RDVY: Simple Dividend ETF, Excellent Growth, Low 2.0% Yield

ionic

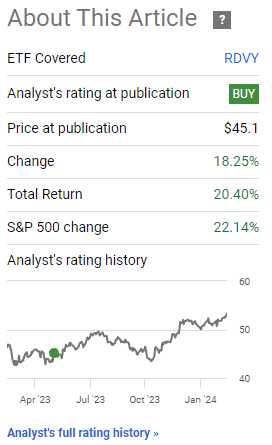

Last time we covered First Trust Rising Dividend Achiever ETF (NASDAQ:RDVY) Mid-2023. In that article, I argued that RDVY’s strong record of dividend growth, cheap valuation, and good performance record make the fund a buy. RDVY slightly underperformed. Since then, the S&P 500 has seen strong dividend growth. Results were reasonably good, slightly better than most dividend and value ETFs over the same period.

RDVY Previous article

RDVY’s fundamentals remain unchanged, so the fund remains a Buy. With a dividend yield of 2.0% but excellent dividend growth, this fund may be of particular interest to long-term dividend growth investors and may be of less interest to current retirees.

RDVY – Overview and Investment Thesis

Indexes and Portfolios

RDVY is a dividend growth index ETF that tracks Nasdaq US Rising Dividend Achievers. It is a relatively simple index including 50 large-cap stocks. These are the U.S. stocks with the strongest combination of dividend growth, yield, and payout ratio. In reality, dividend growth is the most important thing. Like most indices, there are industry caps to ensure some degree of diversification. This is an equal-weighted index, as opposed to a traditional market capitalization-weighted index.

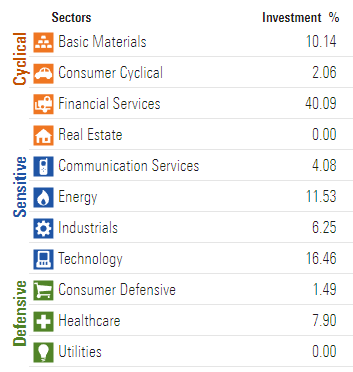

RDVY itself is moderately diversified, investing in 50 stocks from the most relevant industry sectors. Diversification is significantly lower than most U.S. stock indices, including the S&P 500, because the portfolio is smaller and lacks meaningful exposure to several industries, including utilities, real estate, and consumer goods.

dawn of fame

As is the case with most dividend ETFs, RDVY is overweighted by traditional economic industries, such as financials. That’s because companies in these industries tend to boast above-average yields and long track records of dividend growth. On the other hand, RDVY is underweight technology and communications services. This is because most companies in the industry focus on growth and CAPEX rather than dividends. Value ETFs typically have similar industry biases.

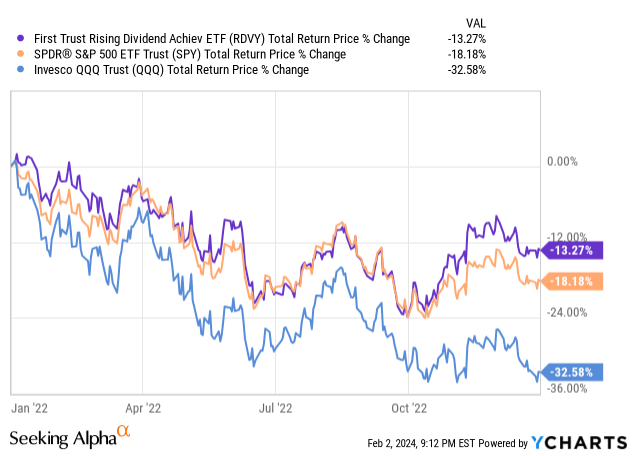

For the reasons above, the fund tends to perform better when technology and growth are slow, as will be the case in 2022.

