Reckitt Stock: Attractively Priced (Rating Upgrade) for a Stable Brand (OTCMKTS:RBGLY)

my neck

Consumer goods producer Reckitt Benckiser ( OTCPK:RBGLY ) has had a very difficult few months.

I last covered this name last November with Reckitt Benckiser: Not A Bargain Even Its Pot, a piece that received a Hold rating. Afterwards, London stock prices plummeted. 17%. This is even after a 10% rebound over the past few months.

At this point I changed my rating from “Hold” to “Buy” and actually purchased some stocks for my portfolio over the past few months.

Major Investor Concerns

The main reason for the stock’s slump this year is, surprisingly, concerns stemming from the Lernaean hydra about the company’s nutrition business. As evidenced by numerous sources in recent years, this has been the cause of major problems and significant losses for the company since its acquisition from Mead Johnson in 2017.

In March, news broke that an Illinois court had ruled against him and that many other cases were pending. Last March, it was announced that an Illinois state court had awarded $60 million in damages to a plaintiff related to necrotizing enterocolitis. Reckitt’s statement emphasized that this was a single judgment and that the company would “explore all options to overturn the ruling.”

Compare this to the statement of final results released two weeks ago (emphasis mine).

Product liability lawsuits involving NEC have been filed in U.S. state and federal courts against the group or Abbott Laboratories. This action alleges injuries related to NEC in premature infants. Plaintiffs claim that premature infant formula containing human milk fortifiers (HMF) and bovine-derived ingredients cause NEC and that premature infants should receive only breast milk. The company denied significant claims in the claims. The company’s products claim to provide expert neonatologists with an important tool for the nutritional management of premature babies for whom breast milk alone is nutritionally inadequate. The product is used under the supervision of a physician. Any potential costs associated with these actions are not considered likely to be incurred. Reliable estimates cannot be made at this time.

The decline in stock prices we saw in response to the Illinois ruling reflects the potential costs of such litigation and investors’ concerns that management may not have been fully aware of the risks.

Stock prices have plummeted, but at this point the final cost of the incident is still unknown and investors are throwing around wildly different ballpark numbers. Barclays analysts say £2 billion would be the “extreme worst case”, with £100 million to £400 million more likely.

Reckitt has pledged to fight the lawsuit, but it’s hard to imagine a scenario in which settling the lawsuit without admitting liability would result in no ultimate cost to the company.

But in the long term, we think even a £2bn hit (basically one year of free cash flow for the company) is manageable and not worth the kind of share price cut we saw following the ruling.

Business performance isn’t great, but that’s okay.

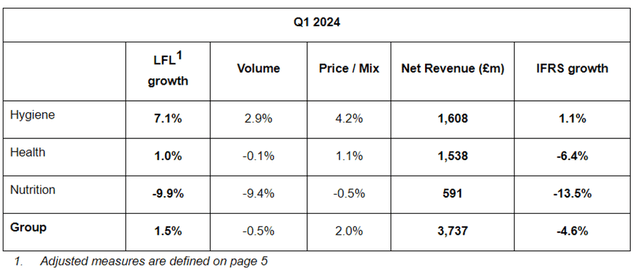

In April, the company released its first quarter trading update. I don’t think the title “Good Q1, Ongoing Full Year” is inaccurate. Or at least I don’t want to see what management thinks if a decline in both sales and net revenue seems “good.” bad performance. Part of the blame lies with foreign exchange movements.

In my view, the health sector, unlike the sanitation sector, is not performing very well. But the biggest challenge is nutrition, which has been problematic for a long time. I covered why this is problematic in a previous analysis, and it continues to be so.

The overall quarterly results struck me as disappointing, with both the health and nutrition businesses seeing declining volumes, offset by price and mix changes, at least for the health division.

Company first quarter trading update

The company anchored its nutritional performance based on strong comparisons from previous years due to supply issues from competitors at the time.

The company is in the third phase of its £1 billion share buyback program, which it expects to complete in July.

Reckitt confirmed its full-year outlook for net revenue growth and adjusted operating profit growth of 2% to 4%, with this year’s performance weighted towards the second half of the year.

