Q2 Holdings: Bullish may be priced in (NYSE:QTWO)

SDI Production

2nd quarter holdings (New York Stock Exchange: QTWO) is a company that provides digital end-to-end banking solutions to local and community financial institutions across the United States.

Stock performance has been relatively volatile over the past few years. QTWO was listed in 2014 at a price of $16, but has since declined. After hitting an all-time high of $145 per share in 2021, QTWO continued its decline, bottoming out at a price level of $22 in mid-2023. Nonetheless, QTWO appears to have gained some momentum over the past year. It has increased by more than 125%. This was also driven in part by strong price performance 50% YTD. QTWO is currently trading at $63 per share.

I rate QTWO as Neutral. My one-year price target of $64 per share projects an upside of about 3%. At this level, QTWO appears to be fully valued. I believe QTWO should be in a good position on the revenue side. With growth accelerating in FY, most of the upside may have been priced in, especially with the stock already up over 46% YTD.

financial review

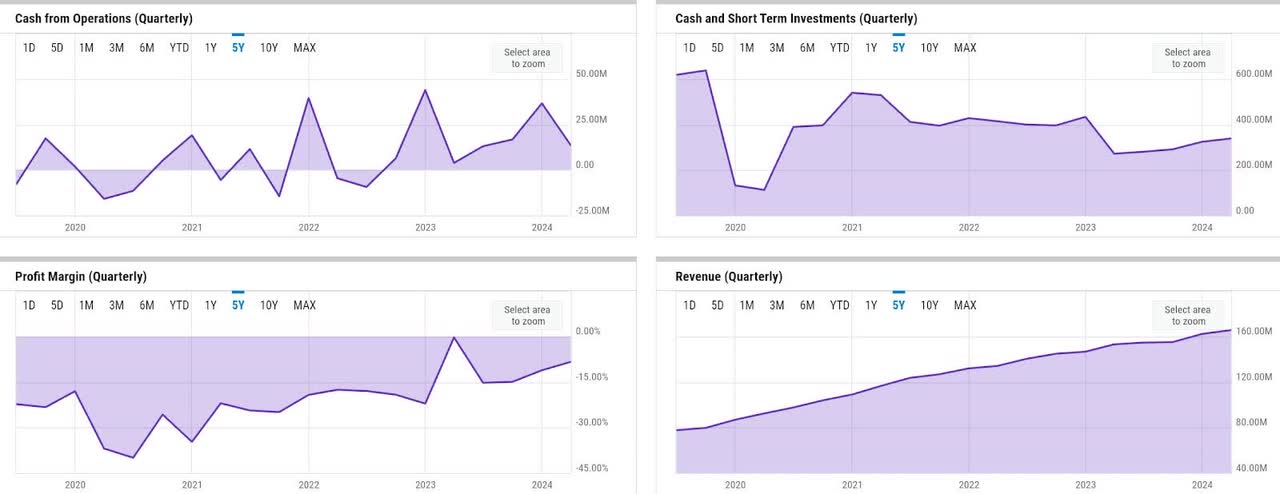

Y chart

Fundamentals are relatively mixed but improving. Sales growth continued to decline from over 30% in the first quarter to just over 8%, but profitability and operating cash flow (OCF) generation improved overall. Although QTWO was not very profitable in the first quarter, its net loss rate was -8.4% as of the first quarter, and has already significantly reduced from -11% to -15% recently. Meanwhile, QTWO appears to have consistently generated positive OCF every quarter since 2022. QTWO continued this trend in the first quarter, delivering $13.4 million in OCF. This helped QTWO maintain adequate liquidity levels. QTWO ended the first quarter with liquidity of $338 million, with a relatively manageable debt-to-equity ratio of 1x.

