Portman Ridge Finance: Complex 15% Dividend at 18.5% Discount to NAV (NASDAQ:PTMN)

poco_bw/iStock (Courtesy of Getty Images)

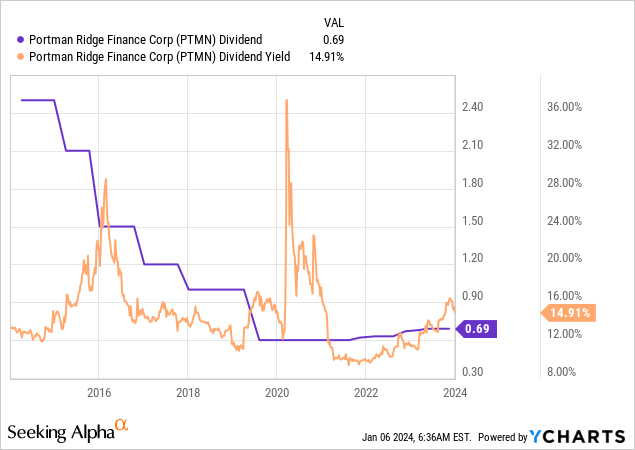

Portman Ridge Finance (NASDAQ:PTMN) is a small, externally managed business development firm that invests in middle market businesses using a variety of financing structures, from first lien loans to subordinated debt and equity co-investments. BDC It is largely sector neutral with investments in technology companies, food and beverage businesses, and pharmaceuticals. Fully guaranteed dividend distributions, stable net asset value growth, and strong underwriting quality are key parameters for investing in BDCs, and PTMN provides a mixed picture. BDC last declared a quarterly cash dividend. $0.69 per shareUnchanged sequentially for an annualized forward dividend yield of 15%.

Portman Ridge Finance Fiscal 2023 Third Quarter Earnings Presentation

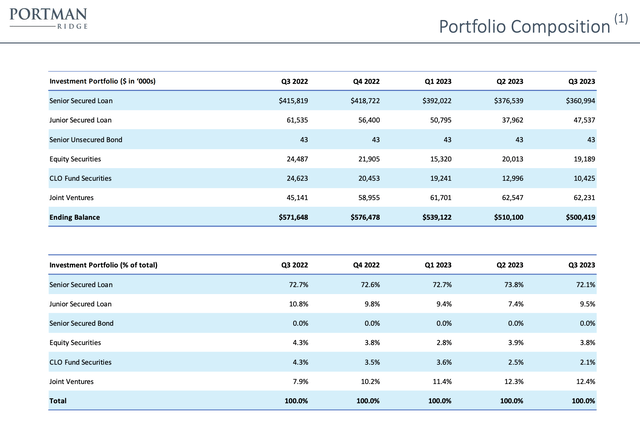

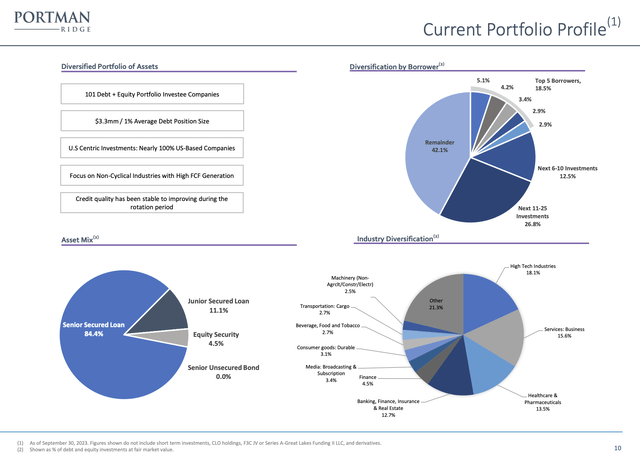

PTMN’s fair value portfolio was $504.2 million as of the end of the third quarter of its most recent fiscal year 2023, a decrease of $10 million, or 12.46%, from $571.65 million in the previous quarter. Same period last year. Senior secured loans comprised 72.1% of the portfolio, with the two joint ventures making up the second largest component at 12.4%, with PTMN allocating 3.8% to equity securities.

