QDPL: Basically the S&P 500 index but with higher returns (NYSEARCA:QDPL)

Riasik

When investing in the stock market, investors are always looking for innovative strategies that can deliver growth and returns. And Wall Street is always happy to provide it. for teeth, Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF (NYSEARCA:QDPL) It’s definitely different and an approach I’ve never encountered before.

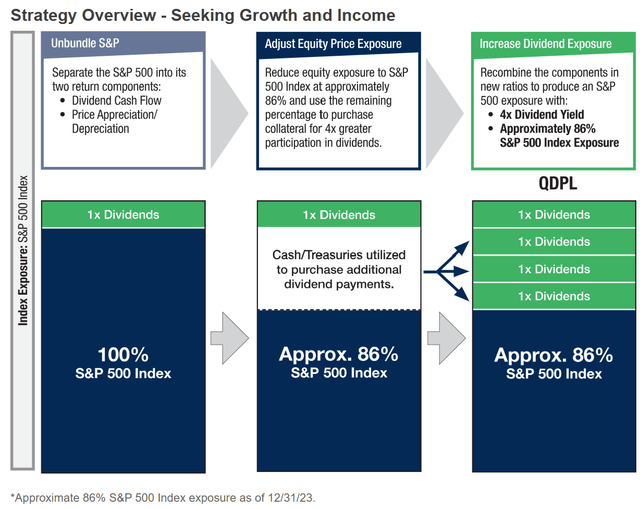

QDPL is an exchange traded fund (ETF) that seeks to track the total return performance of the Metaurus US Large Cap Dividend Multiplier Index – Series 400. The fund achieves this by investing approximately 86% of its assets in underlying assets. S&P 500 (SP500), with the remaining percentage being used to purchase collateral to quadruple dividend participation. This unique approach allows QDPL to provide investors with exposure to dividend cash flow: It maintains a significant portion of its equity exposure to the S&P 500 Index.

pacretfs.com

Launched on July 12, 2021, the fund has amassed approximately $315 million in assets. QDPL will charge a total expense ratio of 0.60% after reducing the management fee from February 1, 2024. This expense ratio is quite high compared to the average stock ETF expense ratio of about 0.16%.

ETF holdings and sector composition

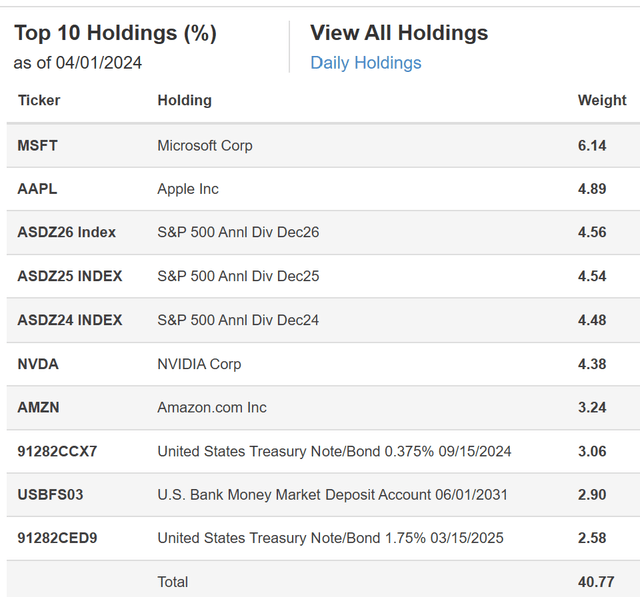

To better understand QDPL’s investment strategy, let’s take a closer look at its top holdings and sector composition. QDPL invests primarily in the underlying assets of the S&P 500, but also holds a portion of its assets in dividend futures contracts. This combination allows the fund to provide investors with exposure to both the dividend cash flow and price appreciation/depreciation of the S&P 500.

