PRF: Low valuation, but performance not very attractive compared to this value ETF

Richard Drury

There is no doubt that ETFs with a value-oriented approach have a difficult time competing with broader market benchmarks such as the Russel 1000 and S&P 500 indices. This is mainly because large-cap stocks in the technology sector have been leading the stock market for quite some time. .

Nonetheless, portfolios following value-focused strategies still have some appeal, especially as valuations expand again. The investment approach adopted by the Invesco FTSE RAFI US 1000 ETF (NYSEARCA:PRF) I empathize with this scenario. These ETFs follow an index based on fundamental measures, creating a portfolio with a significantly lower valuation multiple compared to the benchmark.

While valuations are generally lower than their peer group of value-oriented ETFs, PRF has underperformed its category over time. This appears to be influenced by the low allocation to mega- and large-cap stocks and the significantly lower sector weighting of the technology sector. It is likely that this has had an impact on total returns.

Therefore, while this ETF’s investment methodology is expected to appeal to value-seeking investors, we do not believe a large allocation to this ETF is warranted given its outperformance over time.

ETF Description and Highlights

PRF is an exchange-traded fund based on the FTSE RAFI US 1000 index. The index consists of 1000 stocks of the largest US companies with the highest fundamental weight.

These base weights are calculated for each security based on four accounting measures: Adjusted Sales, Adjusted Cash Flow, Dividends + Repurchases, and Book Value + Intangible Assets. Typically, these measures are calculated taking into account five-year averages and other metrics such as equity-to-assets ratio and R&D expenses. The average of these four measures is used to assign weights to each company that makes up the index. Every quarter, a tranche equivalent to one quarter of the index is rebalanced. Additionally, the entire index is reconstituted annually.

As a result of this approach to stock selection, the FTSE RAFI US 1000 Index has a slightly different composition compared to the Russell 1000 Index, and nearly 20% of the FTSE RAFI US 1000 Index’s holdings are not included in the Russell 1000 Index.

This is also reflected in the top 10 holdings of the FTSE RAFI US 1000 index and PRF (Exxon, Berkshire, Apple, Microsoft, JPMorgan, Amazon, Verizon, Bank of America, Chevron and Citigroup), primarily in the financial and energy sectors. This contrasts with the Russell 1000 index, where the majority are technology names (Microsoft, Nvidia, Apple, and Broadcom) or the communications services sector (Meta and Alphabet).

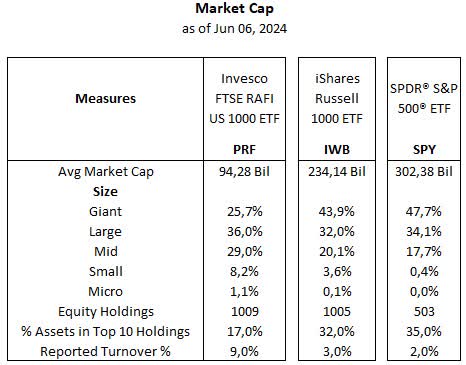

PRF’s stock mix is also less allocated to so-called megacaps, with an average market capitalization of $94 billion compared to $234 billion for the Russell 1000 index represented in the analysis of the iShares Russell 1000 ETF (IWB). We can also see that PRF’s top 10 holdings account for 17% of total assets, which is almost half of the Russell 1000’s top 10 holdings allocation of 32%.

Morningstar integrated by the author

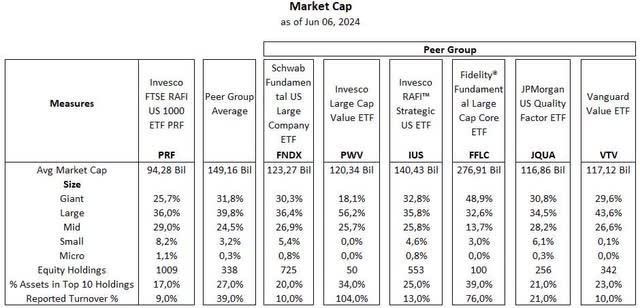

Below is a comparison between PRF and its large-cap ETF peer group that uses a value-oriented approach. The first and third ETFs (FNDX and IUS) follow the RAFI index with a fundamental approach, while PMV and VTV track value-focused indices. On the other hand, JQUA has a quality profile, and FFLC is an actively managed ETF.

