simple moving average and is on a relatively steep upward trend beyond 2022 (see chart below), a correction is not a concern until the index plunges below the threshold. There is no need. Support level.

Chart 1. Monthly chart of S&P 500. The index has been trending upward since 2012 and, with a few exceptions, remains above its 50-month simple moving average. A break below the blue dotted uptrend line could be the first sign of a reversal.Chart source: StockCharts.com. For educational purposes.

We have seen a shift in leadership from technology to finance and healthcare, two sectors that have struggled over the past year. Expectations of an interest rate cut are likely to have boosted financial stocks, which have shown a rapid rise since early November. The healthcare sector had a similar move to the financial sector, but retreated slightly on Friday.

Chart 2. Daily chart of the Financial Select Sector SPDR ETF (XLF). After yields began to fall, the financial sector began to recover and bounced back strongly.Chart source: StockCharts.com. For educational purposes.

But that doesn’t mean the Magnificent Seven will lose their status symbols. Nvidia (NVDA) closed off record highs but showed signs of recovery today. NVDA’s stock still has a strong chart and holds support at its 50-day SMA. If the stock continues to rise in 2024, it could drag down the rest of the market, especially the other six stocks that are following closely behind. So don’t lose faith in megacap tech stocks just yet.

Chart 3. NVIDIA Stock Still Going Strong. Don’t give up on Magnificent Seven stock. They can still rise higher.Chart source: StockCharts.com. For educational purposes.

With the Federal Reserve expected to cut interest rates, it is not impossible for Treasury yields to fall. Lower interest rates could set growth stocks back, but how low can interest rates go?

As long as the economy continues to falter, market expectations will likely remain. But this doesn’t mean interest rates will get close to zero. Perhaps they will pull back and perhaps settle at the 3% level. It has a lot to do with the balance between interest rates and economic growth.

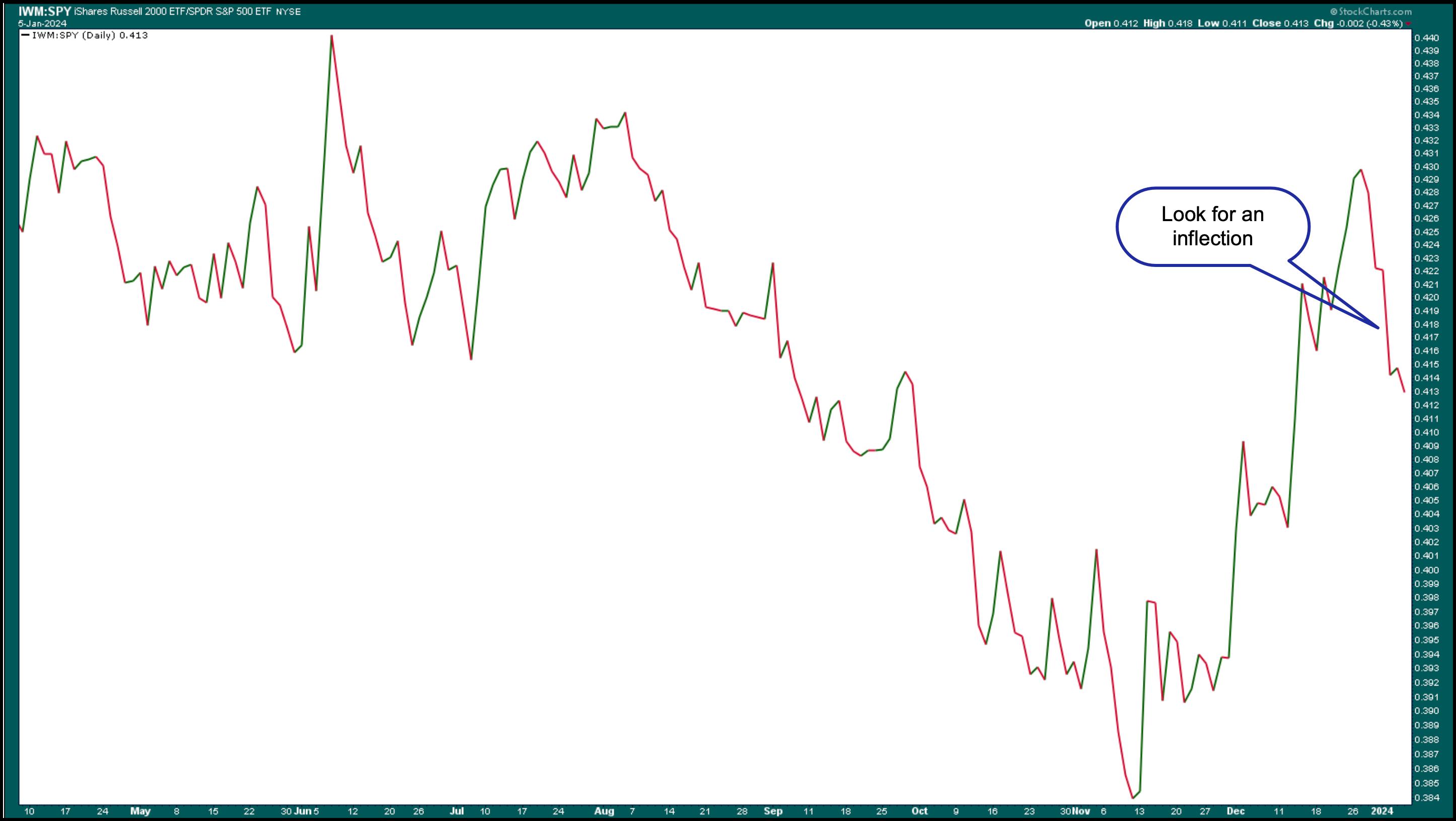

Finally, small-cap stocks may perform well as interest rates fall. Keep an eye on charts of small and large caps for 2024, like the charts below for the iShares Russell 2000 ETF and SPDR S&P 500 ETF (IWM:SPY).

Chart 4. Small cap VS. Big capital letters. When small-cap stocks start to outperform large-cap stocks and show an upward trend, it may be a good idea to give more weight to small-cap stocks.Chart source: StockCharts.com. For educational purposes.

If there is a clear cycle and investors are drawn to small-cap stocks, it may be worthwhile to add more weight to this asset class.

weekend wrap up

- $SPX was up 0.18% at 4697.24, $INDU was up 0.07% at 37,466.11 and $COMPQ was up 0.09% at 14524.07.

- $VIX was down 5.52% at 13.35.

- Best performing sector this week: Healthcare

- Worst performing sector this week: Technology

- Top 5 Large Cap Stocks SCTR Stocks: Affirm Holdings (AFRM); USX-US Steel Group (X); Coinbase Global (COIN); PDD Holdings (PDD); Karuna Therapeutics (KRTX)

On the radar next week

- December CPI

- December PPI

- Earnings season begins with Bank of America (BAC), JP Morgan Chase (JPM), Wells Fargo (WFC), Citigroup (C), Delta Airlines (DAL), and more.

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

Jayanthi Gopalakrishnan is the Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she served as Technical Analysis Editor for Stocks & Commodities magazine for over 15 years. Learn more