pacretfs.com

peer comparison

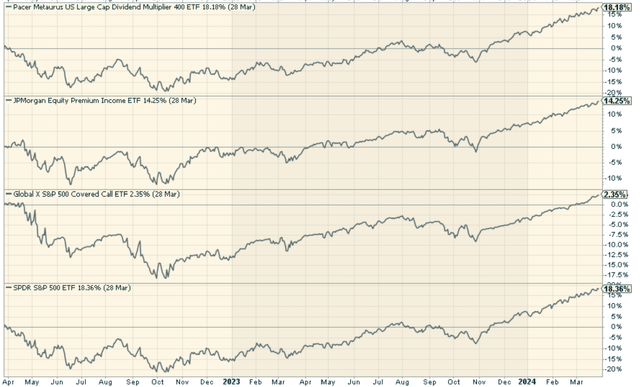

Two notable competitors to QDPL are the JPMorgan Equity Premium Income ETF (JEPI) and the Global X S&P 500 Covered Call ETF (XYLD). Both funds use different strategies to generate returns and provide exposure to the S&P 500.

JEPI focuses on writing cover call options on the S&P 500 to generate premium returns, while XYLD also focuses on writing cover call options on global portfolios. These strategies aim to enhance income potential but may limit the upside potential of the underlying index.

From a total return perspective, QDPL performed better than JEPI and XYLD, and slightly underperformed SPY. That’s not surprising given the fund’s S&P focus, in a cycle that largely favors the S&P 500 over most other major market proxies.

stockcharts.com

Advantages and disadvantages of investing in QDPL

As with all investments, there are pros and cons to consider when investing in QDPL.

Advantages of investing in QDPL

-

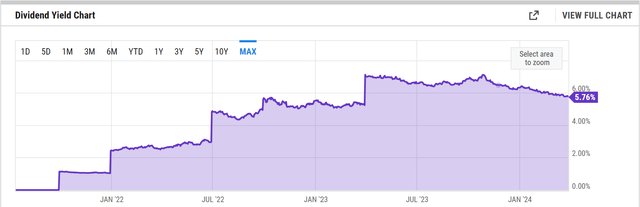

Enhanced Dividend Exposure: QDPL provides investors with exposure to 4x the dividend yield of the S&P 500, making it an attractive option for those seeking higher cash flow.

ycharts.com

2. Moderate Equity Exposure: QDPL offers slightly reduced equity exposure compared to the S&P 500, which may appeal to investors looking for a more conservative approach.

3. Diversification: By investing in the underlying holdings of the S&P 500, QDPL provides investors with the benefit of diversification by providing exposure to a broad range of companies in a variety of sectors.

4. Historical Outperformance: QDPL has historically delivered on its promise of returning 85-90% of the S&P 500 and more than four times the distribution return. This performance may be attractive to investors seeking consistent relative returns.

Disadvantages of investing in QDPL

-

Volatility: While QDPL aims to provide enhanced dividend exposure, it is important to note that dividend futures can be subject to volatility and market movements. This volatility may affect the Fund’s performance.

-

Expense Ratio: QDPL charges a total expense ratio of 0.60%, which is slightly higher than the average stock ETF. Investors should consider the costs of investing in QDPL and evaluate whether the potential benefits outweigh the costs.

-

Market Risk: Like investments in the stock market, QDPL is also subject to market risk. Changes in general market conditions and economic factors may affect the Fund’s performance.

-

Limited Performance: QDPL is a relatively new ETF with a launch date of July 12, 2021. Investors should consider the limited performance of the Fund when making investment decisions and carefully evaluate its performance over time.

conclusion

The Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF is an interesting one. QDPL offers a potential avenue for income-oriented investors seeking growth with the goal of delivering four times the return of the S&P 500 while maintaining exposure to the stock performance of the index. Basically, the S&P 500 is generating a larger portion of its total returns from dividends rather than capital appreciation. I can see what value this might have for some investors looking at the income. It’s worth considering if you fall into that category.