For reference, we can see that PRF has a much more diverse allocation, with almost 1000 holdings compared to its peer group’s average of 338 holdings. Additionally, the peer group is more skewed towards large-cap stocks, with nearly 71% allocated to large-cap and so-called mega or mega-cap stocks, compared to 61% allocated to PRF.

Morningstar integrated by the author

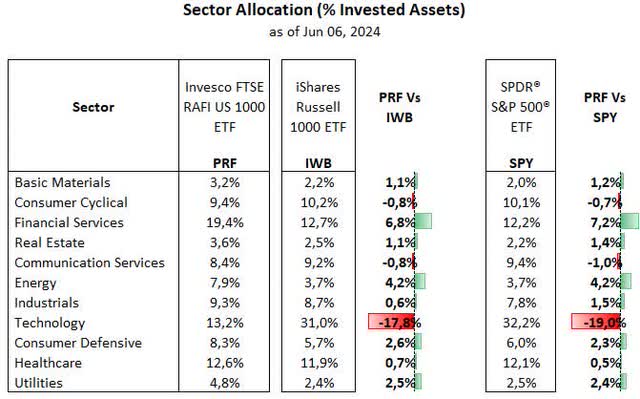

From a sector allocation perspective, PRF’s largest allocation as of June 6, 2024 is to the financial sector, accounting for 19.4% of all stocks, followed by technology at 13.2%, healthcare at 12.6%, consumer cyclical at 9.4%, industrial at 9.3%, and telecommunications. Follow behind. Services 8.4%, consumer defense 8.3%, energy 7.9%, utilities 4.8%, real estate 3.6%, basic materials 3.2%. Compared to the Russell 1000 Index, PRF is primarily overweight Financials (+6.8%) and Energy (+4.2%) and significantly underweight Technology (-17.8%).

Morningstar integrated by the author

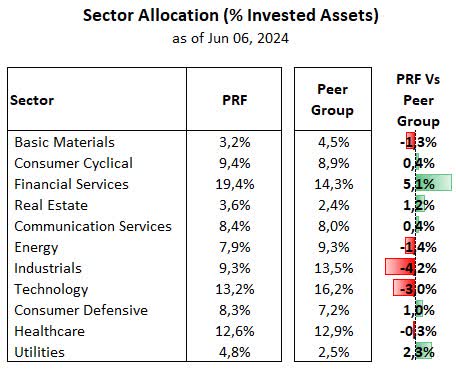

PRF has a large exposure to the financial sector compared to its peer group of large ETFs, but is mostly underweight the industrials (-4.2%) and technology sectors (-3.0%). The relatively small sector allocation discrepancy with peer groups is expected as all ETFs used in this comparison have a value-oriented bias, which explains their limited exposure to overvalued sectors such as technology.

Morningstar integrated by the author

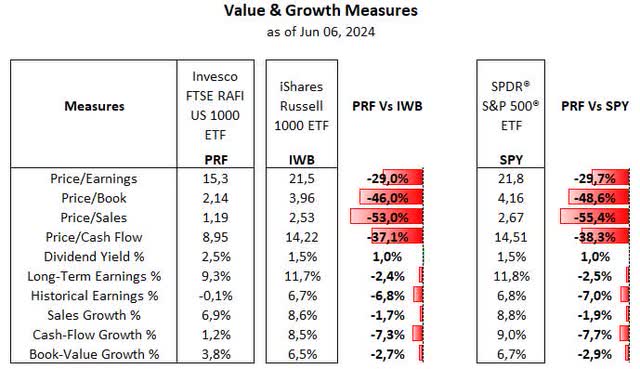

From a valuation perspective, PRF exhibits a significantly lower multiple compared to the Russell 100 index, with a gap of at least 29% against that benchmark. On the other hand, growth indicators are slightly lower. This suggests that FTSE RAFI’s methodology has successfully captured underlying valuation inefficiencies across markets. This is because there is not enough difference in the average growth profiles to justify such a significant multiple difference.

