Prohibited Blackjack Strategies for Trading – Analysis and Forecasts – February 17, 2024

card counting

Contrary to popular belief, card counting does not mean remembering every card from the shoe. There is no need to meticulously keep track of the quantities of specific cards such as 3s, 4s, etc. from previous hands. Rather, the focus is on measuring the overall value of the remaining deck. By doing so, you can adjust your gameplay and bet sizes accordingly.

In blackjack, the odds are in the player’s favor when the deck contains more cards worth 10 or 11 points. Card counting therefore allows you to effectively monitor the balance between low-value and high-value cards remaining in the deck.

Card counting for transactions

In blackjack, it is advantageous to know, or at least have a clue, the value of the rest of the deck. Is it also possible to estimate the value of a “deck” in a transaction?

Let’s take a moment to think about what a deck is in a trade.

trading deck

While most people think of volatility or the direction of price movement, I think of this deck as a collection of upcoming trades. This is very simple because we design the cards for the games we play. Let’s say you are using a martingale strategy where positions of equal or increasing size are opened until some profit is reached. If your strategy is designed correctly, every trade will be either:

-

There are between 1 and 5 positions before the trade closes, which happens quite often.

-

If there are more than 6 positions before the trade is closed – very rare

So we have two types of cards: boring cards and Devley Card.

To estimate the “value” of the remaining trading deck, we want to know how many boring, demonic cards are in it. Is that possible?

Trading Deck Quote

First, run a backtest and see how many positions are typically taken before a trade closes at a profit.

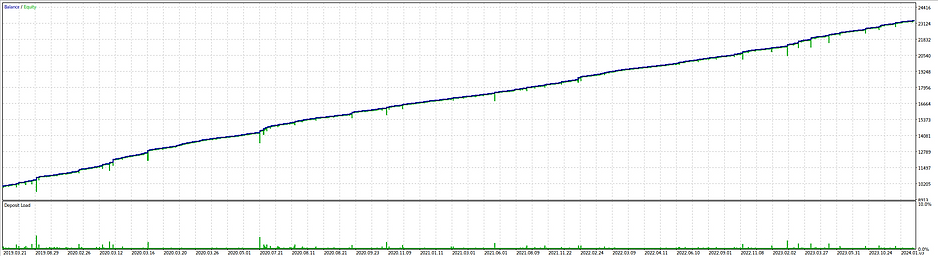

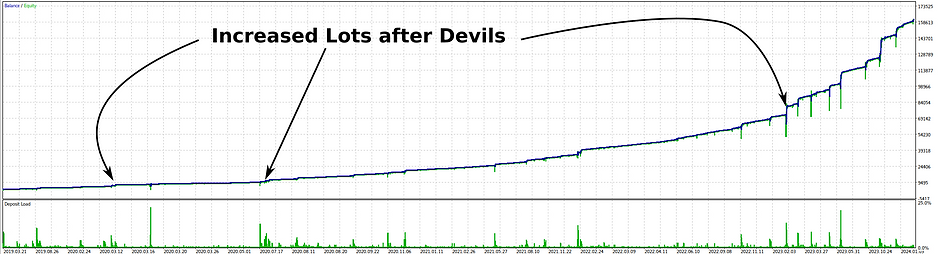

This is a const-lot backtest. BFG9000 Low risk from 2019 to 2024

In some cases, some spikes can be seen on the charts, indicating that EA had to open more positions to cover the decline.

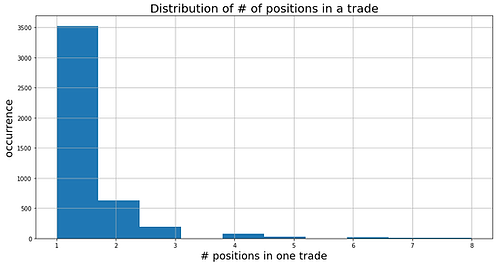

I extracted this data and created a histogram for all transactions. The horizontal axis represents the number of positions used before the trade is closed. The vertical axis shows how often such trades occurred in the backtest above.

As expected, EA’s typically require no more than 3 positions in most cases to close a trade. In rare cases, this is four. And there are more than 6 positions in devli trading. But the histogram gives you a feel for what’s in the stack. What we are still missing is time information between devil deals!

hidden secret

The period between devil bargains reveals the hidden value of the bargain deck.

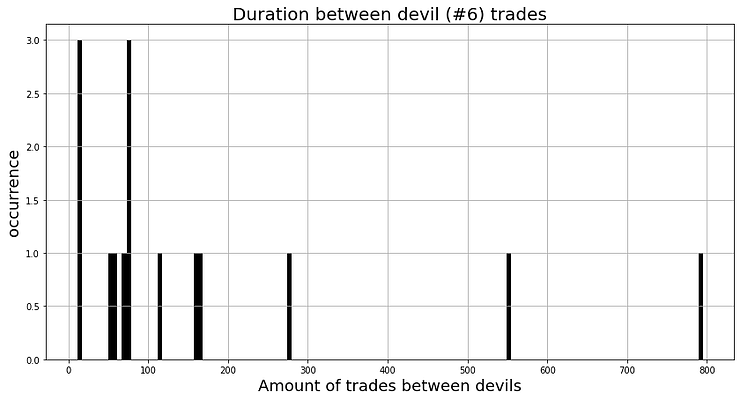

We define the number of positions in a trade as 6 for it to be a devil trade.

And this is a histogram of trading volume between demons:

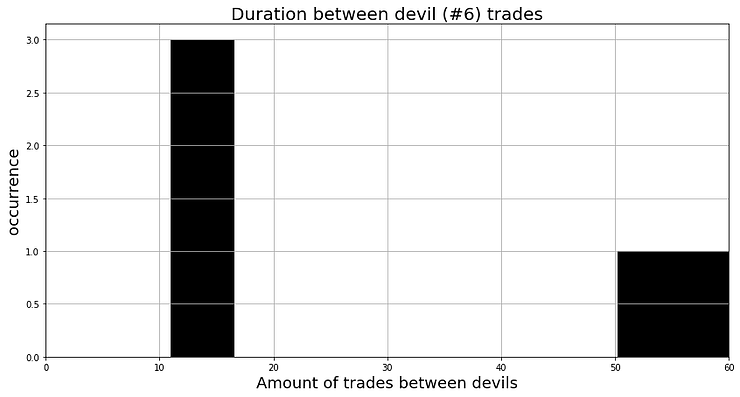

What is the minimum transaction amount between two devils? that eleven.

In the enlarged chart you can see that there are at least 11 trades before the next devil card comes 🔥

What can we do if we know that after 11 deals the devil will come? Arrrgh! strengthen your position Your deal is Brrrrrrr!

To mention BFG9000, this is the first EA to apply this methodology. EA plans to release it to the public on February 22nd.

EA basically tracks transactions and detects evildoers. We then apply the previously introduced scaling approach. older Blog post. The final result is:

We can clearly see a few demons on the stock chart and see that EA scales up for a short period of time and continues to use minimal lot sizes while waiting for the next demon. It’s simple.

I hope you liked the article. Share with everyone Who cares? Serious forex transaction.

thank you!

Subscribe to receive future articles directly to your inbox.