Practical Options Strategies for Trading Home Depot | Option play

key

gist

- To take advantage of Home Depot’s stock price decline, consider implementing a put vertical spread.

- Put vertical spreads can lower your risk while taking advantage of downward movements in HD.

- With an August expiration date, you can open a vertical put position at a relatively low price.

America’s largest home improvement store, Home Depot, Inc. (HD) has benefited from a long period of investor attention and has traded at a premium valuation for several years. However, the recent environment of slowing consumer spending and rising interest rates has finally caught up with HD. Risk falls below $300.

After rallying towards an all-time high just below $400, HD has retreated below key support levels of $350 and $335 and is at risk of continuing its decline. HD’s relative performance recently hit a new 52-week low. This suggests further downside risk, with the next support target lowered to just below $300.

Figure 1. Daily chart of HOME DEPOT (HD). HD stock price has fallen below a key support level and could see further declines.Chart source: StockCharts.com. For educational purposes.

Given that analysts expect earnings per share (EPS) and revenue to grow in the low single digits and net margins remain below 10%, HD still trades at a premium, trading at 21 times forward earnings. The reality is that relatively low margins and slowing consumer spending will make it harder for HD to achieve the same type of premium valuation relative to the market.

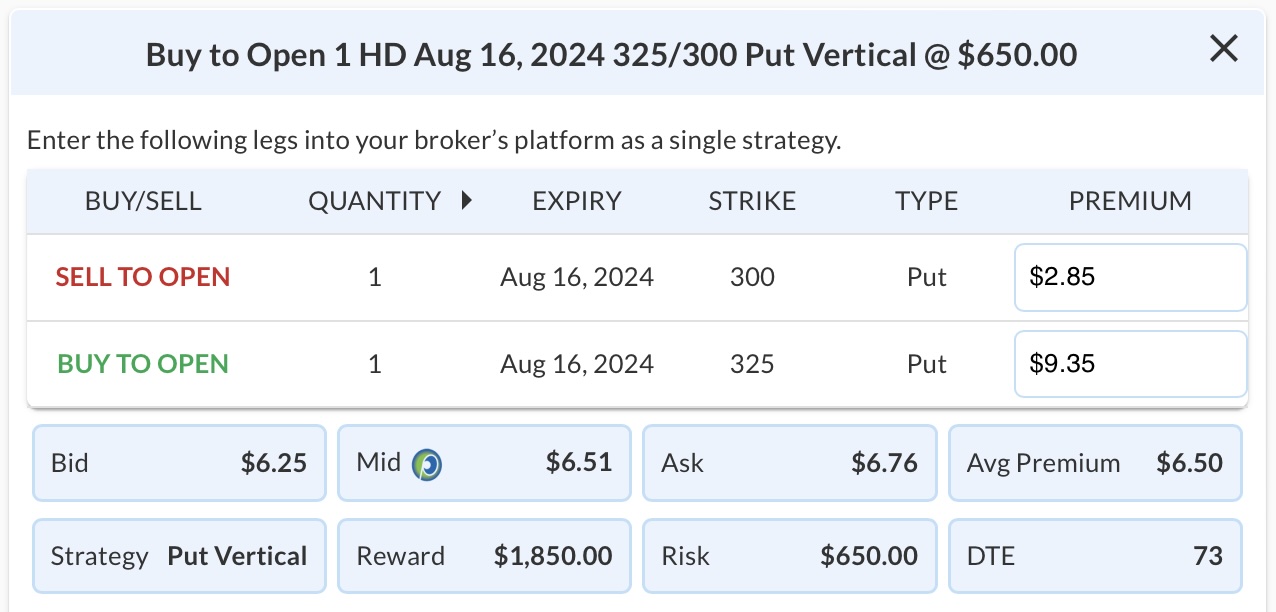

Options are cheap now, so buying downside exposure is cheap, and you can do so by buying $325/300 Put Vertical @ 6.50 debit in August. This means buying at a higher strike and selling at a lower strike (see below).

- Buy August $325 put option @ $9.35 debit

- Sell August $300 put @ $2.85 credit

Figure 2. Example of a put vertical spread option trade for HD.

If HD is above $325 at expiration, you risk a total of $650 ($935 – $285) per contract, and if HD is below $300 at expiration, you stand to make nearly three times that of $1,850 per contract.

Tony Zhang is Chief Strategist at OptionsPlay.com, where he assembled an agile team of developers, designers, and quants to create the OptionsPlay suite of products for trading and analysis. He also developed and managed the firm’s many partnerships, expanding from the Options Industry Council, Nasdaq, Montreal Exchange, Merrill, Fidelity, Schwab and Raymond James. Tony, a proven thought leader and contributor to CNBC’s Options Action show, shares ideas on how to leverage profits while reducing risk using options. Learn more