catalyst

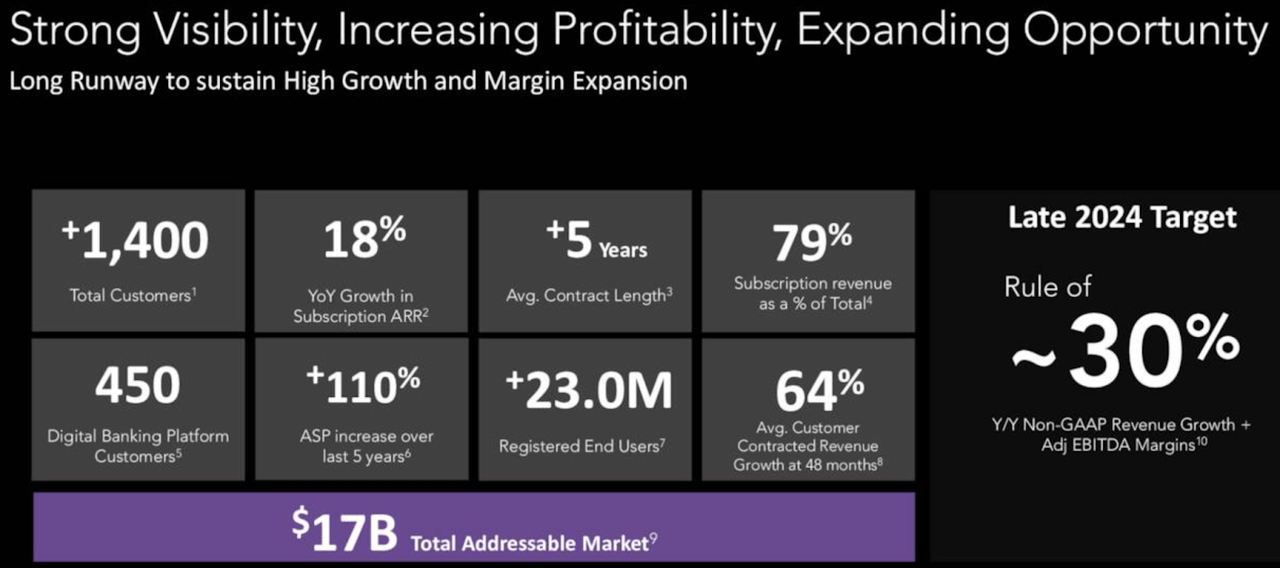

I believe QTWO is well positioned to achieve its “Rule of 30” goals. This equates to a combined year-over-year non-GAAP revenue growth and adjusted EBITDA margin of 30.

company presentation

Although QTWO’s overall revenue growth was only 8% in the first quarter and is expected to be only 10-11% for the fiscal year, QTWO’s subscription ARR continues to grow strongly at 18% year-over-year. QTWO believes it is possible to achieve steady ARR growth through FY 2024, potentially driven by expansion opportunities from existing customers.

company presentation

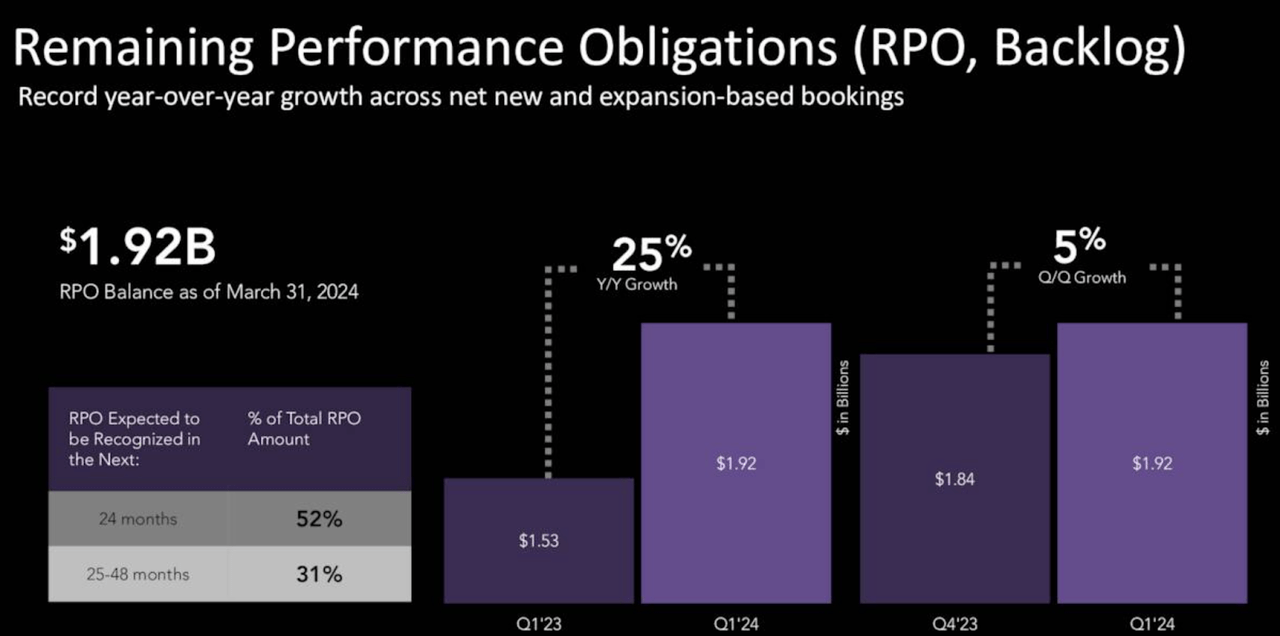

This is further evidenced by the very strong RPO growth of 25% year-on-year, despite much slower reported revenue growth. QTWO has already seen pretty solid expansion growth in the first quarter, but notable new customer acquisitions this quarter should indicate high-margin revenue growth going forward, as management mentioned.

First, we continued our sales momentum through a broad mix of net new and expansion success. The success of our two Tier 1 digital banking expansions in the quarter demonstrate the unique opportunity we have to deepen existing relationships due to our single platform and large and diverse customer base. And given the strength of the demand environment, pipeline health and recent wins, we are optimistic about the remainder of the year.

Source: First quarter earnings announcement.

