Reddit: IPO Icebreaker (undefined:RDDT) | pursue alpha

mario tama

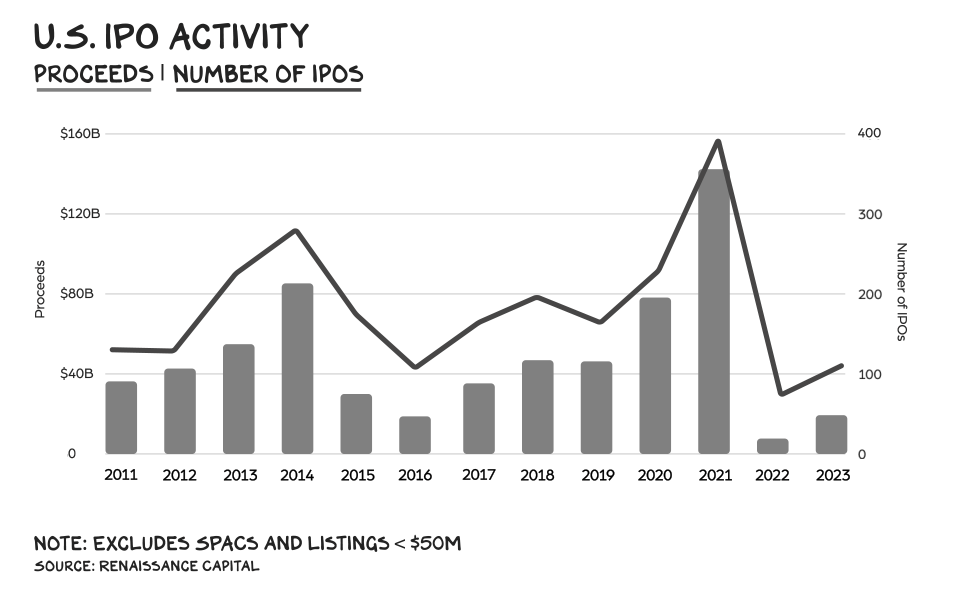

Markets are shaped by psychology, not finance. And the sentiment surrounding the IPO has been traumatized since retail investors were swept up by SPACs and semi-trailers wearing mud flaps that said Rate Hike.

winter has come IPO, and we’re still waiting for the thaw. Despite a glut of high-quality private companies and significant capital waiting to strike, new proposals are lacking.

With the broader market breaking all-time highs, pent-up supply/demand from corporate/capital is waiting for the green flag to drop.

In particular, high-profile companies that made their first transactions as public companies recorded healthy profits. I believe the icebreaker for price next week will be Reddit (RDDT). Note: This is not financial advice.

The most valuable companies are a function of the resources and activities that dominate the economy. We evolved from an agricultural economy to an agricultural economy. One-to-one service for industries using oil, and now… attention.

