Reddit is exploring an IPO in 2024. Could this be good news for investment banks?

Last week, Bloomberg reported that social media company Reddit was talking to potential investors for an initial public offering (IPO) next year. People familiar with the matter told Bloomberg News that the IPO could happen as early as the first quarter of next year.

The IPO could be a positive signal for other hopefuls looking to go public. Investment banks are also eagerly awaiting the IPO, hoping it could set the stage for a rebound in 2024. Here’s what you need to know about potential investment opportunities.

Image source: Getty Images.

Demand for the IPO market has been frozen since the Federal Reserve started raising interest rates.

Reddit filed for an IPO in December 2021 and planned to go public the following March at a valuation of $15 billion. But that changed when the Federal Reserve announced it would raise interest rates to combat inflationary pressures, resulting in a volatile stock market that left many IPO candidates on the sidelines.

This has been the story of the IPO market since the Federal Reserve began its aggressive rate hike campaign in March 2022. From early 2022 Renaissance IPO ETF, which tracks companies that have gone public through recent IPOs, has lost nearly 40% of its value. This shows that there was absolutely no investor appetite for new listings.

The past few years have been a volatile time for investment bankers.

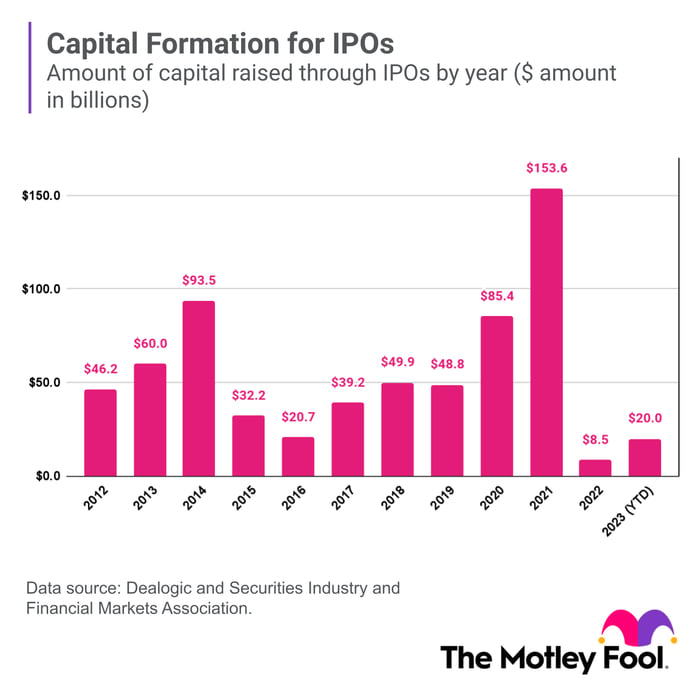

2021 saw a surge in public debuts via IPOs and special purpose acquisition companies (SPACs), making it a record year for: Goldman Sachs (GS 0.78%), Morgan Stanley (M.S. 1.18%)and JP Morgan Chase (J.P.M. 0.31%) It achieved the highest profits in investment banking history. Companies raised nearly $154 billion through IPOs in 2021, according to data from Dealogic. But this flood of deals was short-lived. Last year, companies raised $8.5 billion through IPOs, a 94% decline that hit investment banks hard.

Chart by author.

A good IPO launch can open the floodgates for others to list.

Although deal activity remains quiet, we are seeing the market becoming more receptive to new listings, with capital raised through IPOs reaching $20 billion by the third quarter of this year. same company Arm Holdings, Klaviyo, Instacartand kava group It’s all been revealed in recent months. While the market initially wasn’t as responsive as expected (the stock was down 20-30% from its initial trading price), the stock’s recent gains have lifted its share price from the lows of just a few months ago.

Investment bankers are hoping 2024 will be a big comeback year for IPOs. Goldman Sachs and Morgan Stanley are two investment banks working with Reddit, and there are several reasons for optimism.

First of all, the fact that major IPO candidates are coming back to the market is a good sign. In addition to the above, Shein, a fast fashion company last valued at $66 billion, recently filed for a private initial public offering, which could happen in early 2024.

A slowdown in the Fed’s aggressive interest rate hike campaign could be another positive development. Inflation pressures have retreated from 2022 highs, and many are optimistic that the Fed can achieve a ‘soft landing’ or lower inflation without triggering a recession. The Federal Reserve has given up on raising interest rates at its last two meetings, and markets believe it is over.

Target Federal Funds Rate Cap data Y chart.

According to CME GroupAccording to ’s FedWatch Tool, the market is currently pricing in five rate cuts before the end of next year. Removing the overhead caused by higher interest rates could provide a more favorable environment for stocks and help new listings in the process.

The IPO, which received rave reviews from Reddit and Shein, could launch the investment bank to higher heights.

Investors looking to get in on the action will want to watch the Reddit and Shein IPOs to see how the market reacts. A positive response would be an excellent signal for investment banks who are patiently waiting for a recovery in capital markets.

If the market becomes more receptive to IPOs, it could encourage more candidates to list. This will create excellent investment opportunities for companies with large investment banking operations, such as Goldman Sachs, Morgan Stanley, and JPMorgan Chase.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen holds a position at Morgan Stanley. The Motley Fool has positions in and recommends Goldman Sachs Group and JPMorgan Chase. The Motley Fool recommends CME Group and Cava Group. The Motley Fool has a disclosure policy.