Meanwhile, expanded sales success associated with lower customer acquisition costs should also support expanded adjusted EBITDA margins through lower sales and marketing (S&M) spending as a percentage of revenue. The S&M ratio as a percentage of sales has already decreased from 18% in the first quarter of last year to 15% in the recent first quarter due to lower labor costs. We think 15% is already a good number, but expansion-focused sales efforts could potentially push that number even lower.

danger

It seems to me that QTWO’s relatively long implementation cycle could potentially result in slower revenue recognition and slower reported revenue growth. Moreover, the current uncertain macro environment may continue to put downward pressure on professional services revenues, which has already offset first-quarter revenue growth by $3.5 million, effectively lowering projected 10% revenue growth to just 8% in the first quarter. .

It’s also important to note that while QTWO currently has a solid RPO backlog, it also needs to acquire new clients to create new expansion opportunities. New customers typically require more in-depth implementation activities, and there is a risk of a further slowdown if new sales activity becomes more active than usual, as management suggested in the first quarter.

The easiest way to think about it is as a net new, sort of bifurcated net new and intersection or extension. On the net new side, everything we do for the rest of this year will have very little revenue. As you know, the implementation cycle can be anywhere from 9 to 15 months depending on the size of the deal. Conversely, in terms of crossover or expansion, we see a lot of strength and the time to revenue for that is faster.

Source: First quarter earnings announcement.

Meanwhile, S&M may also trend higher as QTWO could potentially add more implementation staff to address this issue, potentially negatively impacting profitability.

Evaluation/Price

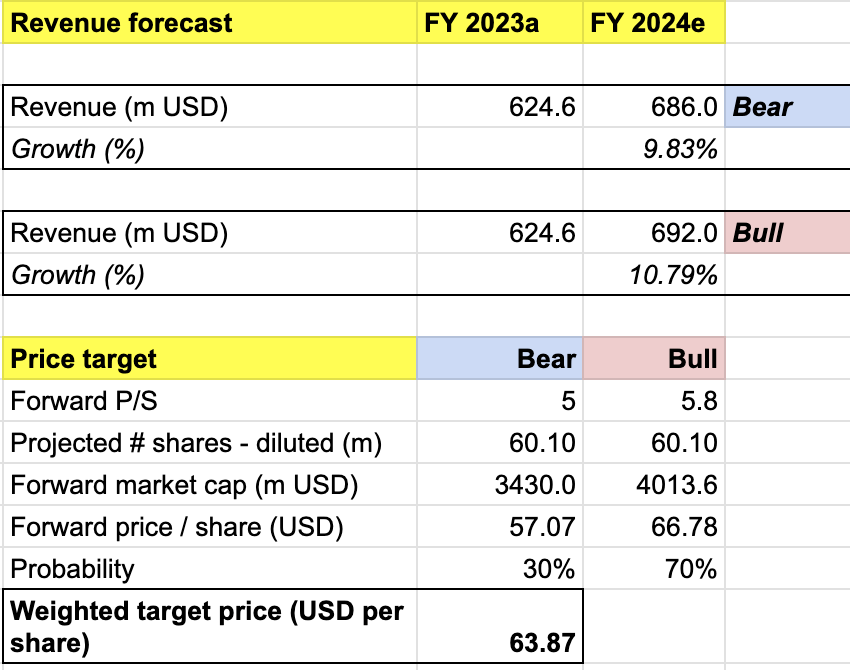

My price target for QTWO is determined by the following assumptions about bullish vs. bearish scenarios for the fiscal 2024 outlook.

-

Assuming a bullish scenario (50% probability) – Based on the company’s guidance, we expect revenue to increase 10.8% year-over-year to $692 million. The forward P/S is assumed to remain at 5.8x, which means the stock price has risen to the $66.8 price level.

-

Assuming a bearish scenario (50% probability) – QTWO will achieve fiscal 2024 revenue of $686 million (9.8% YoY growth). Since this is a slowdown in growth compared to the previous year, the P/S is expected to decrease by 5 times, leading to a stock price adjustment of $57.1.

self analysis

Incorporating all of the above information into my model, I arrived at a weighted target price of $64 per share for fiscal 2024. This represents an expected one-year upside of approximately 3%. I would rate the stock Neutral.

Overall, I think QTWO is well worth it. My 70-30 Brown Bear probability allocation is based on my belief that QTWO should be well-positioned to deliver expected revenue growth, given its higher pipeline visibility and more expansion opportunities. Nonetheless, it is also important to remember that my relatively aggressive assumptions give my price target an upside of just 3%. With the stock price up more than 46% YTD, it appears that much of the recent upside has been reflected.

conclusion

QTWO is a company that provides technology solutions to the U.S. financial services industry. Recent notable first-quarter wins at several banks suggest that QTWO should look to potential revenue growth through future expansion. With RPO growth reaching 25% YoY, we believe QTWO is well-positioned to deliver accelerated revenue growth in fiscal 2024. Still, applying these assumptions to our price target model, a 3% upside in just one year is just as meaningful. Some of QTWO’s upside potential may be priced in. For now, we rate the stock as Neutral.