Realty Income: Perhaps The Smartest 6% Yield You Can Own (NYSE:O)

CalypsoArt

I last wrote a bullish note on Realty Income (NYSE:O) in October here. The argument was its 6%+ yield, unmatched real estate diversification, conservative balance sheet, and lower-than-normal valuation were quite attractive for new investors. My earlier title still sums up the situation best, “Realty Income: Getting More Interesting With Same Price As 2015.” Of course, underlying values have grown dramatically over the past nine years. So, it’s very logical to conclude new buyers are getting cheaper long-term real estate value on every buck you invest today.

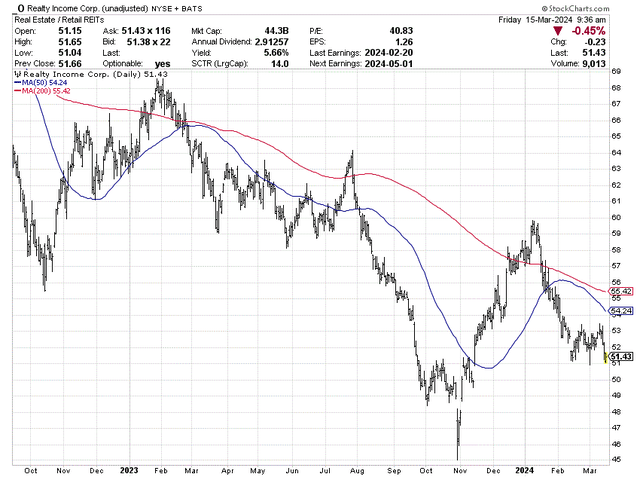

The good news for prospective buyers is a quick move from under $49 at my previous article posting to almost $60 has reversed back to $52. I am writing on Realty Income again to point out tremendous value and a wonderful upfront 6% dividend yield are back in focus. Yes, smart investors are getting another crack at buying shares, if they missed the October opportunity.

StockCharts.com – Realty Income, 18 Months of Daily Price & Volume Changes

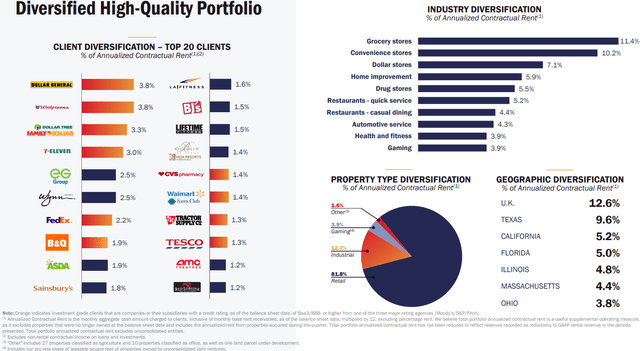

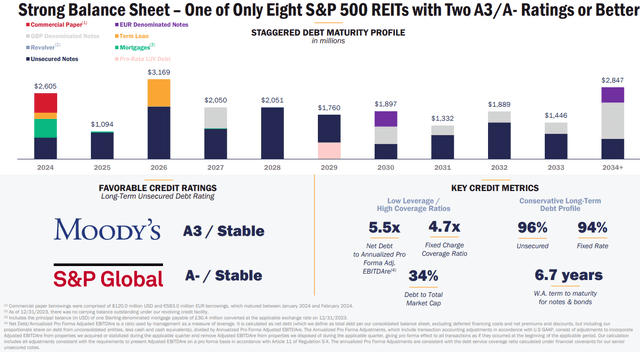

Right after my first story, the company announced an all-stock merger deal to acquire Spirit Realty Capital for nearly $9.3 billion. Spirit stockholders were slated to receive 0.762 shares of newly issued Realty shares for each share of Spirit. This transaction closed on January 23rd, with Realty Income’s existing shareholders overall now controlling about 87% of the married company, and Spirit shareholders owning the rest. Operating similar real estate assets, business models, and balance sheets, the deal is a stab at even greater diversification and a somewhat accretive bump to per share cash flow/income metrics. We should get a better readout in early May, when Q1 earnings are released and revised guidance is made for all of 2024. For me, the deal is likely a very small net positive for shareholders.

