Redfin: The Game Isn’t Over Yet, but the Outlook Is Cloudy (Rating Upgrade) (NYSE:COMP)

miscellaneous photos

In my opinion, few industries have been as battered and bruised as the real estate industry over the past few years. Real estate faces three negative factors: high interest rates and very limited housing supply (discouraged by high capital costs). new build) and bulges in the recent NAR lawsuit. Starting in July, real estate agents will be banned from listing broker compensation on the MLS.It is widely expected to reduce agency fees overall.

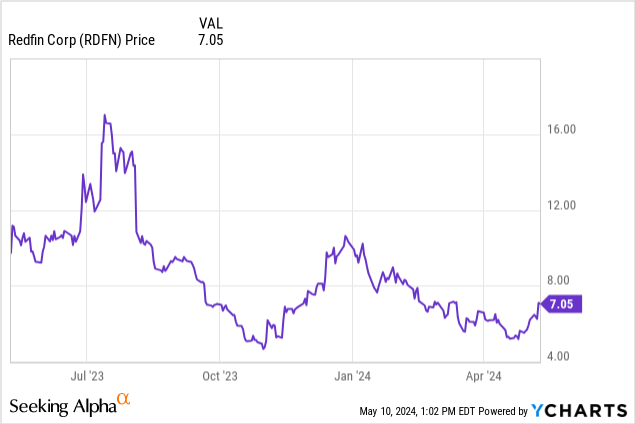

Against this backdrop, I expect the highly fragmented real estate industry in the United States to become increasingly consolidated, with clear distinctions between winners and losers. Unfortunately I think replystore (NASDAQ:RDFN) It’s in the loser’s bucket. The stock is down nearly 30% year to date (main competitor Compass (COMP) is up 10%), but the forward-thinking The outlook for Redfin is slightly more optimistic than before, but we still don’t think Redfin has the legs to bounce back.

Little confidence in Redfin Next’s ability to turn the company around

I last wrote a very bearish article about Redfin in early March when the stock was trading at similar ~$7 levels. Since then, the company has reported slightly better first quarter results and has seen a slight recovery in its U.S. market share. Additionally, increased rental revenue and higher attached interest rates on mortgage products, along with the closing of Redfin’s deal, helped reduce the company’s losses. With these factors in mind, I’d give Redfin a slightly higher rating. bearish, But I still don’t think the company has attractive prospects worth investing in.

For investors who are new to the Redfin story: The company is undergoing a seismic shift in its traditional business model. For the first time, and as it neared its IPO in 2017, Redfin prided itself on not paying agents commissions, instead paying them salaries. This was also the brand message to customers. Redfin argued that agents who aren’t motivated by commissions would better serve customers’ interests.

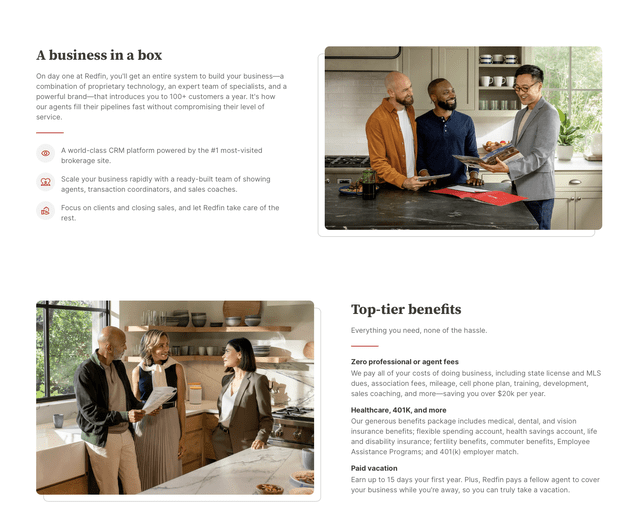

Now Redfin has completed a complete 180-degree turn, piloting Redfin Next. Essentially, Redfin Next redistributes the standard commission model more common in the real estate industry while offering broker benefits and insurance without the need for a salary plan. Agents receive up to a 75% commission split on deals they close on their own, while Redfin-sourced opportunities offer a 40% split.

Key benefits advertised to potential agents on the Redfin Next website include:

Redfin Next (Redfin.com)

It’s easy to see what these movements are. It’s a cost play in a shrinking real estate industry where Redfin is struggling to even out its profits. Simply put, Redfin found that the real estate industry is highly cyclical and that many agents cannot afford to pay agents a regular salary if they are not producing enough to earn an income.

Redfin Next is currently in limited launch, but plans to expand into more markets. CEO Glenn Kelman’s comments on the recent first quarter earnings call:

The most innovative of these initiatives is Redfin Next. In the first quarter, the four California markets piloting Redfin Next grew market share, luxury sales, and loyalty sales significantly faster than the rest of Redfin’s regions. Gross margins in all four markets were better in the first quarter of 2024 than in the first quarter of 2023. We were worried that agents who lost their pay would quit and it would harm our culture and market share, but so far we have seen a decline. In the following markets, rates were only slightly higher than domestic rates.

