Pro Arbitrage EA Trading Strategies, Details, Examples – Analysis and Forecasts – May 14, 2024

Pro Arbitrage EA trades based on triangular arbitrage. Triangular arbitrage (also known as cross-currency arbitrage or three-point arbitrage) is the act of exploiting arbitrage opportunities that arise from price differences between three different currencies in the foreign exchange market. A triangle arbitrage strategy involves three trades, exchanging the initial currency for the second currency, the second currency for the third currency, and the third currency for the initial currency. During the second transaction, the arbitrageur secures a zero-risk profit due to the mismatch that exists when the market cross rate does not match the implied cross rate. Profitable trading is only possible if there is a market defect.

strategy :

Triangular arbitrage opportunities can only exist if the quoted exchange rate is not equal to the market’s implicit cross rate. The following equation represents the calculation of the implicit cross rate, which is the exchange rate expected in the market implied by the ratio of two currencies other than the base currency.

If we consider a,b,c to be currencies, it looks like this:

Exchange rate (a/c) = Exchange rate (a/b) * Exchange rate (b/c)

where

Rate(a/c) is the implicit cross rate for currency c relative to currency a.

The exchange rate (a/b) is the quoted cross-market exchange rate for currency a against b.

Rate(b/c) is the quoted market cross rate for currency b against c.

If the market cross-rate quoted by the bank is the same as the implicit cross-rate implied by the exchange rates of other currencies, the no-arbitrage condition remains. However, if there is an inequality between the market cross rate, Rate(a/c), and the implicit cross rate, Rate(a/b) * Rate(b/c), an arbitrage opportunity exists. Difference between two exchange rates.

yes:

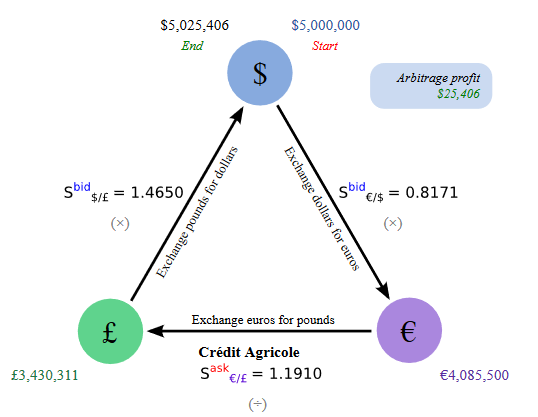

For example, a broker will quote dollars with a bid of 0.8171 €/$, sterling with a bid of 1.4650 $/£, and sterling with a bid of 1.1910 €/£. The quoted market cross rate is 1.1910€/£, but the trader realizes that the implied cross rate is 1.1971€/£ (calculated as 1.4650 × 0.8171 = 1.1971). The market suggests that the implicit cross rate should be 1.1971 euros per pound, but the market is selling pounds at a lower price of 1.1910 euros. Traders can exercise triangle arbitrage in a hurry by exchanging dollars for euros, exchanging euros for pounds, and finally exchanging pounds for dollars. The following steps demonstrate triangular arbitrage.

1. A trader sells $5,000,000 in Euros and receives €4,085,500. ($5,000,000 × 0.8171 €/$ = €4,085,500)

2. Trader sells €4,085,500 per pound and receives €3,430,311. (€4,085,500 ¼ 1.1910 €/£ = £3,430,311)

3. The trader sells £3,430,311 for dollars and receives $5,025,406. (£3,430,311 × 1.4650 $/£ = $5,025,406)

4. The trader ultimately earns an arbitrage profit of $25,406 on the $5,000,000 capital used to execute the strategy.

A quick look at the strategy:

There are two ways to exchange currency a for c.

1. Exchange a directly for c

2. Change a to b and then change b to c.

The above methods generally give the same results. However, in some market conditions there are differences (several points range). EA waits for those conditions and then initiates the transaction. For example, if Method 2 is cheaper, exchange for Method 2 first, then immediately reverse to Method 1.

Trading pairs:

The EA trades 56 triangle combination pairs as shown below. (These are all possible combinations of the 28 major forex pairs and cross forex pairs.)

One AUDCAD CADJPY AUDJPY

2 AUDCAD CADCHF AUDCHF

three honorable USDCAD AUDCAD

4 honorable USDCHF AUDCHF

5 honorable USDJPY AUDJPY

6 EURCAD CADJPY EURJPY

7 EURCAD CADCHF EURCHF

8 EURCHF CHFJPY EURJPY

9 EURGBP GBPUSD EURUSD

10 EURGBP GBPCAD EURCAD

11 EURGBP GBPCHF EURCHF

12 EURGBP GBPAUD EURAUD

13 EURGBP GBPJPY EURJPY

14 EURGBP GBPNZD EURNZD

15 EURUSD USDCAD EURCAD

16 EURUSD USDCHF EURCHF

17 EURUSD USDJPY EURJPY

18 GBPUSD USDCAD GBPCAD

19 GBPUSD USDCHF GBPCHF

20 GBPUSD USDJPY GBPJPY

21 NZDUSD USDCAD NZDCAD

22 NZDUSD USDCHF NZDCHF

23 NZDUSD USDJPY NZDJPY

24 USDCAD CADJPY USDJPY

25 USDCAD CADCHF USDCHF

26 USDCHF CHFJPY USDJPY

27 GBPCAD CADJPY GBPJPY

28 GBPCAD CADCHF GBPCHF

29 GBPCHF CHFJPY GBPJPY

30 EURAUD AUDCAD EURCAD

31 EURAUD AUDJPY EURJPY

32 EURAUD honorable EURUSD

33 EURAUD AUDCHF EURCHF

34 EURAUD AUDNZD EURNZD

35 GBPAUD AUDCAD GBPCAD

36 GBPAUD AUDJPY GBPJPY

37 GBPAUD honorable GBPUSD

38 GBPAUD AUDCHF GBPCHF

39 GBPAUD AUDNZD GBPNZD

40 AUDCHF CHFJPY AUDJPY

41 CADCHF CHFJPY CADJPY

42 EURNZD NZDJPY EURJPY

43 EURNZD NZDUSD EURUSD

44 EURNZD NZDCAD EURCAD

45 EURNZD NZDCHF EURCHF

46 GBPNZD NZDJPY GBPJPY

47 GBPNZD NZDUSD GBPUSD

48 GBPNZD NZDCAD GBPCAD

49 GBPNZD NZDCHF GBPCHF

50 NZDCAD CADJPY NZDJPY

51 NZDCAD CADCHF NZDCHF

52 NZDCHF CHFJPY NZDJPY

53 AUDNZD NZDJPY AUDJPY

54 AUDNZD NZDUSD honorable

55 AUDNZD NZDCAD AUDCAD

56 AUDNZD NZDCHF AUDCHF