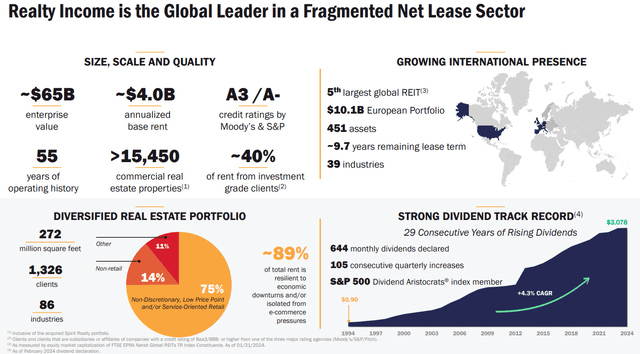

Today, the company’s monthly dividend is funded through cash flow generated by 15,450 real estate properties (including Spirit assets), owned under long-term net lease agreements with commercial clients.

Realty Income – February 2024 Presentation

Putting all the ideas together since early October, I view the current $52 price just as constructively as $49 five months ago. My Buy rating is based on a 6% annual cash dividend yield surpassing most other “safe” blue-chip investment ideas, with diverse real estate holdings (and future inflation) backing up both the dividend payout and future price appreciation in the REIT.

Realty Income – February 2024 Presentation

Strong Yield and Growth Potential

An investment in Realty Income comes down to your forecast for long-term inflation rates. The higher the inflation level we experience in the years ahead, the higher total returns will be delivered from Realty Income, relative to the S&P 500 index. That’s the bullish investment proposition in a nutshell. Let me explain.

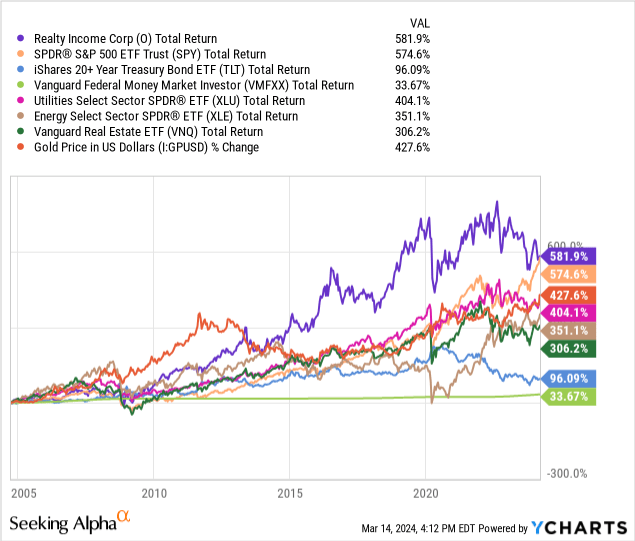

With just mild inflation averaging 3% annually since 2004, a good 20 years running, Realty Income has been able to generate top-tier investor returns of almost +9.2% annualized. If you are looking for Big Tech high-flyer gains, certainly this REIT name may not be your cup of tea. But, compared to other “yield” or “income” alternatives, O has been an A+ performer!

To begin the discussion, Realty Income’s total return has beaten the S&P 500 blue-chip index, believe it or not, over two decades. Second, the REIT has smoked the “risk-free” returns available from investments in the iShares 20+ Year Treasury Bond ETF (TLT) or the short-term Vanguard Federal Money Market Investor (VMFXX). Other income-focused equity alternatives like the Utilities Select Sector SPDR ETF (XLU), Energy Select Sector SPDR ETF (XLE), and Vanguard Real Estate ETF (VNQ) have performed admirably, but still failed to keep up with Realty Income. Finally, if you could not beat gold’s +7.7% annualized advance over 20 years, why bother? Checking yes, Realty was able to outperform both gold and the S&P 500.