Portman Ridge Finance Fiscal 2023 Third Quarter Form 10-Q

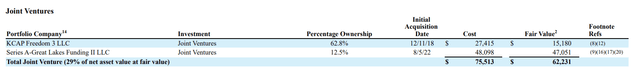

The KCAP Freedom 3 JV primarily invests in middle market loans, while the Series A – Great Lakes Funding II JV acquires and holds senior secured unit loans to middle market companies. Crucially, PTMN acquired 90.5% of its debt securities held at floating rates with spreads pegged to SOFR. The BDC’s top five borrowers also make up 18.5% of the portfolio adjusted for debt and equity alone, along with 101 debt and equity portfolio investment companies. PTMN’s external managers are supported by BC Partners, a global multi-asset investment manager with over $30 billion in AUM.

Portman Ridge Finance Fiscal 2023 Third Quarter Earnings Presentation

Net asset value and investment returns

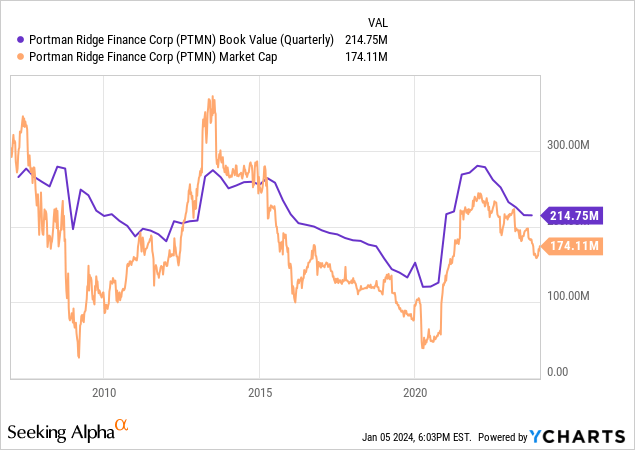

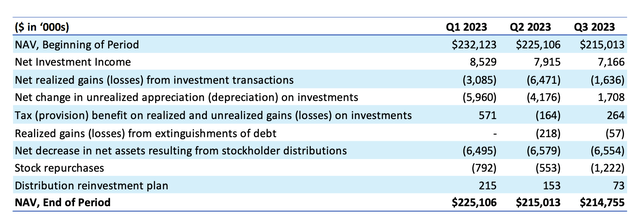

Book value in the third quarter was $214.8 million, or approximately $22.65 per share. BDC’s common stock is currently being exchanged as follows: $18.45 per share; 18.5% discount to NAV. Launched in 2015, this discount has remained a permanent feature of PTMN since then. While it is generally attractive to purchase BDCs at a discount to book value, PTMN’s discount has become an inherent part of its common stock.

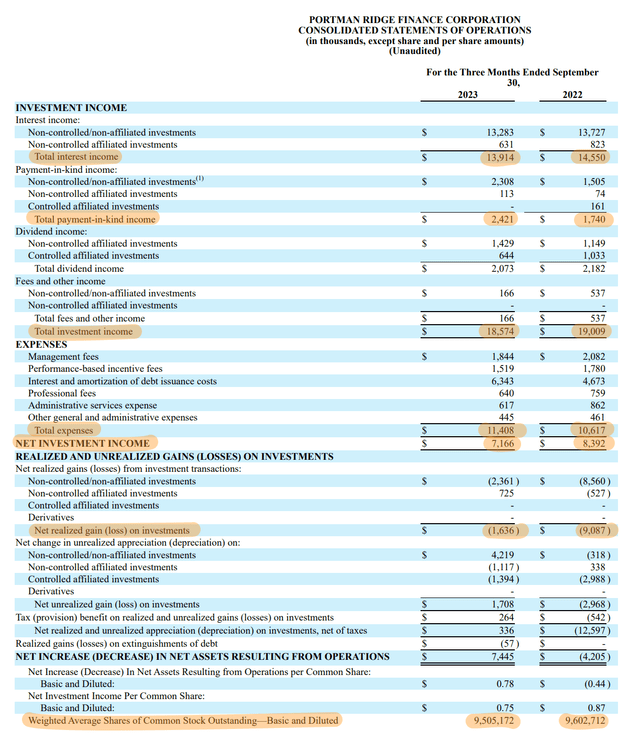

The direction of NAV has also been quite volatile over the years. NAV per share in the most recent third quarter increased by 11 cents compared to the previous quarter, but decreased significantly by 13.48% to approximately $3.53 per share compared to the same period last year. PTMN reported gross investment income of $18.6 million during the third quarter, down 2.3% year over year, and net investment income of $0.75 per share, down 12 cents year over year.