U.S. Steel (

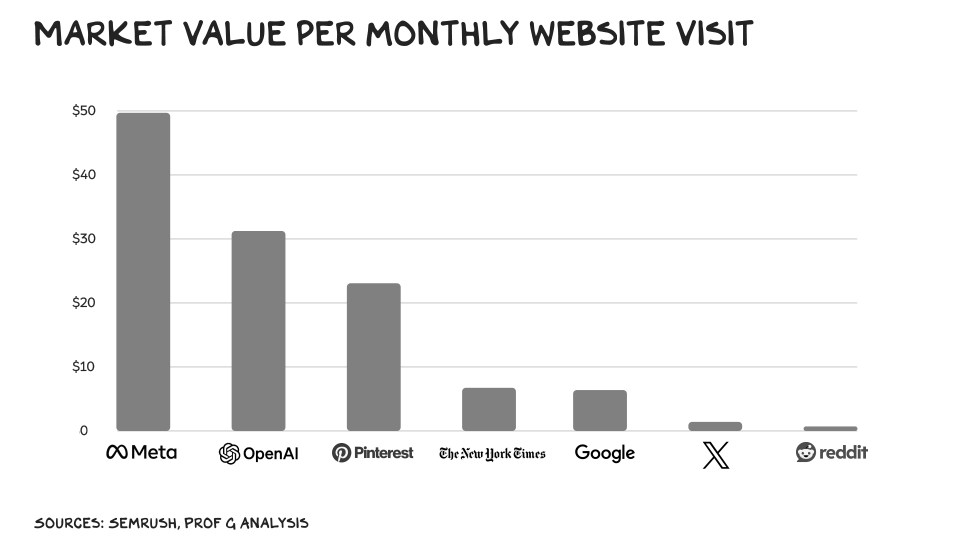

Today’s most valuable consumer companies monetize attention. And Reddit has more attention in the U.S. than any company not owned by Alphabet.

If interest were the new oil, Reddit would be Saudi Arabia, and beneath the platform there would be a sea of interest as big as the Ghawar oil field.

correction

Fifteen years ago, newspapers accounted for three times the media revenue as a percentage of attention share, and digital accounted for one-third. The gangster investment thesis was that rates would adjust… It actually did.

The companies just ahead and behind Reddit’s US interest reserves (Alphabet and Meta (META)) have market capitalizations of $1.8 trillion and $1.3 trillion, respectively. Compared to website traffic, Reddit is underrated.

This is a rough metric because not all web visits are equal and it does not capture app traffic. However, the brand captures 850 million monthly users, more than Pinterest (PINS), LinkedIn (MSFT), or Snap (SNAP). ).

The low valuation reflects Reddit’s modest 20% revenue growth, which is a product of its inferior advertising stack and business model. But if this comes to light, we will see the mother of all market corrections.

At an expected valuation of $6.5 billion, I believe Reddit is the only company with an opaque but visible 100x return path. Identifying revenue generation is difficult. Developing a product that can attract this level of interest is more difficult. Reddit did it.

Will Reddit figure out how to monetize its attention volcano? It’s doing the work. Similar to plugging pipeline leaks, they restricted API access, and appear to have dissipated the resulting controversy.

Now we’re launching an advertiser tool that leverages its inherently contextual nature. Advertisers don’t have to rely on arcane algorithms or invasive trackers to target consumers interested in their categories; they can simply buy ads on the appropriate subreddits.

Although the site’s content is overwhelmingly in English, growth in non-English territories offers more upside opportunities and, for now, the company remains focused on its products and dollars to consumers who are most valuable to most advertisers.

Not making enough money with 7.5 billion visits a month is a good problem to have. A question that remains unanswered is whether Reddit is similar to Digg and Vine or Alphabet and Meta.

History suggests that upside potential is asymmetrical, along with recognition of how difficult it is to build a global platform like Alphabet or Google.

There are also a few chasers that could accelerate Reddit’s market value. For LLMs, the richest data buyers on the planet, some form of special interest is desirable.

Reddit conversations, which can be broad, deep, and wide-ranging, are an ideal training resource for AI, and Reddit is starting to monetize them.

The company’s S-1 has over 1 billion posts and 16 billion comments, and it reports over $200 million in revenue from AI companies seeking to train that corpus.

Interestingly, the investor with the second-largest voting power, with 9.1% of the vote, is OpenAI CEO Sam Altman. It’s not AI “washing” per se, but AI remora – swimming next to AI companies that have added the value of the global auto industry to their own market capitalization over the past 12 weeks. In Oracle’s (ORCL) recent earnings announcement, there were more mentions of ‘Nvidia’ and ‘AI’ than ‘Oracle’.

One of the dark spots in Reddit’s profile is its governance structure. Thanks to dual-class stock and deals with the company’s two largest shareholders, CEO Steve Huffman has almost complete control over his business while he is in office.

It’s a bad system, regardless of the individuals within it. Finally, Reddit is a meme factory for the meme stock movement, which is not a sustainable engine for shareholder value.

But there’s a non-zero chance that Reddit will become the most talked-about mid-cap company in history and break the ice dam that’s been choking the IPO market.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.