YCharts – Realty Income vs. Yield Alternatives, Total Returns, 20 Years

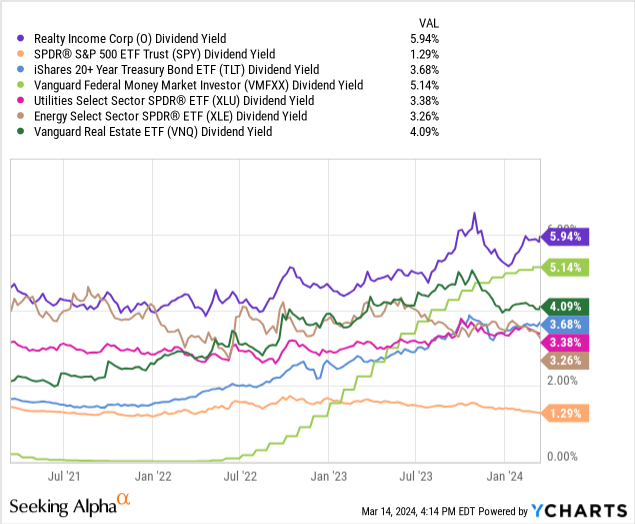

Realty Income has usually offered a stronger dividend yield than the alternatives, but the positive spread in March is the highest in many years. The closest yield competitor from my peer group is cash (short-term Treasury bills) through the Vanguard money market fund at 5.14%. However, only “trust” in reasonable federal government deficit spending policy is realistically backing your principal over the long term. With a structural deficit of almost $2 trillion annually remaining in 2024 after years of economic GDP growth, that’s not saying much (as deficits work to devalue the dollar and create inflation). I would rather own real estate values rising with inflation, taking advantage of too much U.S. fiscal spending. In addition, the long-bond yield and alternative income-related equity classes are in the 4% or under range currently. So, receiving almost 6% from Realty Income is very attractive.

YCharts – Realty Income vs. Yield Alternatives, Trailing Dividend Rates, 3 Years

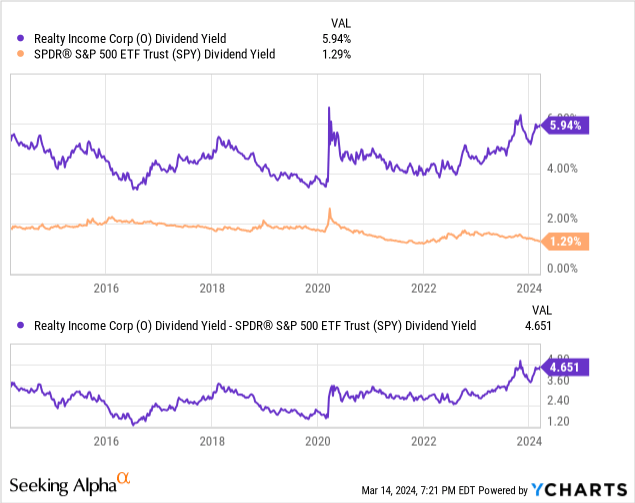

To further illustrate my thinking, Realty Income is delivering a nearly 10-year high spread to the equivalent S&P 500 dividend yield (next to October’s setup), with 5.94% in trailing yield sitting at greater than 4x the SPY ETF rate of 1.29%.

YCharts – Realty Income vs. S&P 500 Dividend Yields, 10 Years

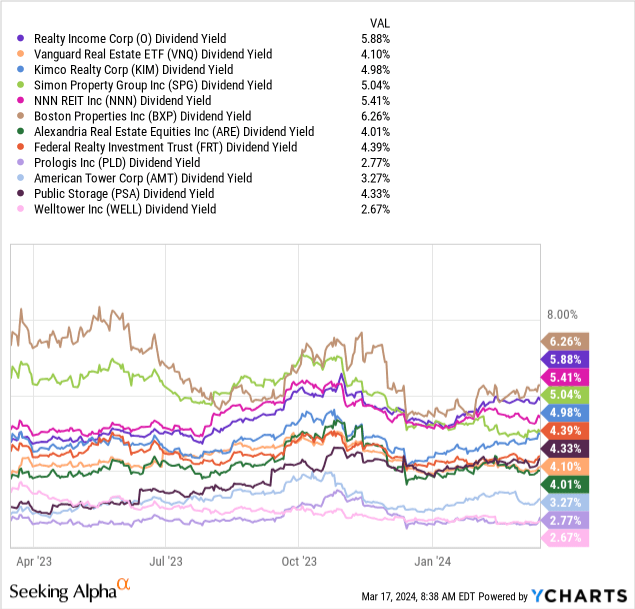

Compared to a cross-section of the largest peer REITs traded in America, Realty Income’s current yield is one of the top rates available. And, the upfront yield proposition has moved from an average peer position a year ago, to one of the leaders in March 2024. Only the beaten down office-building sector offers better cash yields today, albeit with much greater risk of payout cuts in the future given a recession scenario. My sort group includes the main Vanguard Real Estate ETF (VNQ), Kimco Realty (KIM), Simon Properties Group (SPG), NNN REIT (NNN), Boston Properties (BXP), Alexandria Real Estate (ARE), Federal Realty (FRT), Prologis (PLD), American Tower (AMT), Public Storage (PSA), Welltower (WELL).