Portman Ridge Finance Fiscal 2023 Third Quarter Form 10-Q

The decrease in investment income was due to a decrease in total interest income resulting from a year-over-year decline in BDC’s investment portfolio. Additionally, in-kind payment income increased 39% year-on-year to $2.42 million, accounting for 17.40% of total investment income. PIK income accounted for 11.96% of total investment income in the same period last year, down 544 basis points from the most recent three quarters.

Insurance Quality, Dividend Coverage and NAV Discount Closing

Portman Ridge Finance Fiscal 2023 Third Quarter Earnings Presentation

The decline in NAV per share compared to the same period last year was due to PTMN’s purchase of 60,559 shares during the quarter. PTMN diluted weighted average shares of common stock outstanding ended the quarter at 9,505,172, down 1.02% from the prior year. The share repurchase resulted in a sequential increase in NAV per share compared to a decrease in NAV of $258,000 on a nominal basis.

Portman Ridge Finance Fiscal 2023 Third Quarter Form 10-Q

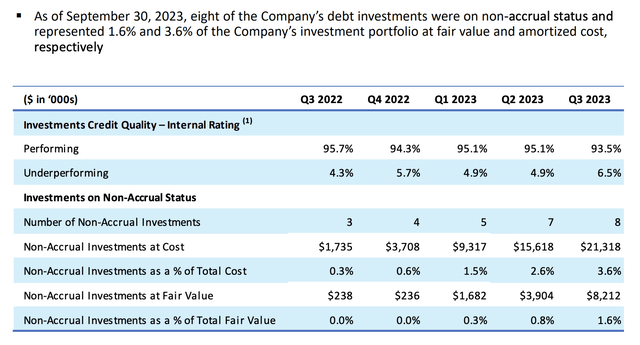

As of the end of the third quarter, there were eight debt investments in an unaccrued state, accounting for 1.6% of PTMN’s investment portfolio at fair value and 3.6% at amortized cost. BDCs also saw a significant deterioration in the performance of their debt investments, with underperforming loans increasing to 6.5% in the third quarter from 4.3% in the year-ago period.

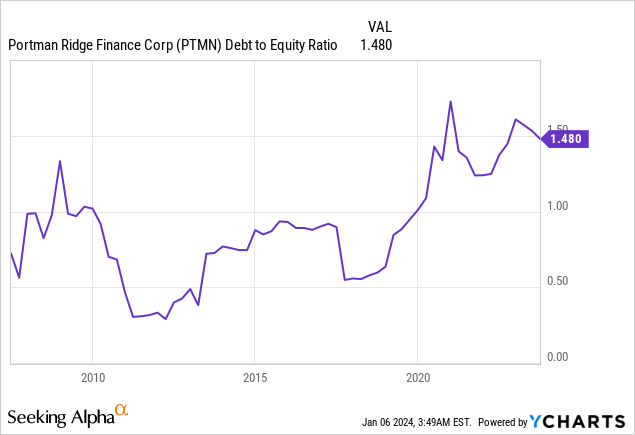

This is because the debt ratio is 1.48 times, close to the highest level since before the pandemic. As PIK income grew and NAV continued to experience weak weakness, non-performing loans increased gradually, further compounding the short-term headwinds. The risk here is that investment income will continue to decline as non-performing loans are likely to rise, putting pressure on dividends.

The BDC had a quarterly distribution of $1 per share before the pandemic, and while it has risen, it has yet to fully recover. The long-term timeline for dividends has been negative due to the current Goldilocks economics of BDCs leading the recovery. BDC is currently covering 109% of its quarterly distributions, which is down from the same period last year but still more than adequate. What will happen in a year when the Fed is expected to cut interest rates by 75 basis points? The pressure is already being experienced, so it’s probably not good. I have no plans to purchase.