Data from YCharts

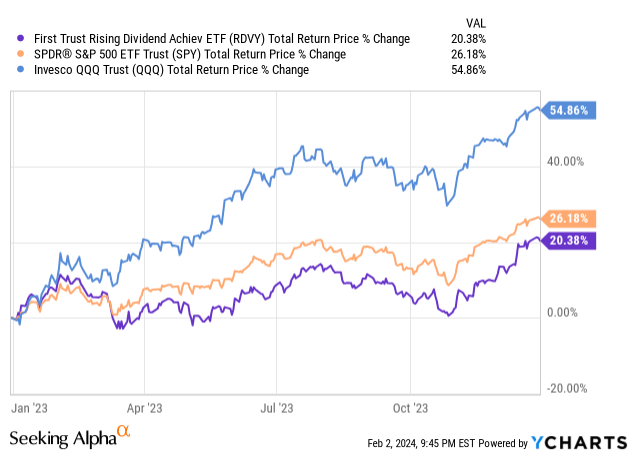

On the other hand, when technology and growth perform better, as is the case in 2023, the fund tends to underperform.

Data from YCharts

In my opinion, the above is neither negative nor positive, but it is an important fact for investors to consider. This is a common problem with dividend and value ETFs, leading many investors to significantly underweight technology in their portfolios.

Strong Dividend Growth Performance

RDVY focuses on the 50 U.S. stocks with the strongest combination of dividend growth, yield and payout ratio. What I’ve seen is that dividend growth itself tends to dominate the other two factors, resulting in funds with incredibly strong dividend growth records.

The dividend has grown at a CAGR of 10% since inception, with double-digit growth rates in most other relevant periods. Growth appears to be a bit more consistent than the average for ETFs, although there is still some volatility.

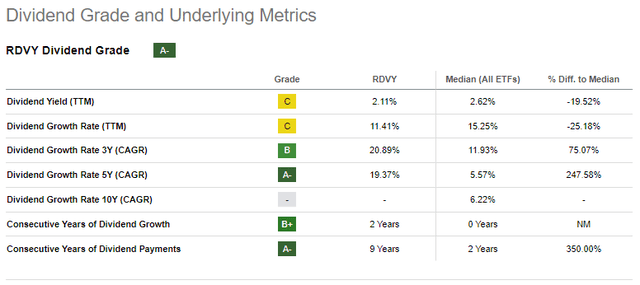

pursue alpha

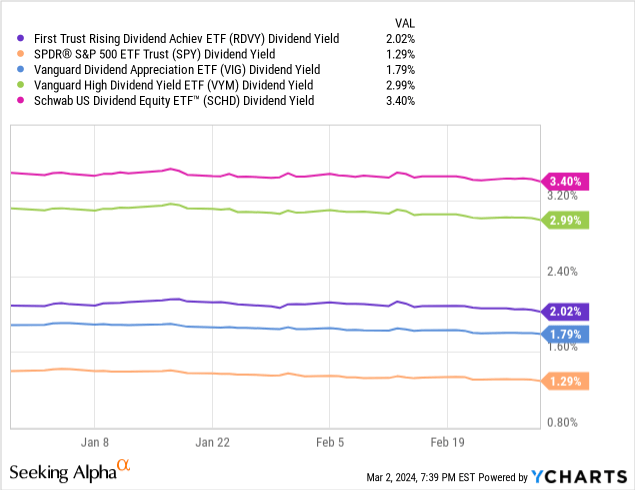

RDVY boasts a 2.0% dividend yield, which is higher than the S&P 500. maximum But not all US Dividend ETFs.

The initial rate of return of the fund is very low, but growth This yields reasonable returns for long-term investors. The fund boasts a five-year return at 3.6% costs, rising to 5.4% at the 10-year point. Reinvesting your dividends will give you a much higher return on cost.

pursue alpha

RDVY has a significant advantage over its peers on these issues. For example, the Vanguard Dividend Appreciation Index Fund ETF (VIG) has a 5-year return of 2.9% and a 10-year return of 4.3%. Both figures are lower than RDVY, and the gap appears to be widening over time.

pursue alpha

The only fund with a much stronger dividend growth/expense yield than RDYV is the Schwab US Dividend Equity ETF (SCHD). However, growth in SCHD has slowed over the past two years.

pursue alpha

RDVY’s strong record of dividend growth benefits the fund and its shareholders, especially long-term income investors. Investors needing income now will likely prefer higher-yield alternatives to RDVY, including funds focused on high-yield corporate bonds, senior loans, covered call ETFs, BDCs, and other similar asset classes.