YCharts – Realty Income vs. Largest U.S. REITs, Trailing Dividend Yield, 12 Months

In terms of margin-of-safety logic, O’s dividend may actually hold up better (backed by long-term rental contracts from an extensive list of America’s blue-chip leaders) in a prolonged recession than S&P 500 businesses generally.

YCharts – Realty Income vs. S&P 500 Dividend Yields, 10 Years Realty Income – February 2024 Presentation

Inexpensive Valuation

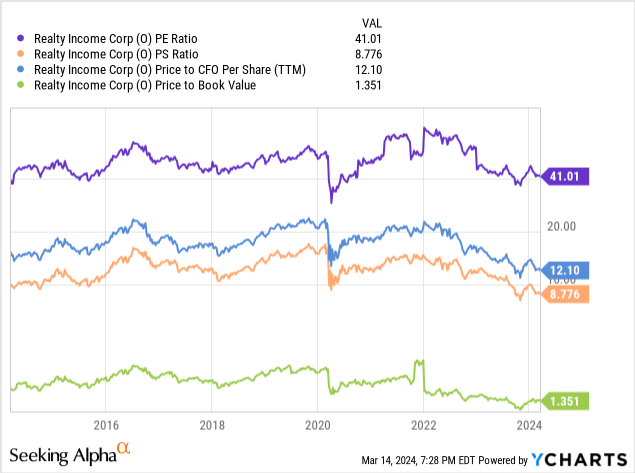

A review of valuation stats also reveals the stock is reaching for a 10-year low in price vs. underlying fundamental business performance. On price to GAAP earnings, sales, cash flow, and book value, Realty Income is trading just above the decade low numbers of October (pre-merger).

YCharts – Realty Income, Basic Fundamental Ratio Analysis, 10 Years

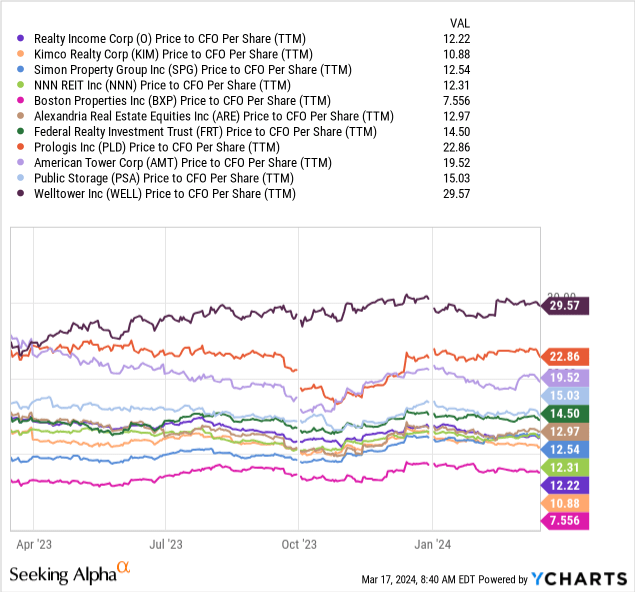

On basic accounting cash flow figures (as a proxy for FFO, Funds From Operations), Realty Income price has moved from a 15x multiple to 12.2x over the latest year. Outside of the office-building names, this valuation is one of the lowest in the entire large-cap REIT grouping, despite O’s super-strong diversification and balance sheet characteristics.