Morningstar integrated by the author

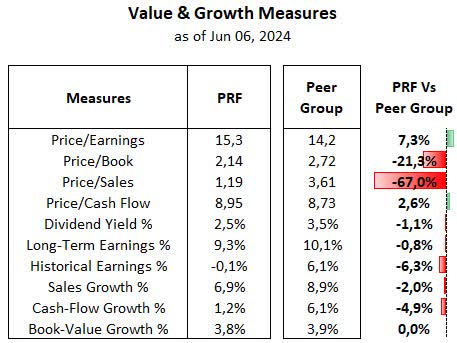

Interestingly, while compared to the ETF’s peer group, PRF’s price/earnings ratio shows a small premium, we see PRF showing a significant valuation gap in terms of price/book ratio and price/sales ratio compared to its peer group. . Applies to the underlying measure used in constructing the FTSE RAFI US 1000 Index. This includes adjusted sales and book value instead of the more commonly used price-to-earnings ratio.

Morningstar integrated by the author

Underperforming Benchmarks and Peer Groups

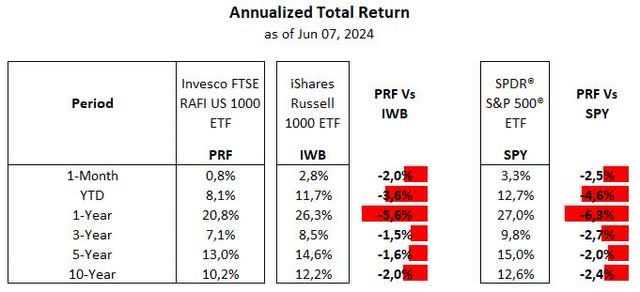

Comparing PRF to the Russell 1000 and S&P 500 indices is, not surprisingly, unfavorable to PRF. Given the leadership of high-growth megacaps over the past decade or so, value-driven approaches have struggled to keep up with these benchmarks.

Morningstar integrated by the author

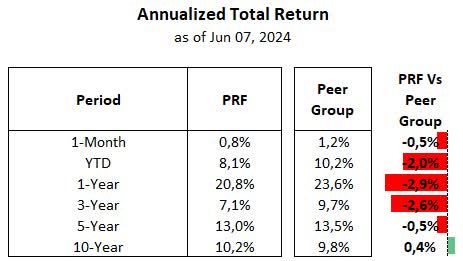

Compared to its peer group of large-cap value ETFs, PRF’s returns have closely matched the pack over the long term. However, PRF has shown poor performance over the past three years. Of course, this must be understood in the context of difficult times for value stocks, but this relatively weak performance is certainly unwelcome for PRF investors.

Morningstar integrated by the author

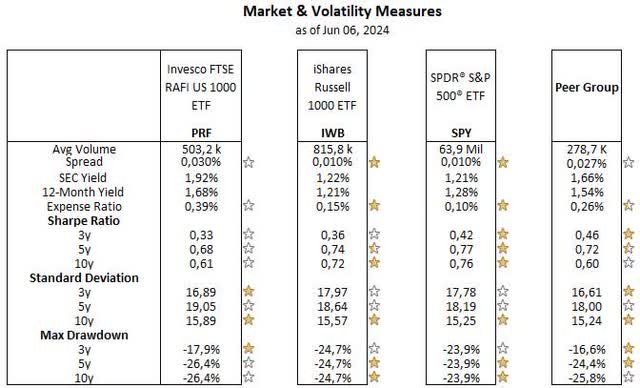

PRF’s risk-adjusted return and volatility measures were also not very good. This is because Sharpe ratios are generally lower than the benchmark and peer group, and standard deviation and maximum drawdown are consistently high across all time periods. The exception is a comparison with the Russell 1000 Index over a three-year period, where the benchmark’s reading was worse than that of PRF and other value ETFs.

Morningstar integrated by the author

In my view, PRF’s underperformance compared to its peers is at least partly due to the approach used by its parent indices, which selects stocks with, on average, low price/sales ratios. While this may be considered a valid criterion, in current market conditions where investors are highly obsessed with growth, a portfolio with a low price/sales ratio can undermine the performance of a growth-oriented strategy. Notably, PRF’s average price/sales ratio is much lower than its peer group, so this effect is likely to have worsened over time.

On the other hand, I think earnings growth is needed to lift the stock market, especially at this level of valuation. That said, with many stocks already having high growth expectations, there may be a good setup to drive a rotation into lower valuation sectors.

With this in mind, we believe PRF is a valuable alternative for investors looking to diversify into a value-oriented portfolio, as this ETF exhibits decidedly lower valuations compared to the Russell 1000 or S&P 500 indices. On the other hand, given its underperformance compared to a group of peer ETFs that follow a value-oriented strategy, we believe there is no reason to maintain a large position in PRF and rather take a relatively small position for diversification purposes.