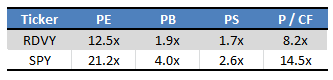

cheap evaluation

RDVY is overweight traditional economy industries, which tend to have low valuations, while underweight technology, communications and growth, which tend to boast premium valuations. This results in the fund trading at a discount of approximately 40% to the S&P 500.

Morningstar – Table by Author

this is exorbitant That’s a discount, especially considering that RDVY focuses on U.S. large-cap stocks, which are basically S&P 500 stocks. Industry tilt and security weighting appear to have had a huge impact on the fund’s price and valuation.

RDVY’s Cheap Valuation could do Normalization of valuations will result in significant capital gains and outperformance. Valuations began to normalize in early 2021, with significant valuation outperformance in 2022. The situation was reversed in 2023. The overall trend is unclear and somewhat dependent on the specific fund or index analyzed, as well as the specific time period. RDVY itself has underperformed the S&P 500 slightly since the start of 2021 and in most other recent periods as well.

A lower valuation also increases the impact of the company’s dividend payments and share repurchase program. RDVY’s returns are slightly higher than the S&P 500, but the difference is small so the impact here does not appear to be significant. There’s also no reason to believe that RDVY’s underlying holdings are doing significantly more share buybacks than average. These problems are not negative in and of themselves, but they are certainly devoid of anything positive.

Excellent performance track record

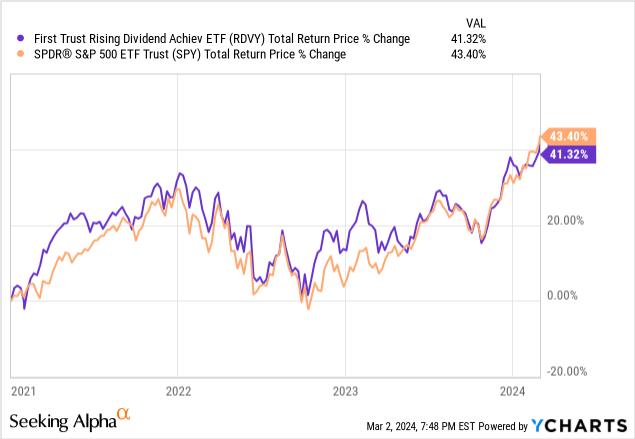

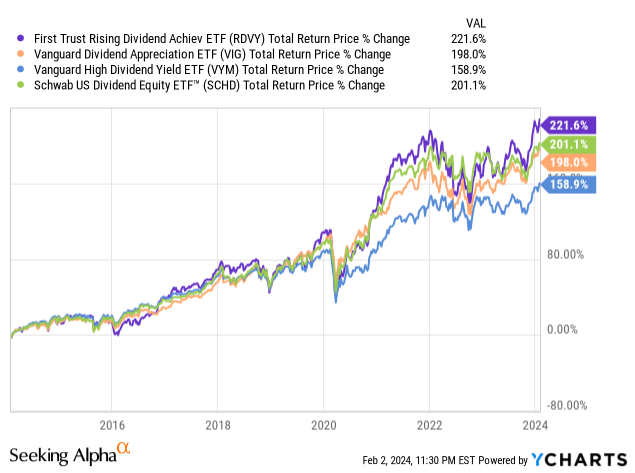

RDVY’s performance track record is relatively good, and the fund has outperformed most U.S. dividend ETFs since inception. part consistency. RDVY even outperformed SCHD, one of the best-performing dividend ETFs on the market and one of the most popular ETFs.

Data from YCharts

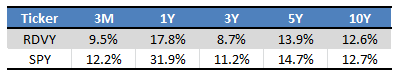

RDVY has matched the performance of the S&P 500 from the beginning, but not consistently. The fund has had periods of significant outperformance, including 2022, and periods of significant underperformance, including 2023.

Seeking Alpha – Table by Author

but matching While the performance of the S&P 500 cannot really be interpreted as positive, we think it makes the fund’s overall performance look stronger. maximum Dividend ETFs have underperformed over the past decade. RDVY I didn’t. The fund’s performance looks quite good in context and could improve as sentiment shifts back to value. Otherwise, current yields are decent, and this fund offers investors slightly above-average yields and a much stronger track record of dividend growth.

conclusion

RDVY’s strong record of dividend growth, cheap valuation, and good performance record make the fund a buy.