Recession for Buffett’s biggest holdings | a cautious investor

As investors flock to Omaha, Nebraska, for their annual pilgrimage to learn from the great Warren Buffett, it seems like a perfect opportunity to ponder the technical evidence for Berkshire’s largest holding, Apple (AAPL).

Today we will consider AAPL using “multi-time period analysis,” which analyzes the same stock on three different time frames. This allows us to think about how short-term fluctuations relate to medium-term trends, and how medium-term trends fit into longer-term longer-term trends.

First, let’s consider a short-term time frame using a daily chart.

The stock drifted higher above its 200-day moving average on Friday after reporting earnings this week, which disappointed investors with poor iPhone sales but excited investors by announcing the largest share buyback in Apple’s history. After making lower highs and lower lows over the past two months and RSI levels becoming very consistent with a bearish phase, the stock appears to have finally reversed its downtrend with higher prices and improving momentum.

For now, staying above the 200-day moving average remains the most important factor on the daily chart after gapping higher on Friday. It will be very telling in the coming days and weeks whether additional buyers are willing to come on board and pay more for this long-term market outperformer!

For the medium term, let us consider the price movements over the past 10 months, starting from the July 2023 high of $197. After hitting the high, AAPL retraced the 38.2% retracement of the 2023 rally phase and found support around $169. Over the next seven to eight months, Apple bounced back and forth between retests to all-time highs before returning to test support in the $165-$169 range.

This week’s gap increase confirms that support in that range remains strong once again and appears to provide a clear bottom to last year’s price action. In this rally, the stock price appears to be showing strength as momentum has improved, with RSI exceeding 60. However, I would classify the medium term as ‘neutral’ until there is a clear break above the previous highs around $197.

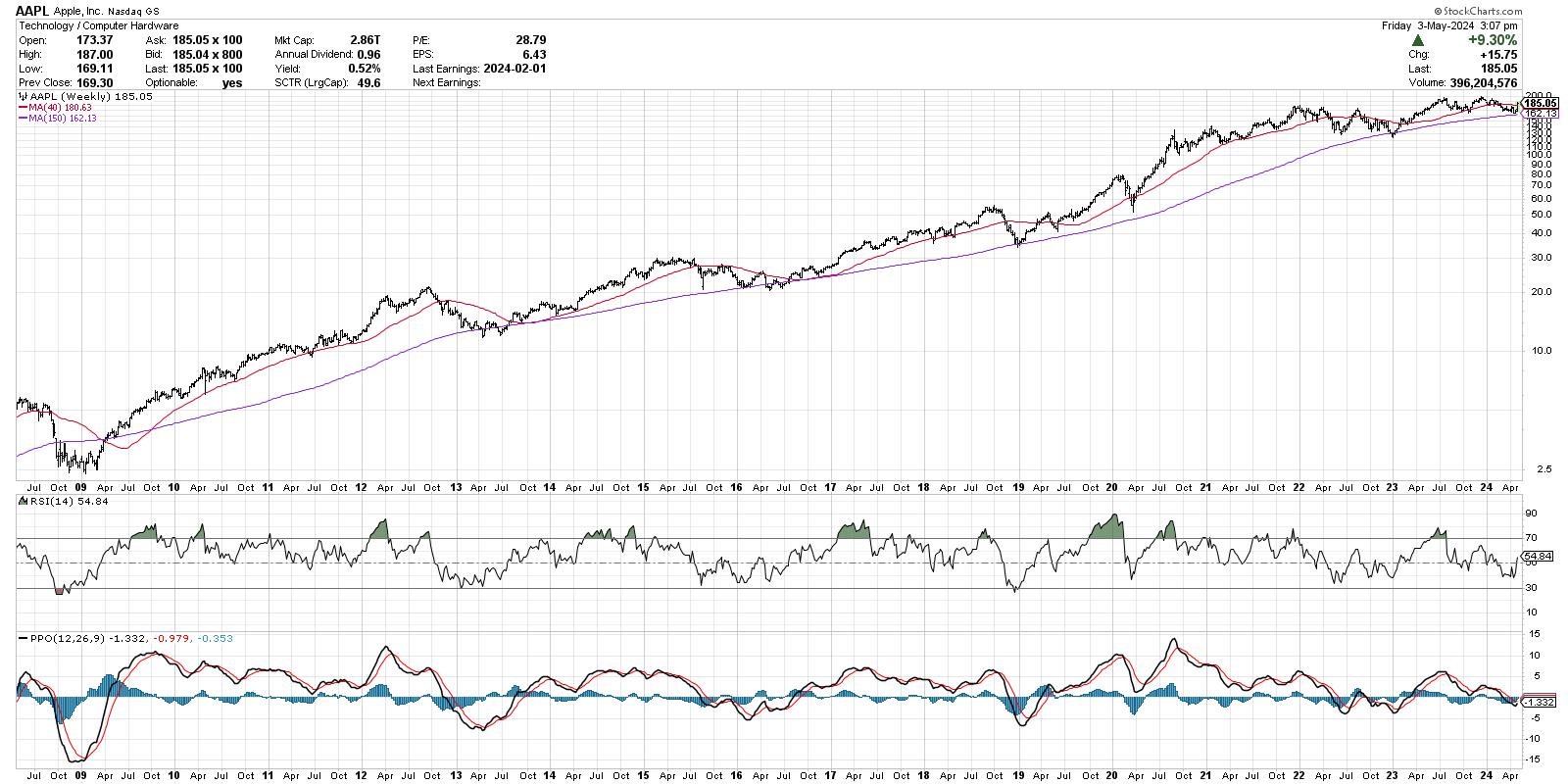

Now let’s look at the long-term trend using weekly charts.

Simply put, AAPL’s long-term prospects are very bright. Since the market lows in 2009, stocks have experienced numerous tests of the 150-week moving average rise. And in 100% of these tests, the stock bounced higher and eventually hit an all-time high soon after.

Looking at the RSI levels on the weekly chart, we can see that momentum remains in a bullish range since late 2018. This means that long-term momentum is positive and any pullback to moving average support should be viewed as an opportunity to take advantage in the short term. Market weakness.

Do you think the second quarter presents a decent opportunity after Apple pulls back to test longer-term moving average support? Watch the video below and vote in the comments!

RR#6,

dave

P.s Are you ready to upgrade your investment process? Check out our free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

The author had no positions in any securities mentioned at the time of publication. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

David Keller, CMT, is Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral bias through technical analysis. He is a frequent host of StockCharts TV and links mindfulness techniques to investor decision-making on his blog, The Mindful Investor. David is also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research firm focused on risk management through market awareness. He combines strengths in technical analysis, behavioral finance, and data visualization to identify investment opportunities and strengthen relationships between advisors and clients. Learn more