YCharts – Realty Income vs. Largest U.S. REITs, Price to Cash Flow, 12 Months

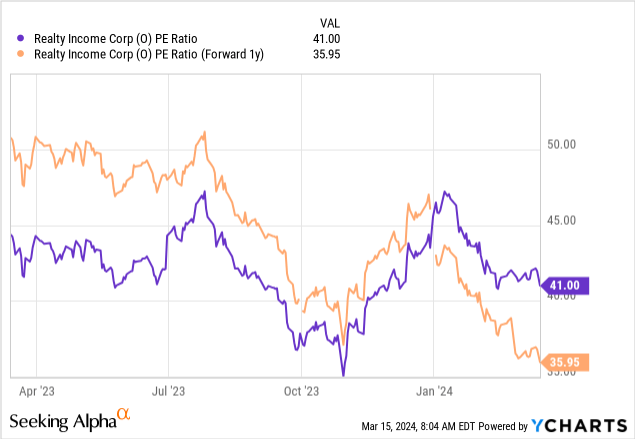

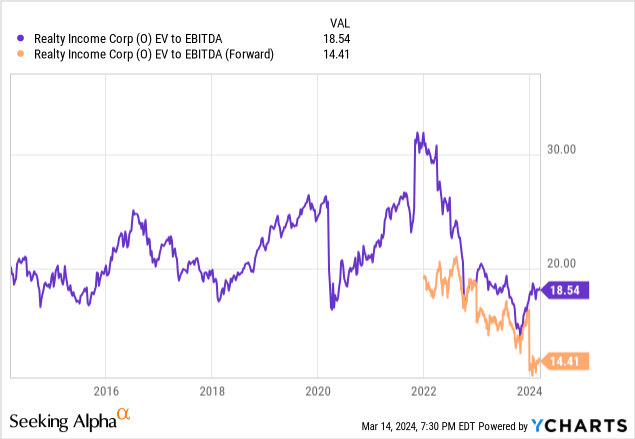

More positive operating news is the Spirit merger is expected to be accretive to both final income per share and general EBITDA cash flow. Below are graphs of the expected improvements. Essentially, the current share quote is something of a bargain on forward earnings (36x vs. 50x P/E average over last decade) or EV to EBITDA multiples (14x vs. 22x average over last decade), which should support the dividend and encourage future payout raises by management.

YCharts – Realty Income, Price to Earnings Estimates, 1 Year

YCharts – Realty Income, Enterprise Value to EBITDA & Forward Estimates, 10 Years

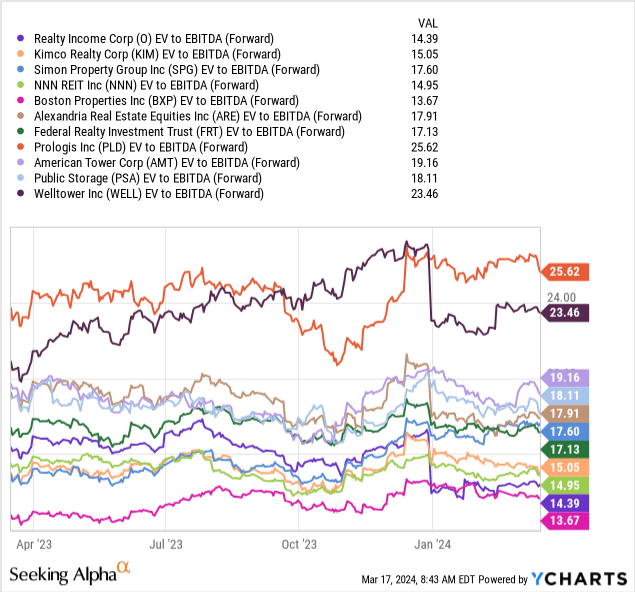

In fact, on forward estimated EBITDA, Realty Income is one of the cheapest REITs to own right now. Again, only the riskier office-building owners are less expensive. A year ago, O was sitting closer to the middle of the pack.