Overall, this update seems to confirm what we’ve seen from Reckitt over the past few years. What was once a growth machine has turned into a company that has to work hard to stay still. But all in all, it got the job done. In my opinion, the fundamentals for future success remain the same, with the brand stability still as strong and strategically focused as it has been in almost a decade.

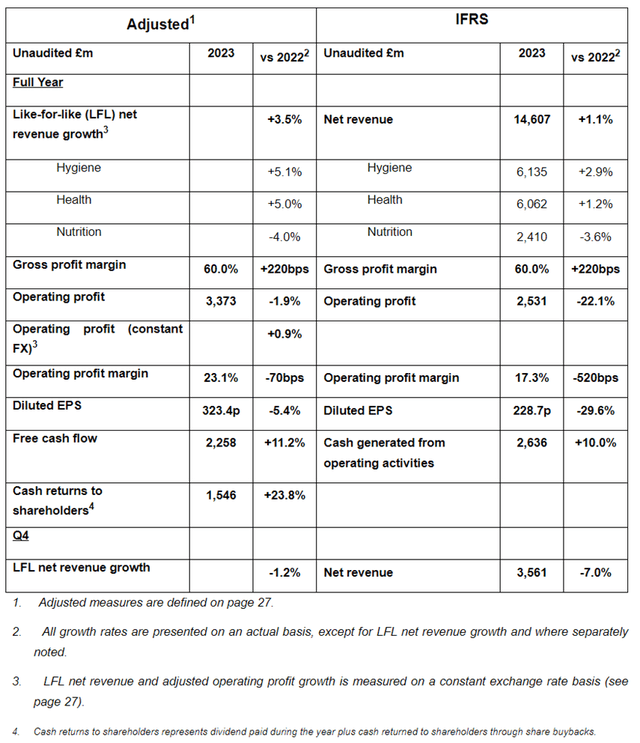

This comes on top of last year’s full-year performance, which could be described as proficient rather than strong given the persistent inflation environment (although free cash flow performance was strong).

Announcement of final results

But it’s important to remember that Reckitt’s hygiene brands have boomed during the pandemic, and despite its increased base, it continues to see growth in two of its three segments. For example, last year’s revenue was 14% higher than in 2019.

So, while the business isn’t very exciting at the moment, I think the stage is set for solid performance over the next few years. I don’t think Reckitt’s forecast for 2-4% net revenue growth this year can be ignored. Especially given ongoing challenges for its nutrition business (we expect net revenue to decline mid-to-high single digits this year) and weak economics in many markets, which is pressuring demand for premium-priced branded consumer goods.

negative scuttlebutt

I’m not a regular user of Reckitt products, but I recently bought a canister of “Vanish” detergent from a Spanish supermarket. I was disappointed to find that the large container was less than half full. Some settlement may occur during transport and a limited range of container sizes are typically used to reduce complexity, but the low fill levels have significantly dented my opinion of Vanish and indeed Reckitt as a consumer.

I don’t know if this is an unusual case or a symptom of the company’s broader approach to shelf impact. But I would venture to say that it has negatively colored my view of the company, and that leaving shoppers feeling like there is a lack of change in the long run is almost certainly no way to succeed.

I bought at a valuation that I found attractive.

However, recent business performance has been mixed and the possibility of nutritional debt is undoubtedly a risk, but I think the stock price has been evaluated too unfavorably. I’ve taken stock of the company over the past few months and upgraded my rating to “Buy.”

The current P/E ratio is 14. Compare this to 20 for UK peer Unilever (UL) and 25 for US peer Procter & Gamble (PG). I think there is still some discount on the uncertainty surrounding Reckitt following the US ruling (although it has decreased in recent months) and its recent overall poor business performance.

But let’s not overdo it. The company has a number of very well-known brands such as “Lysol” and “Durex” with significant pricing power. Last year’s sales reached an all-time high. The company earned £1.6 billion in after-tax profits. Adjusted free cash flow last year was £2.3 billion. Net debt is still higher than I would like, but it fell to £7.3 billion last year. This means that Reckitt is worth less than £40 billion. Even taking legal uncertainty into account, we think this is a good value for a company with brand equity and proven long-term profitability.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.