We expanded Redfin Next to seven additional markets on May 5, with a third, much larger market planned for the summer. We are also expanding our other sales initiatives. All You Can Meet, which expanded nationwide except in a few smaller markets on April 1, increased the percentage of homebuyers who see a Redfin agent on their first tour in April to more than 90%. This metric, which accounts only for first-time Redfin customers, has historically ranged mostly between 60% and 65%. The remaining customers meet contractors who Redfin pays to provide short-term access to assets.”

My assessment of this change in strategy: First and foremost, what Redfin needs most is to supercharge its deal growth, which is mostly an agent-targeted program that is unlikely to close more deals.

First Quarter Summary

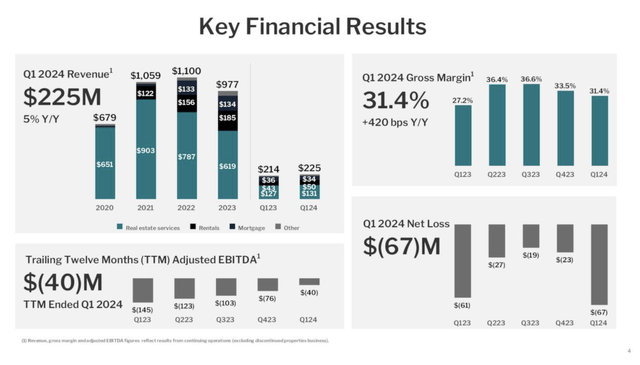

Redfin’s latest results show a business that’s still struggling but has an easier structure, at least for the year behind it. First quarter sales returned to growth of 5% Y/Y, an acceleration of 7 points compared to a -2% Y/Y decline in the fourth quarter.

Redfin Q1 Highlights (Redfin Q1 revenue data)

However, the most notable indicator is that US market share has also returned to growth, with a 0.77% share up 5 basis points sequentially and year-on-year. This is the main reason why I give Redfin a slight rating boost. This follows several quarters of relentless market share declines (at one point, Redfin reached over 1.0% market share in the U.S. in 2020).

Nonetheless, Redfin is still lagging behind Compass, which has just under 5% U.S. market share and is improving its market share by 25 basis points year-over-year in the most recent quarter. This is much faster. Redfin.

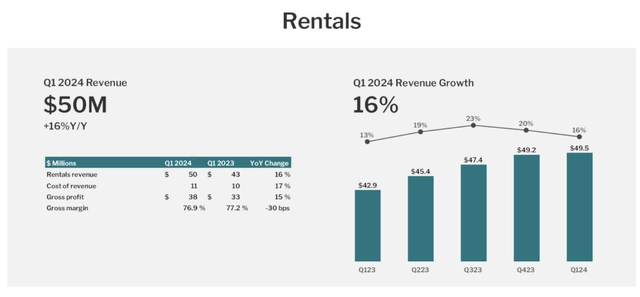

Non-tradeable products continue to be a tailwind for Redfin. Rental revenue increased 16% year over year to $50 million, representing 22% of the company’s total revenue. This is not surprising, as high interest rates have put many buyers off homeownership. The gross margin on rentals is 77%, making it an important profit lever for the company.

Redfin Rental (Redfin Q1 revenue data)

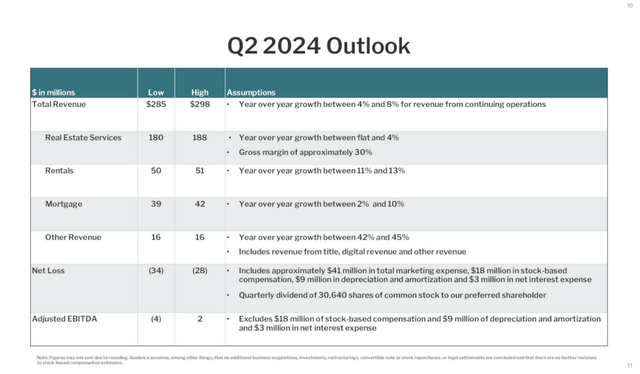

Looking ahead to the second quarter, Redfin expects to continue to see single-digit growth in real estate transactions and double-digit growth in leasing, while mortgages are also expected to continue to see strong attachment rates and sales growth of up to 10%.

Redfin View (Redfin Q1 revenue data)

Also important to note is that Redfin is guiding for adjusted EBITDA for the next quarter to roughly -$28 million in Q1. This is very important for a company that maintains a large net debt position (Redfin’s most recent balance sheet had $170 million in cash against $797 million). debt that poses a great risk to the company)

Key Takeaways

Redfin remains relevant, with its market share improving slightly, but we don’t think the company’s big investment in Redfin Next will solve the company’s core growth issues. Long term, I continue to believe that Redfin will be pushed out by rival Compass and that the stock is still dead money. Be careful here.