YCharts – Realty Income vs. Largest U.S. REITs, EV to Forward EBITDA Estimates, 12 Months

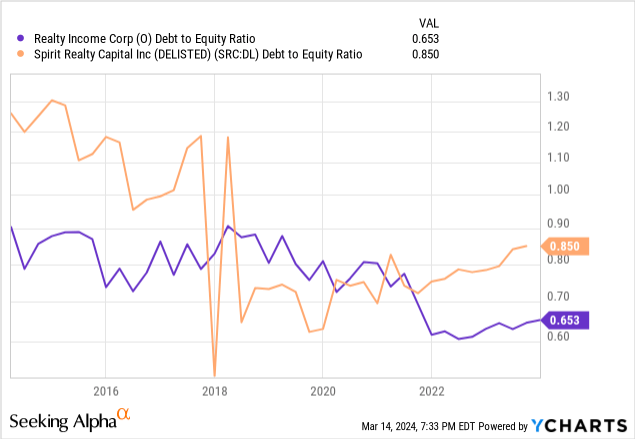

Lastly, all the bullish fundamental gains in profitability are not coming at the expense of a leveraged (debt-fueled) balance sheet. The debt-to-equity ratio will bump up slightly on the Spirit merger (closer to 0.7x), but the overall multiple will remain far under the 0.9x readings of 2015-18.

YCharts – Realty Income vs. Spirit Realty Capital, Debt to Equity, 10 Years Realty Income – February 2024 Presentation

Portfolio Stabilizer

Outside of the 2020 pandemic panic (which pulled Realty Income down like most every equity name), the last three bear market periods have proved a terrific time in the cycle to own O, even during the Great Financial Crisis and real estate bust of 2007-09.

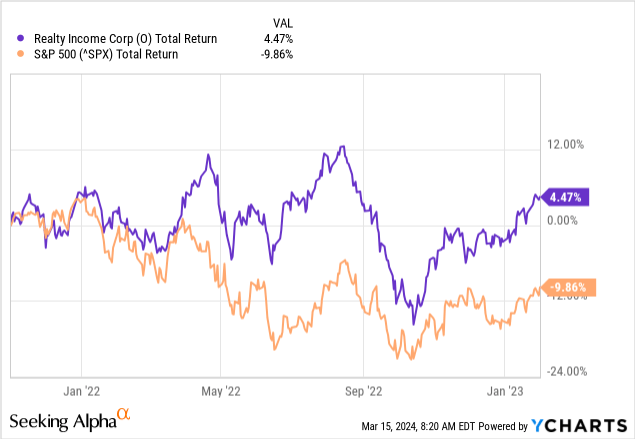

2022 Inflation & Interest Rate Spike

You would think the massive jump in interest rates during 2022 would have torpedoed the Realty Income share price, because of its yield component. Wrong. Investors gravitated toward this name because of its exposure to sharply rising real estate values at the same time. While not a spectacular performer to the upside, total returns including dividends far surpassed the S&P 500 losses during 2022.

YCharts – Realty Income vs. S&P 500, Total Returns, Nov 2021 to Jan 2023

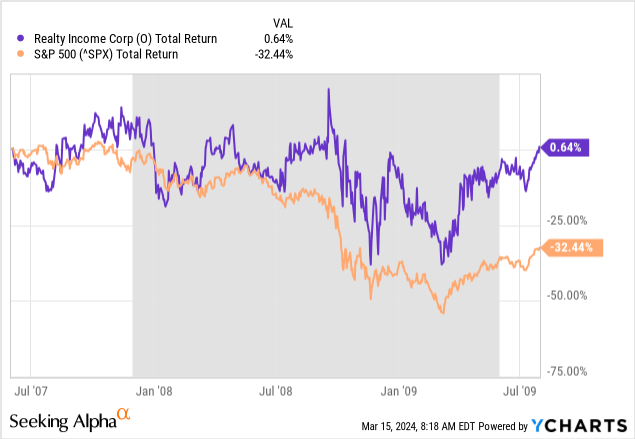

2007-09 Great Recession

When we go back to the last regular economic cycle recession during 2008-09 (excluding the pandemic situation), Realty Income widely beat the S&P 500 (and most every REIT and real estate investment, not pictured). Initially, this REIT investment fell less in price on the market selloff. Then, it rebounded more quickly coming out of recession in 2009.

YCharts – Realty Income vs. S&P 500, Total Returns, Recession Shaded, June 2007 to July 2009

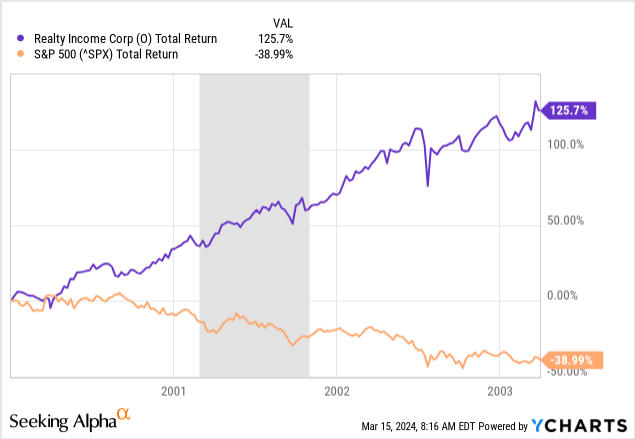

2000-03 Dotcom Tech Bust

Perhaps the best recession and bear market span on Wall Street to own Realty Income was following the original Dotcom Technology Boom ending in the year 2000. For sure, there are plenty of parallels to today’s Big Tech and Magnificent 7 bubble. It’s quite possible a repeat pattern of strong REIT outperformance vs. both the tech sector and the S&P 500 overweight these names could be approaching. Between January 2000 and March 2003, Realty Income was a top place to have money parked with a total return advance of +125% vs. the -39% loss of capital invested in the S&P 500 index.

YCharts – Realty Income vs. S&P 500, Total Returns, Recession Shaded, Jan 2000 to March 2003

Final Thoughts

In summary, if you are searching for a defensive pick, with a high dividend yield upfront, and robust long-term appreciation dynamics with inflation, all available at a cheap valuation, Realty Income could be your best pick. What’s not to like?

I will say there remains some recession risk in O shares. If the economy turns over and real estate prices succumb to falling personal income and confidence levels, downside in Realty Income will likely appear. Nevertheless, I would expect the S&P 500 index to fair even worse, as the overvalued technology sector will almost surely fall faster in price. And, this sector of the market pays less than 1% for dividend yield vs. Realty Income’s 6% to offset material losses.

Another perhaps larger risk is a stock market crash or new black swan event similar in bearish effect to the pandemic cannot be ruled out. Given a major and unexpected market drop of -20% or -30% overall in 2024, Realty Income could witness a drawdown just as rotten.

A final outlier risk to contemplate is we could be about to enter a debt-implosion depression like the 1930s. Record debts are everywhere in the global economy, not just the U.S. If a multi-year, deflationary recession is next, Realty Income’s earnings and dividend payout could decline. To me, this is a low-probability event, as the Federal Reserve would undoubtedly print tons of money and hand it out at your local street corner. All economists are aware of the extreme risks of matching too much debt with deflation. I would peg the odds of a worst-case deflationary economic scenario playing out during 2024-25 at less than 5%.

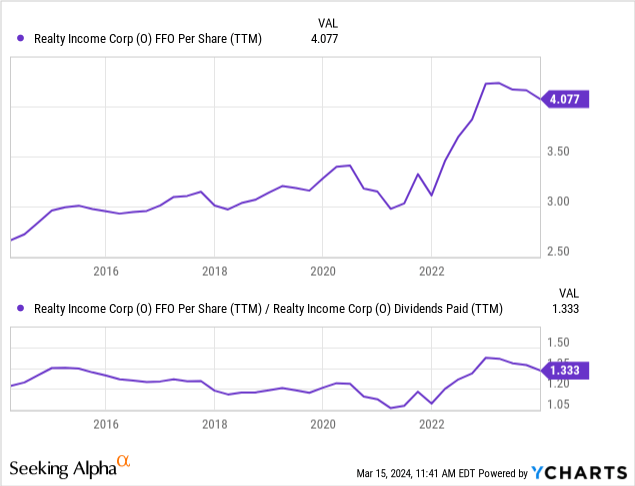

On the plus side of the equation, the dividend coverage from FFO reached a 10-year high in 2023. So, if GAAP earnings and FFO continue to rise in 2024, nice dividend hikes could be on the way for shareholders this year and next.

YCharts – Realty Income, FFO vs. Dividends, 10 Years

My investment research conclusion is Realty Income is a unique risk/reward Buy in the REIT space. My last trade involved heavy buying on the dip under $47 when the Spirit deal was announced in October, that was liquidated months later in the middle-$50s. My goal is to reenter a position on any material weakness under $52 in coming weeks. If the market rapidly corrects in price this spring (which it easily could), I am modeling $45 as Strong Buy territory, all other variables remaining the same as today.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.